caspermhlo

Private

- Messages

- 20

Original FPA Traders Court Submission:

I am submitting the case against: www.alphatradingcm.com

My Case is: This is the Matter concerning Alpha trading CM and my Live account No. 753266

There are three issues I would like to be helped with and get compensation for.

1. They manipulate prices against the client’s position; they did this to me about 100 pips in few seconds every time i placed a trade

2. They start trades on the clients account without clients knowing and hope to blow the client’s account. They did this whilst my MT4 was not even running.

3. They don't allow your withdrawal. If you fight them hard enough they end up giving you whatever they want instead of what You requested in your withdrawal request. In my case I had $1240 in the account and requested $668 withdrawal. They refused to give it to me. At last they gave me $224. They said they were trying to break even.

1. First issue in details: Manipulation of currency pair prices against the client’s trade/position

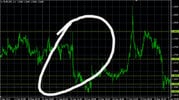

What happens it that there is an immediate spike against my position on the currency pair I am trading at that point, this happens just after I have placed the trade. When there is no trade entry there is no such spike. But once I enter the trade again, then this spike shows up moving very quickly opposite to my position. This spike lasts between 120-180 seconds against my position. During that abnormal spike I am not even able to exit the trade. I am not even able to put the stoplosses and take profits. It is like the platform is frozen when infect the platform is not frozen; it is the broker that is refusing to accept my changes. The broker literally blocks me out. The way this happens is so abnormal because during those moments when those spikes occur, other brokers are showing normal prices and no spikes. Only Alpha Trading Mt4 is showing that false. Even so, the same Alpha MT4 is showing no spike when there is no trade entered. It happens only when I enter the trade. Even that spike is only for the particular pair that am trading at that time, other pairs play normal. One may say it is news release or something, but I promise you it has nothing to do with news release because at that time there is no news release. If it was normal price action spike, then all other brokers should show at least some sort of that spike. All brokers should show almost similar price movements, but they don’t, only Alpha Trading shows the spike just after I have entered the trade. Talking to Alpha Trading CM about this matter, they shifted the blame to their liquidity provider, namely, Barclays and this was their response: “i will find another feed for you and not let that bank take your trades but you will have a slightly higher spread”.

I would make profits and this false spike would comes from nowhere and hit my account hard with spikes which seem to be stoploss hunting and threaten to blow my account. Here below are the details of the events:

On Tuesday the 12th Nov 2013 it happened at between 3h15---3h28 (broker time), a first false spike emerged out of the blue once I entered my four trades simultaneously, it moved 16pips in matter of seconds caused me to lose 64 pips in an instant. Then it went quite for about 7 minutes. I instructed my EA to place 4 trades simultaneously and again that false spike came back instantly after entering the trade with a move of 11 pips causing me to lose 44 pips in few seconds. I was trading 0.1 lots and that costed me 108 pips which was $108. My account was at $803, it shrank to $695. Again there were no such price movements from other brokers. I would make profits by literally sitting and watching the account so that when those false spike ok I would stop the EA and close the trades and shutdown the platform. On the 19 Nov 2013 at 8:06 (MT4 broker time) the GBPUSD jumped 101 pips immediately after I had entered a sell trade from 1.61257 to 1.62272 in few seconds. I had placed 4 simultaneous trades of 0.1 lot each and lost 404pips = $404. Again there was no such price movement from other brokers. I immediately stopped the EA and the Platform. 45 minutes later I restarted the platform and re-enabled the EA. At 8: 50 (MT4 broker time) my EA placed 4 simultaneous buy trades on GBPUSD and again immediately the price jumped 98 pips in few seconds taking away 392pips =$392 with it. Again there were no major news releases and there was no such price movement from other MT4 brokers, only Alpha Trading platform came up with these anomalies. This continued until I decide to withdraw part of my funds which they refused to give. And that leads me to my second issue, the withdrawal issue.

2. Failure to process the withdrawal request as requested by clients.

I want them to explain to me why they did not effect the $668 withdrawal as requested by me? Why did they unilaterally decided to just give me $224? Was it because they felt my initial deposit was $220 and so I was only deserving $220? Throughout the withdrawal process they said nothing until the funds arrive arrived via wire transfer and it was not the $668 I had requested, it was $224. Note that at the time I submitted a withdrawal request there was $1240 in my trading account and there were no open trades running. From that $1240, I was withdrawing $668 so that $572 would remain in my account. Instead they sent me $224 leaving $1016 in my account. When asking them about this via email and suggesting that they were handling matters like a scam broker, this below is their response to this withdrawal saga:

" You were sent the fund amount because your account was not profitable due to the short duration the and special trading requirements-per your request. As far as we are concerned this matter is closed. You are at the very least made whole as you were sent more funds than you deposited. Please explain to us how a "scam" broker would do such a thing? Isn't the idea to cheat you out of your deposit? As you know, you were sent funds that exceeded your deposit. This is a fact, is it not? It is!"

