Sive Morten

Special Consultant to the FPA

- Messages

- 18,669

EUROPEAN FOREX PROFESSIONAL WEEKLY

Analysis and Signals

March 4, 2010

Analysis and Signals

March 4, 2010

Fundamentals

There are two most expected events for the nearest future that should influence the market's direction. The first is Non-Farm Payrolls data, second – the Greece situation announcement from EU officials.

Although we’ve seen yesterday's increase in the ISM index (from 50.5 to 53) and especially in the ISM Non-Manufacturing employment index from 44.60 to 48.60, there is a high probability that NFP will be worse than expected. And more specifically not in the current month but in a revision of the previous data like in ADP employment. The ADP index for February shows numbers almost in a row with expectations - 20K, but the previous one was revised from -22K to -60K and has shown total result at – 58K. So, NFP is expected around -20K, but I think that we can see a bit better numbers for February (around -15K) but a negative revision for January and a total number around “-70K” – “-90K”. This revision is mostly due bad weather conditions that did not favor employment and a headwind for real estate development. All these events have influence on the situation with NFP and its revision to downside.

Another situation is a Greece problem. According to recent news, Greece has found some additional possibility to reduce its budget deficit for another 4.8 Bln. EUR. But this is like a drop in the ocean. Officially Greece has time until March, 15 when they should announce their austerity plan. Till this moment I expect that rhetoric about a bailout plan and the way that it will be accepted will be smoothed. The ECB will not be hawkish in searching for a solution to this problem (even on today’s announcement). But let’s see on some numbers…

First, Greece should pay out E 1.645 Bln in coupon payments due March 20th, E 8.48 Bln in redemptions and interest payments due April 20th, and, finally E 10.712 Bln also in redemptions and interest due May 19th. After that the debt burden will be much lighter. So the X-point is a possibility to payout these sums and market will track this very carefully. I expect that there will be a solid bailout from France and Germany (maybe directly, but more probable that through guarantees on new issued debt or through government-owned banks, like KFW in Germany), because Greece can’t accumulate such liquidity at such short term. If there will be a default in Greece, then it will have a strong negative impact on the whole EU financial sphere, so this scenario is almost impossible. The amount of bailout aid that can be made is about E 20-25 Bln. Until we will not see definite signs that Greece can pass through all these debt payments the EUR will stay under pressure. If sufficient aid will be granted sooner and crisis will be resolved for awhile then is possible that EUR can gain in mid-term.

Résumé: In short term the future market behavior depends on NFP data. The midterm perspective for EUR/USD is based on a Greece bailout program development and the level of sufficiency of this program. As I said, X-point is a Greece’s debt redemptions in April and May. Until investors become sure that aid is sufficient to fulfill obligations, the EUR will stay under pressure. If the situation is resolved in favor of Greece, then we can see some retracement higher in EUR/USD, but Greece is only a top of the Iceberg. There are Spain, Portugal, Eastern EU countries, so in long-term the position of USD is more preferable.

Technical

Monthly (EURO FX all sessions CME futures)

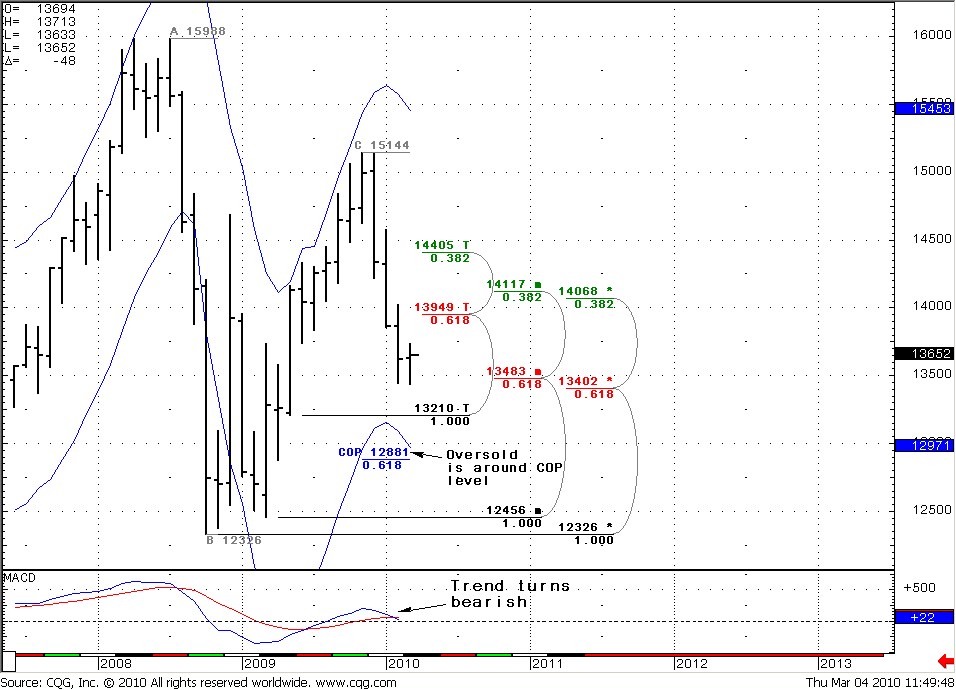

The monthly trend turns bearish. Market could not break through 1.34-1.3480 monthly 0.618 support in February and still above this level. Although we can see some retracement higher in mid-term period, the long term monthly target is COP=1.2881 (there will be an oversold by the way), next is OP=1.1482.

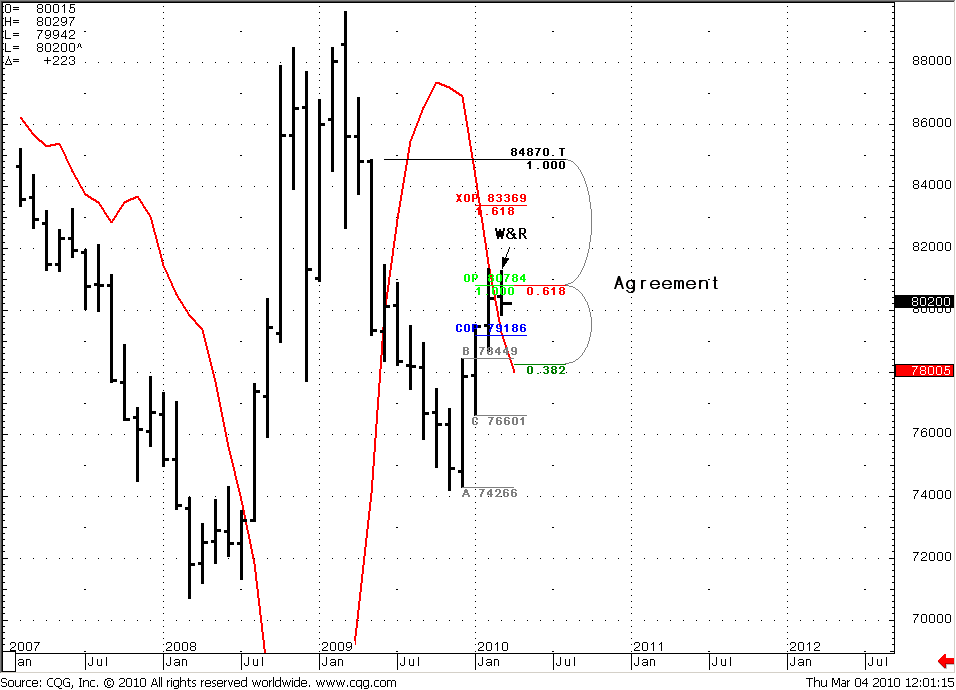

If we look at DXY (Dollar index) it looks soft a bit. The index has reached weekly OP target at 80.784 and 0.618 resistance from a monthly thrust bar at 80.783 (this results in agreement) and shows W&R of this 0.618 resistance level. We have confirmed bearish and unconfirmed bullish monthly trend in DXY. Although March is just started and it can go up further during the March but current situation looks bearish for DXY and points on a possible retracement down.

Monthly EUR/USD

Monthly DXY

Weekly (EURO FX all sessions CME futures)

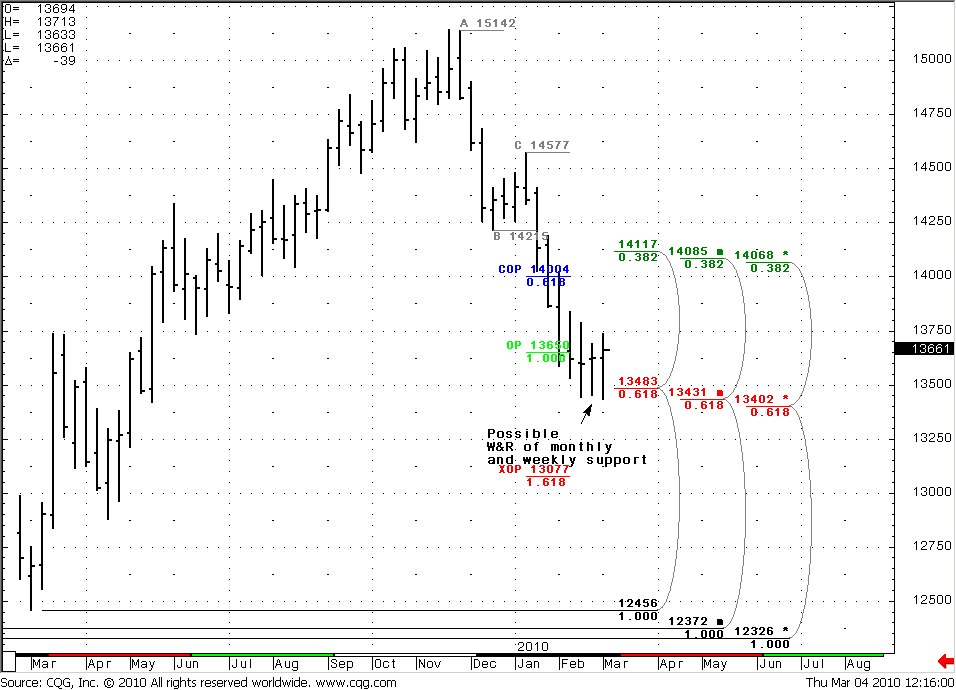

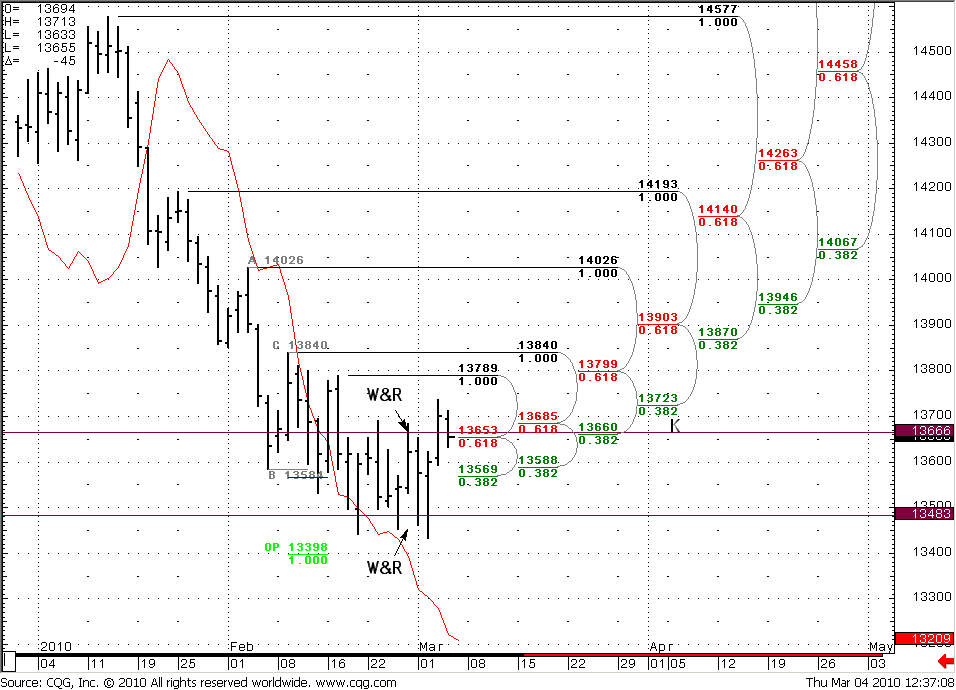

The market still is above solid 1.3400-1.3483 weekly and monthly support levels. Prices tried to pass through it but were pushed higher every time. In general all the past week was like one stop hunting event in the 1.3450-1.3650 range. Both levels were cleared by market-makers. That’s why I’ve recommended to stay aside for awhile in previous research. This 1.3480 penetration looks like Wash & rinse (W&R) of support level that makes possible some retracement upper in mid-term.

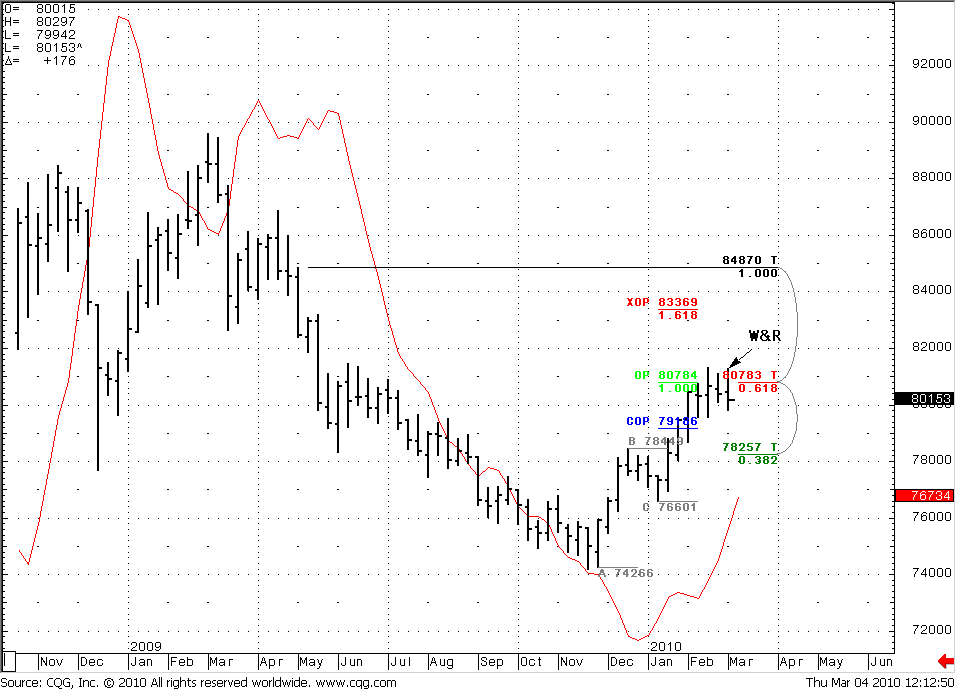

The same thing we can see at weekly Dollar Index chart (weekly#1 DXY), but the W&R there is more obvious, besides there is not just support, but Agreement also.

Weekly EUR/USD

Weekly DXY

Daily (EURO FX all sessions CME futures)

As we said on previous research, market is making a decision. As a result market-makers had a great possibility to grab stops of many participants. On the daily chart we see at least three W&R of 1.3480 support and 2 W&R of 1.3650 resistance daily area. With all my respect to 1.3650 resistance, I think that 1.3400-1.3480 is much stronger, because it is monthly and weekly support rather than daily. The market even couldn’t reach an OP at 1.3398. Daily trend turns bullish, 1.3650 was broken yesterday, so, I expect that market should take some relaxation in mid term and show some retracement upper – 1.38-1.3870 level the nearest target. Besides, I expect worse than expected NFP (as we pointed out in Fundamental part). That should be enough for the near term, taking into consideration some weakness in DXY.

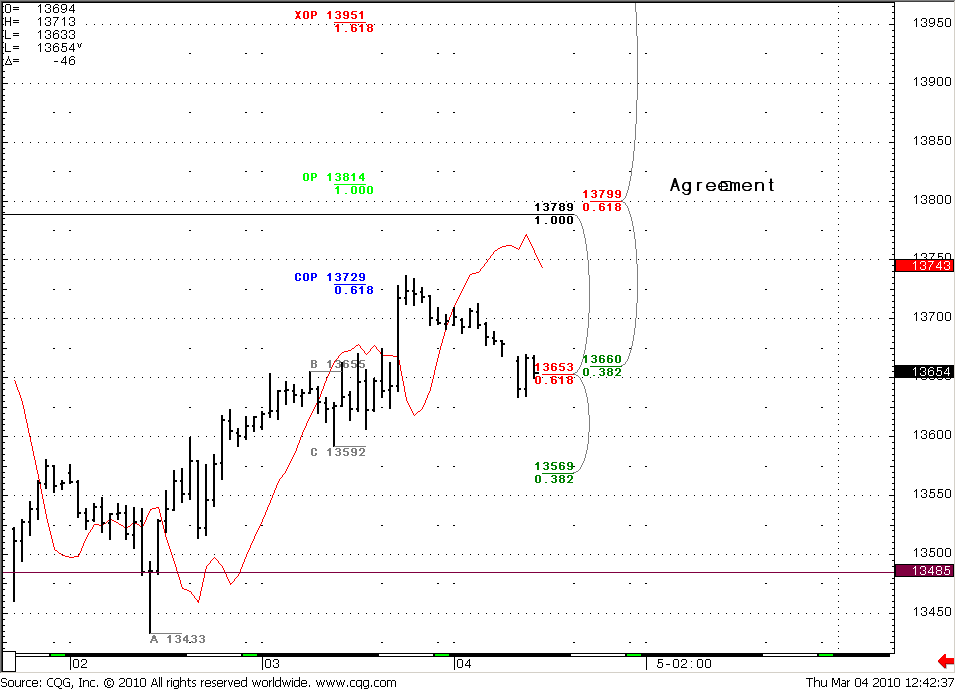

Also I’ve posted 60 min EUR/USD chart to show target calculation for up move to 1.380-1.3870 target. We have OP=1.3814 that is agreed with 1.3799 resistance and XOP = 1.3951 that is also agreed with daily resistance at 1.3946. For now market has reached COP at 1.3729 and starts a retracement.

Daily EUR/USD

60 Minute EUR/USD

Trade possibilities (1):

Monthly

Now we can say that a monthly bearish trend has been confirmed. Although there can be some improvements in Greece’s situation in the mid-term (and a retracement higher as a result), I think that in long-term USD is more favorable. The nearest long-term target is COP=1.2880.

Weekly

We have down trend, no oversold conditions. Taking in consideration some weakness in DXY and brighter W&R signal there, it makes possible to make an assumption that weekly EUR/USD also has shown W&R of weekly and monthly 1.3480 support. So, we can see some retracement higher in mid-term.

Daily

The context is as follows – weaker than expected NFP, W&R of weekly support at 1.3480, breaking daily Confluence resistance at 1.3650 and signs of retracement in the Dollar Index. The ECB will be dovish about Greece tonight, because they should make a decision as early as March, 15, so this event shouldn’t have much influence on the situation to my mind. So, the main driver for 2-3 days is NFP.

I expect that we can see retracement higher, at least to 1.3820 level at near-term.

Current European Forex Professional Weekly Signal - Forex Peace Army Forum

(1) “Trade possibilities” are not detailed trade signals with specific entries and exits. They are expectations about possible moves of the market during the week based on market analysis.

<!-- AddThis Button BEGIN -->

<div class="addthis_toolbox addthis_default_style">

<a class="addthis_button_facebook"></a>

<a class="addthis_button_email"></a>

<a class="addthis_button_favorites"></a>

<a class="addthis_button_print"></a>

<span class="addthis_separator">|</span>

<a href="http://www.addthis.com/bookmark.php?v=250&pub=fb-promotion" class="addthis_button_expanded">More</a>

</div>

<script type="text/javascript" src="http://s7.addthis.com/js/250/addthis_widget.js?pub=fb-promotion"></script>

<!-- AddThis Button END -->

General Notice: Information has been obtained from sources believed to be reliable, but the author does not warrant its completeness or accuracy. Opinions and estimates constitute author’s judgment as of the date of this material and are subject to change without notice. Past performance is not indicative of future results. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. The opinions and recommendations herein do not take into account individual client circumstances, objectives, or needs and are not intended as recommendations of particular securities, financial instruments or strategies to particular clients. The recipients of this report must make their own independent decisions regarding any securities or financial instruments mentioned herein.