Bitcoin Fundamental Briefing, April 2021

Fragile equilibrium

April is becoming the special month for Bitcoin in particular and the cryptocurrency market in general. Right in April, Bitcoin has reached the top of its capitalization and an all-time high, and strongest downside retracement either. It is a hot topic on the market – how to treat retracement properly, what stands behind it, and how deep it might be. Is retracement a reflection of changes in long-term driving factors that bring the hazard of collapse?

Indeed, there are a lot of economists that treat Bitcoin and cryptocurrencies as a bubble and fever. For the truth’s sake – they have reasons to think so. But at the same time, currently, we believe that the crypto market is still far from collapse sentiment. Our view and investors’ mood mostly point to the natural stage in any market – temporal saturation. It means that super-fast growth might be in the past, but it doesn’t mean that trend has to turn bearish.

This month we try to focus on the important news only that correctly reflects the market background. And keep everything “secondary” behind just to not repeat many things that already have become routine – rising mining activity, regular new records of the hash rate, rising capitalization, rising activity on cash and derivative markets, etc. Major driving factors remain the same – interest in cryptocurrencies among institutional investors is growing, liquidity in the US economy stands at unprecedented levels, improving and more loyal regulation, infrastructure progress, and other factors should support the market in the foreseeable future.

We’re primarily interested in the medium-term perspective, how big whales treat current pullback, and their targets. Additionally, we consider risk sources that are not widely announced and not felt by far.

Market sentiment

PayPal CEO Dan Schulman: Cryptocurrency Is the Real Deal. And the Superapps Are Coming.

Ten years from now, you will see a tremendous decline in the use of cash. All form factors of payment will collapse into the mobile phone. Credit cards as a form factor will go away, and you will use your phone because a phone can add much more value than just tapping your credit card. And so when all of those things start to happen, then central banks need to rethink monetary policy as well, because you can’t just issue more paper money into the system because people aren’t using paper money. And so this is the advent of digital currencies.

JPMorgan to Let Clients Invest in Bitcoin Fund for First Time

JPMorgan Chase is preparing to offer an actively managed bitcoin (BTC, +2.74%) fund to certain clients, becoming the latest, largest and – if its CEO’s well-documented distaste for bitcoin is any indication – unlikeliest U.S. mega-bank to embrace crypto as an asset class.

The JPMorgan bitcoin fund could roll out as soon as this summer, two sources familiar with the matter told CoinDesk. Institutional bitcoin shop NYDIG will serve as JPMorgan’s custody provider, a third source said.

Rothschild’s RIT Capital Partners invests to Kraken exchange

According to media reports, Kraken is considering going public through a direct listing in 2022, after seeing record trading volumes and new clients amid a surge in the price of bitcoin.

Coinbase, Kraken’s main rival in the US, posted record quarterly revenue of $1.8bn in the Q1 2021, which is more than it made for the whole of 2020.

Kraken is currently in talks with investors about another round of fundraising that could give it a valuation of $20bn. According to reports, talks have been held with is in discussions with firms including Fidelity, Tribe Capital and General Atlantic.

