Zforex

zForex.com Representative

- Messages

- 30

EUR/USD Volatility Follows PMI Data

The EUR/USD had strong volatility yesterday after PMI data while still hovering around the support at the 200MA and the 1.0850, waiting for today's GDP data for direction. The next support is at the 1.0800 level and the next resistance is at 1.0900.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.1100 | 1.1000 | 1.0900 | 1.0850 | 1.0800 | 1.0750 |

GBP/USD Stalls in Price Range with Growing Uncertainty

The GBP/USD is experiencing range-bound movements due to increasing uncertainty at the start of the new year. The next resistance if the rebound continues is at 1.2800 while the 50MA will be the next support.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.3100 | 1.2930 | 1.2800 | 1.2600 | 1.2500 | 1.2400 |

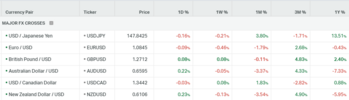

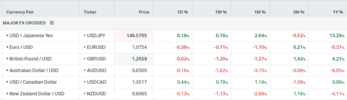

USD/JPY Dependent on Dollar Movements

The USD/JPY pair is making some corrections but limited as it will depend on US dollar movements for today. The next support is at 146.50. If a breakout occurs, the next target is 150.00.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 152.00 | 150.00 | 148.35 | 146.50 | 144.80 | 144.00 |

Gold Slips Following US PMI Data

Gold is falling today after yesterday's US PMI data where markets believe US economic resilience and rates will be held for longer. The short-term bearish trend is still active. If it continues to decrease, the next level will be at 2006 again.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 2070 | 2052 | 2021 | 2006 | 1979 | 1960 |

Crude Oil Initiates Reversal, Next Resistance at 78

Recent market trends indicate a potential reversal in oil prices, with the commodity poised for an upward movement. The next significant resistance level stands near the 200-day moving average, hovering around 78 and the support level remains steady at 70.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 81 | 78 | 74 | 70 | 68 | 64.9 |