The issue for me is not whether or not I was sent funds which were equal or greater than my deposit, the issue at hand is that I was withdrawing funds from the profits I had made, plain and simple. If the client trades the market and makes profit, the client has the right to withdraw his/her funds, that is what I understand. So for Alpha Trading CM to say that they gave me $4 extra to my deposit of $220 is just not good enough explanation for not processing my withdrawal as requested, moreso when I had $1240 in my account and asking for just $668. I still feel that they owe me this money because the 3rd issue I want to raise below relates exactly to their operations building up to their third fraudulent activity

3 Placing a Ghost trade on my account

Just a few days (1 day or 2 days) after the withdrawal saga, there was about $1025 in my trading account. The last stunt they pulled was to enter the trade in my absence. I had shutdown my MT4 and went to bed. 12hrs later I woke up and went to start my MT4 platform. When it started I checked that it was disabled and I asked them why, they said I had placed 1 trade that went against me in few seconds and wiped my account out. My Balance before this trade was $1025 and this trade was a GBPUSd for 1 lot. It took out $1027 if few seconds and left $-1.44 in my account which is still there in the client area. I would have never traded a 1 lot with a $1025 balance. My EA was not even programmed to trade 1 lot, my EA was set to trade 0.04 lot. The EA could not just simply decide to place the 1 lot trade. My EA does not use Martingale. Even worse the MT4 platform was not even running, thus there was no way the EA could place that trade.

This screen shot of Myfxbook linked account shows that my Alpha MT4 platform was last updated by MyFxbook on 26 November 2013 at 18:59 South African time. This is the last time my Alpha Trading MT4 Platform was opened and updated by myfxbook for trading before I shut it down and went to bed. Brokers time when I shut down the platform was 26 November 2013 at 16:59 . The last trade I placed on the MT4 was at broker’s date and time 11.26.2013 at 16:52. This is the last trade I ever made with the broker then I shut down my MT4 platform 7 minutes later and went to bed. I was never able to login to my Alpha MT4 trading account after that since the next time I tried login into MT4 platform I got the “account disabled” message. This message was a result of the ghost trade that was placed in my account whilst my platform was not even running. I may never know whether this trade was ever recorded in the trading history of the MT4 platform. I was never even able to see this trade from the MT4 trading history since I could not access the platform on restart after I had shut it down the previous night.

What I think Alpha Trading CM did in this case, they placed the trade in my account from their side. This was a huge 1lot trade on GBPUSd on a very small account of $1027, which with their price manipulations and false spikes wiped my accounts in seconds. Then they disabled my account immediately. What they did not know at that time was that my platform was not running because I had shut it down since I had been aware that it was never safe to leave the platform running with them since they manipulated prices to go against my trades, so the EA would only trade when I was there and watching the trades so that I would intervene when they came up with their tricks. I was only able to know about this ghost trade once I received an email from them telling me about it. I then logged into the client area (website client area) to see the statement and I saw that the trade had been place around midnight (my local time, when I was deep asleep). That is how I came to know about that trade. This trade was placed during Asian session. I did not trade Asian session; I mostly traded European and US sessions. This was the biggest stunt they pulled. They realised that I had caught them up on price manipulations, they had refused my withdrawal, so they decided to do it in one go, by just placing a single trade to wipe the account once and for all so that I would never have a chance again to request a withdrawal. I had never placed a 1 lot trade in the entire history of that trading account. Throughout that day my EA was trading 0.04 lots. Only that ghost trade came up with 1 lot trade. I do not know who placed it and why is was placed. Even worse is that this single trade that wiped out my entire account was opened on EURUSD at 1.3665 on 26/11/2013 and closed at 1.3565 same day 26/11/2013, the funny thing about this is that the EURUSD pair never rose above 1.3620 between 25 Nov 2013 and 28 November 2013, so how could I possibly have opened the trade at 1.3665? Asking Alpha trading about it this was their response:-

“We have received your email. We have looked at this case. We have found nothing done on the end of Alpha. In fact, the trade appears to be done by you, the client. We have no risk to clients and as a result we have no need to "manipulate trades". If you made a trade and you lost, then that is of your own accord. You needed to continue to trade in order for Alpha to break even - without having to take the other side of your trades. Since we are an STP firm, we make money on the spreads. Your spreads were low, so we needed high volume. For you to achieve that you would have needed more time. You have a legal team. We do as well. We will fight from our end as well because we are confident we did nothing wrong. You made a bad trade, you blew your account, end of story.”

This was the last communication from them. This was the reason I came to seek help from FPA to help resolve this matter. I feel that Alpha Trading owes me $1025 which they docked illegally. They feel that I can do nothing about this; it was their benefit, end of story as they put it.

New thread in the Scam Alerts Folder:

Review is submitted by Casper on 12/02/13

The company was first contacted about the issue on 11/14/13 the last contact was on 12/03/13

Details: The company has refused coming to FPA to explain their position.

I have uploaded a transaction statement here downloaded from within inside client member’ area. This statement has trading history from 10 Nov 2013 to 27 November 2013. The reporting from Alpha Trading Cm is not good as you can see from the statement that the trades are not chronologically flowing. For example the last trade that caused all this issue was place on 26.11.2013 at 21.04 according to their reporting. But this trade is found in the mist of trades that were placed far earlier and were concluded far earlier before i shutdown the MT4 and went to bed, only to find out the next morning that there was this Ghost trade placed, which I am convinced it was placed on the side of Alpha Trading CM. I have highlighted this trade in yellow for your convenience. As you can see from my statement that all trades traded on that day were 0.04 lots trades. Only this ghost trade was 1 lot. and there are no other trades around the time it was taken except for it only. This trade was not recorded in my Myfxbook which clearly shows the last time it updated and recorded activity in my account. This trade was never placed in my platform, it was never recorded by Myfxbook as you can see from the last trade recorded by Myfxbook, it was 0.04 lot at on the same day at 16:52. This was the trade placed by my EA then I shutdown the platform 7 minutes later. Then the ghost trade was placed that very same night and never recorded by Myfxbook. The reason for this my platform was not running throughout that tim

Company representatives' emails: Fred Velez<info@alphatradingcm.com>

Dana O'Keefe<dok@alphatradingcm.com>

I am submitting the case against: www.alphatradingcm.com

My Case is: This is the Matter concerning Alpha trading CM and my Live account No. 753266

There are three issues I would like to be helped with and get compensation for.

1. They manipulate prices against the client’s position; they did this to me about 100 pips in few seconds every time i placed a trade

2. They start trades on the clients account without clients knowing and hope to blow the client’s account. They did this whilst my MT4 was not even running.

3. They don't allow your withdrawal. If you fight them hard enough they end up giving you whatever they want instead of what You requested in your withdrawal request. In my case I had $1240 in the account and requested $668 withdrawal. They refused to give it to me. At last they gave me $224. They said they were trying to break even.

1. First issue in details: Manipulation of currency pair prices against the client’s trade/position

What happens it that there is an immediate spike against my position on the currency pair I am trading at that point, this happens just after I have placed the trade. When there is no trade entry there is no such spike. But once I enter the trade again, then this spike shows up moving very quickly opposite to my position. This spike lasts between 120-180 seconds against my position. During that abnormal spike I am not even able to exit the trade. I am not even able to put the stoplosses and take profits. It is like the platform is frozen when infect the platform is not frozen; it is the broker that is refusing to accept my changes. The broker literally blocks me out. The way this happens is so abnormal because during those moments when those spikes occur, other brokers are showing normal prices and no spikes. Only Alpha Trading Mt4 is showing that false. Even so, the same Alpha MT4 is showing no spike when there is no trade entered. It happens only when I enter the trade. Even that spike is only for the particular pair that am trading at that time, other pairs play normal. One may say it is news release or something, but I promise you it has nothing to do with news release because at that time there is no news release. If it was normal price action spike, then all other brokers should show at least some sort of that spike. All brokers should show almost similar price movements, but they don’t, only Alpha Trading shows the spike just after I have entered the trade. Talking to Alpha Trading CM about this matter, they shifted the blame to their liquidity provider, namely, Barclays and this was their response: “i will find another feed for you and not let that bank take your trades but you will have a slightly higher spread”.

I would make profits and this false spike would comes from nowhere and hit my account hard with spikes which seem to be stoploss hunting and threaten to blow my account. Here below are the details of the events:

On Tuesday the 12th Nov 2013 it happened at between 3h15---3h28 (broker time), a first false spike emerged out of the blue once I entered my four trades simultaneously, it moved 16pips in matter of seconds caused me to lose 64 pips in an instant. Then it went quite for about 7 minutes. I instructed my EA to place 4 trades simultaneously and again that false spike came back instantly after entering the trade with a move of 11 pips causing me to lose 44 pips in few seconds. I was trading 0.1 lots and that costed me 108 pips which was $108. My account was at $803, it shrank to $695. Again there were no such price movements from other brokers. I would make profits by literally sitting and watching the account so that when those false spike ok I would stop the EA and close the trades and shutdown the platform. On the 19 Nov 2013 at 8:06 (MT4 broker time) the GBPUSD jumped 101 pips immediately after I had entered a sell trade from 1.61257 to 1.62272 in few seconds. I had placed 4 simultaneous trades of 0.1 lot each and lost 404pips = $404. Again there was no such price movement from other brokers. I immediately stopped the EA and the Platform. 45 minutes later I restarted the platform and re-enabled the EA. At 8: 50 (MT4 broker time) my EA placed 4 simultaneous buy trades on GBPUSD and again immediately the price jumped 98 pips in few seconds taking away 392pips =$392 with it. Again there were no major news releases and there was no such price movement from other MT4 brokers, only Alpha Trading platform came up with these anomalies. This continued until I decide to withdraw part of my funds which they refused to give. And that leads me to my second issue, the withdrawal issue.

2. Failure to process the withdrawal request as requested by clients.

I want them to explain to me why they did not effect the $668 withdrawal as requested by me? Why did they unilaterally decided to just give me $224? Was it because they felt my initial deposit was $220 and so I was only deserving $220? Throughout the withdrawal process they said nothing until the funds arrive arrived via wire transfer and it was not the $668 I had requested, it was $224. Note that at the time I submitted a withdrawal request there was $1240 in my trading account and there were no open trades running. From that $1240, I was withdrawing $668 so that $572 would remain in my account. Instead they sent me $224 leaving $1016 in my account. When asking them about this via email and suggesting that they were handling matters like a scam broker, this below is their response to this withdrawal saga:

" You were sent the fund amount because your account was not profitable due to the short duration the and special trading requirements-per your request. As far as we are concerned this matter is closed. You are at the very least made whole as you were sent more funds than you deposited. Please explain to us how a "scam" broker would do such a thing? Isn't the idea to cheat you out of your deposit? As you know, you were sent funds that exceeded your deposit. This is a fact, is it not? It is!"

The issue for me is not whether or not I was sent funds which were equal or greater than my deposit, the issue at hand is that I was withdrawing funds from the profits I had made, plain and simple. If the client trades the market and makes profit, the client has the right to withdraw his/her funds, that is what I understand. So for Alpha Trading CM to say that they gave me $4 extra to my deposit of $220 is just not good enough explanation for not processing my withdrawal as requested, moreso when I had $1240 in my account and asking for just $668. I still feel that they owe me this money because the 3rd issue I want to raise below relates exactly to their operations building up to their third fraudulent activity

3 Placing a Ghost trade on my account

Just a few days (1 day or 2 days) after the withdrawal saga, there was about $1025 in my trading account. The last stunt they pulled was to enter the trade in my absence. I had shutdown my MT4 and went to bed. 12hrs later I woke up and went to start my MT4 platform. When it started I checked that it was disabled and I asked them why, they said I had placed 1 trade that went against me in few seconds and wiped my account out. My Balance before this trade was $1025 and this trade was a GBPUSd for 1 lot. It took out $1027 if few seconds and left $-1.44 in my account which is still there in the client area. I would have never traded a 1 lot with a $1025 balance. My EA was not even programmed to trade 1 lot, my EA was set to trade 0.04 lot. The EA could not just simply decide to place the 1 lot trade. My EA does not use Martingale. Even worse the MT4 platform was not even running, thus there was no way the EA could place that trade.

This screen shot of Myfxbook linked account shows that my Alpha MT4 platform was last updated by MyFxbook on 26 November 2013 at 18:59 South African time. This is the last time my Alpha Trading MT4 Platform was opened and updated by myfxbook for trading before I shut it down and went to bed. Brokers time when I shut down the platform was 26 November 2013 at 16:59 . The last trade I placed on the MT4 was at broker’s date and time 11.26.2013 at 16:52. This is the last trade I ever made with the broker then I shut down my MT4 platform 7 minutes later and went to bed. I was never able to login to my Alpha MT4 trading account after that since the next time I tried login into MT4 platform I got the “account disabled” message. This message was a result of the ghost trade that was placed in my account whilst my platform was not even running. I may never know whether this trade was ever recorded in the trading history of the MT4 platform. I was never even able to see this trade from the MT4 trading history since I could not access the platform on restart after I had shut it down the previous night.

