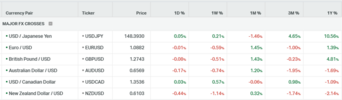

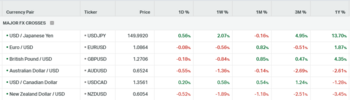

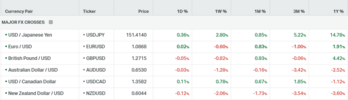

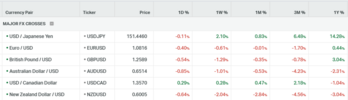

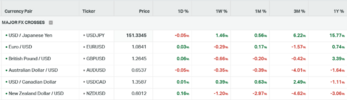

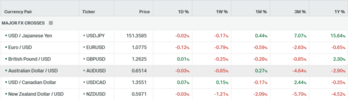

On Tuesday, the US dollar index continued its upward trajectory, following a surge on Monday triggered by a strong US retail sales report. In March, retail sales, which reflect consumer spending, increased by 0.7% from February, surpassing expectations. This strong consumer activity contradicts earlier predictions of a spending pullback, prompting further speculation about the timing of potential Federal Reserve interest rate cuts. This speculation has been fueled by strong employment gains in March and rising consumer inflation.

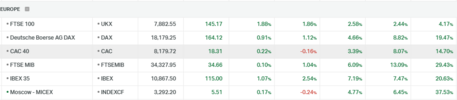

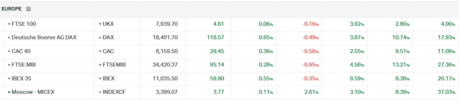

In contrast, the European Central Bank (ECB) views market expectations for a rate decrease starting in June as reasonable, following a steady decline in the annual core Consumer Price Index (CPI), which excludes volatile food and energy prices, to 2.9% in March. This marks the eighth consecutive month of declines, suggesting that inflation is on a sustainable path towards the ECB's 2% target. Last week, the ECB maintained its Main Refinancing Operations Rate at 4.5%. ECB President Christine Lagarde indicated that if upcoming assessments provide more confidence that inflation is returning to the target, rate cuts would be justified.

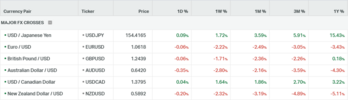

In the UK, the Pound Sterling is under pressure due to disappointing labor market data for the quarter ending in February, which reflected a deteriorating economic outlook. The UK's Office for National Statistics (ONS) reported that the unemployment rate increased unexpectedly to 4.2% from the anticipated 4.0% and previous 3.9%. Additionally, layoffs in February rose to 156,000 up from 89,000 in January. Market attention is now turning to the upcoming release of the UK Consumer Price Index (CPI) for March, which could significantly influence expectations for future Bank of England (BoE) rate adjustments, currently projected to begin in August.

The Japanese Yen weakened further on Tuesday, hitting a new 34-year low against the US dollar. This follows the Bank of Japan's (BoJ) decision to maintain a dovish stance, refraining from providing clear guidance on future policy directions or the pace of policy normalization after the cessation of negative interest rates in March. A recent report suggests a shift in the BoJ's focus from inflation targeting to a more discretionary approach, which will consider various economic indicators to guide future rate decisions, contributing to the yen's depreciation.

Gold prices hovered near record highs on Tuesday, strengthened by a prediction from a major Wall Street bank that the precious metal could reach $3,000 per ounce within the next six to 18 months.

Oil prices climbed on Tuesday, supported by faster-than-expected economic growth in China and heightened geopolitical tensions in the Middle East following a missile and drone attack by Iran on Israel over the weekend.

EUR/USD Decline Continues Amid Dollar Strength: Targets 1.0500 Area

The EUR/USD pair continues to decline as the dollar strengthens, breaking through the 1.0660 level with the next target set at the 1.0500 area. The ECB's potential rate cut in June, prompted by recent CPI data, contrasts with the Fed's possibly hawkish stance and the likelihood of a delayed rate cut in September as inflation rebounds.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.0950 | 1.0870 | 1.0800 | 1.0700 | 1.0660 | 1.0500 |

GBP/USD Falls Below 1.2500 Support, Eyes 1.2400 Level

The GBP/USD pair similarly continues to fall breaking the support level around 1.2500 and now the next target is at 1.2400. The last data from the UK labor market adds more pressure on the pound.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.3100 | 1.3000 | 1.2700 | 1.2600 | 1.2500 | 1.2400 |

USD/JPY Surges to New Highs, Targets 155 Amid Fed-BOJ Policy Divergence

The USD/JPY pair continues to climb, reaching new historical highs, driven by the significant divergence in monetary policies between the Fed and the BOJ. The pair is expected to rise further, with the next target set at 155.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 155.00 | 153.00 | 152.00 | 148.2 | 146.30 | 145.00 |

Gold Nears $2400, Eyes $2560 as Momentum Persists

Gold's momentum is relentlessly pushing towards a new historical high, approaching the 2400 mark with the next potential target around 2560. The prevailing conditions continue to favor further advances in gold prices. While there may be some price consolidation at the current levels, the strong momentum suggests continued upward movement.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 2560 | 2300 | 2260 | 2140-45 | 2088 | 2055-60 |

Oil Market Consolidates Near $85 Support, Eyes $89 Target

In the short term, the oil market is experiencing directionless trading within a tight range where the support is at 85, yet the overall outlook remains bullish and strong. The market is poised to potentially continue its ascent towards the next target at 89.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 94 | 89 | 84.7 | 85 | 80 | 78 |

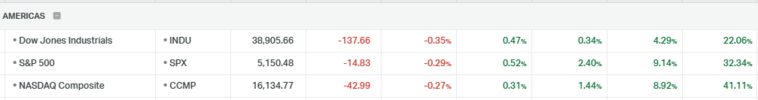

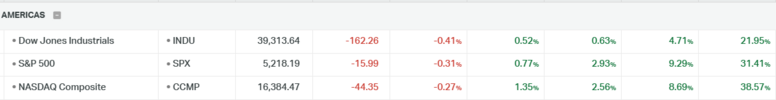

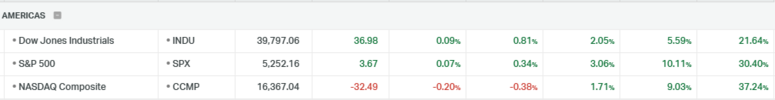

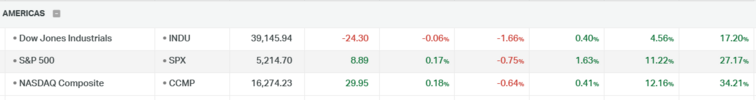

Nasdaq Futures Correct Amid Skepticism, Target Support at 17,600

Nasdaq futures are undergoing a correction following a phase of rising price accumulation and divergence. This shift has been influenced by changing sentiment due to recent US data and disappointing Q2 earnings, which have fueled skepticism. The next potential support level is targeted at 17,600.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 18800 | 18500 | 18400 | 18000 | 17600 | 17400 |

DAX Corrects as ECB Rate Cut Speculation Grows

Mirroring trends in US indices, the DAX is currently undergoing a correction as market sentiment grows more cautious. Weaker-than-expected inflation figures have bolstered confidence in a potential rate cut by the ECB. The 50-day moving average, indicated by the blue line, may act as the next potential support level.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 18700 | 18440 | 18000 | 17600 | 17500 | 17300 |