Sive Morten

Special Consultant to the FPA

- Messages

- 18,732

Guys, I have to place charts as attachement, since I'm now in another town and can't upload pictures on server

Fundamentals

Reuters reports The euro fell sharply on Friday after European Central Bank chief Mario Draghi said inflation expectations were declining to levels that were very low, keeping the door open for further monetary easing soon.

The euro fell 1.19 percent to $1.2389 and dropped 1.58 percent against the Japanese yen to 145.89 yen .

"His comments have hit the euro hard," said Niels Christensen, FX strategist at Nordea, adding that euro zone inflation data next week would be a crucial influence on the ECB's thinking.

"Particularly his comments that he is worried about inflation expectations means that the ECB could ease policy soon. If it doesn't buy government bonds, then at least it could announce a decision to buy corporate bonds."

The Australian dollar and other high yielding currencies jumped after China cut benchmark interest rates for the first time in over two years to bolster a sagging economy.

The Aussie, which is often used as a more liquid proxy for Chinese investments, was last up 0.59 percent at $0.8669 , with the rate cut likely to assuage fears of a Chinese slowdown that have hurt commodity currencies.

"They have added significant liquidity to a global system that already has ample liquidity," said Lane Newman, director of foreign exchange at ING Capital Markets in New York.

The U.S. dollar is seen as continuing recent gains as the Federal Reserve is viewed as likely to increase interest rates next year as Europe, Japan and other economies continue very loose monetary policies meant to stimulate growth.

"The Fed will be a much more hawkish central bank relative to other central banks," Newman said.

Earlier, the yen rose after Japanese Finance Minister Taro Aso said the currency's fall over the past week was too rapid, one of the strongest warnings against a weak yen since Japan started its aggressive monetary stimulus in 2012.

The dollar fell to 117.72 from around 118 yen before his comments.

The dollar has climbed almost 10 yen since the Bank of Japan surprisingly eased policy in late October.

Recent CFTC data shows increasing of shorts with growing opent interest, while longs were contracted. No doubts that reason of these changes is recent ECB comments:

Open interest:

Shorts:

Shorts:

Longs:

Longs:

It looks supportive factor for our long-term nearest target at1.22. Market gradually but stably continue to approach to it and right now it stands not too far from current levels.

It looks supportive factor for our long-term nearest target at1.22. Market gradually but stably continue to approach to it and right now it stands not too far from current levels.

Technicals

Monthly

On previous week we’ve made wide comments on complex situation around EUR. As we’ve said previously EUR right now stands in center of geopolitical and economical turmoil and we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking we expect that EUR will continue move down.

We will remind you here major points of our analysis. In EU-US relations there are two topics right now – political and economical. On political side US forces EU to increase pressure on Russia and take disandvantageous steps and measures that primary hurts EU and almost harmless for US. Here we know about sanctions, Mistrale ships question, etc. Simultaneously US is aiming to replace Russia as important and strategic partner for Europe by enforcing “Zone of free trade agreement”. This falsity of ally becomes possible mostly because Europe de facto is not independent but mostly the colony of US. That’s why US freely can give the law to EU.

Economically US and EU drives on opposite courses. Recently Draghi has given a hint that ECB will increase balance to the level of March 2012 and this assumes QE on approximately 3 Trln EUR. And recent comments from ECB makes us think that if even this former statement will be tamed, EUR still will remain under pressure. US economy, in turn, now shows signs of improving. The major concern still is lack of inflation. Although Jobs are growing, but wealth of middle class and wages are stagnating.

This makes us think that EUR now stands under double pressure – EU pulls chestnuts out of the fire for US (in relation with Russia) and particularly due this action makes economical pit deeper. What could bit this sorrow?

As a result of blind or coercive following to US policy, EU meets problems with Russia, it’s 3rd largest trading partner. We suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises. Any ECB efforts on stabilizing of EU economy could be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

From technical point of view trend holds bearish here, but market is not at oversold. Price has broken through all solid supports and right now stands in “free space” area. As we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point. Take a look how harmonic this downside action, the speed of CD and AB legs are almost equal. EUR looks really heavy, month by month it opens at the high close at the low. Currently we see small relief but 1.22 target should be hit. Three black crows pattern and breakout through Yearly Pivot Support 1 suggests that 1.22 is not final target probably, and we should not surprise if we will see decline in next year as well. Only some structural shifts could change situation.

