Dear Rafost,

The trading orders mentioned above were executed without any mistakes.

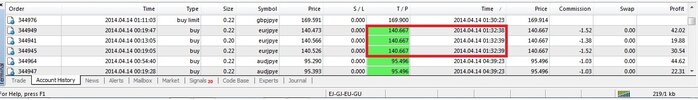

The orders #344945, #344941, #344949, #344964, #356857, #356853 were executed at the Take Profit level. The orders #344943, #357065 were closed by yourself. The order #357135 was executed with a slippage with a profit to the client.

Regarding the orders #358016, #358035, #358053, #358116, the market did not reach the Take Profit level, that is why they were executed with losses (as you have the Buy orders, and the market went down).

The order #353387 was also executed without any mistakes. The price of the execution was confirmed by the liquidity provider.

Regarding the difference between the price on the graph and the price of the execution, may I remind you, that the Take Profit you set is the limit order. As we enter the pre-limit orders into the interbank market system ahead of time, we can not tell you in advance, what would be the execution price of the order, and what liquidity provider will execute the order. So the price on the graph may be shown by the different liquidity provider.

Slippages may happen if you trade on the ECN account with the market execution of the orders, and it is closely related to the fact, that such type of execution guarantees the entry into the market, but sometimes can not provide its exactness, especially when market changes extremely fast.*

As you may notice, some of your orders are executed with a slippage with a profit to you. That is the proof of the correct and true market execution.

A characteristic of the interbank market is the fact that client bids for the purchase and sale of a given financial asset are executed at current market prices. During publishing the important economic news, the liquidity of the financial instrument on the market can be reduced. And that is a normal market situation, which can lead to the high volatility for the concrete financial instrument. As we show the real market situation, you may face the peculiarities of the trading while publishing the news.

The exact and fast execution of the client`s orders is profitable for EXNESS company, because we value our clients and are focused on long-term cooperation. That is why we always do our best to improve execution. But there are some limitations, which are related to the chosen execution type and the current market situation. *