Bitcoin Fundamental Briefing, February 2021

January has passed under the sign of unprecedented rally on Bitcoin and possibly the whole financial world history. It was really a “rush time” when people could not think what to do with just opened position as the next day it costs 30% higher.

Still, as the coin has exceeded most brave forecasts, the reasonable question is rising – what to expect from the market in the nearest term. How high the risk of the reversal, and what chances for the same pace collapse. We try to set our view following three parts: a market overview, third-side forecasts, and our own market analysis. Hopefully, by the end of this research, we come to some conclusions.

Market overview

The primary purpose of this overview, as usual, is to understand the sentiment and answer on few questions, such as – whether investors have the interest of the same strength to BTC or they chill out a bit, what is demand stand, what miners’ activity, etc. This should let us take the general view and tell either sentiment healthy, and we should not worry for a long-term perspective, or it has become weaker.

MicroStrategy Inc. has bought another pack of bitcoins for $1.03 Bln.

MicroStrategy® Incorporated (Nasdaq: MSTR) , the largest independent publicly-traded business intelligence company, announced that it had purchased an additional approximately 19,452 bitcoins for approximately $1.026 billion in cash at an average price of approximately $52,765 per bitcoin, inclusive of fees and expenses.

As of February 24, 2021, the Company holds an aggregate of approximately 90,531 bitcoins, which were acquired at an aggregate purchase price of approximately $2.171 billion and an average purchase price of approximately $23,985 per bitcoin, inclusive of fees and expenses.

Tesla says it has bought $1.5 billion worth of bitcoin

Tesla has disclosed in an SEC filing published Monday that it has bought $1.5 billion worth of bitcoin.

“In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity,” reads the filing. “Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy and may acquire and hold digital assets from time to time or long-term.”

Wedbush’s Dan Ives on his estimate that Tesla has made roughly $1 billion in profits from bitcoin

For comparison – Tesla has net income from electro cars sales around $721 Mln. in 2020.

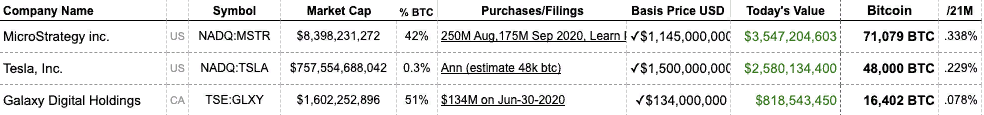

According to Bitcoin Treasuries Tesla Inc. owns 48K Bitcoins:

BlackRock’s Rick Rieder on bitcoin: We’ve started to dabble in it

BlackRock, which manages $ 8.7 trillion in assets, is interested in Bitcoin as an alternative defensive asset. This was announced by the chief investment officer of BlackRock Rick Reeder on the air of CNBC. The company is starting to “gradually engage” in cryptocurrencies, but Reeder did not give details.

“Technology and regulation has evolved to the point where many are starting to see bitcoin as part of the portfolio, and this is pushing the price up,” he said.