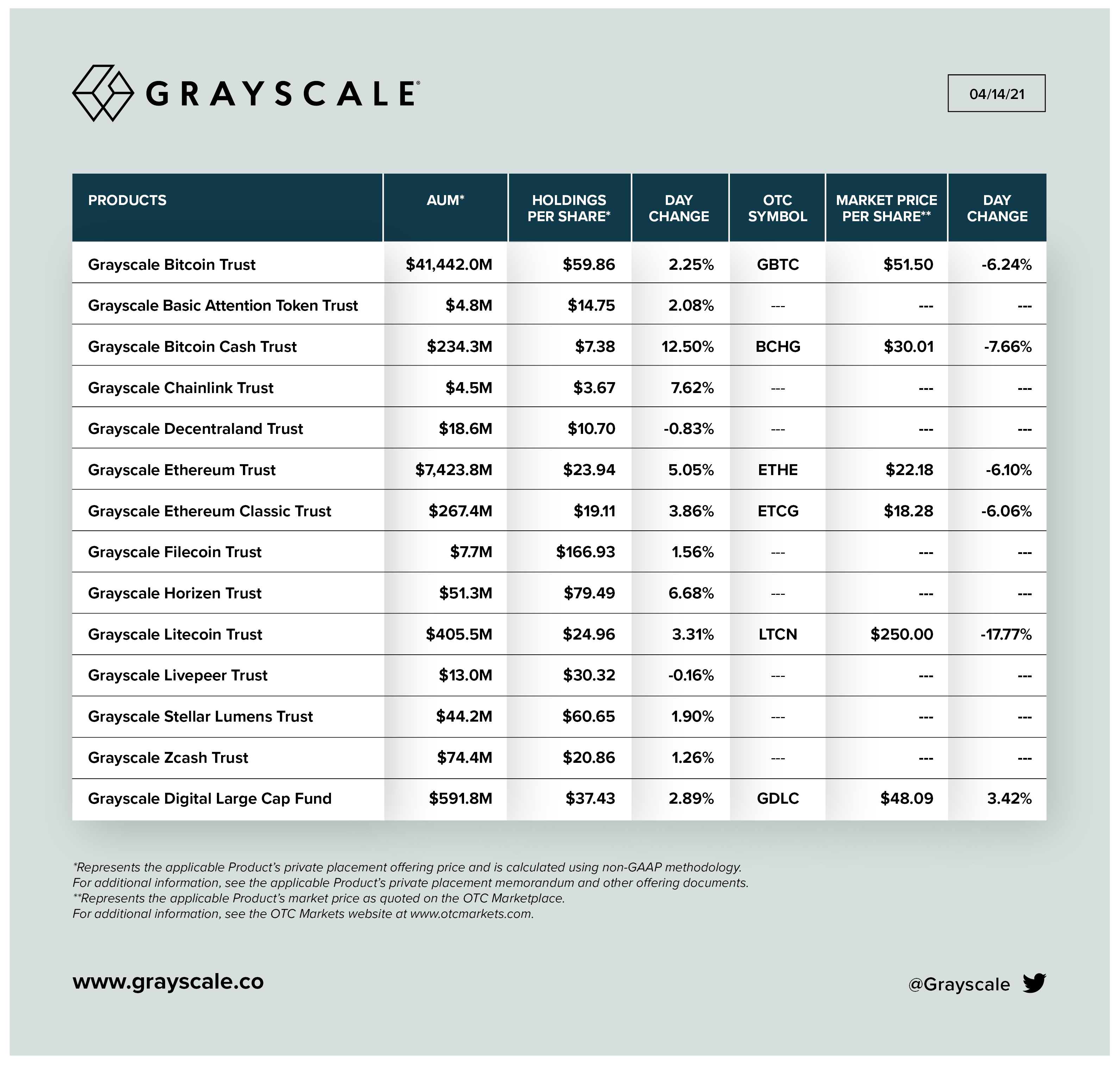

Rothschild Investment Corporation reported owning 38,346 shares of GBTC

In January, it reported owning 30,454 shares. Filing is also reported 265,302 shares of Grayscale ETH Trust. This is a new position.

New Gemini poll shows that 63% of US citizens are interested in cryptocurrencies

Data shows that the “average” cryptocurrency owner is a 38-year-old male making approximately $111k a year.

The crypto-curious audience is defined as those who do not currently own

cryptocurrency but indicate either wanting to learn more or planning to buy soon. This group is significant in size, comprising 63% of U.S. adults, and has the potential to disrupt what we think of as the “average” crypto holder. Roughly 13% of U.S. adults plan to purchase cryptocurrency in the next 12 months. This adds up to approximately 19.3 million adults — which would nearly double the current crypto investor population.

CI Global Asset Management to Launch World’s First Ethereum ETF

Canadian securities regulators have issued a receipt for the final prospectus of the CI Galaxy Ethereum ETF (“ETHX” or the “ETF”), the world’s first Ether ETF with the lowest management fee of any Ether ETF globally at 0.40%. ETHX has started trading on the Toronto Stock Exchange (“TSX”) on April 20, 2021.

