FXOpen Trader

Private, 1st Class

- Messages

- 31

GBPUSD Technical Analysis – 14th FEB, 2024

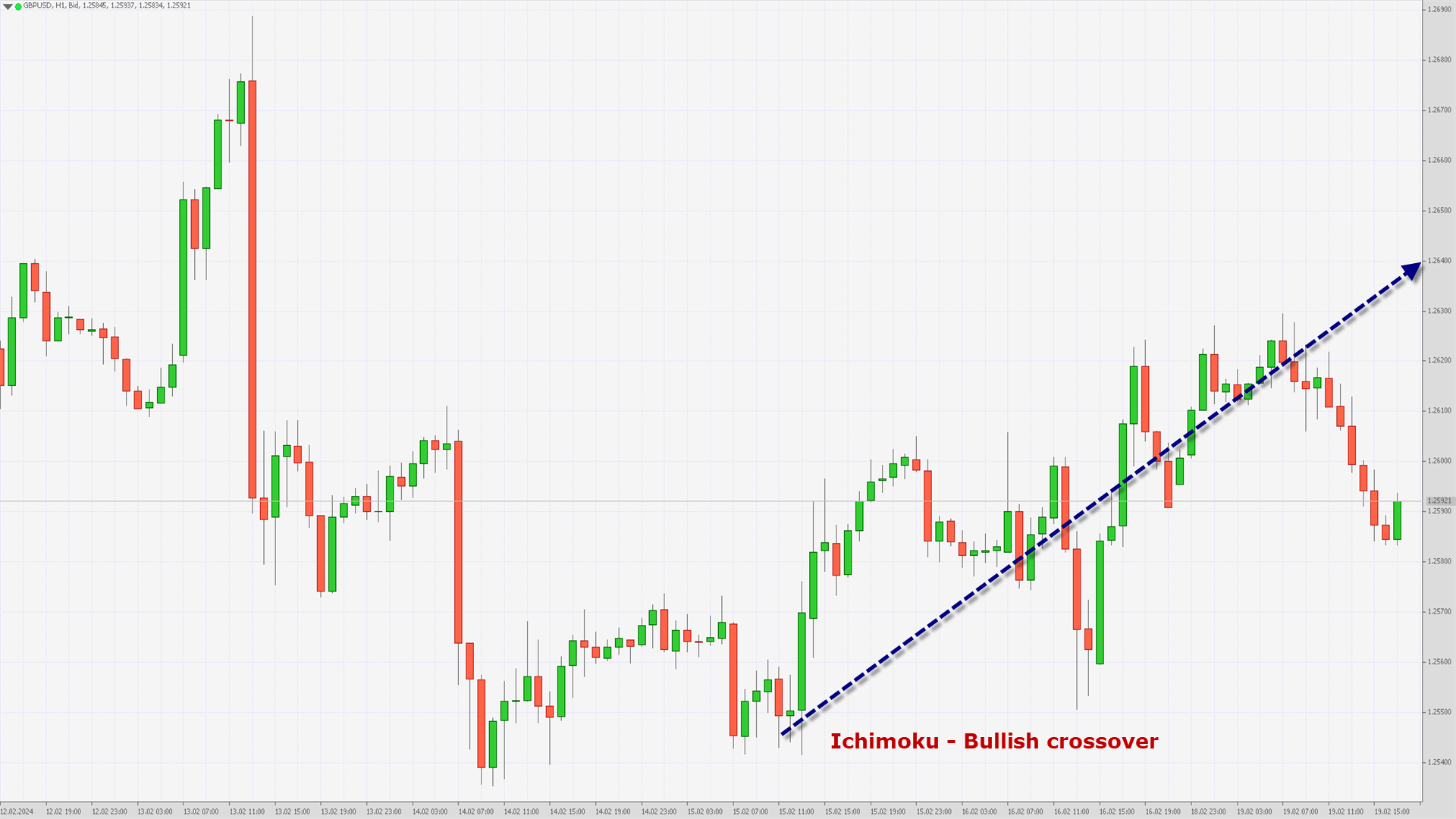

GBPUSD – Bullish Trend Reversal AMA20

GBPUSD was unable to sustain its bullish momentum and after touching a high of 1.2609 yesterday prices started to fall rapidly touching a low of 1.2535 in the Asian trading session today.

