Bitcoin Fundamental Briefing, February 2023

Concerning Regulation

February has become a specific month for Bitcoin market. After the big FTX crush, investors have got a strong psychological punch and were not able to wake up from knockdown for some time. But, at some moment everything has changed. The US economy starts to show signs of inflation slowdown, while job market, consumption were looking more or less strong.

The idea of “Fed pivot” very fast takes minds of investors across the Globe:

The crypto “market is overly optimistic regarding a swift Fed pivot,” Vetle Lunde, senior analyst at Arcane Research, wrote in a note. Lunde added that “slowing momentum, strong technical resistance and expectations of a hawkish FOMC” point to a “poor February.”

Additionally 5 Bln of FTX assets were recovered and returned to investors, Kraken has agreed to cooperate with SEC and Investors “shook off” regulation risks, as Bloomberg wrote. Now, here and there we start hearing optimistic forecasts once again:

Bitcoin’s bull market is likely to start earlier than expected due to anticipation of the BTC halving and favorable macroeconomic conditions, according to Mark Yusko, founder and CEO of Morgan Creek Capital Management.

“What I do think is very likely is the Fed signaling that: ‘Okay, we’re good.’ But that will be interpreted as ‘we’re going to cut’ and then risk assets will explode again,” Yusko pointed out. “The market always anticipates the halving […] Nine months before that is usually when the beginning of summer starts,” Yusko said.

Crypto advocate Mike Novogratz said there’s a good chance of Bitcoin returning to $30,000 by the end of next month — a far cry from the $500,000 he once predicted for the digital currency, but still almost 25% above its current price.

“When I look at the price action, when I look at the excitement of the customers calling, the FOMO building up, it wouldn’t surprise me if we were at $30,000 by the end of the quarter,” the chief executive officer and founder of Galaxy Digital Holdings Ltd. said at a Bank of America Corp. conference Wednesday. “And I would’ve given both my shoes for that to be true just six weeks ago. Like if we end the year $30,000, I will be the happiest guy.”

Others start talking about “Golden cross” on daily chart –

But, somehow they forgot to mention “Deadly cross” on weekly chart –

Bitcoin rose to the highest level since August on February 15th, gaining for a second day as a decrease in risk aversion helps to temper concerns about a widening crackdown by US regulators.

The largest cryptocurrency by market value jumped by 8.2% to $24,083. The increase is the biggest one-day gain in about a month. Smaller digital tokens such as Ether, Cardano and Polkadot also rallied.

Crypto prices have been buffeted in recent weeks by a combination of US Securities and Exchange Commission enforcement actions, warnings and speculation of additional regulatory measures. Kraken reached a settlement last week to end its staking product, while Paxos halted issuance of its Binance-branded BUSD token, raising concern that other stablecoins such as Circle’s USDC token were facing regulatory action.

“I think that today’s pump is basically people realizing that the SEC is probably not going to kill Circle,” said Henry Elder, head of decentralized finance at Wave Financial.

The SEC also notified Paxos Trust Co. that it may sue over the BUSD stablecoin. Finally on Wednesday, the SEC floated a proposal for rules that would tighten regulation around crypto custodians.