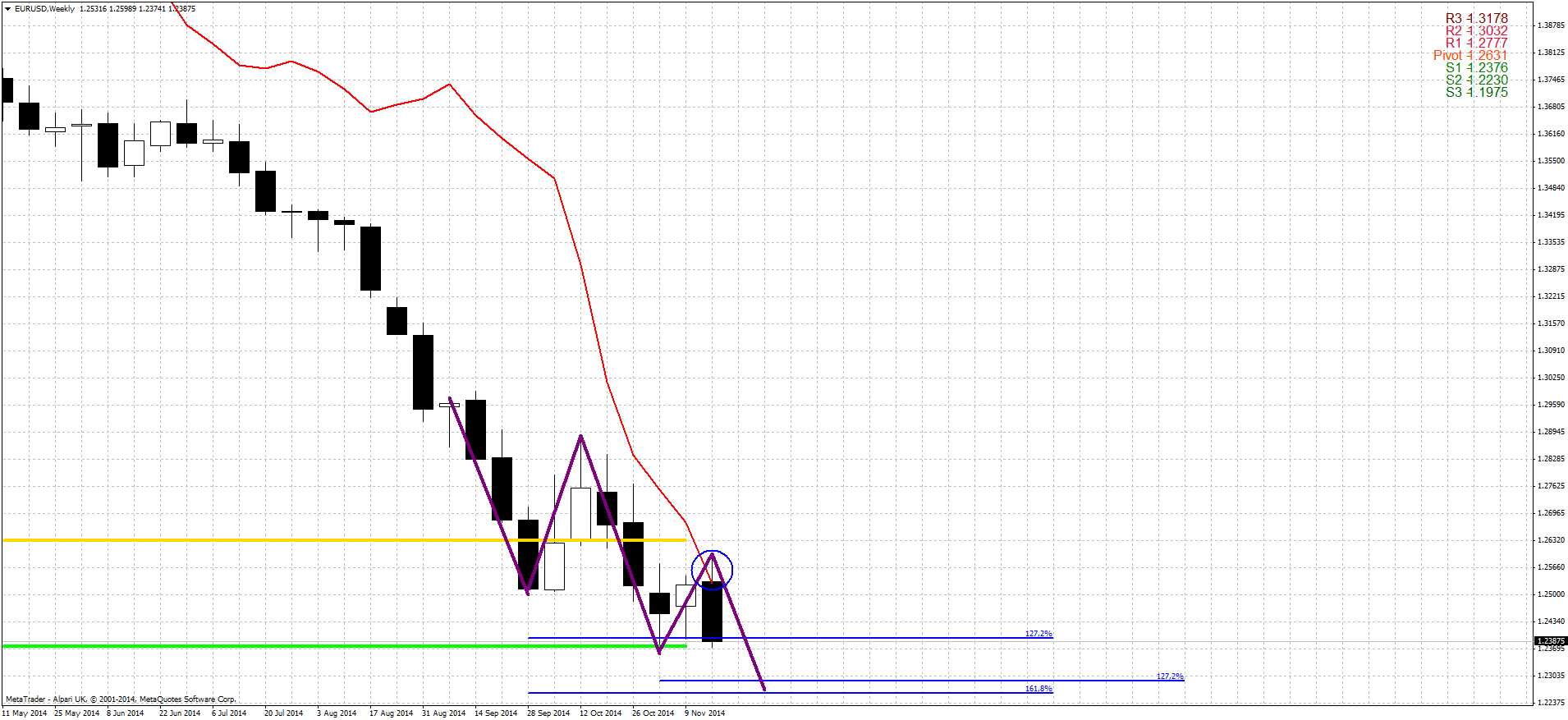

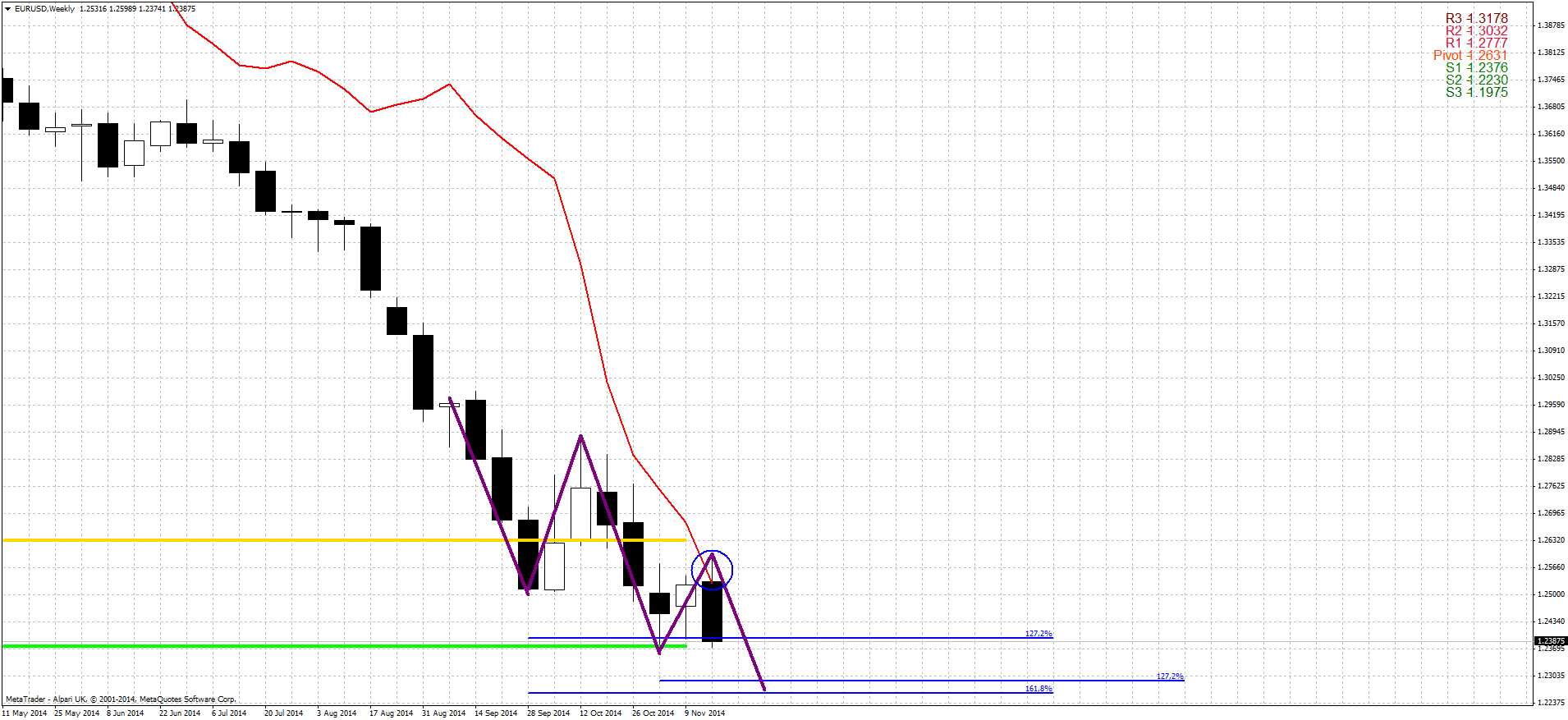

Weekly

Trend is bearish here, as well as on monthly chart. As we ‘ve said many times previously, market has no significant support till 1.22 and nothing could prevent downward action driving by bearish sentiment. As market still stands at support of MPS1 – this level is probably doomed since, we’ve got bearish grabber on Draghi speech and it suggests taking out of current lows. Yes, lows stands very close to current price, but we’re mostly interested with it as trigger for downward action. Combination of lows’ breakout and abscence of meaningful support probably will lead EUR to our 1.22 target.

