Bitcoin Fundamental Briefing, December 2023

ETF BOOSTER IS DONE?

December is a month, when activity on the market reduces. Some investors start preparation for the next year, rebalancing portfolios and distribute bonuses, others think about Xmas and New Year holidays. This year is not an exception – the news stream becomes narrower for two weeks before holidays.

And, in fact, traders on crypto market keep only single question – what fruits ETF adoption will bring next year? Some traders expect early approvement, somewhere in January, others in IQ of 2024. But all traders agree that this should be epic event and it will make impact on market action.

Meantime, some analysts start express an opinion that ETF approvement could make no effect or even could trigger downside action, as its approvement mostly is priced-in and traders could start selling “by fact”…

MARKET OVERVIEW

Bitcoin topping ~$42,000 is just the start of a fresh crypto super-cycle that will push the world’s biggest token above $500,000 in what adherents say is the new monetary order taking Wall Street by storm.

The largest digital asset was advancing roughly 16% to as high as $44,491 before giving up some gains. Its 2023 rebound from last year’s crypto rout now stands at 163%.

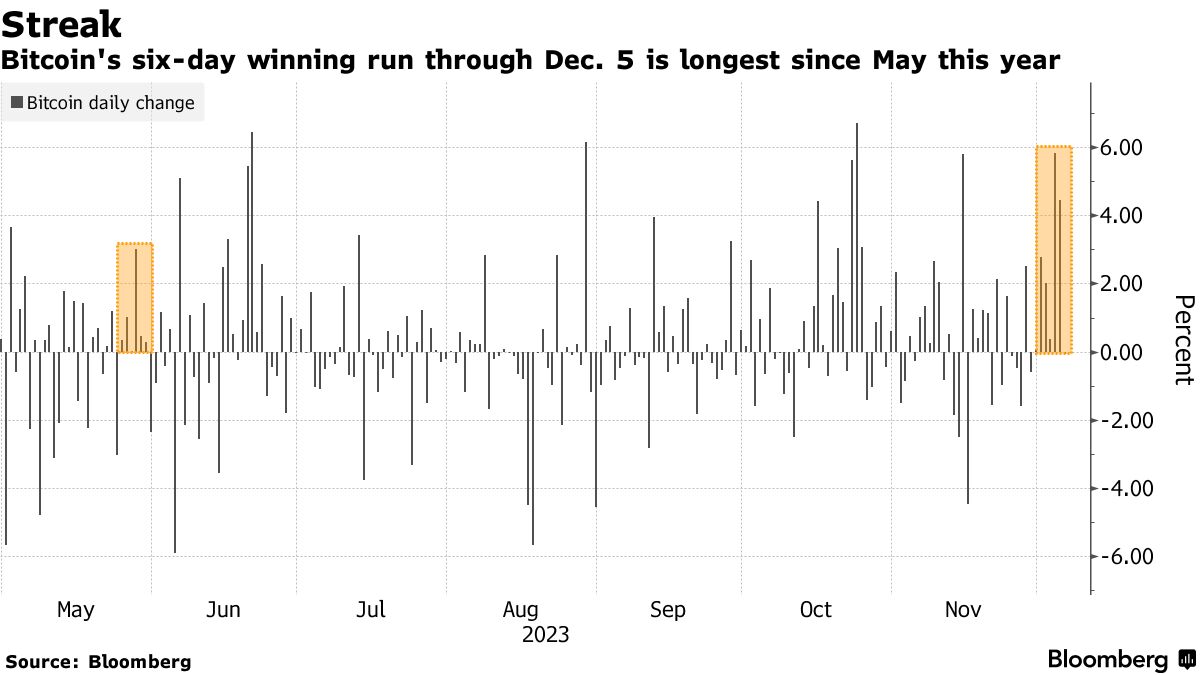

Such is the palpable sense of euphoria within the digital-assets community right now, where the largest token is coming off its third month of gains, adding another 11% so far in December to trade at its highest since the market began to implode in April 2022. All of the excitement about the surge is bringing out hyped-up predictions about further gains — most of them based on little else than intuition or obscure technical analyses.