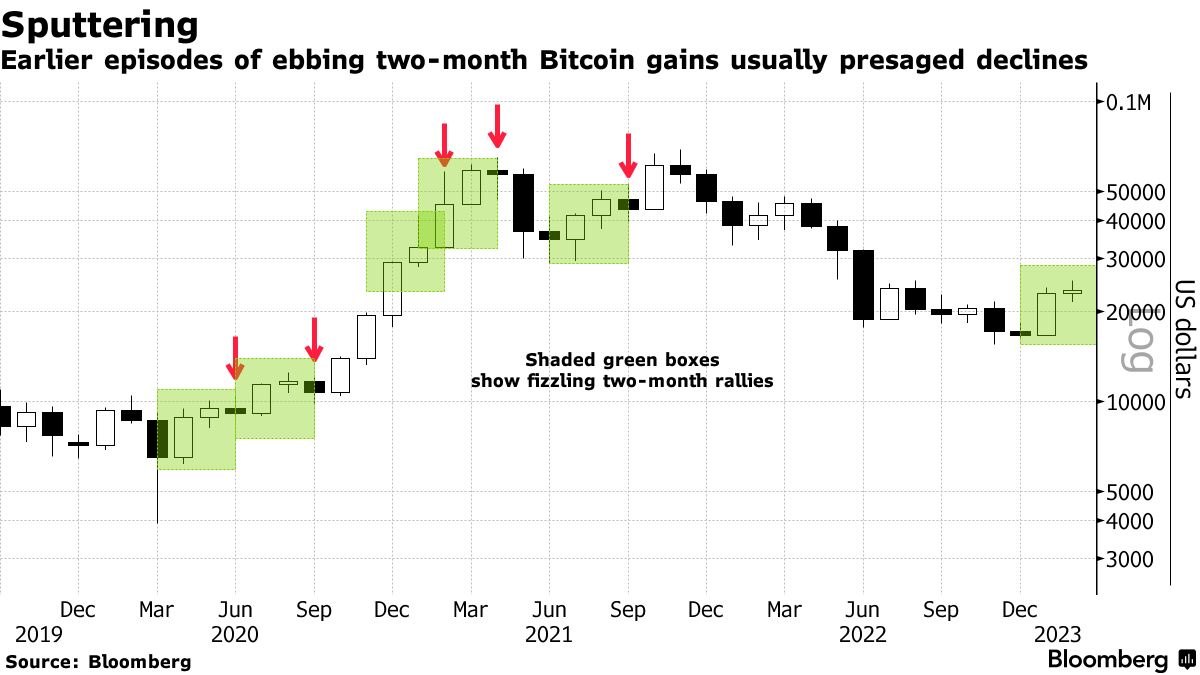

Now bitcoin’s subsiding two-month rally contains a warning for investors if history is any guide. There have been five similar instances since the pandemic low in 2020 when Bitcoin climbed over two straight months but with a smaller gain in the second stanza. It retreated in the third month in four of those cases, posting an average loss of 5.8%. The only exception was a period through February 2021, when the token was in the midst of a powerful bull run.

That’s the situation we have now, shortly speaking. Among some other important nuances of global market that could make impact on Bitcoin as well is the parity of short-term bonds and S&P return yield – around 5-6%:

And changing expectations of investors. Now consensus suggests median Fed rate around 5.45% in summer:

While Big Banks start changing their forecasts and expectations on how high and for how long high rates could stay. For example, JPMorgan Chase & Co Chief Executive Jamie Dimon expects U.S. interest rates could hit 6%, he said in an interview with CNBC on Thursday.

While 601 out of 835 institutional traders surveyed do not plan to invest in digital assets. Such results are contained in a JPMorgan study. The sample included 835 institutions from 60 different countries of the world. The responses were received from January 3 to January 23.

Only 6% of respondents stated plans to start trading digital assets this year, 14% — on the horizon of five years. 8% of respondents have already added cryptocurrencies to the list of traded instruments.

Meantime, with running like train Fed, Bond market has lost all benefits that it has got in 2023:

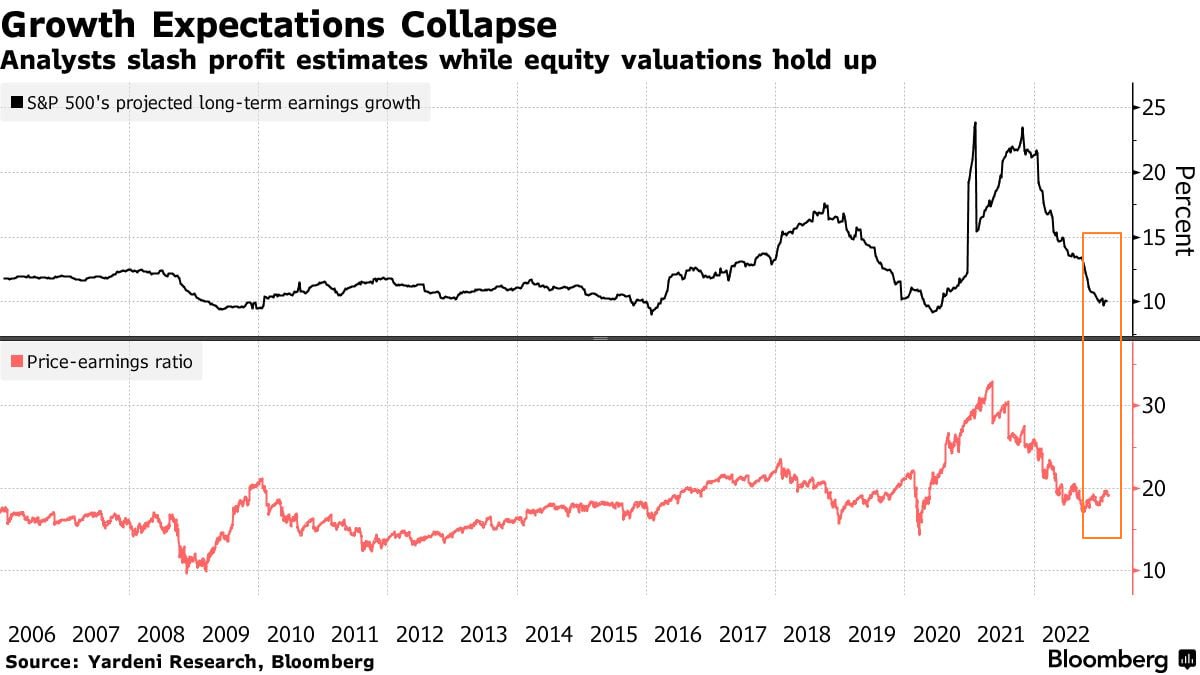

Analysts revise Companies’ earnings expectations down:

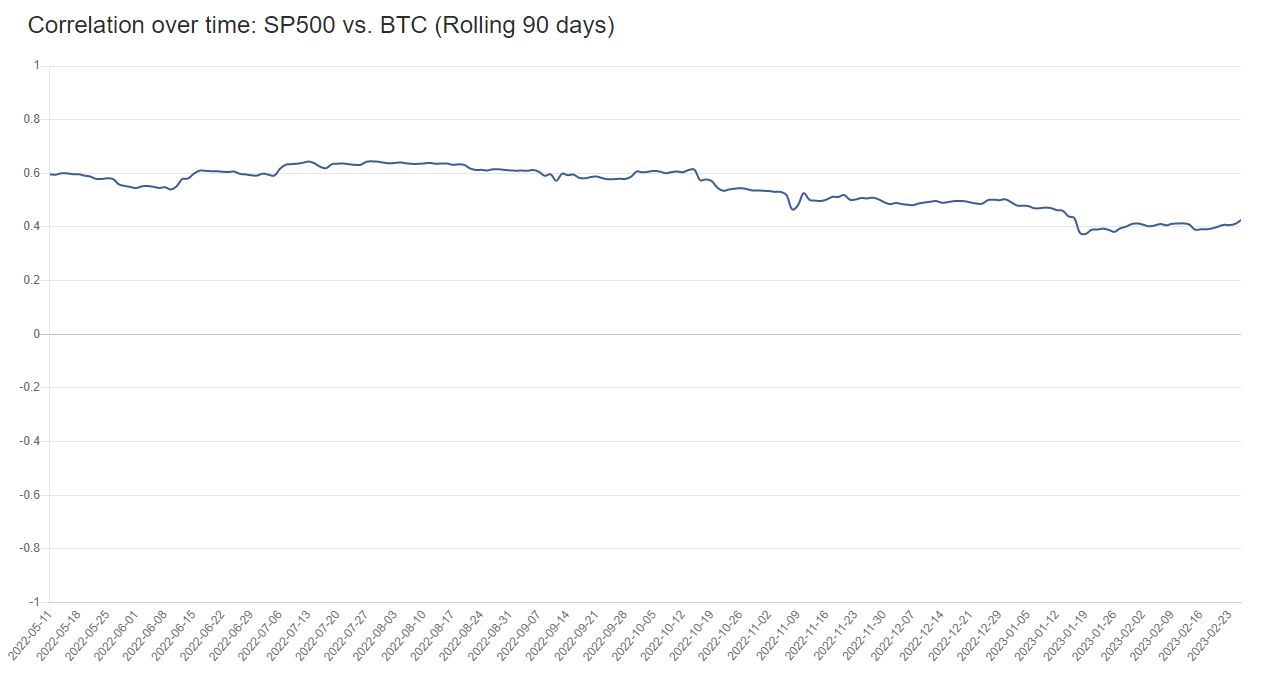

While Bitcoin/S&P correlation remains relatively high –

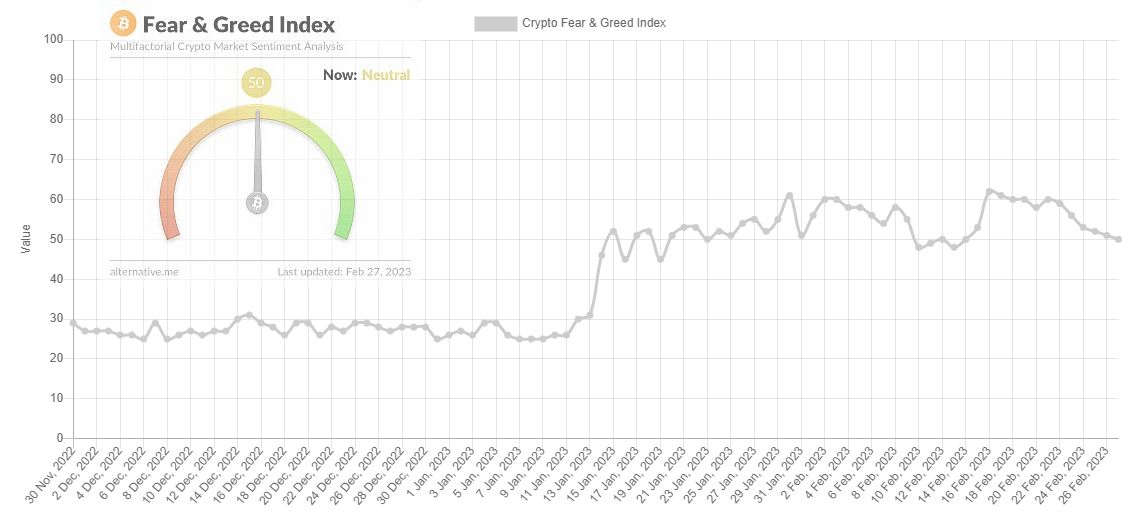

…and traders do not look like too greedy now:

Based on all these stuff, how we could make a conclusion on bullish BTC market? So we already have doubts, while I haven’t said anything on regulation by far.

Finally, those of our forum members who read our weekly fundamental reports on FX market and Gold and follow our Telegram channel know what the US economy problems are, and what is structural long term crisis that it goes in. Major statistics now is the subject of so-called “seasonal adjustments” and “calculation updating” which we see on example of changing way of CPI calculation, which actually twice less than 1980 CPI method shows and 0.2% less per month than previous methodic. The same “adjustments” are made to NFP numbers, Retail Sales, etc.

So question now stands not about “if Fed will turn to easing” but “when Fed will turn to easing” in some way of QE, despite how they will call this. Using simple math it is easy to estimate that with 1.5 Trln Budget deficit, 5% interest rates, negative trade balance and 5-6% Inflation rate (which is actually, at least 1.5 times higher) – US budget can’t hold this burden for too long.

Cryptocurrencies are not interest-bearing assets. Correlation with risky assets stand high and BTC once again will be among the first ones that will be sold off. But this is a bit longer term perspective.

But all this stuff is just a prelude, let’s turn to our major subject – regulation.

So, Regulation…

For a long time, almost since the beginning of active trading the subject of regulation stands around. But traders have become so inhabit with it, that stop paying any attention to it. It seems that regulation stands somewhere far and has no relation to particular company, bank or fund. Now situation is changing rapidly.

If earlier regulation topic mostly was enlighted by special news agencies, now even top news makers pay high attention to it. Take a look what Agustin Carstens, the head of the Bank for International Settlements said.

“Only the legal, historical infrastructure behind central banks can give great credibility” to money, Carstens said, adding he anticipates a “strong statement” from the Group of 20 for strengthened regulation of the digital-asset sector. Crypto is a financial activity that can really only exist “under certain conditions,” he said.

Kristalina Georgieva says IMF wants more regulations on private cyrptocurrencies. IMF Managing Director tells Bloomberg exclusively because they lack the backing from authorities, they are speculative and therefore there is a high risk associated with them. She spoke with us on the sidelines of the G-20 finance ministers meetings in Bengaluru, India.

So, regulation is becoming a hot topic on highest level of BIS and IMF.

Crypto’s been getting a pretty bad rap from US regulators in recent weeks, with the Securities and Exchange Commission targeting the sector in a slew of enforcement actions and outlining proposed new rules for safeguarding digital assets.

The US Securities and Exchange Commission laid out a series of possible changes to rules on custody on Feb. 15, expanding its framework to explicitly cover a range of assets including digital tokens. The 434-page document proposed asking qualified custodians to give assurances that client assets are properly segregated and protected from insolvency, in addition to carrying out annual independent audits and turning over records upon request. The rules are set to be finalized in the coming months after a short period of consultation.

In the wake of FTX’s collapse, the industry is learning some hard lessons. Namely, it’s no longer good enough just to say that you’re segregating client assets from exchange funds, or that your books are getting regular independent audits — you have to be able to file the paperwork to prove it. That’s what the SEC is now asking of any US firm looking to custody crypto, as Chair Gary Gensler seeks to close the gap between the digital Wild West and Wall Street.