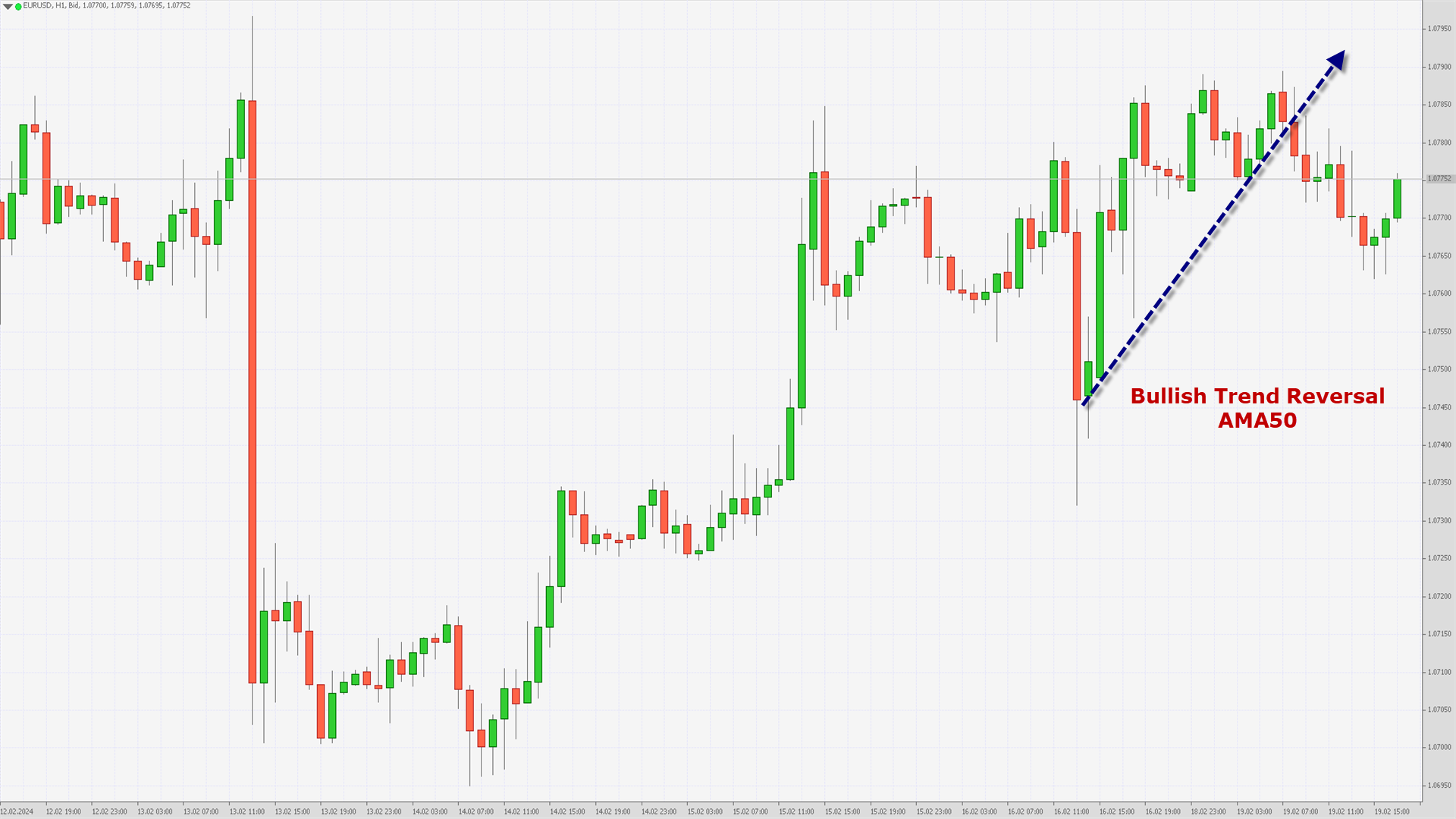

We can see Bullish Trend Reversal with the Adaptive moving average AMA20 in the 15-minutes timeframe.