Greyscale AUM hits $50.6 Bln in April

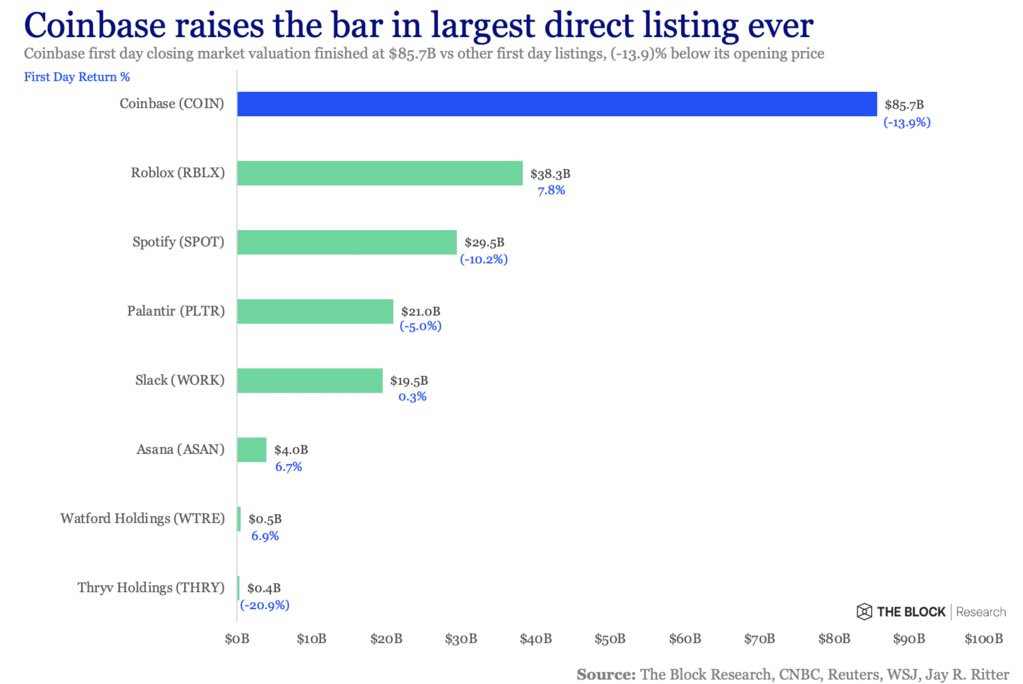

Coinbase exchange listing starts on NASDAQ

It becomes largest by capitalization exchange in the world with value around $100 Bln. on a listing date – greater than CME Group, NASDAQ and NYSE.

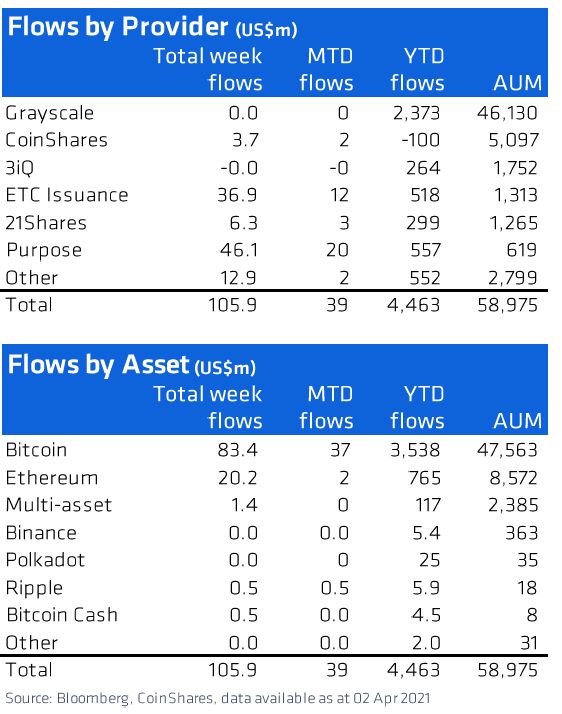

Coinshares: IQ 2021 inflows brought record high $4.5 Bln to cryptocurrency funds

Goldman Sachs CEO predicts “huge evolution” of the cryptocurrency market

“There are significant regulatory restrictions around us and us acting as a principle around cryptocurrencies like bitcoin,” says GS CEO David Solomon. “As our clients have demand to be involved in this space we can continue to find ways to support our clients.”

Morgan Stanley considers investments in cryptocurrency derivatives by its subsidiaries.

Funds could invest up to 25% of their assets in crypto derivatives. Certain Funds may have exposure to bitcoin indirectly through cash settled futures or indirectly through investments in Grayscale Bitcoin Trust .

To the extent a Fund invests in bitcoin futures or GBTC, it will do so through a wholly-owned subsidiary, which is organized as an exempted company under the laws of the Cayman Islands.

BlackRock Global Allocation Fund reports on BTC futures investing

According to the statement, total amount invested is 37 futures contracts, with expiration date at March, 26 that represents 0.14% of total assets ($25.43Bln). Single contract is equivalent to 5 BTC.

Nearly 3 in 4 professional investors in Bank of America survey see bitcoin as a bubble

Some 74% of those who responded to the closely watched market gauge said they see the leading cryptocurrency as a bubble. Just 16% said no to the question, indicating the highly speculative ground they see bitcoin on.

“It (BTC) may become a great asset class and I do believe this can become a great asset class,” says Larry Fink. “I don’t believe we should think about crypto as a substitute of currency.”

Larry said that he has not noticed an increase in interest in bitcoin from institutional investors. More attention is paid to the risks of climate change, national budget deficits and inflation.

“We are studying cryptocurrency, we made money on it, but I will not say that we see a wide interest of institutional investors around the world,” said Fink.

