Bitcoin Fundamental Briefing, December 2022

Careful look in 2023

Previous two reports we’ve dedicated to the changing market sentiment, and right in time have shown that splash of positivity in October was mostly emotional and had no foundation. November month has confirmed our conclusion.

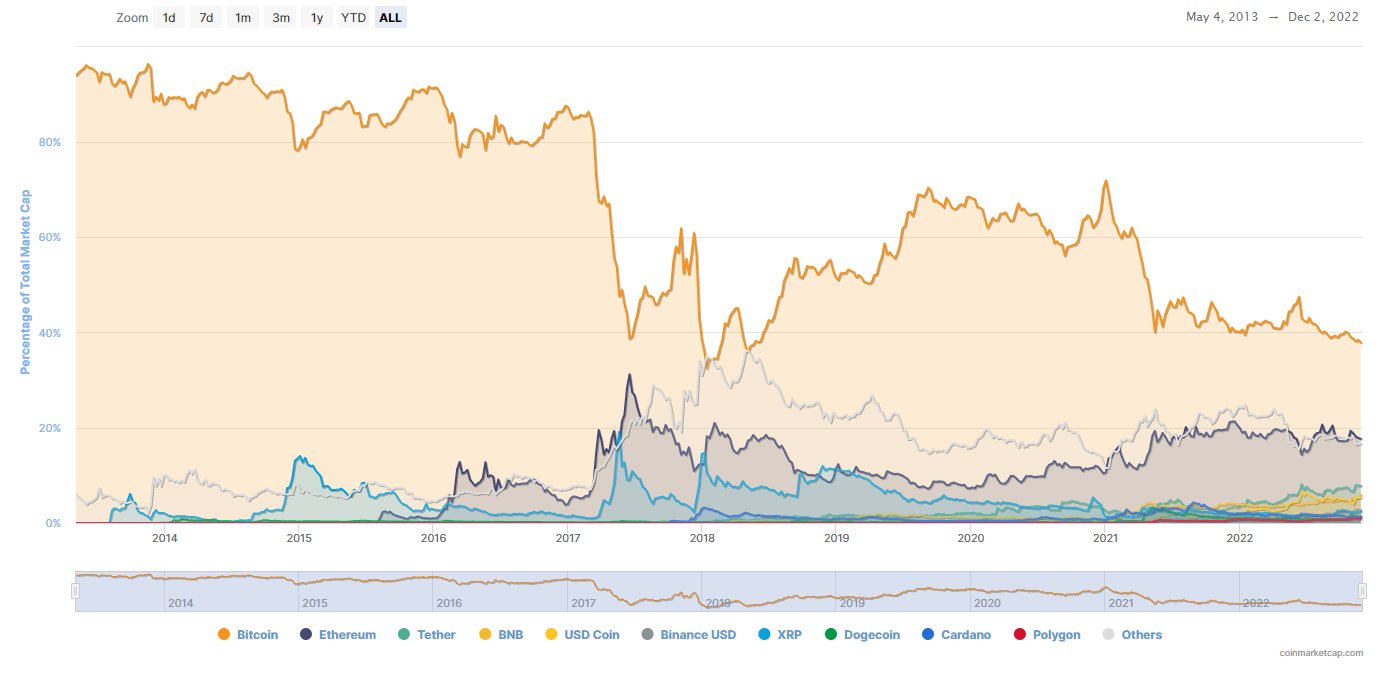

We suggest that market makes big mistake, trying to look at cryptocurrencies with “old eyes”, segregating it from global economical events, trying to follow “ideal” and too optimistic, if not to say naive, look that crypto currencies are independent, unique by its nature, suggesting that they are not affected by strict rules of global economy.

Through the whole 2022 we’ve shown that it is not so. In fact, every time we’ve made correct conclusions when we put Fed policy analysis as a background of our view. And Central banks’ steps remain the key to understanding of BTC performance in the future.