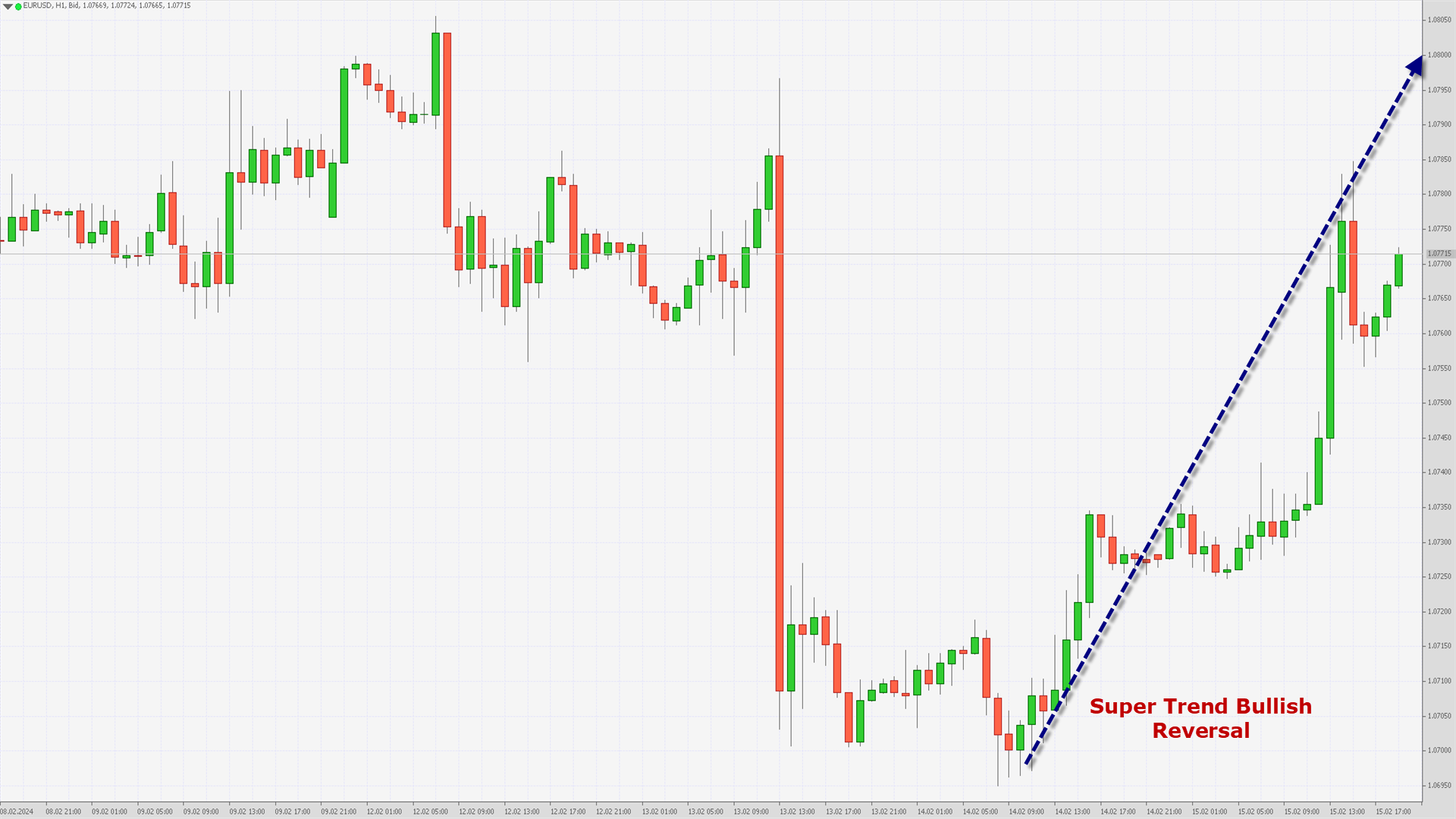

The prices of EURUSD are ranging near horizontal support in the 1-hourly timeframe.