Until the new rules are finalized, there’s only one surefire bet for the crown and that’s the banks themselves — or at least, the bank-adjacent.

Traditional financial firms and the crypto custodians they’ve backed may be best-positioned to cash in on proposed changes to US regulation for safeguarding digital assets, thanks to an existing portfolio of licenses and a trusted reputation in handling client funds.

Digital asset custodians that are either wholly owned or backed by Wall Street names, like PolySign Inc.’s Standard Custody & Trust, Copper Technologies Ltd. and Zodia Custody Ltd., are among the firms that are seeing an uptick in interest from traditional financial clients for their services, according to interviews with more than half a dozen executives.

Meanwhile large institutions including Bank of New York Mellon Corp. and Nasdaq Inc. are continuing to build out their own digital asset custody offerings as they assess how the proposed rule changes could affect their plans, according to spokespeople at the companies.

“The bigger banks are the logical participants who would potentially benefit from [rule changes], in that they now have a roadmap to what they would need to do to support institutions who want to invest in crypto,” said Jack McDonald, CEO of Standard Custody, whose parent company counts Brevan Howard Asset Management, Soros Fund Management and Cowen Digital among its investors.

Many professional investors are skeptic on crypto. Charlie Munger, who has called for a ban on cryptocurrencies in the U.S., slammed digital assets again Wednesday and had a single choice word for those who oppose his position on the asset category:

Crypto? ‘It’s worthless. It’s no good. It’s crazy. It does nothing but harm, and it’s antisocial,’ says Charlie Munger .‘I’m not proud of my country for allowing this crap,’ says the Berkshire Hathaway No. 2

Somebody could say that old man keep yelling on crypto. Still, this is a theoretical background, but what we have in reality. Stay calm, guys – the reality could shock you. Just try to imagine the scale of the jitter.

No 1 – The ban on the placement of assets managed by investment consultants in crypto companies:

...some crypto trading and lending platforms may claim to custody investors’ crypto, that does not mean they are qualified custodians. Rather than properly segregating investors’ crypto, these platforms have commingled those assets with their own crypto or other investors’ crypto.

Make no mistake: Based upon how crypto platforms generally operate, investment advisers cannot rely on them as qualified custodians.

Further, today’s proposal, in covering all asset classes, would cover all crypto assets—including those that currently are covered as funds and securities and those that are not funds or securities.

No 2 – Violent pursuit of staking and similar schemes:

- Kraken to Discontinue Unregistered Offer and Sale of Crypto Asset Staking-As-A-Service Program and Pay $30 Million to Settle SEC Charges;

- Paxos Trust Co., issuer of a Binance-branded token that ranks as the third-largest stablecoin, is being investigated in the US in the latest regulatory escalation to hit the cryptocurrency sector;

- Banks Are Breaking Up With Crypto During Regulatory Crackdown. Banks are backing away from crypto companies, spooked by a regulatory crackdown that threatens to sever digital currencies from the real-world financial system.

- Crypto Giant Binance Expects to Pay Penalties to Resolve U.S. Investigations. And SEC Probes Trading Affiliates of Crypto Giant Binance’s U.S. Arm. Penalties’ sum is not determined yet.

- Watchdog and West Yorkshire police raid crypto ATM operators in UK first. Authorities have raided several sites around Leeds as part of what is believed to be the UK’s first crackdown on illegally operated crypto ATMs.

- Binance Considers Pulling Back From US Partners as Crypto Crackdown Escalates. Crypto giant Binance Holdings Ltd. is considering ending relationships with US business partners as regulators turn up the heat. Binance US will keep working as a separate branch unit.

- Crypto ATM Coin Cloud, which manages more than 4,000 bitcoin ATMs in the United States and Brazil, has filed for bankruptcy. The Las Vegas-based company’s liabilities to ~10,000 counterparties are estimated in the range of $100-500 million.

- SEC Charges Terraform and CEO Do Kwon with Defrauding Investors in Crypto Schemes

And these are just the most resonance affairs in last month. So let’s go further:

No 3 – The Fed refuses to register banks specializing in crypto.

Federal Reserve Board announces denial of application by Custodia Bank, Inc. to become a member of the Federal Reserve System.

The Board has concluded that the firm’s application as submitted is inconsistent with the required factors under the law. The firm proposed to engage in novel and untested crypto activities that include issuing a crypto asset on open, public and/or decentralized networks. The firm’s novel business model and proposed focus on crypto-assets presented significant safety and soundness risks. The Board has previously made clear that such crypto activities are highly likely to be inconsistent with safe and sound banking practices.

