EUR/USD Daily Update, Wed 18, January 2012

Good morning,

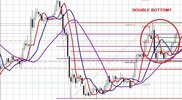

on daily time frame there is not much new. One thing that seems important is that yesterday market has failed to shift trend to bullish. If today we will see the same, and market will close below MACDP (red line) around 1.2650 - this shift probability to downward breakout.

4-hour time frame is bullish. We see fast AB=CD pattern with target at Agreement 1.2860-1.2880 - that is above pivot resistance and, what is more important, above upper border of long-term downward parallel channel on daily time frame. Currently there are unsufficient signs of market's strength, there is not enough confidence in bullish ambitions of the market and it has to prove us that they are really exist by some upward acceleration.

hourly time frame trend is also bullish, here is a potential for butterfly "sell' pattern. You, probably also see it.

In general, market gives us very important advantage - low at 1.2713. Why this is advantage? If market will move below it - it will erase all bullish hopes by single move. It will erase current AB-CD, Butterfly, shift intraday trend to bearish and move below pivot. AS I've said, if it will even proceed to 1.2650 and confirm daily trend as bearish - that will be solid impact on bulls.

So, today our focus on 1.2713, or from the other side - breakout of pivot resistance and upper border of channel