Sive Morten

Special Consultant to the FPA

- Messages

- 18,699

Fundamentals

Reuters reports euro inched higher against the dollar on Friday as Greece said it was getting closer to a deal on its debt, which could stave off default for the cash-strapped country.

On Friday, a Greek government official said the country was ready to submit counterproposals and is closer than ever to an agreement with its creditors.

"The news gives hope Greece can avert default and stay in the eurozone," said Joe Manimbo, senior market analyst at Commonwealth Foreign Exchange in Washington. "The euro seems to be at its best when there is good news on Greece."

Earlier in the session, the euro had been under pressure after German Chancellor Angela Merkel said a strong currency made it harder for the likes of Spain and Portugal to reap the benefits of economic reform.

"The ongoing shift back and forth about Greece has kept the euro weak the last few days," said Minh Trang, senior currency trader at Silicon Valley Bank in Santa Clara, California. "There should be a little more downside."

The dollar reacted little to fresh data on U.S. inflation and consumer sentiment, even though both reports were seen as positive for the greenback.

U.S. producer prices in May recorded their biggest increase in more than 2-1/2 years as the cost of gasoline and food rose.

U.S. consumer sentiment, meanwhile, rose more than expected, a survey showed. The University of Michigan's preliminary June reading on the overall index on consumer sentiment was 94.6, up from the May reading of 90.7.

The data reinforced expectations that the Federal Reserve will raise interest rates at least once this year.

Next week, the Fed meets for a two-day policy meeting. Investors are hoping the Federal Open Market Committee will provide an indication of the timing of first rate hike.

A more hawkish Fed is likely to underpin the dollar, said Jane Foley, senior FX strategist at Rabobank in London, although she added that the rise in the greenback between July and April might already have acted as monetary tightening.

Foley said the dollar's strength could affect the timing of the Fed's rate increase.

Speaking on UK, guys, the major economy topic is still BREXIT. The only major ratings agency still to give Britain a top-notch credit rating said on Friday it risked a downgrade due to Prime Minister David Cameron's decision to hold a referendum on whether to leave the European Union.

Standard & Poor's lowered the outlook for Britain's triple-A rating to negative from stable on Friday, saying the EU vote

"represents a risk to growth prospects for the UK's financial services and export sectors, as well as the wider economy".

Widespread dissatisfaction with the EU within Cameron's Conservative Party, and among many voters, prompted him in 2013 to promise to re-negotiate Britain's membership of the bloc and hold a referendum on the revised terms by the end of 2017.

But the referendum was in question until the Conservatives unexpectedly won a clear majority in last month's election, as other major parties had opposed it.

Opinion polls suggest around a third of Britons want to leave the 28-member bloc, which Britain joined in 1973.

Sterling weakened by around a third of a cent against the dollar after the news.

Britain's finance ministry said "resolving the uncertainty around Britain's relationship with the EU" via a referendum was central to its economic plans.

S&P said that if Britain looked likely to leave the EU, it could cut Britain's rating by more than one notch, and said sterling risked losing its status as a global reserve currency.

As well as hurting Britain's economy, leaving the EU would damage Britain's ability to finance its large stock of public debt and its current account deficit, S&P said. The latter ballooned to a record 5.5 percent of gross domestic product in 2014, largely due to low returns on Britain's investments elsewhere in the EU.

"The U.K. government's decision to hold a referendum on EU membership by 2017 indicates that economic policy-making could be at risk of being more exposed to party politics than we had previously anticipated," S&P added.

Supporters of Britain leaving the EU say it is important for national sovereignty reasons and that the economy would grow faster if the country was free to agree its own trade deals with foreign countries and scrap some EU regulations.

S&P said a negative outlook meant there was at least a one-in-three chance of a downgrade in the next two years.

Maintaining Britain's triple-A credit rating was a key aim for the Conservatives when they came to power in 2010 in a coalition with the centrist Liberal Democrats.

But a failure to reduce the budget deficit as fast as planned due to slow economic growth led to Moody's and Fitch Ratings downgrading Britain to one notch below AAA in 2013.

S&P warned of the threat facing Britain's rating from an EU referendum when it raised its outlook for UK debt last year on the basis of stronger economic growth. Since then Moody's has also said the EU vote posed a risk.