What I think Alpha Trading CM did in this case, they placed the trade in my account from their side. This was a huge 1lot trade on GBPUSd on a very small account of $1027, which with their price manipulations and false spikes wiped my accounts in seconds. Then they disabled my account immediately. What they did not know at that time was that my platform was not running because I had shut it down since I had been aware that it was never safe to leave the platform running with them since they manipulated prices to go against my trades, so the EA would only trade when I was there and watching the trades so that I would intervene when they came up with their tricks. I was only able to know about this ghost trade once I received an email from them telling me about it. I then logged into the client area (website client area) to see the statement and I saw that the trade had been place around midnight (my local time, when I was deep asleep). That is how I came to know about that trade. This trade was placed during Asian session. I did not trade Asian session; I mostly traded European and US sessions. This was the biggest stunt they pulled. They realised that I had caught them up on price manipulations, they had refused my withdrawal, so they decided to do it in one go, by just placing a single trade to wipe the account once and for all so that I would never have a chance again to request a withdrawal. I had never placed a 1 lot trade in the entire history of that trading account. Throughout that day my EA was trading 0.04 lots. Only that ghost trade came up with 1 lot trade. I do not know who placed it and why is was placed. Even worse is that this single trade that wiped out my entire account was opened on EURUSD at 1.3665 on 26/11/2013 and closed at 1.3565 same day 26/11/2013, the funny thing about this is that the EURUSD pair never rose above 1.3620 between 25 Nov 2013 and 28 November 2013, so how could I possibly have opened the trade at 1.3665? Asking Alpha trading about it this was their response:-

“We have received your email. We have looked at this case. We have found nothing done on the end of Alpha. In fact, the trade appears to be done by you, the client. We have no risk to clients and as a result we have no need to "manipulate trades". If you made a trade and you lost, then that is of your own accord. You needed to continue to trade in order for Alpha to break even - without having to take the other side of your trades. Since we are an STP firm, we make money on the spreads. Your spreads were low, so we needed high volume. For you to achieve that you would have needed more time. You have a legal team. We do as well. We will fight from our end as well because we are confident we did nothing wrong. You made a bad trade, you blew your account, end of story.”

This was the last communication from them. This was the reason I came to seek help from FPA to help resolve this matter. I feel that Alpha Trading owes me $1025 which they docked illegally. They feel that I can do nothing about this; it was their benefit, end of story as they put it.

New thread in the Scam Alerts Folder:

Review is submitted by Casper on 12/02/13

The company was first contacted about the issue on 11/14/13 the last contact was on 12/03/13

Details: The company has refused coming to FPA to explain their position.

I have uploaded a transaction statement here downloaded from within inside client member’ area. This statement has trading history from 10 Nov 2013 to 27 November 2013. The reporting from Alpha Trading Cm is not good as you can see from the statement that the trades are not chronologically flowing. For example the last trade that caused all this issue was place on 26.11.2013 at 21.04 according to their reporting. But this trade is found in the mist of trades that were placed far earlier and were concluded far earlier before i shutdown the MT4 and went to bed, only to find out the next morning that there was this Ghost trade placed, which I am convinced it was placed on the side of Alpha Trading CM. I have highlighted this trade in yellow for your convenience. As you can see from my statement that all trades traded on that day were 0.04 lots trades. Only this ghost trade was 1 lot. and there are no other trades around the time it was taken except for it only. This trade was not recorded in my Myfxbook which clearly shows the last time it updated and recorded activity in my account. This trade was never placed in my platform, it was never recorded by Myfxbook as you can see from the last trade recorded by Myfxbook, it was 0.04 lot at on the same day at 16:52. This was the trade placed by my EA then I shutdown the platform 7 minutes later. Then the ghost trade was placed that very same night and never recorded by Myfxbook. The reason for this my platform was not running throughout that tim

Company representatives' emails: Fred Velez<info@alphatradingcm.com>

Dana O'Keefe<dok@alphatradingcm.com>

Attachments

-

screen shot of trades during fasle spikes by Alpha Trading Platform.png187.9 KB · Views: 3

-

Screen shote for 26 Nov 2013 with lines.png34.7 KB · Views: 3

-

Screen Shot from MYfxbook fro account 753266.doc149.5 KB · Views: 2

-

logfile for 26 nov 2013.log189 KB · Views: 2

-

Trading statement arrenged chronologically.xls514 KB · Views: 2