In December, investors were so frustrated with FTX drama that now they are too pessimistic, loosing last faith in future of cryptocurrencies, suggesting that “everything is bad” or even “everything is lost”. But, once again, detailed look at recent Fed meeting of 16th of December tells that not necessary it will be so negative as market suggests now. Yes, we also think that until March-April 2023 situation hardly will change, but drastic turn could happen closer to the summer. And this time everything will depend only from BTC inner power, whether it will be able to change investors’ mind, perception, sentiment etc., and finally to change the downside tendency …

Market overview

Bitcoin dropped back below $17,000 and several smaller cryptocurrencies referred to as altcoins posted significantly steeper declines as concern increases that the digital-asset market’s woes are far from over.

The largest token dropped as much as 3.7% to $16,762 on Friday. Earlier in the week, Bitcoin reached its highest price since Sam Bankman-Fried’s crypto empire filed for bankruptcy last month. On Friday, Ether declined as much as 6.3%, while other altcoins like Avalanche and Solana dropped as well.

Cryptocurrencies dipped alongside US stocks as the economy weathers the Federal Reserve’s aggressive tightening. The drop reverses a brief relief rally that pared back some of the token’s November losses. Since the start of the year, Bitcoin has declined roughly 65%.

Fairlead Strategies Senior Analyst Will Tamplin said that the token is at risk of re-approaching its November lows. Then, it sank to its lowest price since November 2020.

Noelle Acheson, author of the of the “Crypto is Macro Now” newsletter, wrote that investors remain skittish about the fates of other crypto-related companies, including Binance Holdings Ltd. and Digital Currency Group, parent company of troubled crypto broker Genesis. Binance’s BNB token was down 6.3% on Friday, and has slumped about 50% in the past year.

“There may be some ugly contagion news yet to drop,” Acheson wrote. “But most investors who were going to sell have done so.”

Shares of companies tied to the digital-asset world continued to be under pressure. Coinbase Global Inc., fell as much as 9% to $34.71, another all-time low. The shares of the biggest US crypto exchange have tumbled 85%. Bitcoin miners Marathon Digital fell almost 85, while Riot Blockchain dropped 6%. They’re down 88% and 83%, respectively, since last December.

“We expect a re-test of the November lows, near $15,600, in the coming weeks” after a failed test of levels in the $17,000 to $18,000 range, said Katie Stockton, founder of Fairlead Strategies LLC. “We ultimately expect Bitcoin to make a lower low, increasing risk to long-term support near $13,900.”

Binance Holdings Ltd., the dominant cryptocurrency exchange, has been hit by large outflows as traders move to take custody of their tokens amid revelations that rival FTX may have misused customer funds before its November implosion.

Net outflows of digital tokens from Binance amounted to about $3.7 billion in the past week, including almost $2 billion in 24 hours, according to data from research firm Nansen . The one-day number was nearly 18 times higher than the next largest outflow, which was from Bitfinex.

“The flows are still relatively small considering Binance’s reserves,” said Alex Svanevik, chief executive officer at Nansen, referring to Binance’s recent outflows. “But given everything that’s happened, it’s not surprising many are choosing a cautious approach.”

Binance temporarily halted withdrawals of stablecoin USDC on Tuesday because it couldn’t process those transactions until its banks in the US opened, Zhao said in a tweet. “We expect the situation will be restored when the banks open,” he tweeted.

Last week, the exchange released a proof of reserves report. The document, based on a snapshot review by accounting firm Mazars, shows the exchange having sufficient crypto assets to balance its total platform liabilities.

But the report also acknowledges limitations, as it didn’t amount to a true financial statement audit that would have given a clearer picture of Binance’s overall health.

The crypto industry remains mired in a deep downturn after a $2 trillion rout in digital assets over the past year. The slide has been pockmarked with a series of blowups of which FTX, once valued at $32 billion, was perhaps the most damaging.

Now that Sam Bankman-Fried’s fall from grace is complete, uneasiness is growing around the dominance that his rival Changpeng Zhao’s Binance holds in the cryptocurrency market.

The worries surfaced again as the accounting firm Mazars Group halted work for Binance and other crypto firms on reports that are meant to demonstrate that the companies hold the necessary reserves needed to cover any potential surge of customer withdrawals.