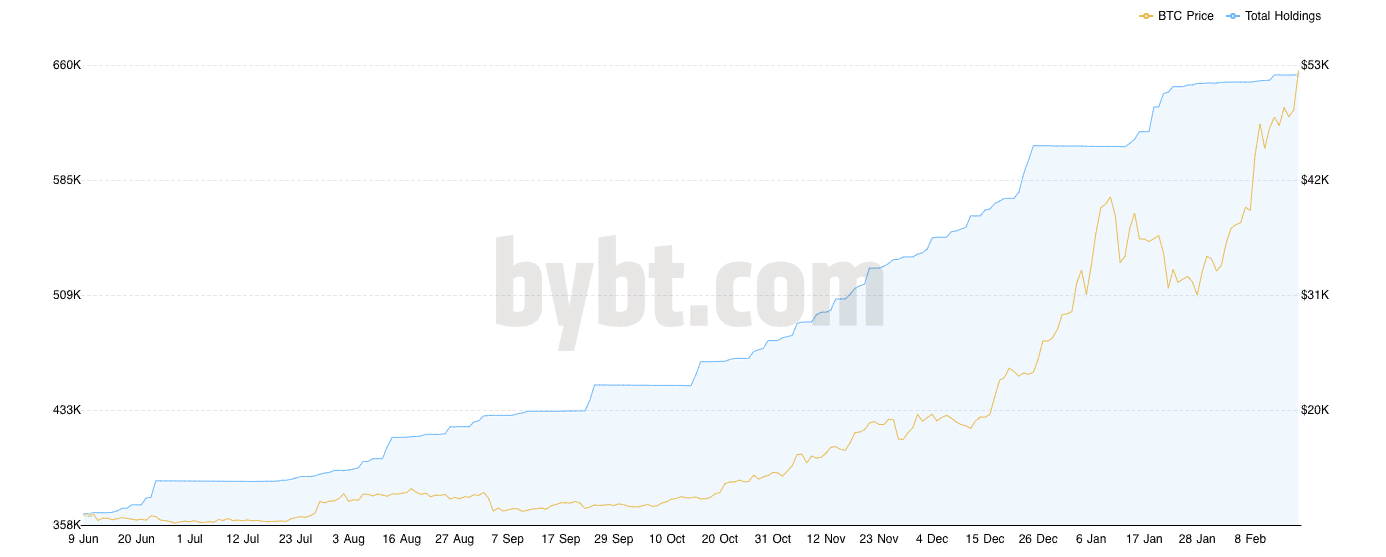

GreyScale Net Assets Under Management hits $40 Bln. in February

Assets are doubled since the beginning of the year. Now the most popular Bitcoin fund holds approximately 3% of absolute amount of Bitcoins (21 Mln).

Grayscale has incorporated six more trusts, including ones for Chainlink and Tezos. Crypto asset manager Grayscale has incorporated six more trusts, including those tied to Chainlink (LINK) and Tezos (XTZ) tokens.

The trusts were formed by Delaware Trust Company, Grayscale’s “statutory trustee,” in recent months.

Besides LINK and XTZ, the other four trusts include Basic Attention Token (BAT), Decentraland (MANA), Livepeer (LPT), and Filecoin (FIL). All the six trusts were formed in December, except the FIL trust, which was incorporated in October.

The GBTC product has continued to trade at a premium between +8.5% and +12.2% Glassnode reports, suggesting continued institutional interest. Where a premium is present for Grayscale products, an arbitrage trade opportunity exists for in-kind transfers of BTC into the trust creating a persistent supply sink. A similar premium is present for the GETH product this week trading between +5.1% and +11.2% compared to net asset value.

Morgan Stanley May Bet on Bitcoin in $150 Billion Investment Arm

A $150 billion Morgan Stanley investing arm known for its prowess in picking growth stocks is considering adding Bitcoin to its list of possible bets.

Counterpoint Global, a unit of Morgan Stanley Investment Management that’s racked up wins in mutual-fund rankings, is exploring whether the cryptocurrency would be a suitable option for its investors, according to people with knowledge of the matter. Moving ahead with investments would require approval by the firm and regulators.

Last month Morgan Stanley has bought 11% shares of MicroStrategy company, mentioned above.

Bitcoin to Come to America’s Oldest Bank, BNY Mellon

Bank of New York MellonCorp., the nation’s oldest bank, is making the leap into the market for bitcoin, a sign of broader acceptance of the once-fringe digital currency.

The custody bank said Thursday it will hold, transfer and issue bitcoin and other cryptocurrencies on behalf of its asset-management clients.

Feeling the heat from employees, Wall Street banks get closer to adopting bitcoin

JPMorgan co-president Daniel Pinto told CNBC in exclusive remarks what it will take for the bank to embrace bitcoin: “The demand isn’t there yet, but I’m sure it will be at some point.”

When asked later by CNBC to clarify his remarks, Pinto, who leads the world’s biggest investment bank by revenue, said the firm’s decision would be informed by whether a critical mass of clients wanted the firm to trade bitcoin.

“If over time an asset class develops that is going to be used by different asset managers and investors, we will have to be involved,” Pinto said in an interview. “The demand isn’t there yet, but I’m sure it will be at some point.”

Miners revenue and activity hits all time highs

Bitcoin miner operator Blockcap is the latest North American company poised to expand its hashing power amid bitcoin’s price rally. The firm said in an announcement shared with The Block that it has purchased 10,000 additional AntMiner S19 made by Bitmain in a bid to double its proprietary computing power.

