Zforex

zForex.com Representative

- Messages

- 28

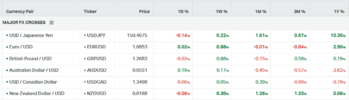

EUR/USD Faces Resistance at 200-day MA, Potential Reversal Ahead

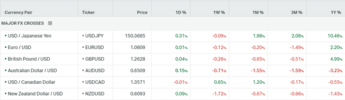

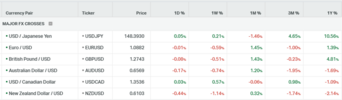

The EUR/USD is encountering resistance at the 200-day moving average (MA) after nearing the 50-day MA close to the 1.0900 resistance level. The pair appears to be facing strong resistance at the current level, indicating a potential reversal.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.1000 | 1.0900 | 1.0850 | 1.0750 | 1.0700 | 1.0650 |

Below 1.2730 Resistance: GBP/USD Reflects Economic Uncertainty

The GBP/USD is maintaining its position below the 1.2730 resistance level, with the 50-day moving average (MA) acting as resistance. Despite the recent increase, the pair continues to exhibit volatility and a lack of clear direction, mirroring the persistent uncertainty around the UK's economic fundamentals.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 1.2930 | 1.2800 | 1.2730 | 1.2500 | 1.2300 | 1.2470 |

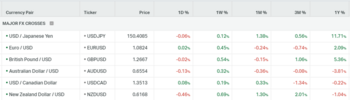

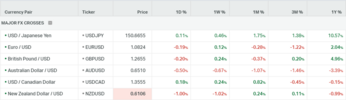

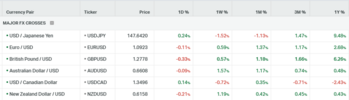

Bullish Momentum: USD/JPY Eyes 152.00 Resistance Level

The USD/JPY pair is advancing towards the upper side, with the next target approaching the 152.00 resistance level. The overall trend remains bullish, with the 152 area serving as the next resistance should the pair continue to rise.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 155.00 | 152.00 | 151.70 | 150.00 | 148.00 | 146.50 |

Gold Rebounds on Dollar Weakness and Geopolitical Tensions

Gold is rebounding after encountering resistance at the 50-day moving average (MA), which initially restrained its advance before reaching 2038. The dollar's weakness, coupled with geopolitical tensions in the Middle East, has supported gold's recovery.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 2077 | 2055-60 | 2038 | 2006 | 1975 | 1965 |

Oil Nears Resistance at $78 Amid Neutral Performance

Oil consistently hovers around the resistance level in the $78 area, closing the week with a neutral performance. A breakout could push prices toward $81, while a pullback might lead prices toward the $73 support level. Oil appears to be in an accumulation phase, poised for a potential upward reversal if demand-side fundamentals improve.

| Resistance 3 | Resistance 2 | Resistance 1 | Support 1 | Support 2 | Support 3 |

| 84 | 81 | 78 | 73 | 70 | 68 |