The cryptocurrency is in the midst of a revival few saw coming this year. It’s added more than 150% so far in 2023 as many market-watchers anticipate an exchange-traded fund that directly holds the token could soon be approved to trade in the US. The jubilation prompted Coinbase CEO Brian Armstrong, for instance, to post that “Bitcoin may be the key to extending western civilization.” Meanwhile, the prophecies for how high the coin could go spanned anywhere from $50,000 in the immediate term, to above $530,000.

“It’s getting crazy again,” said Matt Maley, chief market strategist at Miller Tabak & Co. “Those kinds of comments show just how quickly sentiment can change for this asset class.”

“I would argue that one of the most important reasons Bitcoin rallied so strongly in 2020 and 2021 was because of the massive influx of liquidity into the system due to the pandemic,” Maley added. “Without another huge liquidity program, some of those predictions are a pipe dream.”

A US Bitcoin-based ETF has been long awaited, with the idea being that such a product would allow money managers to buy it for clients with greater ease, which could eventually bring billions of dollars of new investments to the space.

“Since mid-October, we’ve observed a real shift in the market driven by rising institutional enthusiasm around the possible approval of a spot BTC ETF, and more recently, an improving macro environment,” wrote Kaiko researchers in a note.

They also point out that crypto investment products have seen inflows in recent days, and that daily spot-trading volumes in November hit a seven-month high.

“The combination of ETF speculation and now hope on interest-rate-cut-easing is another speculative frenzy,” said Michael O’Rourke, chief market strategist at JonesTrading. “Are people who have been waiting for the ETF and missed a $20,000 rally going to pay double because it is an ETF? Probably not,” he said, adding that “the asset is purely speculative gambling and in the 14 year it has been around, it has not exhibited any true utility other than speculation and illicit money transfer.”

The crypto industry is awaiting the outcome of applications from the likes of BlackRock Inc. to start the first US spot Bitcoin ETFs. Bloomberg Intelligence expects a batch of these products to win Securities & Exchange Commission approval by January.

One boost for sentiment is the so-called Bitcoin halving due next year, which will cut in half the amount of tokens that Bitcoin miners receive as reward for their work. The quadrennial event is part of the process of capping Bitcoin supply at 21 million tokens. The coin hit records after each of the last three halvings.

“We could see Bitcoin run toward $50,000 before any major correction,” said Cici Lu McCalman, founder of blockchain adviser Venn Link Partners. She cited the halving and the outlook for US monetary policy as among the reasons why.

Meanwhile, Bitcoin’s blistering rally in 2023 has made betting against cryptocurrency company stocks a losing bet for short sellers.

Traders betting on declines in crypto-related companies such as Coinbase Global Inc., MicroStrategy Inc. and Marathon Digital Holdings Inc. have accumulated paper losses of $6 billion so far this year, according to data from S3 Partners LLC.

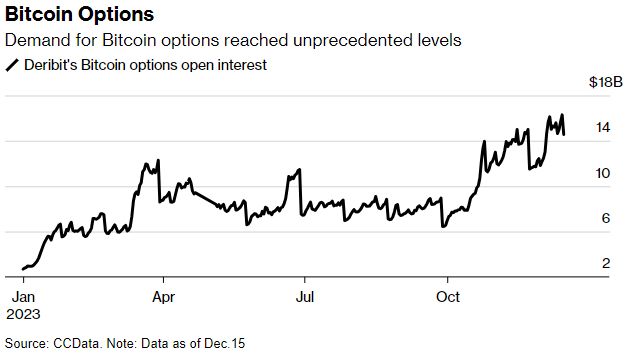

Combined spot and derivatives trading volume on centralized exchanges rose 40.7% in November, to $3.61 trillion, the highest combined total since March, according to researcher CCData. Activities in derivatives such as options and futures have continued to dominate crypto trading.