At the same time here we have a kind of 3-Drive “Buy” pattern with slightly higher target @ 1.2250. This probably will be our destination for coming week.

Daily

On Friday we’ve said that character of price action itself mostly looks like retracement – a lot of deeply overlapping sessions, choppy action, flat angle of upside action, etc. Thus, Drughi comments have blasted this down and market has dropped. On daily chart picture in general stands in favor of downward continuation. Because we have hints on bearish dynamic pressure here, as trend holds bullish but price action is not. Second, applying classical technic we have bearish flag pattern and it suggests the same target as on monthly chart. Usually flag target equals to it’s mast. If we will clone it, drag and count down – we will get 1.2187 area. The one barrier on the road down will be daily oversold. Market could take some pause there. This will be also an area of WPS1.

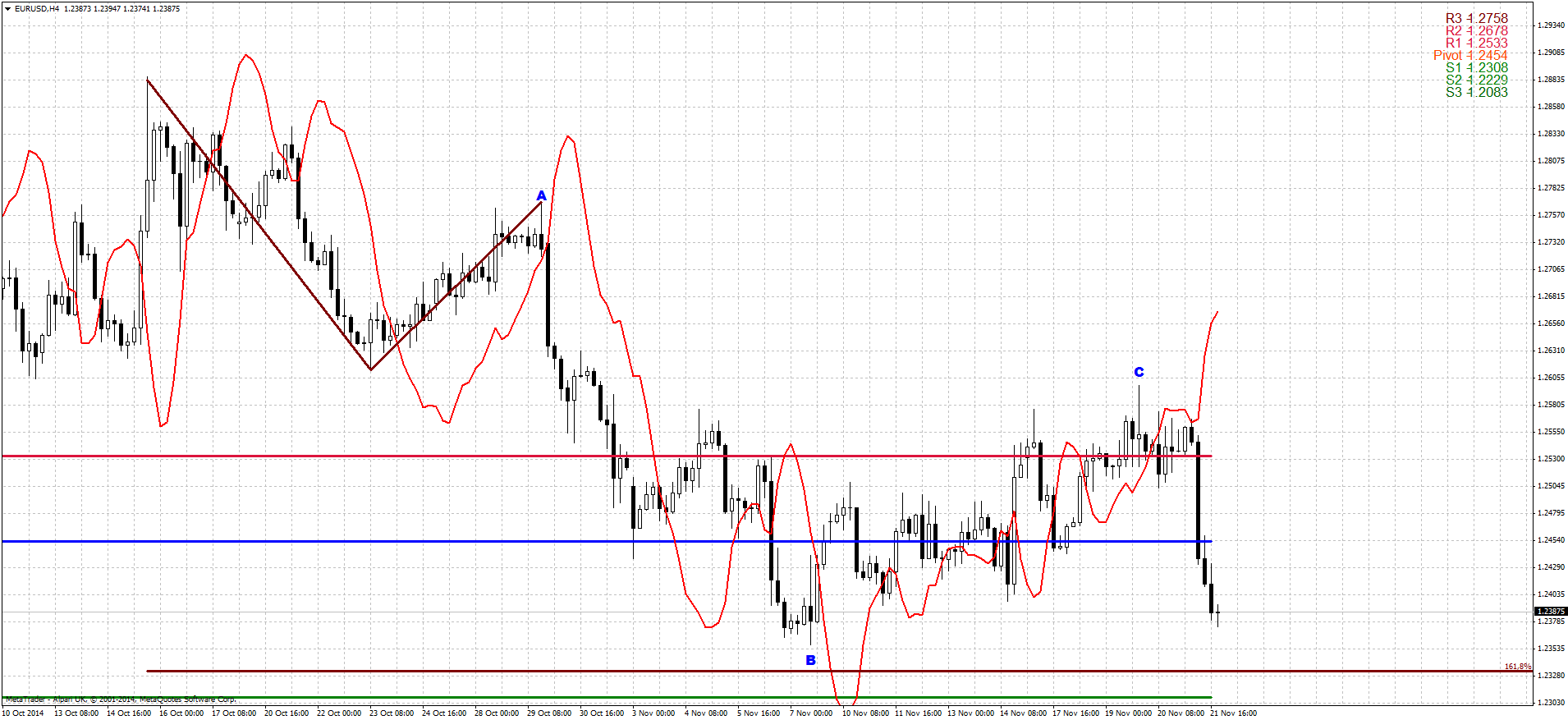

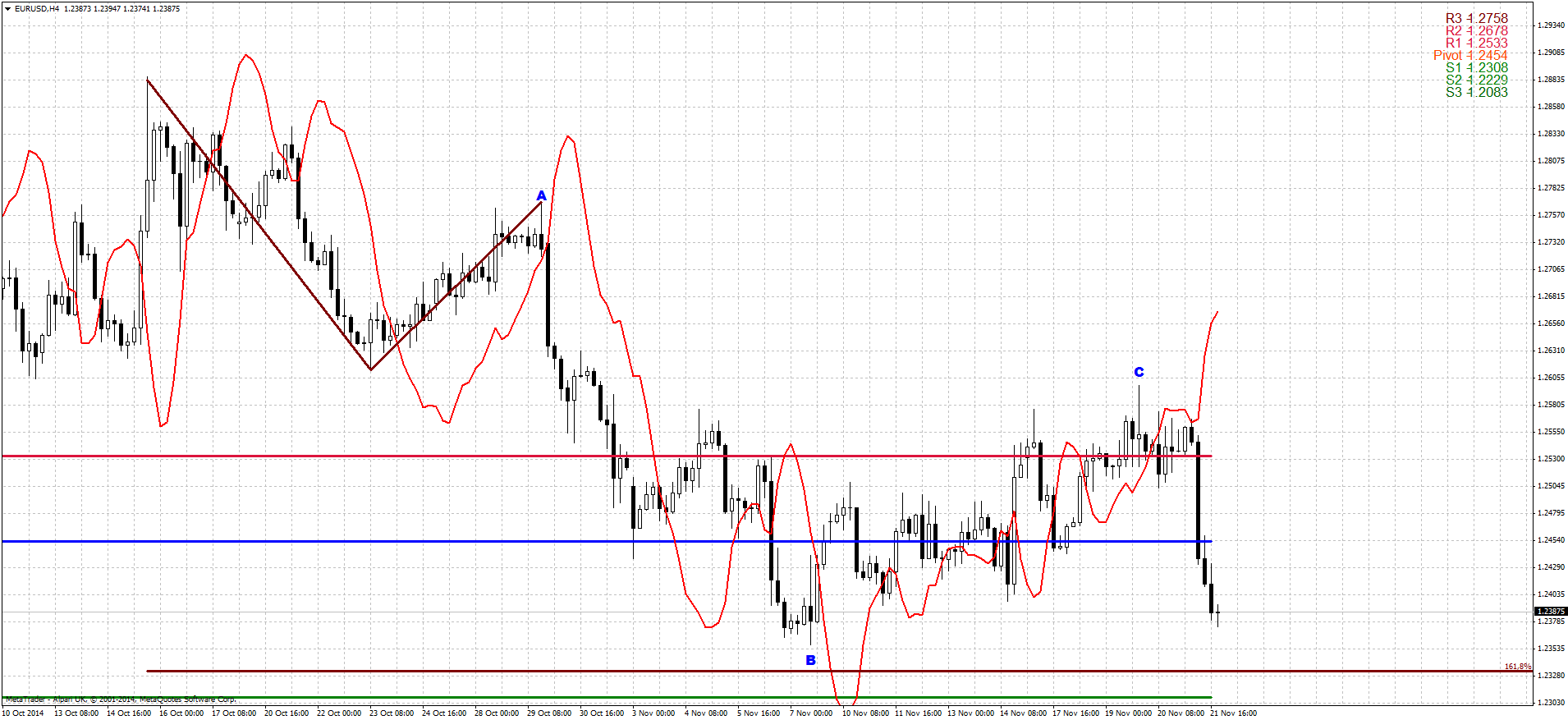

4-hour

As soon as I’ve finished to speak on 4-hour bullish grabber it was erased by following black candle and later market has formed oposite pattern. This picture keeps few chances for current lows to survive. 4-hour chart has its own reasons to suggest their failure. Thus, existing of untouched 1.618 AB-CD target at 1.2325 suggests more action down. Also take a look at A, B, C letters – this is in fact most recent AB=CD pattern, I just haven’t drawn it here to keep correct view of the chart. The point is that this AB-CD pattern has the same target as daily flag – right around 1.22 level.