These existing machines, providing about 950 petahashes per second (PH/s) of computing power in total, are able to produce about 5.5 BTC in 24 hours at bitcoin’s current mining difficulty.

The revenues of bitcoin miners in January reached their maximum level of $ 1.09 billion since December 2017. This was facilitated by new price records of the first cryptocurrency. At the peak of the bull market three years ago, this figure was $ 1.25 billion.

Last month, $ 977.7 million of $ 1.09 billion accounted for income from mined blocks – the maximum in the entire history of observations, $ 112.8 million – for commissions received.

As a result of trading on February 16, shares of Bitcoin mining equipment manufacturers and mining firms traded in the United States showed double-digit growth. Some have updated all-time highs.

Investors pushed up the stock quotes of these companies against the background of the storming of the first cryptocurrency of the psychological level of $ 50,000. Among the companies are – Marathon Patent Group (+13%), Riot Blockchain (+20.67%), Canaan Creative (+50%) and others.

Market Sentiment

The sentiment, in general, stands positive without any signs of major reversal by far. Still, once the market hits record highs above 50K – some profit-taking happens.

Wallets with 1k to 10k BTC holdings over the last two weeks appears to be ‘reducing holdings‘. Is this new sell pressure? Are institutions getting spooked or taking profits?

This wallet behavior suggests a sizeable portion of these coins may not be sold, but instead being restructured in custodial wallets. There was a preference for 1k to 10k wallets in January (acquisition withdrawals perhaps) that are now transitioning into larger sets of UTXOs with smaller denominations between 100 and 1k. Perhaps coins are being placed into multi-signature schemes or custodians are undertaking internal shuffling to meet client requirements.

In fact, once could hazard a guess that this behavior is indicative of very long term custodial holdings and coins are entering deep cold storage. So whilst coins are on the move and larger balances are being reclassified, it does not necessarily suggest an end to whale spawning season (and may in fact suggest the opposite!).