That’s the bullish narrative in virtual-currency land as the clock ticks down to Jan. 10 – when US regulators must finally decide whether to greenlight a physically-backed Bitcoin ETF. The Securities and Exchange Commission will by that time be required to either accept or deny an application from Cathie Wood’s ARK Investment and 21Shares, who were the first to file during this year’s batch of applicants. It could at that time also rule on other similar filings. More than 10 companies are working toward getting these ETFs — which would directly hold Bitcoin — green-lit.

The spot-Bitcoin ETF market has the potential to grow into a $100 billion juggernaut in time, according to Bloomberg Intelligence estimates.

Grayscale Investments CEO Michael Sonnenshein says he thinks the Securities and Exchange Commission should approve all applications for Spot Bitcoin ETFs at the same time. He says he’s as “optimistic as he’s ever been” about getting approvals from regulators.

At the same time, the options market is showing that traders are hedging bets ahead of a Jan. 10 deadline for the US to decide whether to allow exchange-traded funds holding the cryptocurrency.

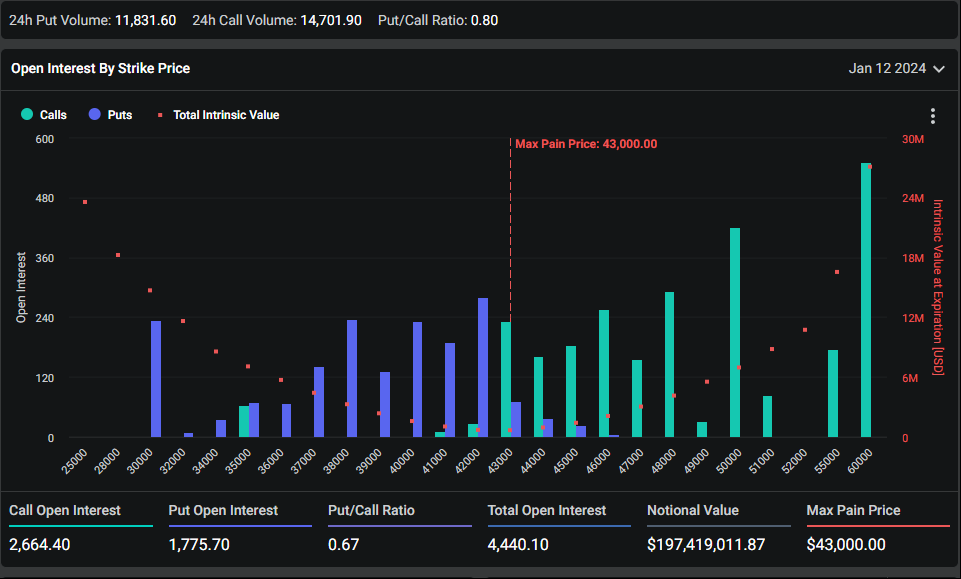

The open interest, or the total amount of outstanding contracts, for puts allowing holders to sell the digital currency expiring on Jan. 12 has surged. That’s made the put-to-call ratio on the contract well above those for contracts with other expiration dates further out from the deadline, according to data compiled by Deribit, the largest crypto options exchange.

The strike prices on the put contracts with the most open interest are for $44,000, $42,000 and $40,000, respectively. With Bitcoin currently trading around $43,500, that means put holders would be able to exercise the options and minimize losses if the cryptocurrency reacted negatively to the looming decision by the US Securities and Exchange Commission.

“The most recent rally is being driven by leveraged/speculative money,” said Ryan Kim, head of derivatives at digital-asset prime brokerage FalconX. “These traders could be finding it prudent to spend premium to protect their leveraged longs with some BTC puts, betting on a big move in either direction.”

A section “Cryptoassets” has appeared on the SEC website.

IS IT REALLY THE INTEREST TO BTC SO HIGH?

