Financial Insights: Inflation, Interest Rates, and Global Diplomacy

On Tuesday, a soft U.S. inflation reading raised hopes that the Federal Reserve is nearing the end of its interest rate-hiking cycle. Furthermore, there was positive economic data from China, reporting better-than-expected retail sales and industrial data for October. This has led to speculation about potential Fed rate cuts, especially following weaker-than-estimated inflation measures (CPI and PPI) published earlier in the week.

In Frankfurt, ECB President Lagarde is scheduled to speak at an event. Additionally, this week will see the release of weekly Initial Jobless Claims, the Philly Fed Manufacturing Index, Industrial Production, and the NAHB Housing Market Index.

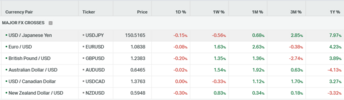

However, on Wednesday, the downbeat UK Consumer Price Index (CPI) data had a negative impact on the British Pound (GBP), serving as a tailwind for the GBPUSD cross. Moreover, the GBP's upside potential might be limited due to the possibility of interest rate cuts from the Bank of England in the near future.

The Japanese Yen (JPY) continues to underperform, primarily due to the Bank of Japan's (BoJ) more dovish stance. The BoJ is the only major central bank maintaining negative interest rates and is in no rush to shift away from its massive monetary easing. Traders also remain skeptical about the possibility of Japanese authorities intervening to combat any sustained depreciation of the domestic currency.

With the two inflation reports now behind us, investors will shift their focus to a range of economic data, including jobless claims, industrial production, and housing market data scheduled for Thursday. They will also closely follow remarks expected from Fed officials, including Cleveland President Loretta Mester and New York President John Williams, at various events throughout the day.

The softer tone around U.S. equity futures is driving some haven flows toward precious metals. Additionally, the expectation that the Federal Reserve (Fed) has completed its policy-tightening campaign is providing further support to gold, a non-yielding asset.

Crude oil prices are facing downward pressure due to a larger-than-expected weekly build in U.S. crude stockpiles. The EIA Crude Oil Stocks Change for the week ending on Nov 10 improved to 3.6M from the prior 0.774M, against an expected 1.793M. Furthermore, signs of easing demand in China are contributing to the negative sentiment surrounding oil prices, with China's oil refinery throughput in October showing a slight slowdown compared to the previous month's highs.

In a noteworthy development, U.S. President Joe Biden and China's President Xi Jinping met in person in San Francisco on Wednesday, marking their first meeting in about a year. Both leaders agreed to resume high-level military communication, but the issue of Taiwan remains a sticking point in their relationship.

Euro Challenges Resistance Against US Dollar as DXY Seeks Support

In today's forex market, the EUR/USD pair is encountering a notable resistance level, while the US Dollar Index (DXY) is actively seeking support around the 100-day Moving Average (100MA). Today's market direction is highly dependent on important data releases and events scheduled for the day.

Analysts suggest that a sustained bullish trend could shape the immediate future of both EUR/USD and DXY. If the bullish momentum prevails, the EUR/USD pair is eyeing significant targets, particularly the 1.0940 level and the psychologically significant 1.1000 round number.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.1050 | 1.1000 | 1.0940 | 1.0850 | 1.0800 | 1.0750 |

GBP/USD Correction from 100MA Resistance as Dollar Developments Awaited

In recent trading sessions, the GBP/USD pair has undergone a correction, stepping back from the resistance level around the 100-day Moving Average (100MA) at 1.2500. Today's market developments, particularly related to the US Dollar, are poised to play a crucial role in determining the pair's future direction.

Looking ahead, traders and investors are eyeing the next target for the GBP/USD pair, which is identified at the 1.2600 level. The realization of this target will depend on the interplay between the British Pound and the US Dollar, influenced by ongoing market developments and key economic indicators.

Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

1.2700 | 1.2600 | 1.2500 | 1.2400 | 1.2300 | 1.2200 |

USD/JPY Surges to New High with Dollar Strength, BoJ Intervention Possible

In the latest market developments, the USD/JPY pair has experienced a notable rebound, reaching new highs following gains made by the US Dollar. The Japanese Yen, currently displaying weakness and lacking fundamental support, raises the likelihood of intervention by the Bank of Japan (BoJ) in the near future.

Analysts note the significant decline in the yen's value, prompting concerns within the BoJ. The central bank may take measures to stabilize the currency and prevent further depreciation, as an excessively weak yen can have broader implications for the Japanese economy.

Traders engaging in USD/JPY transactions are advised to exercise caution due to the observed high volatility, with an average movement of around 350 pips. The dynamics of the currency pair will be closely tied to potential interventions by the BoJ and how the market responds to these actions.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 155.00 | 153.50 | 152.00 | 149.3 | 148.00 | 146.50 |

In a noteworthy market development, gold prices are on a continued ascent, underscoring a robust bullish trend. Both fundamental factors and observed price action align to support this upward trajectory, heightening investor optimism about the precious metal's performance.

The current bullish sentiment in the gold market has propelled prices upward, with market participants closely monitoring the next target at $2003. The optimistic outlook is grounded in a combination of fundamental drivers and favorable price dynamics that contribute to the ongoing positive momentum.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

2020 | 2003 | 1979 | 1940 | 1920 | 1902 |

Oil Prices Bearish, Threatening to Break Key Support Level at $74.20

In the latest market update, oil prices are displaying a persistent bearish trend, with indicators pointing towards a potential descent to the crucial support level at $74.20. Analysts suggest that a breach of this support level could usher in a significant shift, entering what is considered the bottom zone and sending an alarming signal throughout the energy market.

The continued downward movement in oil prices is prompting attention from various market participants, including OPEC. OPEC, historically influential in stabilizing oil prices, may face increasing pressure to intervene if the support level is breached, as such a development could have broader implications for the energy sector.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

82.5 | 80 | 77.20 | 74 | 72 | 68 |