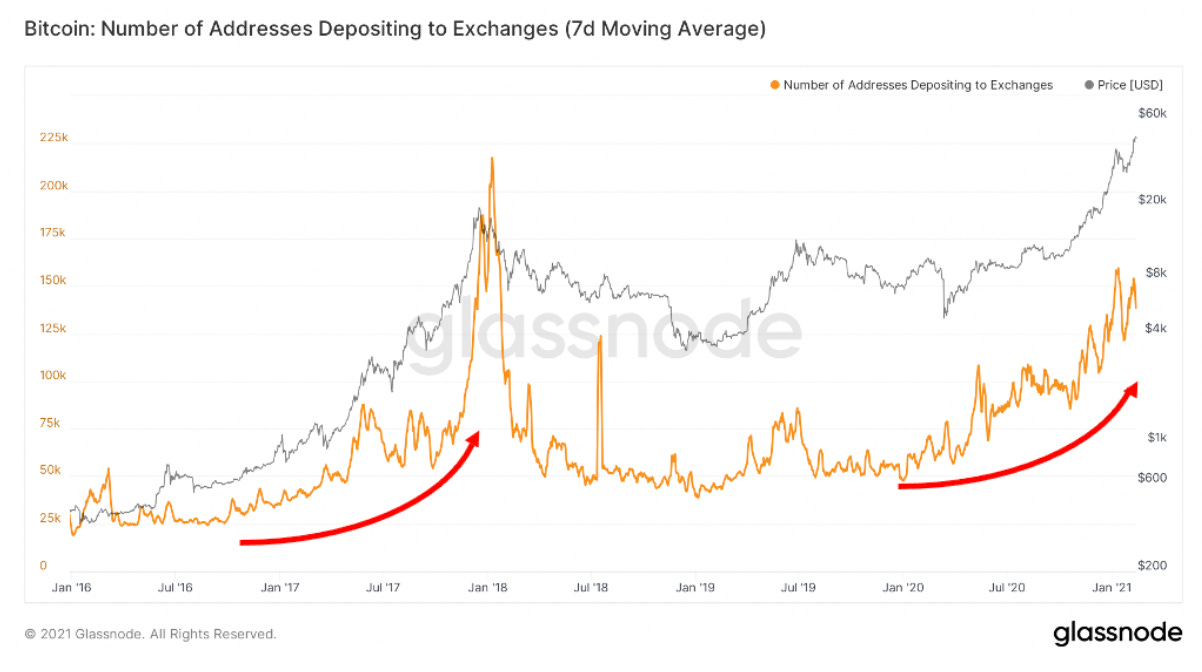

Once the price increases to a certain level, old and new players start to increase the number of deposits towards exchanges, in order to capture profits or speculate on price discovery. Comparing our current cycle to the last bull run in 2017, it becomes clear that we are still in that early acceleration phase of the curve. Note that it is important to normalize the number of depositing addresses to the number of total addresses in the network, which increased about 3 fold since 2017. Thus one should divide the current number of addresses on the chart below by 3 to make any valid comparison with the previous bull run.

Once the price increases to a certain level, old and new players start to increase the number of deposits towards exchanges, in order to capture profits or speculate on price discovery. Comparing our current cycle to the last bull run in 2017, it becomes clear that we are still in that early acceleration phase of the curve. Note that it is important to normalize the number of depositing addresses to the number of total addresses in the network, which increased about 3 fold since 2017. Thus one should divide the current number of addresses on the chart below by 3 to make any valid comparison with the previous bull run.

We are not at the end until the number of addresses depositing to exchanges goes exponential.

As things stand in historical terms we are in the middle of this supply transition from long term holders to short term holders. This transition, although faster than in 2017, is a strong sign that we have moved out of the initial accumulation phase.

in 2017 when this is occurred, about 6 months prior to the peak. Increased roughly 10 fold after that. It means there’s some profit taking occurring from long term holders as new players enter the game, but there’s still a long way to go until the peak.

Third party forecasts on BTC Price

Will Hobbs, the CIO Barclays Wealth & Investments, said his firm is not interested in the world’s biggest cryptocurrency at the moment, despite its recent record-breaking rally. He added that he thought the currency was backed by a “lot of magical thinking.”

“It is multiples more volatile than our most white-knuckle-ride asset class, which is emerging market equities,” he told Insider. In order for an asset to make it into our asset class toolkit, it has to satisfy a couple of things. One, it has to have a positive expected return, obviously. And the other is it has to have some diversification appeal.

“Now it may well be over time that bitcoin satisfies both of those. But at the moment it’s very hard to say.” Hobbs did not rule out ever delving into bitcoin, saying: “We wait on the sidelines and watch others.”

“My hunch is that if real interest rates turned positive, then bitcoin [will] suddenly look like quite a flightless bird. Because if I can get a positive yield from lending to the US or UK government, why am I going to own bitcoin?”

Hobbs said it is too early to tell what the exact nature of bitcoin is. “At the moment, it’s primarily a store of value backed by a lot of magical thinking and also [a] big momentum narrative. It shows the narrative power of markets… similar to the Reddit story,” he said, referencing the GameStop saga.

“Bitcoin prices have continued their meteoric rise with Tesla, BNY Mellon and Mastercard’s announcements of greater acceptance of cryptocurrencies,” JPMorgan said in a research note last week. But fintech innovation and increased demand for digital services are the real Covid-19 story with the rise of online start-ups and expansion of digital platforms into credit and payments.”

JPMorgan’s own strategists say that bitcoin could rally as high as $146,000 as it competes with gold as a potential hedge against inflation in the coronavirus crisis.

Still, skeptics remain unconvinced. Economists like Nouriel Roubini say that bitcoin and other cryptocurrencies have no intrinsic value. And a recent Deutsche Bank survey said investors view bitcoin as the most extreme bubble in financial markets.