Mazars’ move threatens to cloud an accounting picture many already found opaque — indeed it was likely the market’s lack of reassurance from Mazars’ “proof-of-reserves” reports that led the firm to halt all such work. A televised appearance earlier in the week in which CZ was peppered with questions about Binance’s financial strength gave critics grist for another round of heckling.

Weakness in crypto prices that followed headlines about CZ’s company this week reinforce concern that Binance has become a “too big to fail” player in a market where, unlike traditional finance, there’s no one to stop a potential failure, offer a bailout or soothe any contagion.

“I don’t think Binance is trying to cause problems, but that organization is now a risk to all of us,” said Mark Lurie, the chief executive officer and co-founder of Shipyard Software, a developer of decentralized exchanges. “Anytime you have one player controlling substantial amount of volume, there’s a lot of systematic risks.”

The Binance spokesperson said the exchange is exploring how it might provide additional transparency to show users their assets exist on the blockchain, and is seeking another accounting firm to work with it to show proof of its reserves. That may prove difficult: Late Friday, the Wall Street Journal reported that BDO, which recently vouched for stablecoin giant Tether’s reserves, was reconsidering its work for crypto companies.

Bloomberg reported last year that Binance is being probed for money laundering and tax offenses by the Justice Department and Internal Revenue Service. Chainalysis Inc., a blockchain forensics firm whose clients include U.S. federal agencies, concluded in 2020 that among transactions that it examined, more funds tied to criminal activity flowed through Binance than any other crypto exchange.

Industry 2023 outlook

Cryptocurrencies were mostly lower as the risk of further contagion continues to weigh on investor sentiment a month after Sam Bankman-Fried’s FTX exchange sought bankruptcy protection.

“I would expect us to continue to stay range-bound until the new year,” wrote Aya Kantorovich, former head of institutional coverage at FalconX.

Instead of expanding crypto portfolios, clients have unwound and hedged their crypto exposures, which Kantorovich said has pushed down open interest in Bitcoin and Ethereum. Bitcoin dropped 16% in November, its largest monthly decline since June.

Kantorovich added that she expects funds to “re-deploy into the space in January,” and wrote that crypto markets may be hitting a bottom.

Crypto trading firm Cumberland also said it does not “expect this paradigm to last,” given consolidating price action.

Money managers who have avoided the many ups and downs of cryptocurrencies may be feeling relieved for having done so, according to a senior investment strategist at JPMorgan Asset Management.

“As an asset class, crypto is effectively nonexistent for most large institutional investors,” Jared Gross, head of institutional portfolio strategy at the bank, said on this week’s episode of Bloomberg’s “What Goes Up” podcast. “The volatility is too high, the lack of an intrinsic return that you can point to makes it very challenging.”

In the past, there used to be some hope that Bitcoin could be a form of digital gold or haven asset that could provide inflation protection. But it is “self-evident” that hasn’t really happened, Gross said.

“Most institutional investors probably are breathing a sigh of relief that they didn’t jump into that market and are probably not going to be doing so anytime soon.”

BTC 5000$ level is not impossible – Standard Chartered

Speculators cleaving to the view that the crypto rout is mostly over are at risk of a rude awakening in 2023, according to Standard Chartered.

A further Bitcoin plunge of about 70% to $5,000 next year is among the “surprise” scenarios that markets may be “under-pricing,” the bank’s Global Head of Research Eric Robertsen wrote in a note on Sunday.

Demand could switch from Bitcoin as a digital version of gold to the real thing, spurring to a 30% rally in the yellow metal, Robertsen also said.

This possible outcome involves a reversal in interest-rate hikes as economies struggle and more crypto “bankruptcies and a collapse in investor confidence in digital assets,” Robertsen added.

He stressed that he wasn’t making predictions but instead adumbrating scenarios that are materially outside of current market consensus.

“Our base case is that most forced selling is over, but investors might not be compensated for the market risk incurred in the immediate term,” Sean Farrell, head of digital asset strategy at Fundstrat, wrote in a note Friday.