Hourly

It seems, guys that we should search chances to go short. But we can’t offer you too much right now. Retracement up, if it will happen at all, of cause, should not be too deep. Since market just has re-established move down, has not hit any targets yet and is not at oversould. Thus, by looking at hourly chart it seems that most probable area of retracement is combination of former lows, WPP and one of Fib levels – either 3/8 or 50%. We’re interested in 50% level, since we have thrust down here that potentially could become the foundation of DRPO “Buy” pattern.

Conclusion:

Recent ECB comments leave blur hopes to bulls and put solid foundation for further decreasing of EUR. Intraday targets also show a lot of patterns that suggest the same. Our next target is 1.22 although market could take short-term pauses in downward action due some reasons – completion of some patterns, reaching of daily oversold etc.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Fundamentals

Reuters reports The euro fell sharply on Friday after European Central Bank chief Mario Draghi said inflation expectations were declining to levels that were very low, keeping the door open for further monetary easing soon.

The euro fell 1.19 percent to $1.2389 and dropped 1.58 percent against the Japanese yen to 145.89 yen .

"His comments have hit the euro hard," said Niels Christensen, FX strategist at Nordea, adding that euro zone inflation data next week would be a crucial influence on the ECB's thinking.

"Particularly his comments that he is worried about inflation expectations means that the ECB could ease policy soon. If it doesn't buy government bonds, then at least it could announce a decision to buy corporate bonds."

The Australian dollar and other high yielding currencies jumped after China cut benchmark interest rates for the first time in over two years to bolster a sagging economy.

The Aussie, which is often used as a more liquid proxy for Chinese investments, was last up 0.59 percent at $0.8669 , with the rate cut likely to assuage fears of a Chinese slowdown that have hurt commodity currencies.

"They have added significant liquidity to a global system that already has ample liquidity," said Lane Newman, director of foreign exchange at ING Capital Markets in New York.

The U.S. dollar is seen as continuing recent gains as the Federal Reserve is viewed as likely to increase interest rates next year as Europe, Japan and other economies continue very loose monetary policies meant to stimulate growth.

"The Fed will be a much more hawkish central bank relative to other central banks," Newman said.

Earlier, the yen rose after Japanese Finance Minister Taro Aso said the currency's fall over the past week was too rapid, one of the strongest warnings against a weak yen since Japan started its aggressive monetary stimulus in 2012.

The dollar fell to 117.72 from around 118 yen before his comments.

The dollar has climbed almost 10 yen since the Bank of Japan surprisingly eased policy in late October.

Recent CFTC data shows increasing of shorts with growing opent interest, while longs were contracted. No doubts that reason of these changes is recent ECB comments:

Open interest:

Technicals

Monthly

On previous week we’ve made wide comments on complex situation around EUR. As we’ve said previously EUR right now stands in center of geopolitical and economical turmoil and we have mutual 2-side relations EU-US and EU-Russia. And progress of these relations develops not very positive. Shortly speaking we expect that EUR will continue move down.

We will remind you here major points of our analysis. In EU-US relations there are two topics right now – political and economical. On political side US forces EU to increase pressure on Russia and take disandvantageous steps and measures that primary hurts EU and almost harmless for US. Here we know about sanctions, Mistrale ships question, etc. Simultaneously US is aiming to replace Russia as important and strategic partner for Europe by enforcing “Zone of free trade agreement”. This falsity of ally becomes possible mostly because Europe de facto is not independent but mostly the colony of US. That’s why US freely can give the law to EU.