Tom Jessop, head of Fidelity Digital Assets at Fidelity Investments, says that the maturation and adoption of digital assets as a class of investments will continue at a rapid pace in coming years, signaling that crypto may have turned a corner in traditional finance circles.

“I think we continue to see adoption at an accelerated pace for a host of reasons,” he said Wednesday afternoon during an interview at MarketWatch and Barron’s “Investing in Crypto” virtual event series.

Jessop said that a backdrop of ultralow interest rates and an environment that has been stimulated by easy-money policies has helped to drive momentum into bitcoin and other assets, which are increasingly being seen as alternatives to assets that are considered richly priced by some measure and bonds that are offering meager yields.

Fidelity has been at the vanguard of integrating digital assets into traditional investment portfolios. The asset manager was one of the first major institutions to explore bitcoin, starting in 2015. The company created the digital asset unit, which Jessop heads, in 2019.

Medium-term market expectations

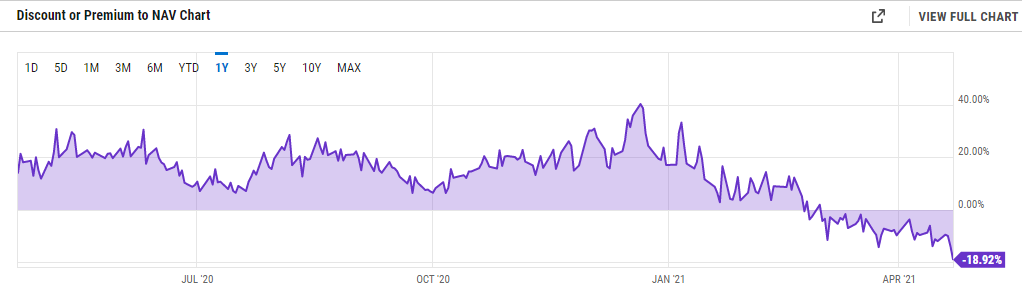

Grayscale Bitcoin Trust discount hits a record 18.92% to NAV value

As a committed, long-term stockholder, Marlton believes in the strategy of offering investors exposure to Bitcoin (“BTC”) in the form of an equity security, thereby avoiding the challenges of investing in BTC directly.

Still, Marlton’s letter notes that despite GBTC’s competitive advantage as the world’s largest Bitcoin fund, its shares have traded at a dramatic discount to net asset value, or NAV. Marlton currently estimates that discount to be over $3.1 billion in total. Given the estimated $600 million in fees the Sponsor collects every year, a true tender offer is the correct value creating initiative for GBTC stockholders.

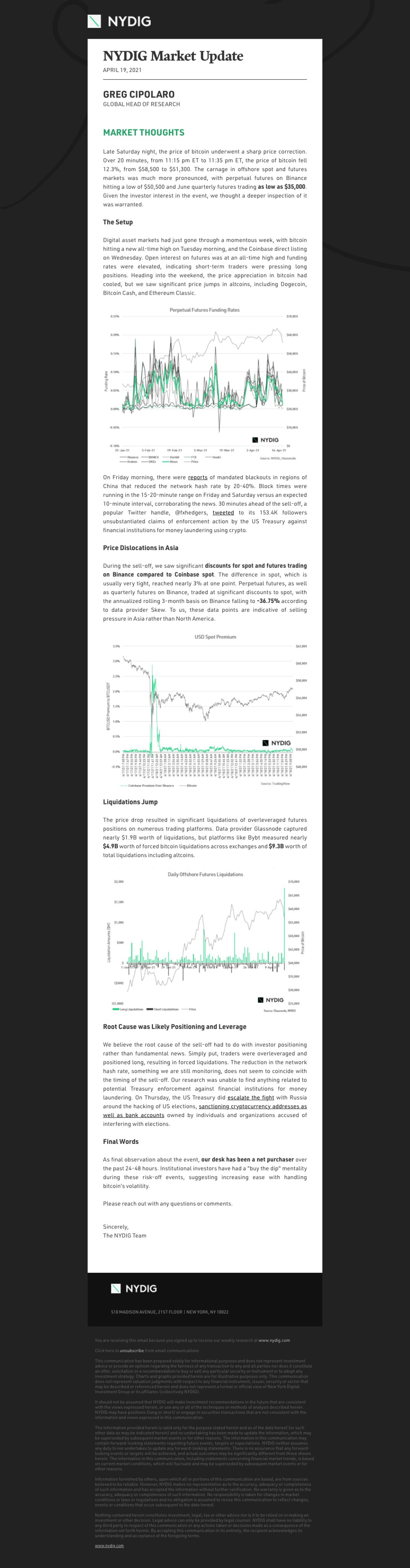

Wall Street Starts to See Weakness Emerge in Bitcoin Charts

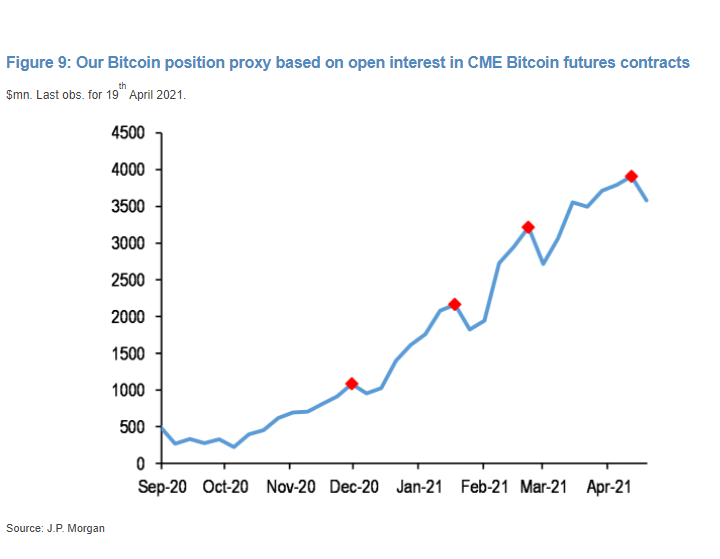

JPMorgan Chase & Co. strategists led by Nikolaos Panigirtzoglou noted that the last few times they witnessed such negative price action in Bitcoin, buyers returned in time to prevent deeper slumps. This time, they’re worried.

“Over the past few days Bitcoin futures markets experienced a steep liquidation in a similar fashion to the middle of last February, middle of last January or the end of last November,” the strategists said. “Momentum signals will naturally decay from here for several months, given their still elevated level.”

In those three previous instances, the overall flow impulse was strong enough to allow Bitcoin to quickly break out above the key thresholds, yielding further buildups in position by momentum traders, JPMorgan noted.

