Sive Morten

Special Consultant to the FPA

- Messages

- 18,766

Sive, couple of things:

1. Your prediction of start of bullish move in euro within 2 weeks is contrarian. The majority of equity analysts are bearish on equities starting within 2 weeks ("Sell in May and go away"). The euro is a risk-on currency, hence if equity market falls, euro is expected to fall. You're usually right when you predict something. I'm going to follow this one.

2. Cable's price action on Fri mirrored the euro. You mentioned last week that GBP is setting up for down move. Would it be appropriate to look for a short entry price on the pound along the same lines as euro? Does the GBP show retracements similar to euro (shallow ones, generally 38.2% or 50%)?

Hi Dave,

The way of market analysis that you've described could be applicable but only under fundamental factors with long term period. It is called as Intermarket analysis, and Murphy has written nice book on it (although it rather old now).

At the same time you can't make trade decisions based on "some unknown equity analysts", who said that equities will go down. Because this doesn't give you issues that you have to know for entry, particular - trend, overall context, patterns and where you will place stop, where will be your target.

Concering our situation the conclusion is quite simple - no pattern or setup - no trade. It's simple. If we see something and understand what we see - we trade it. If not - then stay flat.

But if even we will follow your conclusion about equities - we expect that EUR will fall either, but not too far and not too long (at least now).

Now about GBP. They are different currencies and have to be traded differently. Yes, they have some relation, but this is mostly due their both relation to USD. GBP has greater volatility. And I look at any pair separately - trade only if you have context. Hardly you will start trade GBP, if you have signal actually on EUR.

One thing is could be used though. For instance you have a feeling that EUR will go down, but you have a lack of patterns and neccesary context, at the same time you have strong bearish setup on GBP. This can give you some confidence on EUR bearish view. But may be it is better to trade GBP directly instead of EUR? Thus, you can restore confidence in process of your trading by looking whether GBP supports EUR action or not. But you can't enter on GBP by signal or setup on EUR.

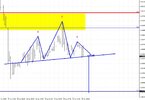

(On GBP we now have B&B "sell" on weekly time frame, and its in progress. I've talked about it for 2 weeks already. )

So, that's my common thoughts - hope this helps.