Farrell pointed to ongoing uncertainty surrounding Digital Currency Group, parent company of embattled crypto brokerage Genesis. Creditors to Genesis are seeking options to try to keep the brokerage from falling into bankruptcy.

“As we’ve just announced to the team, Swyftx has no direct exposure to FTX, but we are not immune to the fallout it has caused in the crypto markets. As a result, we have to prepare in advance for a worst-case scenario of further significant drops in global trade volumes during H1 next year and the potential for more black swan-type events.” — Alex Harper, Swyftx CEO

For all the hand-wringing among digital-asset executives, perhaps the bleakest prediction for the industry comes from one of traditional finance’s biggest names. BlackRock Inc. CEO Larry Fink, a longtime cryptocurrency skeptic, said last week that he expects most crypto companies won’t survive the havoc FTX’s fall unleashed.

“I actually believe most of the companies are not going to be around,” Fink said at the New York Times DealBook Summit on Nov. 30.

Guggenheim Partners Chief Investment Officer Scott Minerd is warning investors there will be more shake-outs to come following the collapse of crypto exchange FTX as years of easy money end.

“There’s another shoe to drop – I can’t tell you where it is. The reason is this is just like any number of periods where we had easy money and a lot of speculation; the weakest players fall first. Crypto was obviously something that is crazy.”

Minerd, who in May predicted Bitcoin would fall to $8,000, said he has confidence the crypto system will move forward despite the recent collapse of prices and high-profile firms.

Minerd also predicted the Fed’s restrictive monetary policy will drive a roughly 2% rise in unemployment over the next two years.

A seasonal cryptocurrency pattern points to more losses for Bitcoin in December in the wake of the seismic collapse of the FTX exchange. The pattern was evident in 2018, 2019 and 2021, leaving an average December slide of almost 11%.

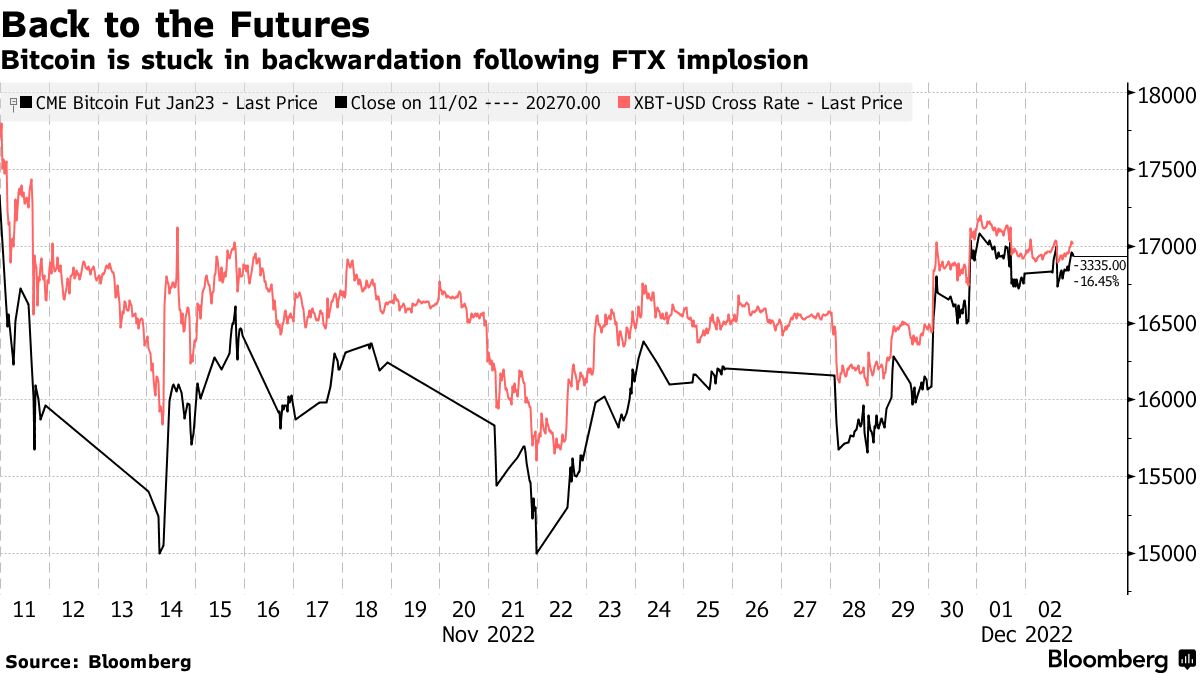

The Bitcoin futures curve is stuck in backwardation,meaning its spot price is higher than its futures price. The CME Group’s January 2023 contract has dropped to its deepest discount to spot since its launch earlier in November and is stuck trading at more than 1% below the cash price. Active Bitcoin futures on the CME group platform are all trading at a discount.

Contracts on Deribit, the most liquid crypto-native derivatives exchange, are also trading at discount with the January contract priced at $17,290 compared with Bitcoin’s cash price at around $17,300.

“It shows some strong bearishness in the market, with no expectations of good news anytime soon,” said Michael Safai, the chief executive of trading firm Dexterity Capital LLC. “Traders are gearing up for a slow and unimpressive trading period, probably into the spring.”

Other investment vehicles focusing on Bitcoin are also signaling more downside. Shares in the largest holder of Bitcoin assets, the Grayscale Bitcoin Trust, hit a record discount in mid-November compared with the value of assets held and they’re currently trading at a 42.6% discount to the trust’s holdings.

“In times of intense uncertainty and market turmoil, you normally see a rotation into the relative ‘safety’ of BTC,” Acheson said. “Part of it is that the FTX drama was for many traders and investors the final nail in the coffin and they didn’t rotate into BTC — they just left the market,” she said, adding that she’s still seeing speculation happening in some smaller coins.

“The question we need to be asking ourselves now is: Are there any sellers left in this market? To my mind, no, there aren’t that many left,” said Jacob Sansbury, co-founder of retail investor services firm Pluto.

Sansbury believes most over-leveraged miners, who tend to be large holders of bitcoin, have exited positions to pay off debts taken out in traditional money to fund their equipment and operations.

Indeed bitcoin’s recent calmness could be down to the fact that there are fewer coins to sell: the amount held on exchanges for trading stands at 1.97 million, Coinglass data shows, down steeply from 2.33 million at the start of the year.

Major offloading has already taken place; November saw a 7-day realized loss of $10.16 billion in bitcoin investments as investors were forced to exit long-term positions, the fourth-largest loss on record by this measure, according to Glassnode data.

Many remaining investors are placing their bitcoin into offline “cold storage” according to on-chain data, which should strengthen a floor price around $16,000, said Bob Ras, co-founder of Sologenic, an exchange and digital asset firm.

“Barring any more surprises in the market, it’s hard to imagine BTC going significantly lower,” he added.

Ras believes that if it wasn’t for the high-profile collapse of crypto players FTX, Celsius and Terra this year, the price of bitcoin would be close to $25,000 now.

Still, first potential peril is the risk of more bitcoin miners being forced to sell their holdings to stay afloat, as mining becomes increasingly expensive.

“Miners as a group start to become unprofitable under $20,000, so we’re below (that) point,” noted Ben McMillan, chief investment officer at IDX Digital Assets.

CrytpoQuant’s miner reserve indicator, which tracks the amount of bitcoin held in miners’ wallets, has dropped by about 7,722 bitcoin since November.

Indeed, Core Scientific Inc., one of the largest miners of Bitcoin, became the latest crypto company to file for bankruptcy as the industry reckons with a plunge in digital-asset prices.

The Austin, Texas-based company listed $1.4 billion of assets against $1.33 billion of liabilities in its Chapter 11 petition, which was filed in the Southern District of Texas. The company’s shares, already down 98% this year to trade at a fraction of a dollar.

Greenidge Generation Holdings Inc., once one of the largest public Bitcoin miners in the US, warned that it may seek bankruptcy protection while entering into debt restructuring talks with lender New York Digital Investment Group.

Grayscale Bitcoin Trust’s discount to its net asset value, is at an all-time low of 48% and shares have not traded at a premium since March 2021, Coinglass data showed.

DCG last month said troubles at Genesis’ lending business had no impact on DCG and its subsidiaries, while Grayscale maintained it was business as usual and its underlying assets were unaffected.

“This could be the other shoe to drop,” said McMillan, referring to the possibility of Grayscale running into financial trouble. “That said, if bitcoin can hold the $15,000 line through the DCG workout, that would be a strong indicator going into 2023.

A more hawkish than expected Federal Reserve at its final meeting of the year on Wednesday could further erode risk appetite and bitcoin’s prospects, crypto watchers said.

GETTING TECHNICAL

The scenarios of bitcoin leaping to $30,000 or tumbling to $5,000 in 2023 were long-shot possibilities flagged by VanEck and Standard Chartered, respectively.

When it comes to the technicals, several analysts pointed to indicators showing bitcoin may have found support between $16,000 and $16,800.

The cryptocurrency could also run into resistance around the $17,490 level, said Eddie Tofpik, head of technical analysis at ADM Investor Services, cautioning that any long-term rally was likely to be challenging.

“Anytime we see a rally, it’s one step up and then two or three steps down,” he said.

Vetle Lunde, analyst at Arcane Research, said long-term bets could be appealing in the wake of the November turmoil.

Nonetheless, uncertainty reigns.

“Bear in mind that massive drawdowns tend to be followed by a long-lasting directionless market filled with apathy and unfathomable second-guessing,” Lunde added.

Nansen analysts suggest that BTC could go down further

Nansen Research have prepared great report, where they mostly follow to cross-market analysis, keeping Fed rate in focus, the same that we do. They come to conclusion that BTC could show another (final?) leg down before situation will change.

We therefore speculate that in the eventuality of a US recession and US equity sell-off (our main scenario for 2023 given the Fed’s determination to maintain tight financing conditions for longer), the ERP (Equities risk premium) is likely to go much higher, and conversely, the CRP or crypto risk premium will probably also jump. It is therefore possible that crypto prices experience a further (and “last” ?) leg down in this cycle before financing conditions turn more favorable to both equity and crypto assets.

CONCLUSION

Within the previous few months we constantly showed how investors misprised the BTC making wrong conclusions on its perspectives. The brightest example is in October when everybody were sure that this is the bottom. But, market once have bitten, is becoming twice shy and now considers risks more or less correct. Indeed, despite the massive sell-off is done, and bearish power is gradually exhausting, there are still few source of final downside challenge exist.

First is Miners. They already feel bad, and even minor downside push could lead to total liquidation of their positions. With big lack of buyers this could trigger solid sell off.

Second – market is too frightened with possible chain of defaults and bankruptcies after FTX drama. And this fear is reasonable. With the strong market, some distressed companies could avoid worst scenario, but with the bearish market hardly it could happen. Although currently activity stops for Holidays, but Binance, Greyscale, Gemini, Genesis problems are not disappear. And next year will start with the close eye on them. Any sign weakness and we get another drop.

Thus, even without consideration of the Fed policy and the limitations that it puts on BTC market, investors definitely will not hurry up with purchases.

Concerning Fed, it’s policy needs a separate research. Hopefully you read our weekly FX reviews that shed light on this subject. Last review shows, that Fed can’t be constant on its policy for long term and in March-April its resources will exhaust. They will have to turn back to QE in some way, maybe even by easing policy. By this moment the effect of the US crisis will be seen not only in statistics data releases, but in real life – wages level, unemployment shelves in the stores etc. The problem though, that inflation will remain around the same 5.5-6% when Fed needs to start easing policy.

At first glance – it sounds good. Easing means liquidity that could increase the cashflows to cryptocurrency market as well. But I wouldn’t be so sure with this fact. We suggest that cryptocurrencies will be the last assets that investors will buy. Thus, in 2023, the most probable scenario by our view is price consolidation between 8-13K area. In the beginning of 2023, when Fed still keep rising rate for 0.25% in Feb and in March, BTC remains under pressure. Following our technical view that we have uncompleted $12.25K target, we also tend to idea of “final drop”, but we are a bit more conservative on the bottom level, suggesting that 5K is too low.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

617 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023