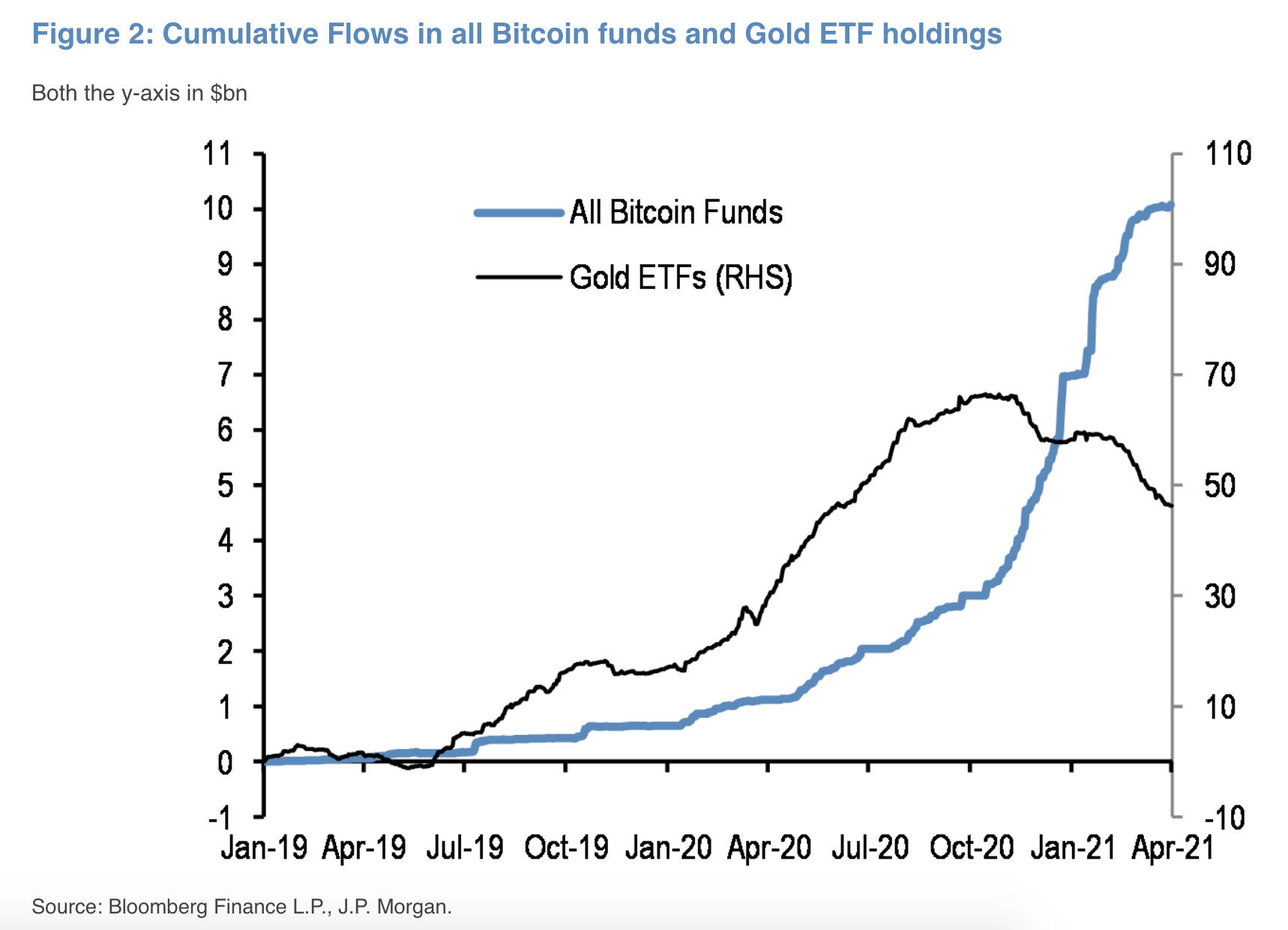

“Whether we see a repeat of those previous episodes in the current conjuncture remains to be seen,” the strategists said. The likelihood it will happen again seems lower because momentum decay seems more advanced and thus more difficult to reverse, they added. Flows into Bitcoin funds also appear weak, they said.