CFTC report shows shy changes in sentiment. Open interest is decreasing, as well as long and short speculative positions. Now they are approximately equal. It is interesting that speculative positions stand just for 25-30K contracts. This is very small value. While open interest stands for 200+K. Current upside action on GBP should be treated as retracement, since it stands on background of falling open interest. Another interesting issue here is hedgers’ short position. Hedgers open position against the trend and their short position is growing, while all other positions are falling. It could tell that some upside progress is still possible here…

Open interest:

Shorts:

Shorts:

Longs:

Longs:

Technicals

Monthly

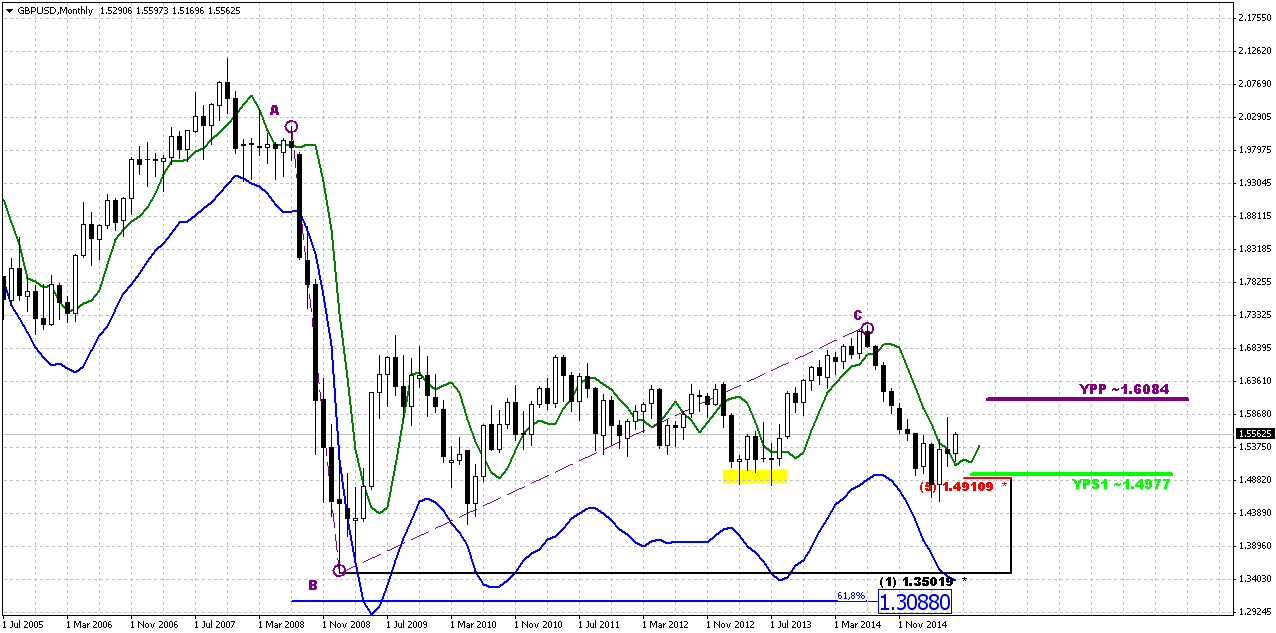

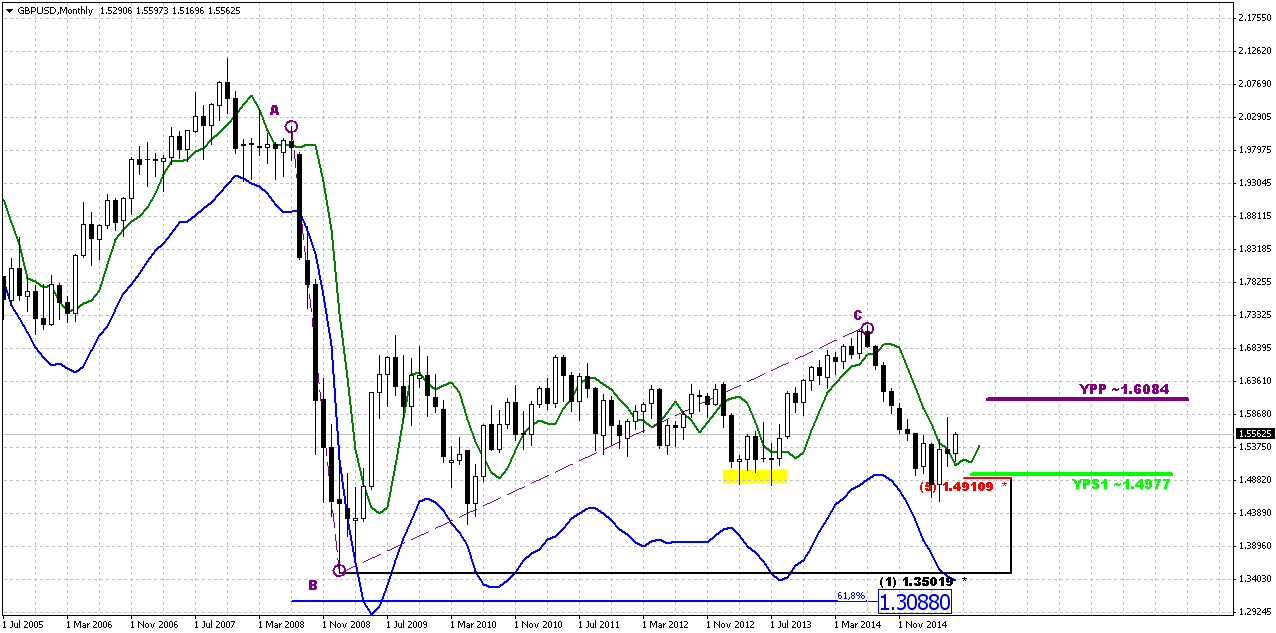

Since our recent discussion GBP shows some important changes. In the beginning we continue to keep our long-term analysis that we’ve made in December 2013 in our Forex Military School Course, where we were learning Elliot Waves technique.

https://www.forexpeacearmy.com/forex-forum/forex-military-school-complete-forex-education-pro-banker/30110-chapter-16-part-v-trading-elliot-waves-page-7-a.html

Our long term analysis suggests first appearing of new high on 4th wave at ~1.76 level and then starting of last 5th wave down. First condition was accomplished and we’ve got new high, but it was a bit lower – not 1.76 but 1.72. This was and is all time support/resistance area. Now we stand in final part of our journey. According to our 2013 analysis market should reach lows at 1.35 area. Let’s see what additional information we have right now.

