Zforex

zForex.com Representative

- Messages

- 27

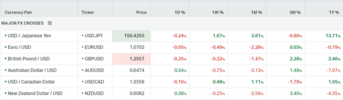

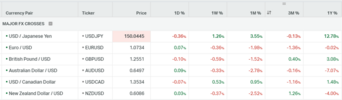

EUR/USD Corrects Amid Dollar Retracement

The EUR/USD is undergoing a correction for the second consecutive day as the dollar retraces following a significant rally. This moderation is a typical market response as investors evaluate the Federal Reserve's potential timing for a rate cut. The current correction could be transient before the dollar potentially resumes its ascent. The next resistance level is anticipated at 1.0850.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.1000 | 1.0900 | 1.0850 | 1.0750 | 1.0650 | 1.0500 |

GBP/USD Gains for Second Day Amid Weaker Dollar

The GBP/USD pair is capitalizing on a weaker dollar, achieving gains for the second day in a row. The current resistance level that the pair is testing is at 1.2600, with the subsequent resistance zone expected to be between 1.2750 and 1.2800.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.2930 | 1.2800 | 1.2600 | 1.2500 | 1.2300 | 1.2470 |

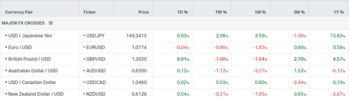

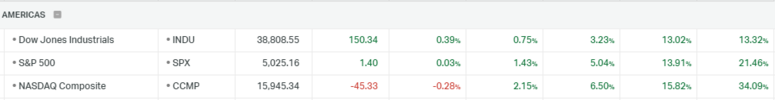

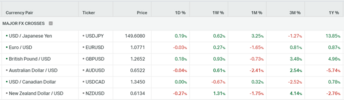

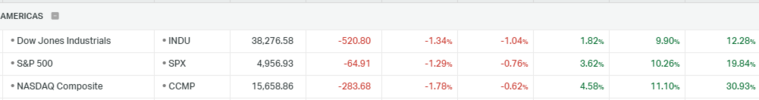

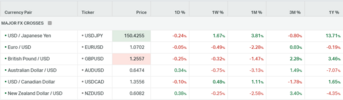

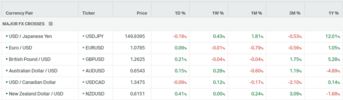

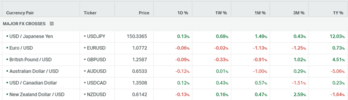

JPY/USD Uncertainty: Short-Term Bullish Trend Awaits Dollar’s Weakening

JPY/USD exhibits some uncertainty at the current level. While the short-term bullish trend appears robust, it requires additional weakening of the dollar to sustain its upward trajectory.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 152.00 | 150.00 | 148.35 | 146.50 | 144.80 | 144.00 |

Gold Range-Bound, Resistance at 2038, Support at 2006

Gold is persisting in its range-bound price movements, facing resistance at the 2038 levels and finding support at 2006. Gold may remain under pressure as the Dollar strengthens and yields rise. However, as long as the support at 2006 holds, gold is likely to avoid a bearish territory.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 2070 | 2055-60 | 2038 | 2006 | 1975 | 1965 |

Oil Prices Go Up Amid Volatility & Geopolitical Tensions

Oil prices are experiencing modest gains within a volatile trading environment, as geopolitical tensions have intensified and waiting for today’s EIA data. The next support level for oil is identified at $70, with resistance anticipated around the $78 mark.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 84 | 81 | 78 | 70 | 68 | 65 |