So, crypto executives are back to waxing eloquent about how, for example, Bitcoin will extend Western civilization. That’s standard stuff for a bull cycle.

That said, so far, we’re not yet seeing anything resembling the hype or interest of prior runs. In the Apple app store, the Coinbase app is the 21st most popular free finance app. It hit the number 1 spot back in October 2021, when Bitcoin reached its record high.

Perhaps the clearest way to see this the lack of FOMO is to simply chart Bitcoin’s price vs. interest in Bitcoin as measured by Google Trends.

Not surprisingly, the two charts tend to move together over time. When the number goes up, interest goes up. And then when the number goes down, people lose interest and move on (with, the exception perhaps, of die-hard Bitcoin maxis).

But this year we’ve seen a pretty dramatic rise in price, with only modest interest in attention paid to it so far. So it’s still TBD about whether, in a few months, people will be crazy about monkey pics again, or whether it fizzles out.

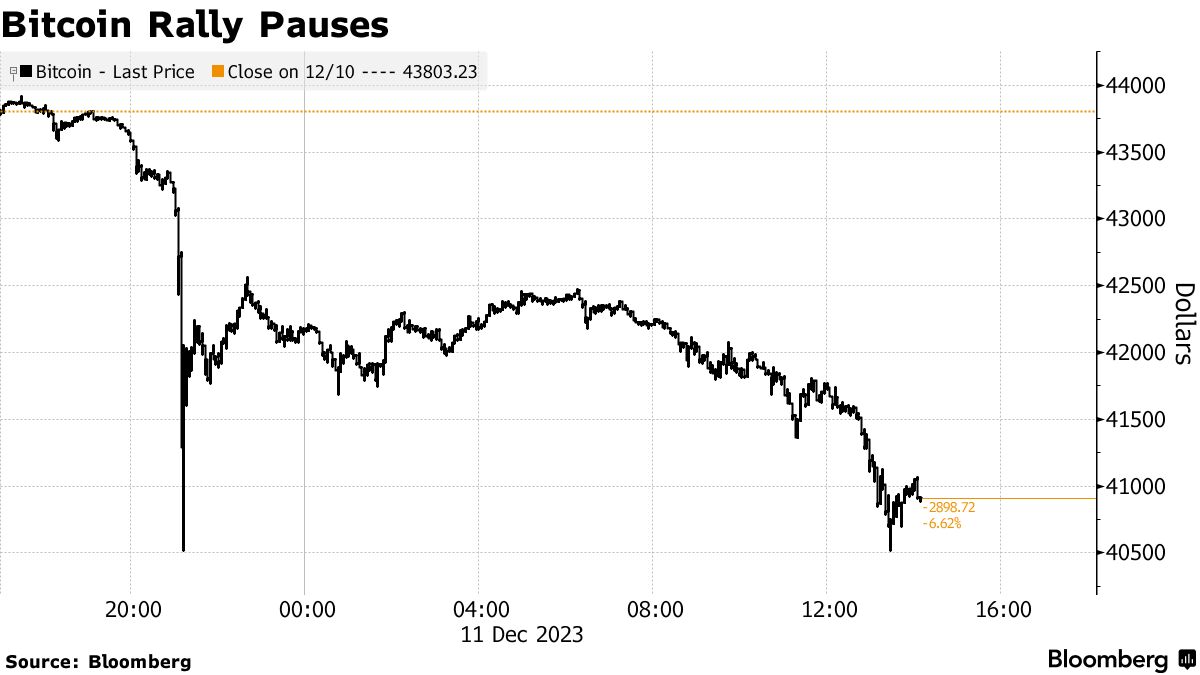

Later in the month, Bitcoin posted its steepest drop in almost four months as traders moved to lock in profits, triggering large liquidations of bullish bets. The largest token sank as much as 7.7% , the biggest intraday decline since Aug. 18.

Coinglass data show that about $500 million worth of crypto trading positions betting on higher prices were liquidated on Dec. 11 — the highest tally since at least mid-September.

“Crypto finally saw some profit-taking after a dizzying surge over the past few weeks,” said Caroline Mauron, co-founder of digital-asset derivatives liquidity provider Orbit Markets. “We expect to see further idiosyncratic volatility in the crypto asset class in the run-up to the ETF decision deadline in early January, which could be exacerbated by poor liquidity during the holiday period.”

While Bitcoin’s price has jumped, the crypto market still shows scars from the collapse of Bankman-Fried’s FTX platform and his trading house Alameda Research in November 2022. The wipeout contributed to a drop in liquidity, making the token harder to trade.

Market depth, or the crypto market’s ability to shoulder relatively large orders without unduly impacting prices, illustrates the problem. The daily value of trades falling within 1% of the mid-price of Bitcoin on centralized exchanges has dropped 55% to about $680 million from as much as $1.5 billion in April last year, Kaiko data shows.

One key issue is whether an actual green light for the products will spur some profit-taking, based on the adage that investors “buy the rumor and sell the news.” Put another way, the potential interest in the spot Bitcoin ETFs planned by the likes of BlackRock Inc. and Fidelity Investments remains unclear.

Vanguard does not intend to offer a spot Bitcoin ETF or any other cryptocurrency-related products . Vanguard believes that the investment appeal of cryptocurrencies is weak,” the company said in a statement.

“Unlike stocks and bonds, most crypto assets have no intrinsic economic value and do not generate cash flows . And the high volatility of cryptocurrencies defeats our goal of helping investors achieve positive real returns over the long term.”

It’s interesting that State Street isn’t rushing into the crypto ETF universe, even though the company is home to the $57 billion gold SPDR stock (ticker GLD) , the largest commodity ETF backed by gold bullion

FORECASTS

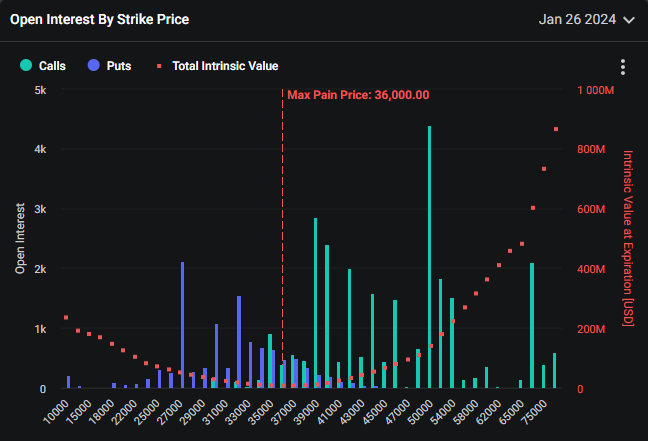

Options traders are loading up on bets that Bitcoin will surge to $50,000 by January, when many market observers expect the SEC to finally allow exchange-traded funds to directly hold the cryptocurrency.

That’s the price level with the largest open interest, or the total amount of outstanding contracts, to buy Bitcoin with call options that expire Jan. 26, according to data compiled by Deribit, the largest crypto options exchange.

Even if Bitcoin ETFs are approved, it is likely that demand for the funds at the start will fall short of market expectations, according to a Dec. 21 report by Singapore-based crypto asset trading firm QCP Capital.

“This sets up a classic ‘sell the news’ scenario in the second week of January,” the report said. “For this reason, we expect topside resistance for BTC in the 45-48.5k region and a possible retracement to 36k levels before the uptrend resumes.”

If the SEC approves spot bitcoin ETFs in early January, the price of the first cryptocurrency will rise to $50,000 by the end of the month. This forecast was given by Matrix port experts.

The company’s specialists drew parallels with the launch of the CME Group settlement bitcoin futures in 2017. Then the exchange announced derivatives at the end of October, and trading began in early December. During this period, the quotations of digital gold jumped by 196%.