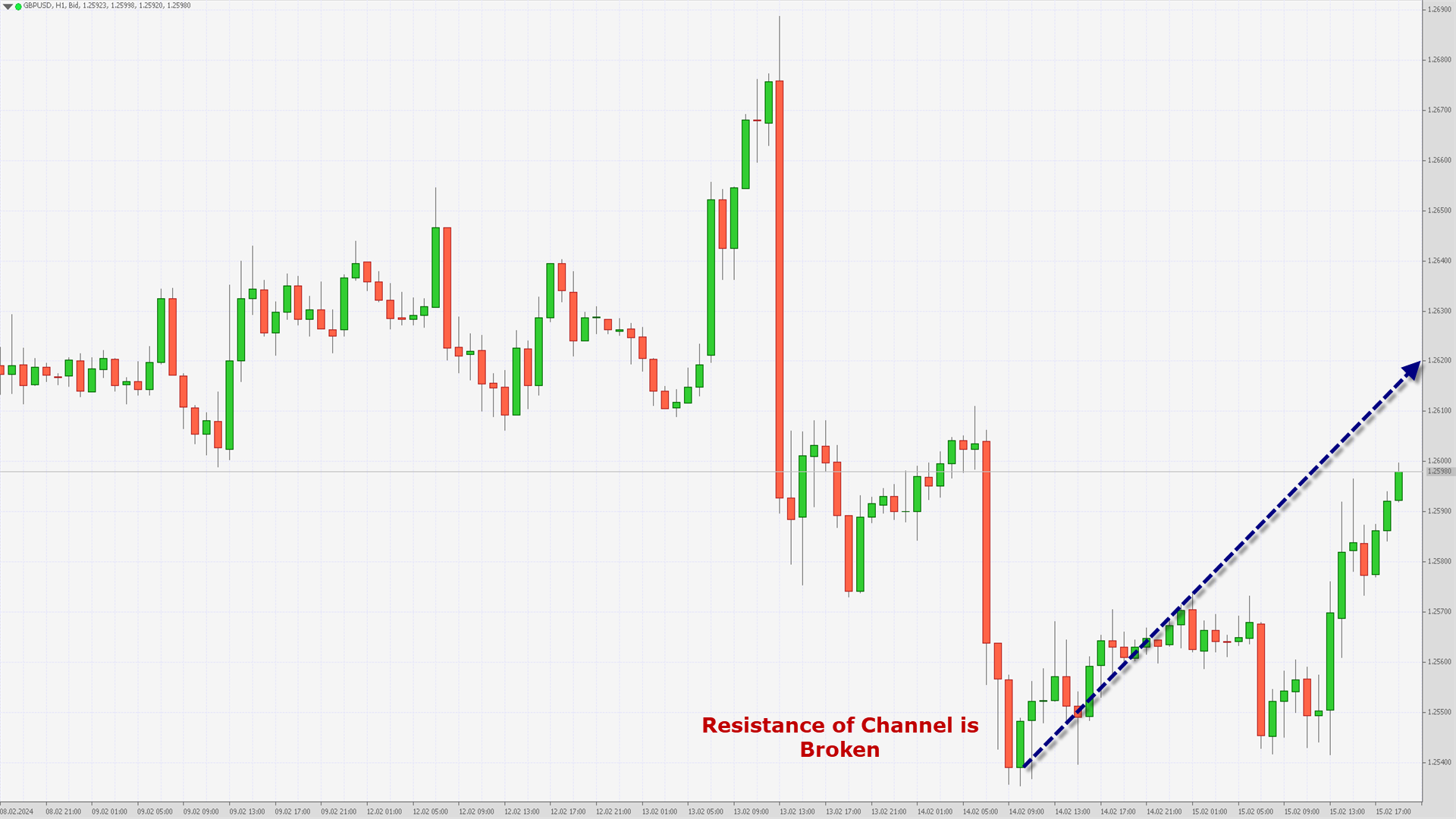

We can see that the price of GBPUSD is ranging near support of channel and near support of triangle in the daily timeframe, which indicates a Bullish tone present in the markets.

The prices are expected to enter into a consolidation phase soon, and we may see some downwards price correction before the resumption of the Uptrend.

GBPUSD is now trading below its both the 100-hour SMA and 200-hour SMA simple moving average.

GBPUSD is now trading below its Pivot levels of 1.2557 and is moving into a Mild Bullish Channel.

The price of GBPUSD has already crossed its Classic resistance levels of 1.2552 and the next target is located at 1.2573 which is a 3-10 Day MACD Oscillator Stalls.

Note: This Analytics is created by me and is based on my own personal Forex trading experience of 10 years. I am using my trading experience to help Experienced and Newbie traders and they should know about the risks of Forex trading.

For in-depth analysis, please check FXOpen Blog

GBPUSD – Bullish Trend Reversal AMA20

GBPUSD was unable to sustain its bullish momentum and after touching a high of 1.2609 yesterday prices started to fall rapidly touching a low of 1.2535 in the Asian trading session today.

We can see Bullish Trend Reversal with the Adaptive moving average AMA20 in the 15-minutes timeframe.

The prices of EURUSD are ranging near horizontal support in the 1-hourly timeframe.

We can see that the price of GBPUSD is ranging near support of channel and near support of triangle in the daily timeframe, which indicates a Bullish tone present in the markets.

The prices are expected to enter into a consolidation phase soon, and we may see some downwards price correction before the resumption of the Uptrend.

GBPUSD is now trading below its both the 100-hour SMA and 200-hour SMA simple moving average.

- Pound bullish reversal pattern seen above the 1.2540 mark.

- Short-term range appears to be Mild Bullish.

- GBPUSD continues to remain above the 1.2550 levels.

- Average true range ATR is indicating high market volatility.

GBPUSD is now trading below its Pivot levels of 1.2557 and is moving into a Mild Bullish Channel.

The price of GBPUSD has already crossed its Classic resistance levels of 1.2552 and the next target is located at 1.2573 which is a 3-10 Day MACD Oscillator Stalls.

Note: This Analytics is created by me and is based on my own personal Forex trading experience of 10 years. I am using my trading experience to help Experienced and Newbie traders and they should know about the risks of Forex trading.

For in-depth analysis, please check FXOpen Blog