Trend is bearish here, but GBP is not at oversold. Couple of months ago market has reached strong support area – Yearly Pivot support 1 and 5/8 major monthly Fib level. Market gradually struggling through YPS1 but it seems that first attempt to pass through it has failed. It means that we could meet meaningful pullback in nearest future. Although in long term it will not mean the capitulation of the bears. This will be probably just temporal pullback, respect of support and correction after unsuccessful attempt to pass through support right on first challenge. CFTC data also tells on the same as we’ve discussed above.

New information here is downward thrust. Occasionally I’ve counted the number of bars there, and guys, it has 8 black candles. Theoretically this thrust is suitable for B&B “Sell” pattern. We do not mention DRPO, since we come to conclusion that current upside action is retracement and it can’t lead to appearing of DRPO on monthly chart. I’m not sure about B&B, it looks a bit shy on overall picture, but this pattern is definitely the one that we should monitor. Some of you were hurry to treat May candle as B&B, but right now we see that market has closed below 3x3 DMA and uncompleted B&B condition, since we didn’t get 3x3 DMA penetration. Right now, June month could fix it. Appearing of B&B harmonically build in our overall view of possible downward continuation.

Beyond B&B we have also bullish engulfing pattern that usually suggests upside development in the shape of AB-CD pattern on lower time frames.

In fact here we have just one major downward destination point. Monthly chart give us just single AB-CD pattern with nearest target at 0.618 extension – 1.3088.

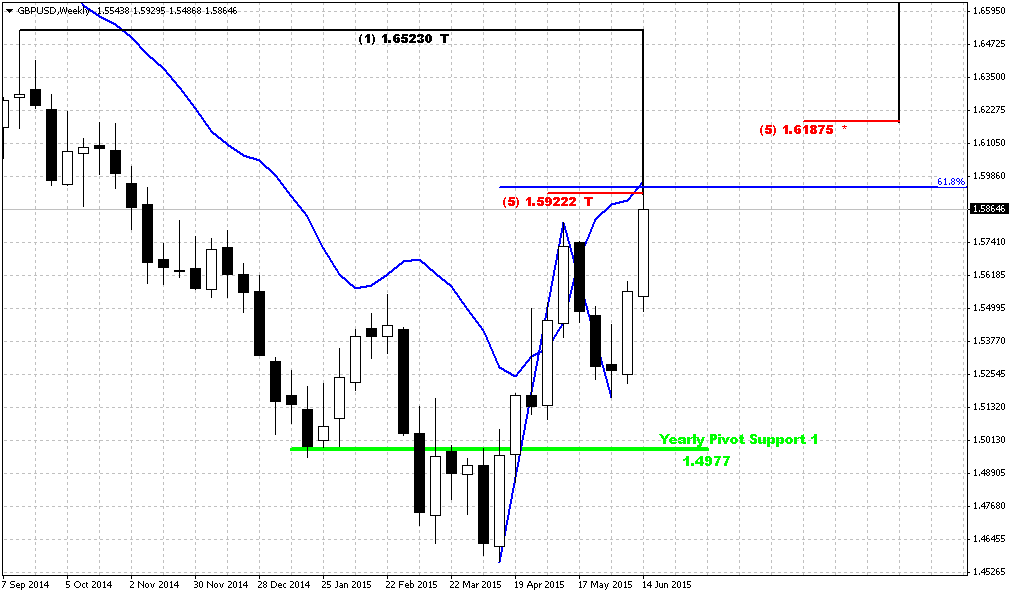

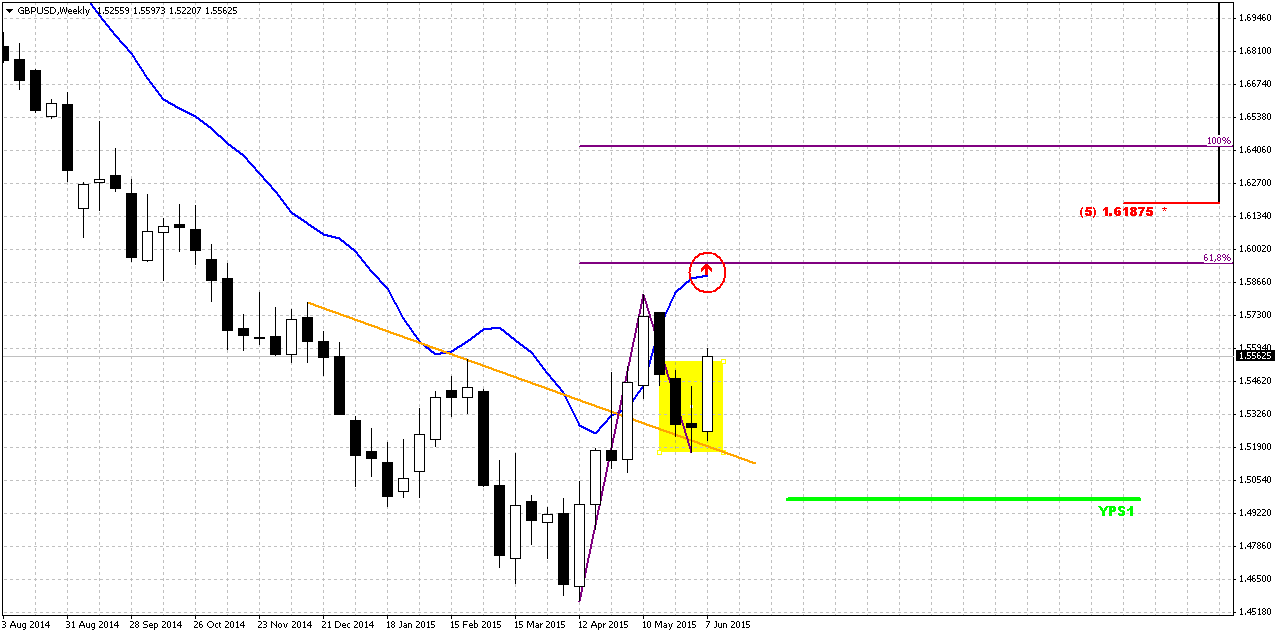

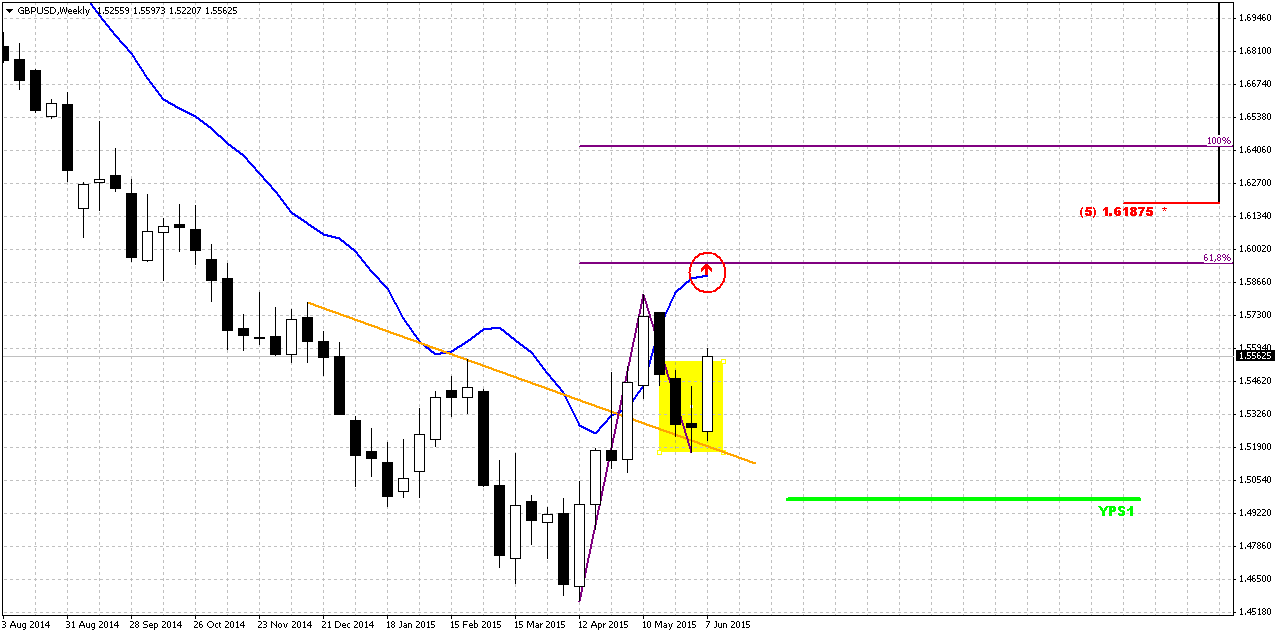

Weekly

Trend is bullish here. After solid upward action market has met overbought. That was a bit above K-resistance area (I do not have it on this chart) so we treat it as broken area. It means that right now we have only one major level if 5/8 Fib resistance, and may be 50%. Latter one may be even is more interesting for us. Since we treat upward action as retracement, there is no guarantee that GBP will complete AB=CD pattern totally. It could reach just 0.618 extension. That’s why we first will focus on 1.60 area - minor AB-CD target, weekly overbought and 50% Fib level.

And the last thing here… Take a look how market response on broken trend line – it has re-tested it and formed morning star pattern. This pattern is very welcome for us. First, is because it could support upside action by itself and second – because it clearly shows invalidation point. It will fail if market will drop below it’s low. If this will happen – Cable simultaneously will appear below neckline again and will change the shape of AB-CD pattern or even will lead to its total failure. For monthly B&B 1.60 level will be sufficient. Besides, 1.6084 is Yearly Pivot that will act as resistance now.

