Zforex

zForex.com Representative

- Messages

- 30

EUR/USD Hovers Around 1.0750, Awaits Economic Data for Direction

The EUR/USD pair is currently fluctuating around the 1.0750 support level as the economic calendar is free for today and market participants await the influx of economic data starting tomorrow. Whether the pair recovers towards 1.0850 or falls back towards 1.0660 will depend on the upcoming economic data and events this week.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.1000 | 1.0900 | 1.0850 | 1.0750 | 1.0660 | 1.0600 |

GBP/USD Consolidates at 1.2500, Dollar Strength Affects Recovery

The GBP/USD pair is currently trading around the 1.2500 mark, having recovered last week but affected by the strengthening of the dollar. While the trend remains bullish, there is potential for the pair to revisit its 1.2700 resistance level.

Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

1.2900 | 1.2800 | 1.2700 | 1.2500 | 1.2400 | 1.2300 |

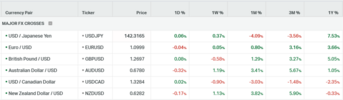

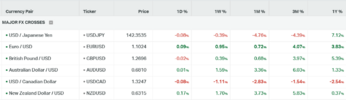

USD/JPY Rebounds from 142.00 Support, Aiming for 146.60 Resistance

The USD/JPY pair after touching the 142.00 support level is coming back strongly after a change in sentiment and outlook. The 146.60 is the next resistance level.

Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

150.00 | 148.00 | 146.50 | 142.00 | 140.00 | 137.90 |

Gold Retreats to 1979 Support with Dollar Strength, Eyes Market Dynamics This Week

Following Friday's data and a shift in market sentiment, the price of gold is weakening and moving towards its next support level at 1979. The dollar and Treasury yields are exerting negative pressure on gold as they have benefited from the recent economic outlook. However, this week's upcoming economic data and events are likely to redefine market dynamics.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

2052 | 2036 | 2006 | 1979 | 1960 | 1940 |

WTI Crude Oil Shows Signs of Recovery, Eyes 72.50 Resistance with OPEC+ Actions

WTI crude oil is exhibiting signs of recovery following seven weeks of continuous selling. The next resistance level is anticipated at 72.90, while a support level of 68 could be established if the downtrend persists. OPEC+ might intensify efforts to support oil prices, while economic conditions in China and other developed countries, such as the US and Europe, could also influence supply forecasts.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

80 | 78 | 72.90 | 68 | 65 | 63 |