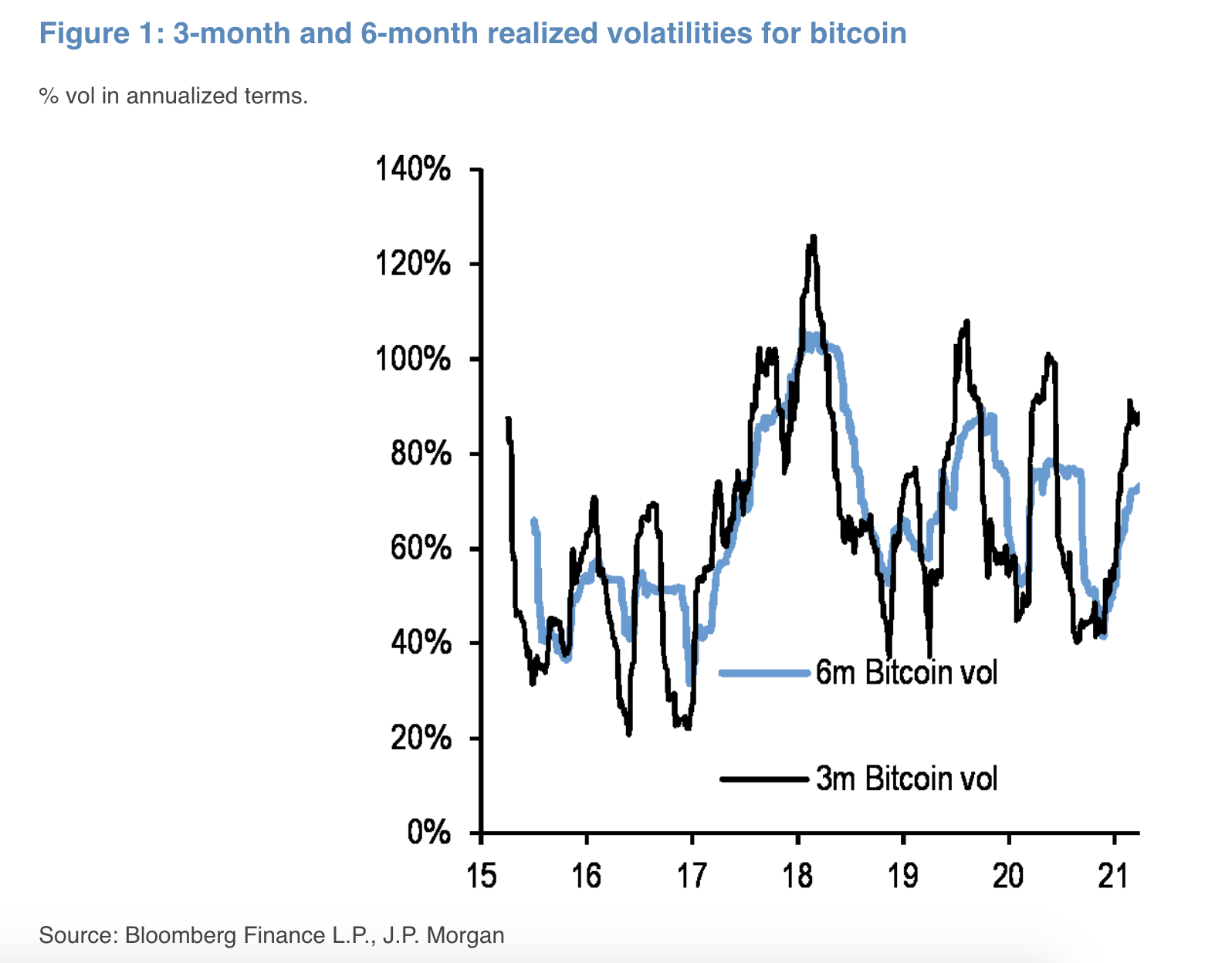

Bitcoin Volatility Decline Paves Way for Banks, JPMorgan Says

The recent pullback in Bitcoin’s volatility is setting the stage for a trend that could encourage institutions to dive in, according to JPMorgan Chase & Co.

“These tentative signs of Bitcoin volatility normalization are encouraging,” strategists including Nikolaos Panigirtzoglou wrote in report emailed Thursday. “In our opinion, a potential normalization of Bitcoin volatility from here would likely help to reinvigorate the institutional interest going forward.”

“Considering how big the financial investment into gold is, any such crowding out of gold as an ‘alternative’ currency implies big upside for bitcoin over the long term,” JPMorgan said.

That upside includes a long-term price target of $130,000, which represents potential upside of 121% from current levels.

“Mechanically, the bitcoin price would have to rise [to] $130,000, to match the total private sector investment in gold,” JPMorgan said, based on the current price of gold of $1,700 per troy ounce.

JPMorgan previously had a $146,000 long-term price target for bitcoin, but that fell as gold’s price has recently fallen from a peak of $1,900 per troy ounce.

“The decline in the gold price since then has mechanically reduced the estimated upside potential for bitcoin as a digital alternative to traditional gold, assuming an equalization with the portfolio weight of gold,” the bank explained.

JPMorgan’s long-term price target for bitcoin is predicated on the idea that bitcoin’s volatility will converge with gold’s. That’s still far off from happening, as the three-month realized volatility for bitcoin recently stood at 86%, versus just 16% for gold.

“A convergence in volatilities between bitcoin and gold is unlikely to happen quickly and is likely a multi-year process. This implies that the above $130,000 theoretical bitcoin price target should be considered as a long-term target,” JPMorgan said.

Guggenheim’s Scott Minerd warns bitcoin could plunge 50% near term — ‘things are very frothy’

Guggenheim Partners’ Scott Minerd remains long-term bullish on bitcoin, but said Wednesday the world’s largest cryptocurrency has run too far, too fast.

“Given the massive move we’ve had in bitcoin over the short run, things are very frothy, and I think we’re going to have to have a major correction in bitcoin,” the firm’s global chief investment officer told CNBC’s “Worldwide Exchange.”

“I think we could pull back to $20,000 to $30,000 on bitcoin, which would be a 50% decline, but the interesting thing about bitcoin is we’ve seen these kinds of declines before,” Minerd said. However, he said he thinks it’s part of “the normal evolution in what is a longer-term bull market,” with bitcoin prices eventually reaching between $400,000 to $600,000 per unit.

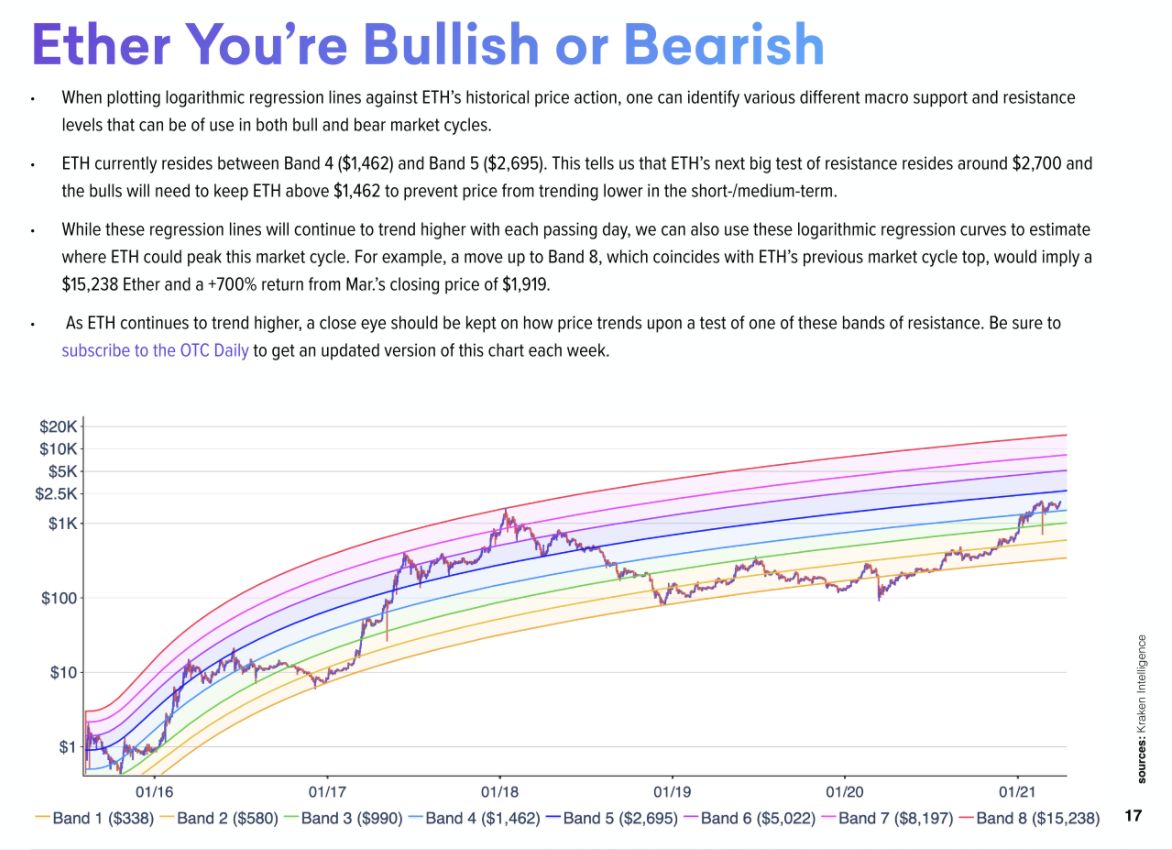

Kraken: ETH needs to hold above 1462$ area to keep bullish context

Watching for previous bounce up from “yellow” bound shows that ultimate upside target stands 700% higher around $15’238 area.

Report also shows that applying the same logic to BTC – it could reach $90K level.

Ark Invest, the vehicle of Cathie Wood, the veteran stockpicker, expects the world’s largest cryptocurrency to “comfortably” eclipse gold’s $10 trillion market capitalisation.

Yassine Elmandjra, a crypto asset analyst at Ark, believes Bitcoin has the potential to surpass gold’s $10-trillion market cap:

“If you look at gold as a $10 trillion market cap, bitcoin is about 10 per cent of that, and if we believe bitcoin is a 100 times better version than that, then it’s fairly safe to say that there’s a stark chance that bitcoin captures a lot of gold and market share, and more.”

Conclusion

The content of our research mostly confirms the idea that we’ve announced in the beginning. The long-term view remains bullish with more price appreciation on the table, but medium-term risks of investments stand too high.

As “The Dwarves delved BTC too greedily and too deep,” the chances of a pullback are incredibly high. Equilibrium stands very fragile. Spirit of euphoria and fever starts to clear, and those who bought it recently now stand in fear of downside action. Technically it makes the overall situation very tricky and dangerous. Big whales, as we’ve shown above, confirm this sentiment on the market.

An additional factor in favor of situation trickiness stands in divergence among major cryptocurrencies. The difference in ETH, BTC, LINK, ADA, and DOT performance is too significant in recent times. This very often could happen before a solid retracement.

Although a lot has been said about institutional investors’ interest, I would say It is still unclear. High volatility, strong dependence from individuals, lack of trading history and correlation analysis, vague regulation, and other things keep big money aside from cryptocurrencies by far.

Finally, the primary fundamental risk, in our view, is coming changes in Central banks’ policy across the Globe. Those who read our regular FX analysis know that as ECB as Fed are coming to more hawkish steps. Our suggestion that first hints we could hear as early as in the Autumn-Winter of 2021. And this is big uncertainty about how cryptocurrencies will react. We expect when Dollar Index hits 87-88 area – the primary stage of the growth cycle begins:

How cryptocurrencies react to Fed policy changes is still the subject for discussion, but US Dollar rally hardly could be a positive factor. Thus our conclusion is – risks of long-term investing are too high to buy cryptocurrencies right now. Only adopting risk control instruments, such as Put options, could do it more or less acceptable. In general – no signs of collapse or reversal on the market suggest holding of long-term positions. But no good signs of immediate continuation either.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

570 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023