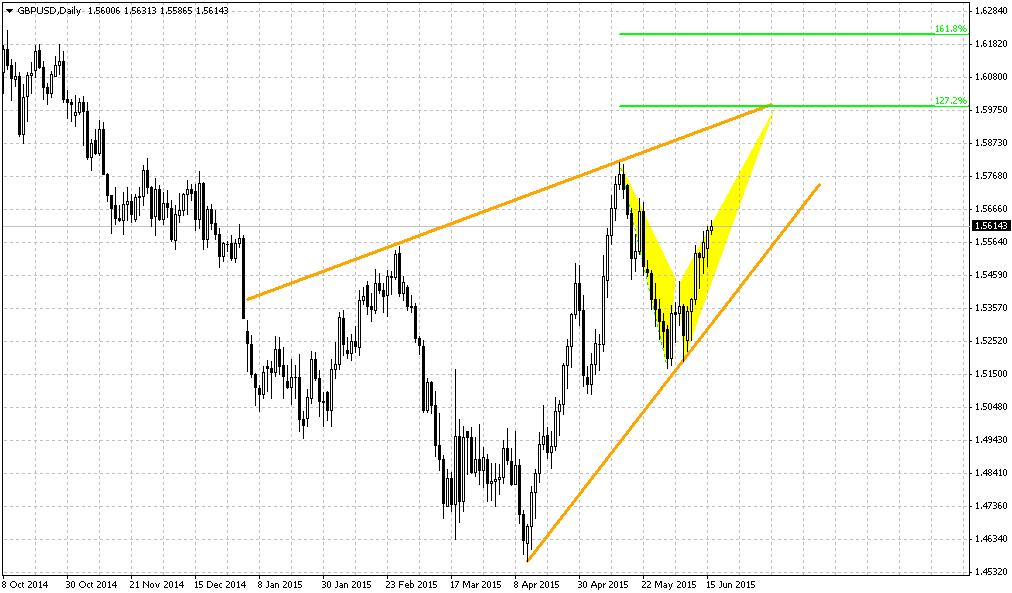

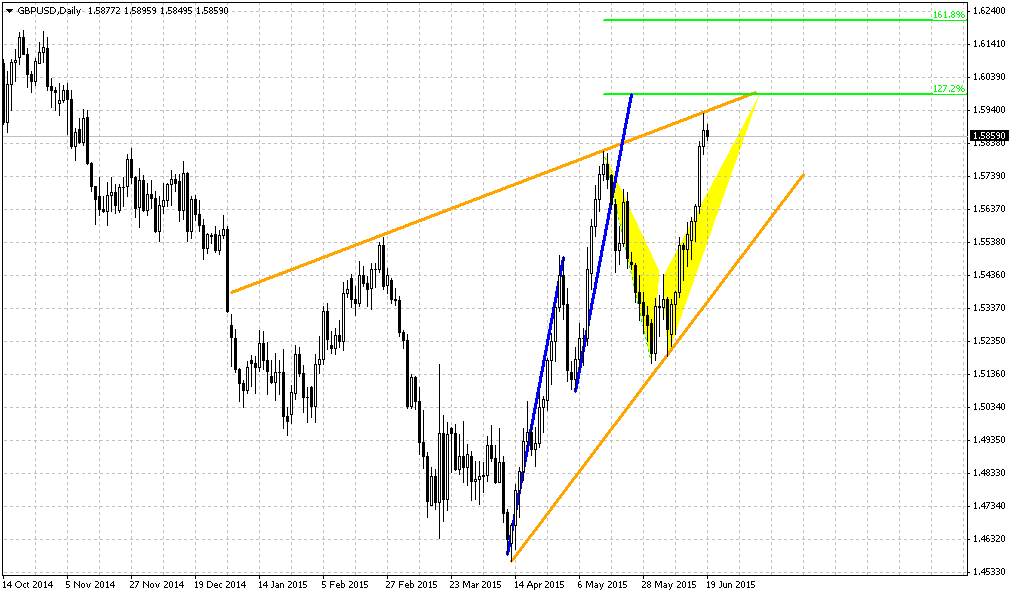

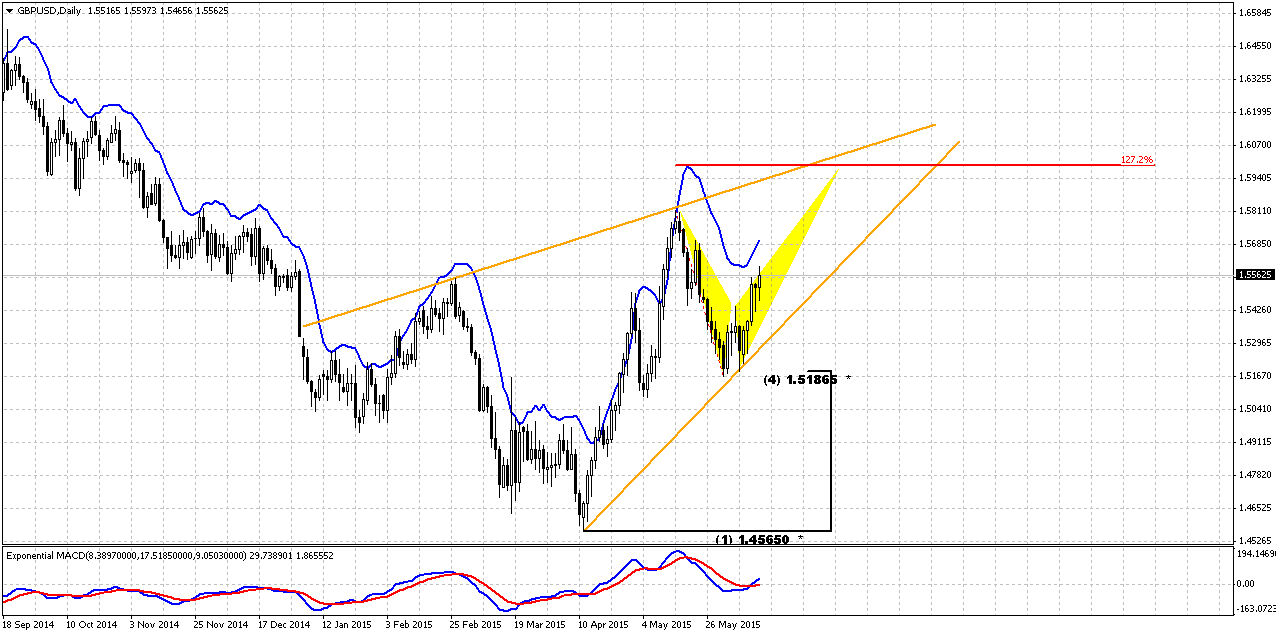

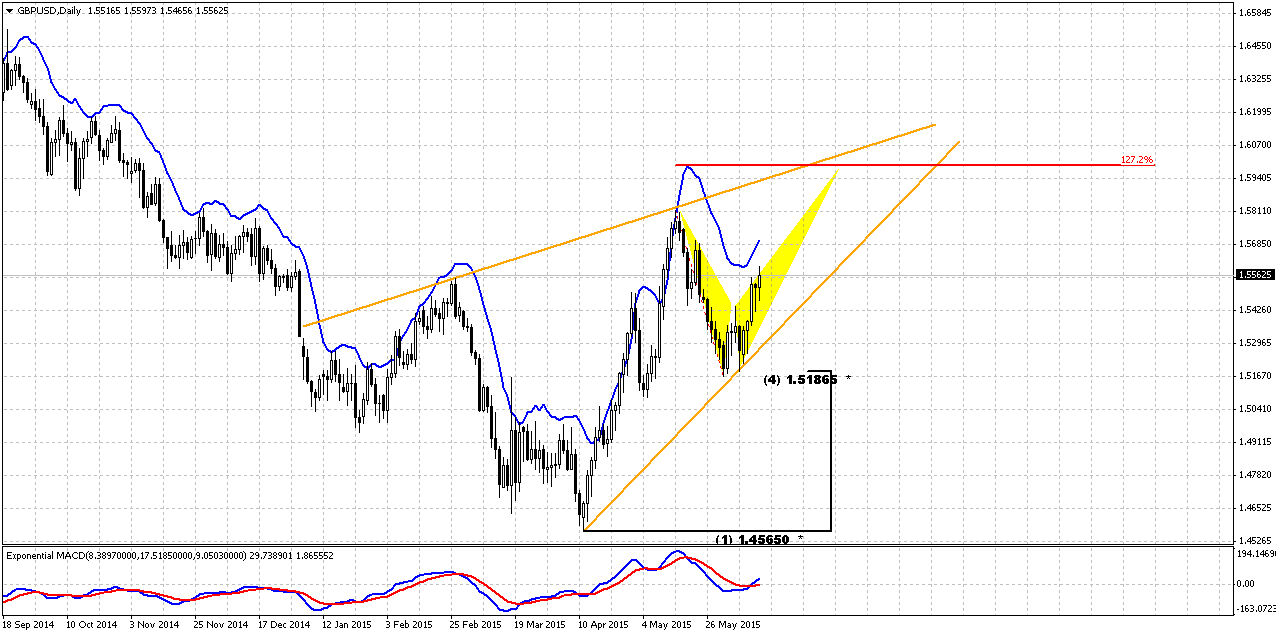

Daily

Daily has shifted bullish again. Market here is forming large rising wedge pattern that potentially is bearish but let market to continue upside action a bit more. May be you could recognize here a bit skewed H&S pattern. Still we wouldn’t advise to rely on it. H&S assumes full completion of upside AB-CD, while we do not sure that this will definitely happen, especially based on recent CFTC data.