Economically US and EU drives on opposite courses. Recently Draghi has given a hint that ECB will increase balance to the level of March 2012 and this assumes QE on approximately 3 Trln EUR. And recent comments from ECB makes us think that if even this former statement will be tamed, EUR still will remain under pressure. US economy, in turn, now shows signs of improving. The major concern still is lack of inflation. Although Jobs are growing, but wealth of middle class and wages are stagnating.

This makes us think that EUR now stands under double pressure – EU pulls chestnuts out of the fire for US (in relation with Russia) and particularly due this action makes economical pit deeper. What could bit this sorrow?

As a result of blind or coercive following to US policy, EU meets problems with Russia, it’s 3rd largest trading partner. We suggest that situation will become worse, US will demand more and more sanctions from EU upon Russia. But in turn, economical situation EU-Russia stands in relation with geopolicy where US will not accept any compromises. Any ECB efforts on stabilizing of EU economy could be mitigated by new spiral of geopolitical tensions and painful sanctions. That’s why here is our conclusion – hardly real reversal on EUR is possible any time soon.

From technical point of view trend holds bearish here, but market is not at oversold. Price has broken through all solid supports and right now stands in “free space” area. As we have large Gartley “222” Sell pattern, it nearest target is 1.22 – 0.618 AB-CD objective point. Take a look how harmonic this downside action, the speed of CD and AB legs are almost equal. EUR looks really heavy, month by month it opens at the high close at the low. Currently we see small relief but 1.22 target should be hit. Three black crows pattern and breakout through Yearly Pivot Support 1 suggests that 1.22 is not final target probably, and we should not surprise if we will see decline in next year as well. Only some structural shifts could change situation.

Weekly

Trend is bearish here, as well as on monthly chart. As we ‘ve said many times previously, market has no significant support till 1.22 and nothing could prevent downward action driving by bearish sentiment. As market still stands at support of MPS1 – this level is probably doomed since, we’ve got bearish grabber on Draghi speech and it suggests taking out of current lows. Yes, lows stands very close to current price, but we’re mostly interested with it as trigger for downward action. Combination of lows’ breakout and abscence of meaningful support probably will lead EUR to our 1.22 target.

At the same time here we have a kind of 3-Drive “Buy” pattern with slightly higher target @ 1.2250. This probably will be our destination for coming week.

Daily

On Friday we’ve said that character of price action itself mostly looks like retracement – a lot of deeply overlapping sessions, choppy action, flat angle of upside action, etc. Thus, Drughi comments have blasted this down and market has dropped. On daily chart picture in general stands in favor of downward continuation. Because we have hints on bearish dynamic pressure here, as trend holds bullish but price action is not. Second, applying classical technic we have bearish flag pattern and it suggests the same target as on monthly chart. Usually flag target equals to it’s mast. If we will clone it, drag and count down – we will get 1.2187 area. The one barrier on the road down will be daily oversold. Market could take some pause there. This will be also an area of WPS1.

4-hour

As soon as I’ve finished to speak on 4-hour bullish grabber it was erased by following black candle and later market has formed oposite pattern. This picture keeps few chances for current lows to survive. 4-hour chart has its own reasons to suggest their failure. Thus, existing of untouched 1.618 AB-CD target at 1.2325 suggests more action down. Also take a look at A, B, C letters – this is in fact most recent AB=CD pattern, I just haven’t drawn it here to keep correct view of the chart. The point is that this AB-CD pattern has the same target as daily flag – right around 1.22 level.

Hourly

It seems, guys that we should search chances to go short. But we can’t offer you too much right now. Retracement up, if it will happen at all, of cause, should not be too deep. Since market just has re-established move down, has not hit any targets yet and is not at oversould. Thus, by looking at hourly chart it seems that most probable area of retracement is combination of former lows, WPP and one of Fib levels – either 3/8 or 50%. We’re interested in 50% level, since we have thrust down here that potentially could become the foundation of DRPO “Buy” pattern.

Conclusion:

Recent ECB comments leave blur hopes to bulls and put solid foundation for further decreasing of EUR. Intraday targets also show a lot of patterns that suggest the same. Our next target is 1.22 although market could take short-term pauses in downward action due some reasons – completion of some patterns, reaching of daily oversold etc.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Attachments

Last edited: