Sive Morten

Special Consultant to the FPA

- Messages

- 18,669

Fundamentals

This week stands under sign of some inflation statistics (in EU and UK) and Fed rhetoric of interest rate change. That were two major driving factors. Also we keep an eye on GBP as we will know the name of new PM on next week, 23rd of July. Now Boris Johnson has better chances to take this appointment.

As Reuters reports, the euro dipped on Thursday following a Bloomberg report that the ECB staff are studying a potential change to the bank's inflation goal of "near 2%." Such a move would potentially leave the door open for more ECB stimulus to continue for a longer period, which would exert downward pressure on the single currency.

Sterling rose for a second day, rebounding from a 27-month low against the greenback, on surprisingly strong UK domestic retail sales last month and developments that would make it harder for the next prime minister to force a no-deal Brexit. Data showed UK retail sales unexpectedly grew 1.0% in June, stoking

hopes the economy would avert a downturn in the second quarter. British lawmakers supported proposals to make it harder for the next prime minister to force through a no-deal Brexit by suspending Parliament.

Trading among major currencies was mostly muted as market players wait to see whether the Fed would lower U.S. rates for the first time in a decade and if it would signal more rate cuts down the road.

The futures market implied traders are positioned for at least three rate cuts by year-end, with the first decrease at the Fed's July 30-31 policy meeting.

"If it sounds like it's one and done, there would be massive repricing," said Steven Englander, global head of G10 FX research at Standard Chartered. "That would be hard for the market to digest."

The dollar did not budge after U.S. Treasury Secretary Steven Mnuchin told Bloomberg earlier Thursday there has been "no change to the dollar policy." He later told Reuters that there was no change to the use of a $94.6 billion federal fund intended to stabilize currencies during times of market turmoil.

There has been speculation whether the White House would intervene to weaken the dollar after U.S. President Donald Trump lashed out at Europe and China earlier this month for what he called their "big currency manipulation game."

But stunning statement was made a bit later on Thursday by New York Fed President John Williams, who

argued for pre-emptive measures to avoid having to deal with too low inflation and interest rates.

Although a New York Fed representative subsequently said Williams’ comments were academic and not about immediate policy direction, investors still took his remarks along with separate comments from Fed Vice Chair Richard Clarida as a dovish signal from the central bank.

The greenback fell broadly on Thursday after Williams’ remarks bolstered bets that the Fed would cut interest rates by 50 basis points, rather than 25 basis points.

Williams said when rates and inflation are low, policymakers cannot afford to keep their “powder dry” and wait for potential economic problems to materialise.

That is especially true with neutral rates that would neither restrict nor accelerate the U.S. economy “around half a percent,” he said. When adjusted for inflation, the neutral rate is near the Fed’s current policy rate, which is in a range of 2.25-2.50%.

Financial markets quickly reacted, with money market futures pricing in almost a 70% chance of a 50 basis point cut at its policy meeting on July 30-31 at one point.

The odds eased to around 40% after the New York Fed said later that his speech was not about potential actions at the upcoming policy meeting.

Still, Williams’ rate-cut view was echoed by Fed Vice Chair Clarida, who told Fox Business Network the central bank might have to act early and not wait “until things get so bad”.

“Williams’ comments were surprisingly dovish. The NY Fed went all the way to try to modify the message but no one seems to have done so for Clarida, who also said a very similar thing,” said Daisuke Uno, chief strategist at Sumitomo Mitsui Bank.

We take careful position in relation to this statement and our trading plan suggests "wait and see" strategy, and it was not in vain as reaction was very short-term and rally was totally cancelled yesterday by opposite price action.

Although probabilities of aggressive rate cut have shown spike on Thursday, now they stand at the same levels - market still expects three rate cuts within a year and two rate cuts this year.

Williams has “reassured markets that his comments were academic and not about immediate policy changes and the dollar has modestly recovered as a result,” said Joshua Tadbir, corporate hedging manager at Western Union Business Solutions.

Investors are now pricing in a 43.1% chance of a 50-basis point cut in U.S. rates later this month, according to CME Group’s FedWatch tool, easing off the 60.2% probability hit on Thursday. The dollar has held up reasonably well as investors bet other central banks also will ease policy.

Source: cmegroup.com

On Friday more fuel to bearish fire were added by anticipation of more dovish policy from ECB at the beginning of the next week. Investors ramped up bets for a European Central Bank interest rate cut as early as next week.

Money markets are now pricing in a roughly 60% chance of a 10 basis point rate cut next week, versus a 40% chance earlier in the week.

Rabobank analyst Jane Foley said ECB President Mario Draghi had surprised the market with dovish comments twice already in 2019, although her bank’s base case was still for a September cut.

“An ECB move would be more likely to have a shock impact...A 25 basis point cut by the Fed is priced in,” she said, adding that euro/dollar could test $1.11 or even $1.10 if the ECB did lower rates.

Central banks are launching another round of policy easing in an attempt to lift stubbornly low inflation and fight signs of an economic slowdown.

Expectations of a dovish shift in the rate cycle have boosted emerging market currencies. MSCI’s emerging market currency index on Friday hit a four-month high.

“We stay bearish on the U.S. dollar but put most focus versus high carry emerging market currencies, helped by global central bank easing,” Morgan Stanley analysts said in a note.

(I could recommend carry on Russian Ruble . 7.5% carry trade by annual Central Bank yield and positive trend against EUR and USD.)

. 7.5% carry trade by annual Central Bank yield and positive trend against EUR and USD.)

So, situation stands tricky. Last week we talked on review of policy by Bank of England into more dovish, now despite that everything is clear with Fed rate cut, ECB is next. And if they will cut rate indeed, this could lead to double bearish effect on EUR/USD as Fed's 25 point is already priced-in.

Recent CFTC data shows that net short position on EUR has not changed. It means that Williams comments have no long-term effect on the market. Otherwise the position should drop more, but we see just pricing-in process of 25 points rate change. As a result net short position decreased more than 2 times in two months:

Source: cftc.gov

Charting by Investing.com

Finally, as we keep an eye on GBP as well and track its fundamental background. The Fathom consulting has released new update on UK situation. Here we bring just few extractions.

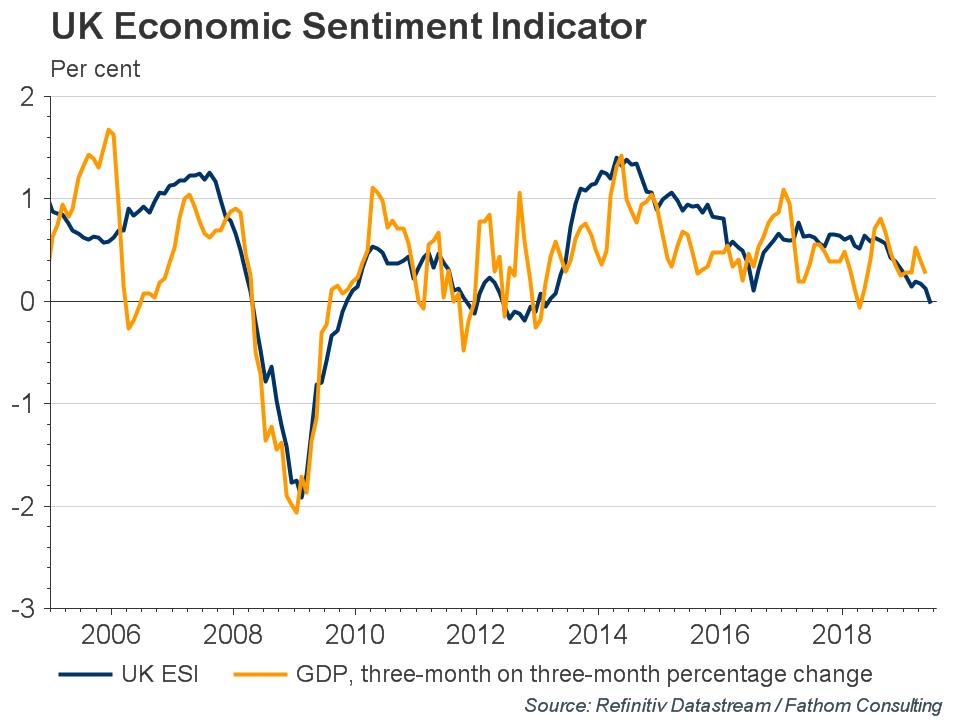

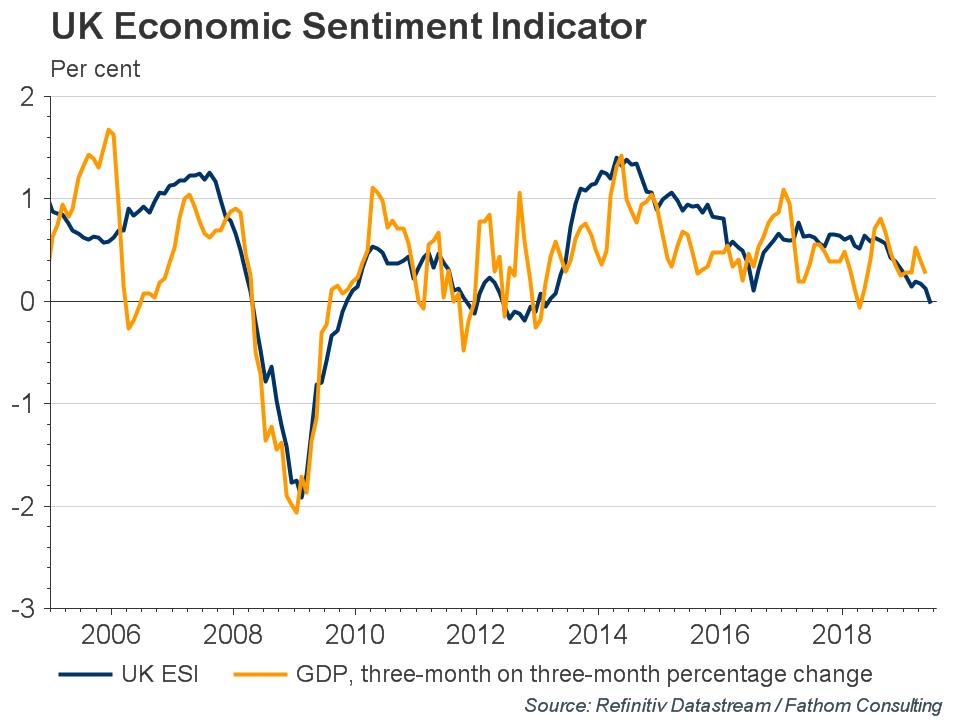

The outlook for investment, and with it the UK economy, will depend crucially on political developments between now and 31 October, when the UK is due to leave the EU. Fathom’s UK Economic Sentiment Indicator (ESI), which we treat as a useful guide to underlying economic momentum, slipped further in June and is now at its weakest in more than six years, consistent with broadly flat economic output. Despite the rhetoric of the favoured leadership candidate, it is of course conceivable that the UK leaves the EU on 31 October with a deal close to that currently on the table. We would give that around a 5% chance. To us, that is more or less the only scenario imaginable that would produce a meaningful near-term rebound in economic sentiment, and with it economic growth.

Much more likely than the UK leaving with a deal on the 31 October is the UK leaving with no deal on that date, or a further postponement of the UK’s departure from the EU following the dissolution of parliament in preparation for a general election. We would give these two options a combined weight of around 90%, split 3:1 in favour of a general election. Either of these outcomes is likely to lead, in the short term at least, to a further, and perhaps marked deterioration in our UK ESI. That is why we see a greater-than-evens chance of a technical recession in the UK within the next twelve months. Getting out of that will require substantially looser fiscal policy than is currently pencilled in by Chancellor Philip Hammond.

That's being said, it seems that next week not the Fed will be major driving factor, but ECB and II Q GDP report and PCE index. So, all eyes on Thursday-Friday on next week.

And the last one... not everybody follow us with gold analysis, but... Gold has hit major monthly target, which significantly increases chances on downside pullback, which should be rather significant. This thing puts the shadow on FX market, as difficult to expect drop on Gold market and rally on FX. Thus, indeed we could get dollar supportive statistics and dovish ECB decision.

Technicals

Monthly

So, culmination point is coming as we will meet IIQ GDP next week and Fed decision soon after. Monthly chart shows net market performance in July - despite multiple upside spikes that hide real result, here we could see that dollar stands in plus net, gradually erasing June upside action. MACD trend holds bearish here.

Our nearest culmination point is Fed July meeting which should clarify whether we right or wrong in our hypothesis. Our plan (according to fundamental issues) tends to idea of downside breakout. Rising concern on more dovish ECB policy and upside surprise of GDP data keeps intrigue hot.

As we've said last week, changes are still look insignificant, trend stands bearish. Monthly chart is rather large and any upside action will have retracement feature, until 1.26 area breakout. The first meaningful resistance here stands around YPP of 1.1740 area, which approximately agrees with 3/8 Fib resistance.

As market has minor drivers, situation changes only on lower time frames - daily and below.

Weekly

Recent week has very small trading range, so we keep up with our "evening star" pattern which supports our bearish short-term view on EUR/USD.

Here we have two potential patterns. The short-term "Evening star" pattern is interesting with two nearest weeks, as it is mostly tactical and doesn't suggest big price swings. In general, "Evening Star" suggests downside continuation, which usually takes the shape of AB=CD pattern on daily/4H chart.

But it is not everything clear with the second pattern, which is reverse H&S as it is difficult to combine bullish character of the pattern and Evening star, which suggests downside drop. We could suggest either H&S destruction or, forming compounded head in a shape of double bottom, if downside action by Evening star will not be too extended. But this is longer perspective and not important right now.

Daily

So, we haven't needed to wait too long to get the clarity. Our Friday plan to wait and see what will happen, what patterns will be formed was correct, as upside rally was totally erased, which looks bearish. Besides we've got bearish grabber here at "C" point. Although it's target stands close, just under recent lows, it could put the foundation of greater collapse as market could start preparation to tough week.

Besides, we should not forget about psychological factors. Market just cancelled strong rally action, which is treated as "mistake", hence EUR should proceed in "correct" direction. Dollar index confirms the grabber as well.

Intraday

In short-term perspective everything stands relatively clear. Until daily grabber (and bearish engulfing pattern) is valid, we have bearish context, which suggests short position against grabber's top.It means that on intraday chart we need to catch some upside pullback, and currently we like K-resistance around 1.1233-1.1241 area, that also includes WPP:

Conclusion:

Investors' concern and doubts on upside continuation is growing. Recent fundamental background and price behavior mostly supports bearish view, which corresponds bearish patterns that we've started to trade two weeks ago. Among our forum members more often sounds bearish suggestions as well. We drift on light bearish sentiment in the beginning of the week, coming gradually to "X" point of ECB meeting and GDP release on Friday.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

This week stands under sign of some inflation statistics (in EU and UK) and Fed rhetoric of interest rate change. That were two major driving factors. Also we keep an eye on GBP as we will know the name of new PM on next week, 23rd of July. Now Boris Johnson has better chances to take this appointment.

As Reuters reports, the euro dipped on Thursday following a Bloomberg report that the ECB staff are studying a potential change to the bank's inflation goal of "near 2%." Such a move would potentially leave the door open for more ECB stimulus to continue for a longer period, which would exert downward pressure on the single currency.

Sterling rose for a second day, rebounding from a 27-month low against the greenback, on surprisingly strong UK domestic retail sales last month and developments that would make it harder for the next prime minister to force a no-deal Brexit. Data showed UK retail sales unexpectedly grew 1.0% in June, stoking

hopes the economy would avert a downturn in the second quarter. British lawmakers supported proposals to make it harder for the next prime minister to force through a no-deal Brexit by suspending Parliament.

Trading among major currencies was mostly muted as market players wait to see whether the Fed would lower U.S. rates for the first time in a decade and if it would signal more rate cuts down the road.

The futures market implied traders are positioned for at least three rate cuts by year-end, with the first decrease at the Fed's July 30-31 policy meeting.

"If it sounds like it's one and done, there would be massive repricing," said Steven Englander, global head of G10 FX research at Standard Chartered. "That would be hard for the market to digest."

The dollar did not budge after U.S. Treasury Secretary Steven Mnuchin told Bloomberg earlier Thursday there has been "no change to the dollar policy." He later told Reuters that there was no change to the use of a $94.6 billion federal fund intended to stabilize currencies during times of market turmoil.

There has been speculation whether the White House would intervene to weaken the dollar after U.S. President Donald Trump lashed out at Europe and China earlier this month for what he called their "big currency manipulation game."

But stunning statement was made a bit later on Thursday by New York Fed President John Williams, who

argued for pre-emptive measures to avoid having to deal with too low inflation and interest rates.

Although a New York Fed representative subsequently said Williams’ comments were academic and not about immediate policy direction, investors still took his remarks along with separate comments from Fed Vice Chair Richard Clarida as a dovish signal from the central bank.

The greenback fell broadly on Thursday after Williams’ remarks bolstered bets that the Fed would cut interest rates by 50 basis points, rather than 25 basis points.

Williams said when rates and inflation are low, policymakers cannot afford to keep their “powder dry” and wait for potential economic problems to materialise.

That is especially true with neutral rates that would neither restrict nor accelerate the U.S. economy “around half a percent,” he said. When adjusted for inflation, the neutral rate is near the Fed’s current policy rate, which is in a range of 2.25-2.50%.

Financial markets quickly reacted, with money market futures pricing in almost a 70% chance of a 50 basis point cut at its policy meeting on July 30-31 at one point.

The odds eased to around 40% after the New York Fed said later that his speech was not about potential actions at the upcoming policy meeting.

Still, Williams’ rate-cut view was echoed by Fed Vice Chair Clarida, who told Fox Business Network the central bank might have to act early and not wait “until things get so bad”.

“Williams’ comments were surprisingly dovish. The NY Fed went all the way to try to modify the message but no one seems to have done so for Clarida, who also said a very similar thing,” said Daisuke Uno, chief strategist at Sumitomo Mitsui Bank.

We take careful position in relation to this statement and our trading plan suggests "wait and see" strategy, and it was not in vain as reaction was very short-term and rally was totally cancelled yesterday by opposite price action.

Although probabilities of aggressive rate cut have shown spike on Thursday, now they stand at the same levels - market still expects three rate cuts within a year and two rate cuts this year.

Williams has “reassured markets that his comments were academic and not about immediate policy changes and the dollar has modestly recovered as a result,” said Joshua Tadbir, corporate hedging manager at Western Union Business Solutions.

Investors are now pricing in a 43.1% chance of a 50-basis point cut in U.S. rates later this month, according to CME Group’s FedWatch tool, easing off the 60.2% probability hit on Thursday. The dollar has held up reasonably well as investors bet other central banks also will ease policy.

Source: cmegroup.com

Money markets are now pricing in a roughly 60% chance of a 10 basis point rate cut next week, versus a 40% chance earlier in the week.

Rabobank analyst Jane Foley said ECB President Mario Draghi had surprised the market with dovish comments twice already in 2019, although her bank’s base case was still for a September cut.

“An ECB move would be more likely to have a shock impact...A 25 basis point cut by the Fed is priced in,” she said, adding that euro/dollar could test $1.11 or even $1.10 if the ECB did lower rates.

Central banks are launching another round of policy easing in an attempt to lift stubbornly low inflation and fight signs of an economic slowdown.

Expectations of a dovish shift in the rate cycle have boosted emerging market currencies. MSCI’s emerging market currency index on Friday hit a four-month high.

“We stay bearish on the U.S. dollar but put most focus versus high carry emerging market currencies, helped by global central bank easing,” Morgan Stanley analysts said in a note.

(I could recommend carry on Russian Ruble

So, situation stands tricky. Last week we talked on review of policy by Bank of England into more dovish, now despite that everything is clear with Fed rate cut, ECB is next. And if they will cut rate indeed, this could lead to double bearish effect on EUR/USD as Fed's 25 point is already priced-in.

Recent CFTC data shows that net short position on EUR has not changed. It means that Williams comments have no long-term effect on the market. Otherwise the position should drop more, but we see just pricing-in process of 25 points rate change. As a result net short position decreased more than 2 times in two months:

Source: cftc.gov

Charting by Investing.com

Finally, as we keep an eye on GBP as well and track its fundamental background. The Fathom consulting has released new update on UK situation. Here we bring just few extractions.

The outlook for investment, and with it the UK economy, will depend crucially on political developments between now and 31 October, when the UK is due to leave the EU. Fathom’s UK Economic Sentiment Indicator (ESI), which we treat as a useful guide to underlying economic momentum, slipped further in June and is now at its weakest in more than six years, consistent with broadly flat economic output. Despite the rhetoric of the favoured leadership candidate, it is of course conceivable that the UK leaves the EU on 31 October with a deal close to that currently on the table. We would give that around a 5% chance. To us, that is more or less the only scenario imaginable that would produce a meaningful near-term rebound in economic sentiment, and with it economic growth.

Much more likely than the UK leaving with a deal on the 31 October is the UK leaving with no deal on that date, or a further postponement of the UK’s departure from the EU following the dissolution of parliament in preparation for a general election. We would give these two options a combined weight of around 90%, split 3:1 in favour of a general election. Either of these outcomes is likely to lead, in the short term at least, to a further, and perhaps marked deterioration in our UK ESI. That is why we see a greater-than-evens chance of a technical recession in the UK within the next twelve months. Getting out of that will require substantially looser fiscal policy than is currently pencilled in by Chancellor Philip Hammond.

That's being said, it seems that next week not the Fed will be major driving factor, but ECB and II Q GDP report and PCE index. So, all eyes on Thursday-Friday on next week.

And the last one... not everybody follow us with gold analysis, but... Gold has hit major monthly target, which significantly increases chances on downside pullback, which should be rather significant. This thing puts the shadow on FX market, as difficult to expect drop on Gold market and rally on FX. Thus, indeed we could get dollar supportive statistics and dovish ECB decision.

Technicals

Monthly

So, culmination point is coming as we will meet IIQ GDP next week and Fed decision soon after. Monthly chart shows net market performance in July - despite multiple upside spikes that hide real result, here we could see that dollar stands in plus net, gradually erasing June upside action. MACD trend holds bearish here.

Our nearest culmination point is Fed July meeting which should clarify whether we right or wrong in our hypothesis. Our plan (according to fundamental issues) tends to idea of downside breakout. Rising concern on more dovish ECB policy and upside surprise of GDP data keeps intrigue hot.

As we've said last week, changes are still look insignificant, trend stands bearish. Monthly chart is rather large and any upside action will have retracement feature, until 1.26 area breakout. The first meaningful resistance here stands around YPP of 1.1740 area, which approximately agrees with 3/8 Fib resistance.

As market has minor drivers, situation changes only on lower time frames - daily and below.

Weekly

Recent week has very small trading range, so we keep up with our "evening star" pattern which supports our bearish short-term view on EUR/USD.

Here we have two potential patterns. The short-term "Evening star" pattern is interesting with two nearest weeks, as it is mostly tactical and doesn't suggest big price swings. In general, "Evening Star" suggests downside continuation, which usually takes the shape of AB=CD pattern on daily/4H chart.

But it is not everything clear with the second pattern, which is reverse H&S as it is difficult to combine bullish character of the pattern and Evening star, which suggests downside drop. We could suggest either H&S destruction or, forming compounded head in a shape of double bottom, if downside action by Evening star will not be too extended. But this is longer perspective and not important right now.

Daily

So, we haven't needed to wait too long to get the clarity. Our Friday plan to wait and see what will happen, what patterns will be formed was correct, as upside rally was totally erased, which looks bearish. Besides we've got bearish grabber here at "C" point. Although it's target stands close, just under recent lows, it could put the foundation of greater collapse as market could start preparation to tough week.

Besides, we should not forget about psychological factors. Market just cancelled strong rally action, which is treated as "mistake", hence EUR should proceed in "correct" direction. Dollar index confirms the grabber as well.

Intraday

In short-term perspective everything stands relatively clear. Until daily grabber (and bearish engulfing pattern) is valid, we have bearish context, which suggests short position against grabber's top.It means that on intraday chart we need to catch some upside pullback, and currently we like K-resistance around 1.1233-1.1241 area, that also includes WPP:

Conclusion:

Investors' concern and doubts on upside continuation is growing. Recent fundamental background and price behavior mostly supports bearish view, which corresponds bearish patterns that we've started to trade two weeks ago. Among our forum members more often sounds bearish suggestions as well. We drift on light bearish sentiment in the beginning of the week, coming gradually to "X" point of ECB meeting and GDP release on Friday.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.