Zforex

zForex.com Representative

- Messages

- 30

EUR/USD Holds Near Median Line with Data Uncertainty

The EUR/USD is hovering around the median line without a clear direction after yesterday's data. Today's PPI data may provide more direction. The next resistance level is at 1.1000, while the support level is close to 1.0850.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.1200 | 1.1100 | 1.1000 | 1.0900 | 1.0850 | 1.0750 |

GBP/USD Approaches 1.2800 Resistance, Correction May Target 1.2630

The GBP/USD currency pair came close to the resistance level of 1.2800. Data from yesterday didn’t support a breakout or a correction as uncertainty continues. If prices break out, they may reach the next target of 1.2930. However, if there is a correction, prices may fall back to 1.2630.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.2930 | 1.2800 | 1.2700 | 1.2650 | 1.2500 | 1.2400 |

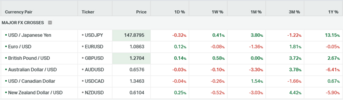

USD/JPY Faces 50MA Resistance, Undergoes Slight Correction

The USD/JPY encountered resistance from the 50MA and is currently undergoing a slight correction. There is no confirmation yet of a clear direction for the pair, but the next support level is at 144.00. As the fundamentals decline, the yen may weaken further, while the direction of the pair will also depend on the dollar.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 155.00 | 152.00 | 148.30 | 145.00 | 144.80 | 140.00 |

Gold Prices Rebound on Treasury Yield Dip, Decline May Test 2006 Support

Today, gold prices bounced back following a drop in the treasury yield. If the rebound is sustained, the next resistance level will be at 2050. However, if prices continue to fall, the next support level will be at 2006.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 2140 | 2090 | 2050 | 2032 | 2006 | 1979 |

WTI Rises as 50MA Poses Temporary Challenge, Bearish Trend Prevails

WTI is moving up today following the geopolitical tension in the Middle East where the 50MA may be temporarily a challenge for the price. The resistance area is between 74 and 76, while support is at 68. The trend is currently bearish.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 81 | 78 | 74 | 70 | 68 | 64.9 |