Matrix port experts expressed confidence that bitcoin will continue to grow in the coming year. Among the factors contributing to this (in addition to the appearance of exchange-traded funds based on the spot price of cryptocurrencies) they called the halving expected in April and the improvement in US macroeconomic indicators. Historically, the digital gold exchange rate reached a new maximum in 6-8 months after the reduction of the block reward.

Matrixport predicted that bitcoin will rise in price to $63,140 by April 2024 and to $125,000 by the end of the next calendar year.

Many experts, including Messari CEO Ryan Selkis and CryptoQuant specialists, agree with the positive influence of the listed Matrix port driving forces for bitcoin. The latter even named a target mark of $160,000 per coin. They also believe that after the approval of the bitcoin ETF, the price of the first cryptocurrency will exceed $50,000.

Black stream CEO Adam Beck is confident that the cryptocurrency exchange rate will break through the $100,000 level even before halving (in April 2024).

Regarding the long-term movement of digital gold quotes, the entrepreneur agreed with the opinion of BitMEX co-founder Arthur Hayes about reaching the level of $750,000 to $1 million by 2026

In 2024, the cryptocurrency market will enter a bullish phase, and bitcoin will become its driver, surpassing most other assets in growth. This forecast was given by the founder and CEO of Messari, Ryan Selkis.

In the long term, the world is moving towards a digital era in which bitcoin will become the digital equivalent of gold, Selkis stressed. The assumed parity with the precious metal gives quotes of the first cryptocurrency over $ 600,000.

The bitcoin MRVR indicator is at the level of 1.3 — values below 1 indicate the accumulation phase, and the output of the coefficient above 3 always signals that the peak of the cycle has been reached. The cryptocurrency is currently in the recovery stage and, despite the rally of 2023 (about 150% growth), is a good investment, according to the head of Messari.

VanEck researchers began their list by suggesting the possible start of a recession in the United States and the long-awaited approval of spot bitcoin ETFs. According to their estimates, the new investment product will attract about $2.4 billion, supporting the price of digital gold.

According to the third forecast, the exchange rate of the first cryptocurrency will reach a new historical maximum in the fourth quarter of 2024, which will potentially be caused by “political events and regulatory changes after the US presidential election.”

Bitcoin price could potentially rise above $50,000 in early 2024: CryptoQuant

The prediction is based on analyzing Bitcoin’s user activity, using the Metcalfe price valuation band metric, considering factors like market capitalization, transaction volume, and user activity. The report suggested Bitcoin’s target price range could be $50,000 to $53,000 early next year.

CryptoQuant analysts noted that Bitcoin’s supply in profit is above 88%, and sell pressure may be increasing as a significant portion of circulating supply is in profit. The report, therefore, cautioned of potential short-term corrections, noting that high levels of circulating supply in profit often align with local market tops.

“Caution is advised due to the possibility of a short-term correction, given that 86% of the circulating supply is currently in profit and funding rates are noticeably elevated,” the report said. Current data from CryptoQuant shows that the circulating supply of bitcoin in profit has now increased to over 88%. The report added that such high levels of circulating supply in profit “have historically coincided with local tops.”

CONCLUSION

What I really do not like with all this noise around ETF is its massive effect. Too many people fell in euphoria, falling obvious comments and taking it without thinking on reality of these statements.

Meantime, we have example of Jacobi ETF – it has grown together with the price of BTC but it has the same number of shares as in the moment of launching. Talk is talk, but so far it has led to nothing even for those who launched such an ETF. We touched on one ( of these about six months ago – from Jacobi Asset Management.

Of course, the quotes of the fund’s shares are growing along with the price, but if we assume that the market was only lacking such a necessary instrument as an ETF, then in this particular case these expectations were not justified. As there were 62,500 shares, it remains so.

Hong Kong, are also talking about it – launching of ETF, I mean.

