Regulators: Commodities and Futures Trade Commission US CFTC summary

Prerequisite: Before you complain to regulators

Prerequisite2: NFA National Futures Association

| Country: | United States of America |

| Country Common Nicknames: | United States, USA, US |

| Big Bad Regulator, Long Name: | Commodity Futures Trading Commission |

| BBR, Short name: | CFTC |

| Type: | Government |

| Main website homepage: | |

| Regulatory licenses issued: | [Yes, required membership of most professional market participants, handled by NFA] |

| Complaints: | yes, and multiple types of complaint avenues, main complaint portal |

| Do they do alerts? | Yes, usually several times a month |

| Do they ever eject a registered company? | Yes |

| Do they ever fine a registered company? | Yes. News releases show regular 6-8+ figure fines and/or compensation amounts. |

| Do they ever directly or indirectly file criminal charges? | Yes. Usually obtaining civil judgements or settlements. |

| Do they ever mandate repayments to clients? | Yes! |

| Contact info | see below [keep reading until end] |

CFTC is one of the most stringent regulators that I’ve come across. A quick look at their enforcements feed will show 6-8 figure judgements against those who are found in violation of laws under CFTC jurisdiction. Very recently there was a case with over $1 billion USD settlement. I could write 1 article for each major enforcement undertaking that they do; that’s how comprehensive the CFTC enforcement of forex and futures is.

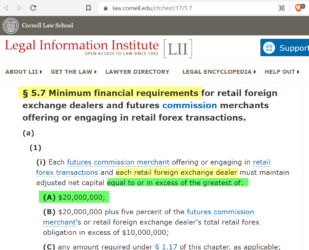

According to eCFR Title 17 § 1.17, the minimum capital requirements to maintain a license is $20 million USD for Forex Brokers who operate as a broker. This is the highest requirement of any jurisdiction. in comparison with another jurisdiction like ASIC, the requirement is $1 Million AUD. So any CFTC regulated fx broker will likely be well capitalized. I do also believe these requirements create a disincentive for OTC forex to ever be able to compete with the fx futures contracts (there is some de-facto bias towards exchange-traded products). (minimum requirements for FCMs who do not offer otc fx contracts is “only” $1 Million USD.

Also, there is another rule (delegated to NFA 2-36) that upon request, a broker is required to give the trader specific details about an executed transaction such as

-

- date time stamp with millisecond accuracy,

- quantity,

- currency pair,

- markups/commissions and also

- up to 15 transactions +/- 15 minutes before and after the transaction (for the same transaction).

- certain other price information identical to that of a commodity exchange.

- Brokers are prohibited from directly or indirectly canceling or adjusting the price unfavorably of executed customer orders

- any qualifying exception, the broker must apply adjustment evenly (no cherry-picking of which accounts to adjust).

- any unfavorable price adjustments must be specifically notified to the customer within 15 minutes of the price discrepancy.

- broker must send copy of customer record request and broker response to NFA

And check out other “silly” rules claiming to promote transparency:

-

- Customer market or limit orders must be executed at prices close to orders of other customers during the same time period have been executed. Price feed should “reasonably resemble” real market conditions of the time.

- Slippage must be symmetrical and evenly applied regardless of market direction, and across all customers. Broker must have written policy on how slippage is dealt with on the platform.

Imagine how many scam alerts FPA forum would have if just 50% of these rules were standard operating procedure across the industry.

You will notice very few retail fx brokerages that still exist in the USA as of 2022. Those that do have very high spreads compared to their counterparts in other jurisdictions like Australia, UK, etc. So what is the point of having such high quality regulation if very few retail customers are willing to pay for it?

How to complain:

There are several ways to complain to the CFTC, One way is to just file a general tip, which has no whistleblower protection. This is more of a suggestion. Then there is also the Reparations Complaint, which is more or less like arbitration. You pay a fee between $50-250 and it can take up to 12 months to proceed.

They also have a dedicated whistleblower program which can be used in cases where the corruption is such that you might fear for your life should there be a real chance that you are bullied or threatened.

#RegulatedFool

_______________________________________________

Remember to study the Before you complain to regulators guide before reaching out. As well as the previous article on NFA National Futures Association

| Contact emails | Questions@cftc.gov |

| Contact list | https://www.cftc.gov/Contact/index.htm |

| Additional contacts | Read below |

|

Washington D.C. |

Commodity Futures Trading Commission Three Lafayette Centre 1155 21st Street, NW Washington, DC 20581 202-418-5000 202-418-5521, fax 202-418-5428, TTY Toll-Free 1-866-FON-CFTC (866-366-2382) |

| Central Region | 77 West Jackson Blvd. Suite 800 Chicago, IL 60604 312-596-0700 312-596-0716, fax 312-596-0565, TTY |

| Southwestern Region | 2600 Grand Boulevard Suite 210 Kansas City, MO 64108 816-960-7700 816-960-7750, fax 816-960-7704, TTY |

| Eastern Region | 290 Broadway 6th Floor New York, NY 10007 646-746-9700 646-746-9888, fax 646-746-9820, TTY |

| CFTC law authority | Commodities Exchange Act (CEA) | CFTC Regulations |

| Research companies | Background Affiliation Status Information Center (BASIC) | Registration Deficient (RED) List |

| Complaint against broker | Complaints homepage | General Tips (no whistleblowing) | Reparations program [arbitration] |

| Investor resources | https://www.cftc.gov/LearnAndProtect/AdvisoriesAndArticles/index.htm |

| Key pamphlets |

Forex Transactions, Regulatory guide (printed from html) | BASIC search tool video webinar | |

Author Profile

4EverMaAT

MaAT is an ancient Kemetic phrase that translates to "Truth, reciprocity, balance". Obviously when a company or trader tries to scam their client/business partner out of money, this upsets the natural balance that exists when contracts are formed and traded. But the best way forward is not to be a helpless victim, but to ensure that you are informed with whom you are trading with. And more importantly, whom you are trusting your hard earned dollars with.

4EverMaAT couldn't help but notice that the scams that most people fall for are very similar day by day, month over month, and year after year. MaAT believes that less people would fall for scams if only they took some more responsibility for their own trading choices. This ultimately means resisting one's own gambling impulse and gathering hard evidence (video, screenshot, trading history, etc) of all relevant trading activity. And consolidating this evidence so that it creates a clear, concise timeline of events. More details are related at upcoming blog RegulatedFool.com

Info

1357 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023