No 4 – The prosecutor’s office is dealing with banks that have already been covered in crypto.

US prosecutors in the Justice Department’s fraud unit are looking into Silvergate Capital Corp.’s dealings with fallen crypto giants FTX and Alameda Research, according to people familiar with the matter.

The criminal investigation is examining Silvergate’s hosting of accounts tied to Sam Bankman-Fried’s businesses, said the people who asked not to be identified to discuss the confidential probe. The review adds to mounting scrutiny of the La Jolla, California-based bank, which has also drawn the attention of lawmakers.

The crypto-friendly bank hasn’t been accused of any wrongdoing and the inquiry, which is in its early phases, could end without charges being brought.

Silvergate shares tumbled more than 20% in extended trading on Thursday, erasing a 29% advance during regular market hours in New York. Silvergate was among the lenders hit hardest by FTX’s sudden implosion last November.

No 5 – Hong Kong’s Crypto Hub Ambitions Win Quiet Backing From Beijing

Sounds great, But, honestly, has anyone read the 350+ page recommendations from the local regulator? And there are many remarkable things. These requirements make the work of any exchange almost impossible.

And even if an exchange can meet regulations, it can basically only list bitcoin and ether, must pay high insurance, cannot accept stablecoins, offer staking, futures/derivatives trading is prohibited, and must comply with draconian know-your-customer/anti-money laundering procedures. If the Hong Kong bill is passed in its current form, then it is better to open an exchange in the US or the UK.

As a result of this week, Glassnode writes in their review –

Bitcoin has seen another strong week of price performance, recovering the entirety of last week’s correction, and reaching above $25.0k, the highest price since June 2022. This market strength comes despite persistent pressure coming out of the US regulatory environment related to digital assets.

The initial wave of Inscriptions on Bitcoin has crossed a total of 100k files immutably stored on the Bitcoin blockchain, highlighting a brand new and unexpected source of demand for blockspace. Inscriptions are unique in that they do not require large volumes of BTC to be transferred, despite their value for discerning owners and buyers.

Despite net growth in on-chain activity, transfer volumes are remarkably subdued, both for Long and Short-Term Holders. Filtering only for coins sent to exchanges, we can also see that several indicators point to a turning of the cycle and a marked shift in investor behavior patterns.

Conclusion

Today we do not provide any technical update on BTC chart, mostly because you know it anyway, as we discuss it twice a week in our videos. We think that drastic change in regulatory authorities activity is very important driving factor for cryptocurrencies. As it was mentioned above, we should pay attention to two major things.

First is, CBDC topic is turning from theory to reality, mostly was tested in many countries and very soon CBDC will be introduced widely.

SEC, Fed and other regulators now have the primary task – to put cryptocurrencies under supervision of classical bank, preferably big banks, sweeping out smaller fish. This will become the new degree of control over the market which leaves to footprint of former BTC romantic treat, totally eliminating any sign of freedom. We already see that US authorities strongly control big players, who have to execute rules to not lose the business. So if you’re big enough – you will execute the rules, if you’re small one – you could go against it, but with new SEC rules, you probably will be probed and punished later.

Develop countries start tighting the bolts. Not occasionally Robert Leshner called the latest actions of US regulators against crypto companies “are a planned liquidation of products” and could destroy a growing market.

While the SEC announce the priority in controlling of cryptocurrencies in 2023 –

Examinations of registrants will focus on the offer, sale, recommendation of, or advice regarding trading in crypto or crypto-related assets and include whether the firm (1) met and followed their respective standards of care when making recommendations, referrals, or providing investment advice; and (2) routinely reviewed, updated, and enhanced their compliance, disclosure, and risk management practices.

Thus, on a background of structural crisis in the US, where situation is deteriorating month by month and equal risk premium of S&P and short-term bonds, we’re skeptic on bullish potential of cryptocurrencies.

Now, when supervision authorities start tightening bolts, with clear direction to lead higher centralization of crypto-market and put it under control and supervision of big banks, washing out of the market small companies – it will lead to headwind of normal market expansion. And together with poor economical situation hardly lets market to show any significant rally.

We treat current upside action just as a pullback with long-term bearish trend and suggest that hardly BTC exceeds 30-32K area. In nearest few weeks 20K area seems vital. If BTC fails to stay above it – we suggest it keep going down to major 12.2K downside target.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

662 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023