It’s possible that it simply doesn’t work that way. And each ETF attracts primarily funds from those who are already clients of the issuer and that’s where it ends. But it is possible that a critical mass of such ETFs has simply not been accumulated.

But what I personally see as good in the news about Hong Kong ETFs is that:

a) A boundless sea of money can flow here from the Chinese individuals, who, as we remember, switched to a savings model from Covid;

b) They confirm the requirement to keep the BTC with the custodian. This means that the more bitcoins there are in such ETFs, the fewer of them there will be on exchanges.

Then suddenly it turned out that BlackRock had set itself as a major corporate goal to obtain approval from the SEC for its spot BTC ETF.

Again. A company with assets under management of $9 trillion says its main corporate goal is to gain approval for ETFs. Neither something related to the management of these same $9 trillion and achieving some indicators, nor the formation of a fund of agricultural land, nor world domination, but the approval of some instrument. Or I don’t understand the meaning of the phrase “main goal”.

You can talk as much as you like about aggressive marketing, about pumping for the sake of exit and profit for insiders, but still they cannot fail to achieve their goal, reputationally and conceptually. This means that there will most likely be approval. From January 5 to January 10 or not is no longer so important. Here I quite see the possibility that the market can be manipulated based on expectations, but this is not necessary.

There is a lot of speculation about what will happen immediately after the ETF is approved. Some say that after this there will be a “sell the news” and everyone who made money waiting for the launch will start leaving and the price will fall. Others say that you shouldn’t expect an immediate injection of huge money into the market, since investors in the new instrument will come gradually. Still others are waiting “to the moon”.

We’ll see how everything will actually turn out, but I would place special emphasis when discussing the likelihood of a particular outcome on the circumstances under which this will happen. Not the launch itself, but, relatively speaking, the first months after the launch. Either inflation, or deflation, a banking crisis, a recession, or just the expectation of these or other events. In general, there are many variations and interpretations.

Will everyone run to the BTC through ETFs to save themselves from inflation, or from a recession, or from problems in the banking system? Whether it will be perceived in principle as a risky or, conversely, a protective asset will depend on two factors – what will happen to the price of the ETF (that is, whether it will perform better than certain instruments) and what narrative will be aggressively promoted through the media.

I would also think about why BlackRock wants this approval now. Meetings with the SEC are held a couple of times a week, etc. It would be quite possible to slowly introduce such an instrument in another six months, without haste. Either way, there is some purpose to all of this. Not necessarily deep and mysterious. It can be simple and banal. In general, there is something to think about.

Besides, the whole market is ~ $600Bln. Is it large? Of course, but not too large, especially if we suggest that not all coins will flow into ETF. So, it seems that all this mess around ETF has some different targets, not economical. Maybe political. Just to take it over control, especially when we see some rush and situation with Binance.

I also some feeling, I wouldn’t say that it is “gut” one, but just some reasonable questions… Everything should go different, not as all around are expected. Because it is impossible that everybody will get the earn. Besides, I’m sure that serious investors have position closer to Vanguard. From valuation science, the cost of any asset is the future value of cashflows that it generates. BTC generates no cashflows, no interest. It even has no intrinsic value. Would you seriously think about investing billions in such an asset? This is arguable question.

Besides, if you hold billions in assets – you have other options to invest. Buy spot BTC, futures on BTC, shares of mining and BTC related companies etc. ETF itself doesn’t provide the breakthrough in investing process. Yes, it brings some special features for holders, but if explosive demand for BTC was existed, it would exist across the board, and everybody wouldn’t just wait for ETF approvement.

Buy BTC for some special purposes to use it as payment tool for transactions and keep it as part of working capital – it is possible. Somehow I’m agree with those people who express some worryings of BTC perspectives after ETF approvement.

We are not trying to dissuade you from buying BTC now. But we call you to think twice and be careful when you make this investment decision – risks that something will go different after ETF approvement are extremely high.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

205 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, November 2023