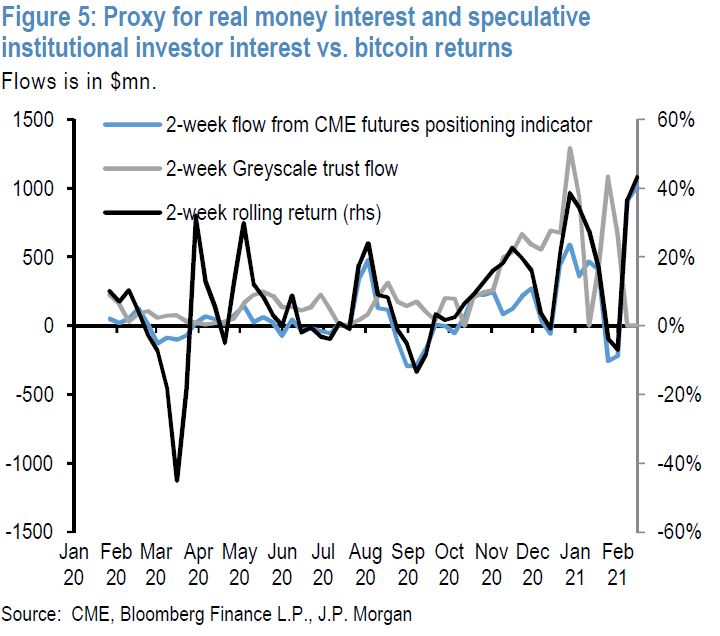

JP Morgan: Has only $11bn of institutional flow into bitcoin since September-end

caused a $700bn increase in its market cap?

What has been remarkable over the past five months is that the $700bn increase in the market cap of bitcoin has taken place with relatively little

institutional flows. For example, proxying these institutional flows via the cumulative flows into the Grayscale Bitcoin Trust or other publicly listed bitcoin funds as well as the cumulative flows into CME bitcoin futures and announcements by institutions such as Tesla, Mass Mutual, Guggenheim

and others, we get an aggregate flow of around $11bn since the end of September which accounts for just above 1.5% of the increase in the bitcoin market cap over the same period. How is it possible that such a limited flow would result in the magnitude of the increase in bitcoin market cap? One possibility is that, given the increase in interest from real money

investors, and speculative investors seeking to front run it, this limited flow is hitting a relatively inelastic supply of a predetermined increase in new bitcoins

mined and having to offer a premium to get existing holders to part with their bitcoin holdings. A second possibility is that retail inflows have significantly

magnified the institutional flow.

