Euro Daily insight

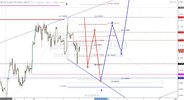

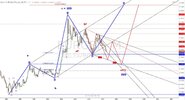

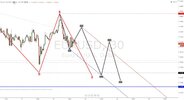

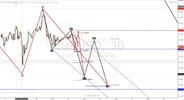

This is what I was expecting and here is decision level..we might drop into 5th, if swing before was not accepted as 5th... I expect just W&R, question remains below 1,3476 or not, or we might go higher above 1,35748 where again we might drop as DZZ into new W&R low or go above 1,36496 and drop later...I do not expect above 1,37...we might wait also in this zone but i hardly believe for more than a week...but it is possible...

This is what I was expecting and here is decision level..we might drop into 5th, if swing before was not accepted as 5th... I expect just W&R, question remains below 1,3476 or not, or we might go higher above 1,35748 where again we might drop as DZZ into new W&R low or go above 1,36496 and drop later...I do not expect above 1,37...we might wait also in this zone but i hardly believe for more than a week...but it is possible...