Hello,

I am a newbie in forex trading, I have been reading a lot about it for a couple of months and traded demo using different brokers , in all the situations I have grown my equity using a strategy and sticking to it...(for example i have grown on broker's free 30$ to 63$ and brought Armada demo from 10000 to 140000, just operating intraday).

Last week i decided to open an Armada Markets standard account. Everything went against me. And when i mean everything i mean really everything if I had traded clicking blindly on the mouse I would have lost less money (luckily i deposited just 200$). Every trade i made became a support if i entered short and a resistance If i entered long. Every buy stop was triggered and then taken to stop loss value and then back again. And over and over. And so happened with all the other things, just everything went against my operations. I am really convinced that it was my inexperience and nothing else, probably forex is not just for me or maybe just demo forex is !!!That is why I am steering away from it today...

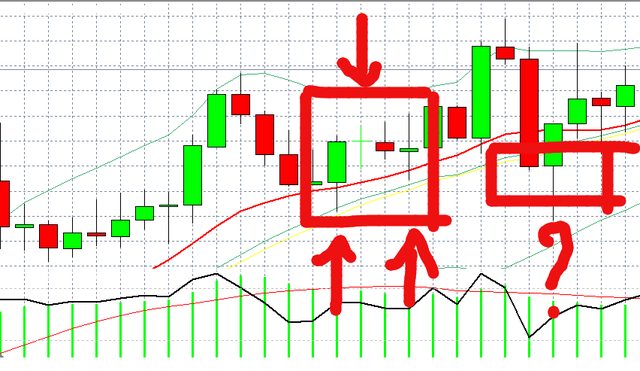

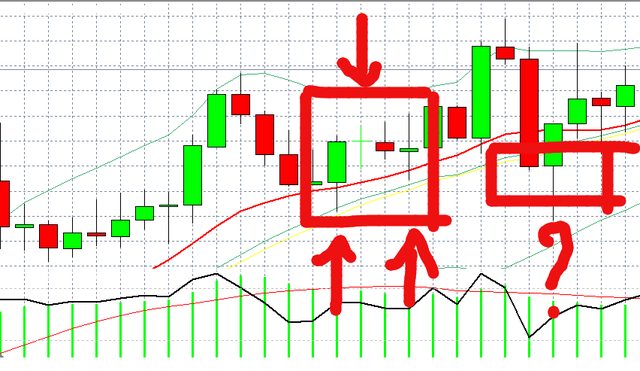

I have a question though , I hope someone will answer. Are we (or you, from now on ) operating on the market or we are operating against the broker?Why the brokers values are VERY different in some situations if compared to the market situation?Here is an example..I highlited the different candles, you just see it visually and of course also the values are different.

) operating on the market or we are operating against the broker?Why the brokers values are VERY different in some situations if compared to the market situation?Here is an example..I highlited the different candles, you just see it visually and of course also the values are different.

I am a newbie in forex trading, I have been reading a lot about it for a couple of months and traded demo using different brokers , in all the situations I have grown my equity using a strategy and sticking to it...(for example i have grown on broker's free 30$ to 63$ and brought Armada demo from 10000 to 140000, just operating intraday).

Last week i decided to open an Armada Markets standard account. Everything went against me. And when i mean everything i mean really everything if I had traded clicking blindly on the mouse I would have lost less money (luckily i deposited just 200$). Every trade i made became a support if i entered short and a resistance If i entered long. Every buy stop was triggered and then taken to stop loss value and then back again. And over and over. And so happened with all the other things, just everything went against my operations. I am really convinced that it was my inexperience and nothing else, probably forex is not just for me or maybe just demo forex is !!!That is why I am steering away from it today...

I have a question though , I hope someone will answer. Are we (or you, from now on