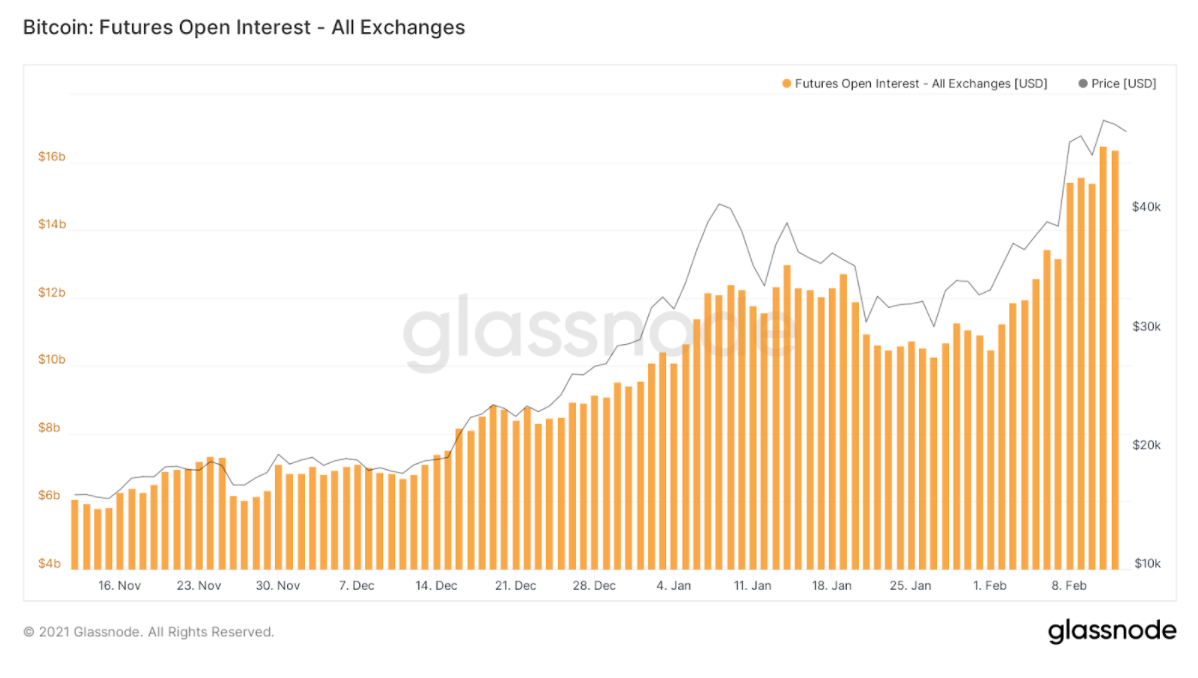

Figure 5 shows 2-week rolling flows into the Greyscale trust as a proxy for real money interest and 2-week rolling changes in our futures positioning indicator as a proxy for speculative institutional investor interest compared to 2-week rolling returns in bitcoin prices. It suggests that, after announcements from end-September onwards, real money inflows during Oct/Nov/Dec contributed to the rally in bitcoin prices at the time, while the movements since January this year appear to have been more influenced by speculative flows. This also

suggest that some pickup in real money flows would likely be needed to sustain current prices in the absence of a re-acceleration of the retail flow.

Guggenheim Partners – Bitcoin could rise to $600K in long term

“If we consider the offer of bitcoin regarding, say, the supply of gold and its total value, and the cryptocurrency rises to similar values, we will talk about $ 400,000- $ 600,000 per coin,” Minerd said.

According to the top manager, Guggenheim Partners has been studying the first cryptocurrency for almost 10 years. He added that previously the market volume was “not large enough and unjustified for institutional money.”

Minerd noted that the rapid growth of digital gold from $ 20,000 to $ 40,000 in a few weeks “smacks of short-term speculation.”

According to him, the participation of institutional investors in the market is growing, but this is still not enough to maintain the current level of the bitcoin price.

On January 21, Minerd announced that the first cryptocurrency this year has already peaked in its market value. He predicted a decline in the price of BTC to $ 20,000.

Michael Burry who has forecasted 2008 crush of Sub Prime debt thinks that governments accelerate inflation and start liquidation of the fiscal rivals:

Our View on BTC medium term perspective

Our general outlook stands positive, as we see that institutional investors keep a beneficial interest in cryptocurrencies. Statistics also show good performance – BTC and ETH hedge funds are growing, mining hits all-time records, trading activity is rising as well.

Still, few risk factors make us cautious on the absolutely cloudless forecast. First is – the rising share of short-term investors that accumulate coins from whales’ selling. When the market strongly depends on short-term positions, it becomes an object of high volatility and poor forecasting.

Second – interest rates. We’ve talked about it in our last report and repeat this once again. We agree with Michael Burry and Will Hobbs from Barclays and tell the same thing – how BTC behaves when interest rates come to 2%, and real interest rates start rising. Our worry is not in vain since a big part of the market stands under institutional investors’ control. The shape of the market is drastically changed. And institutional investors bring their own “classic and scientist” approach to market valuation and the business cycle. This approach tells that on bullish economy cycle, interest-bearing assets dominate over non-interest assets such as gold and… yes – the BTC. So the risk is whether this “rule of thumb” spreads over Bitcoin or will somehow avoid this.

In recent two months, we talk a lot about the correlation of BTC and 10-year interest rates, but yesterday, when rates jumped to 1.55% Bitcoin, has not followed somehow:

Because major shifts start to happen when interest rates are closer to 2%, the recent jump was to 1.55% already. Besides, interest rates now stand at a substantial 1.42-1.50% long-term resistance area, suggesting a technical pullback. Following the cross-market analysis – BTC could follow. Besides, as we’ve mentioned above, as big investors start to book profit, we have other reasons to suggest the pullback.

That’s being said, in the medium-term, we keep a bullish view and think that the best strategy now is to Buy on deeps across all time frames, as the market has strong upside momentum and good fundamentals that just can’t be over in a blink of an eye. But, as interest rates come closer to 2% and real rates start to rise – we have to be more careful as it is unclear how the BTC market response, or better to say how institutional investors treat this “new” toy in the environment of rising interest rates as it was not tested their before.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

547 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023