Weekly morning star pattern has taken the shape of butterfly here. It points on the same target around 1.60 area. So while we’re waiting for big downward reversal somewhere in the future from 1.60 area, we could take long position. From that standpoint we’re interesting just with most recent swing up…

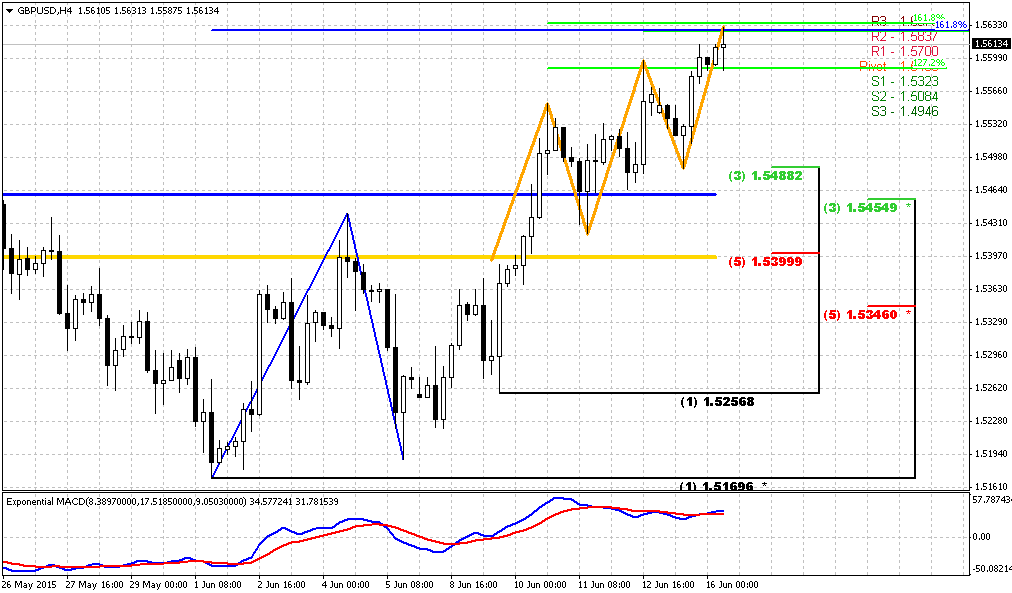

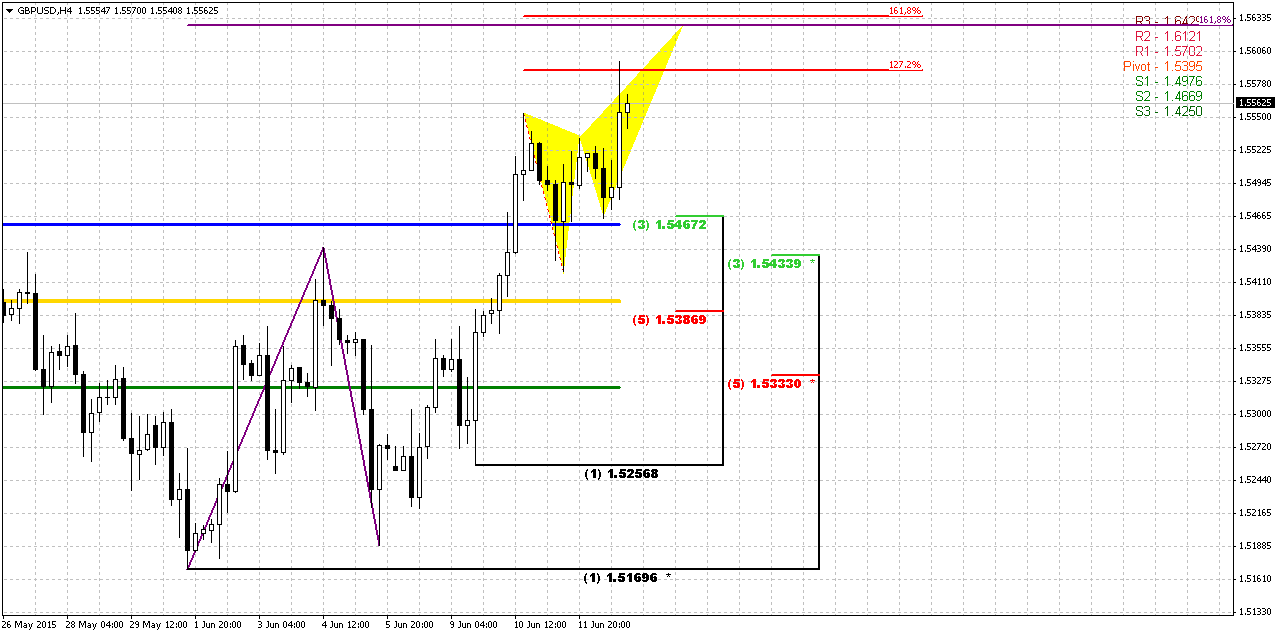

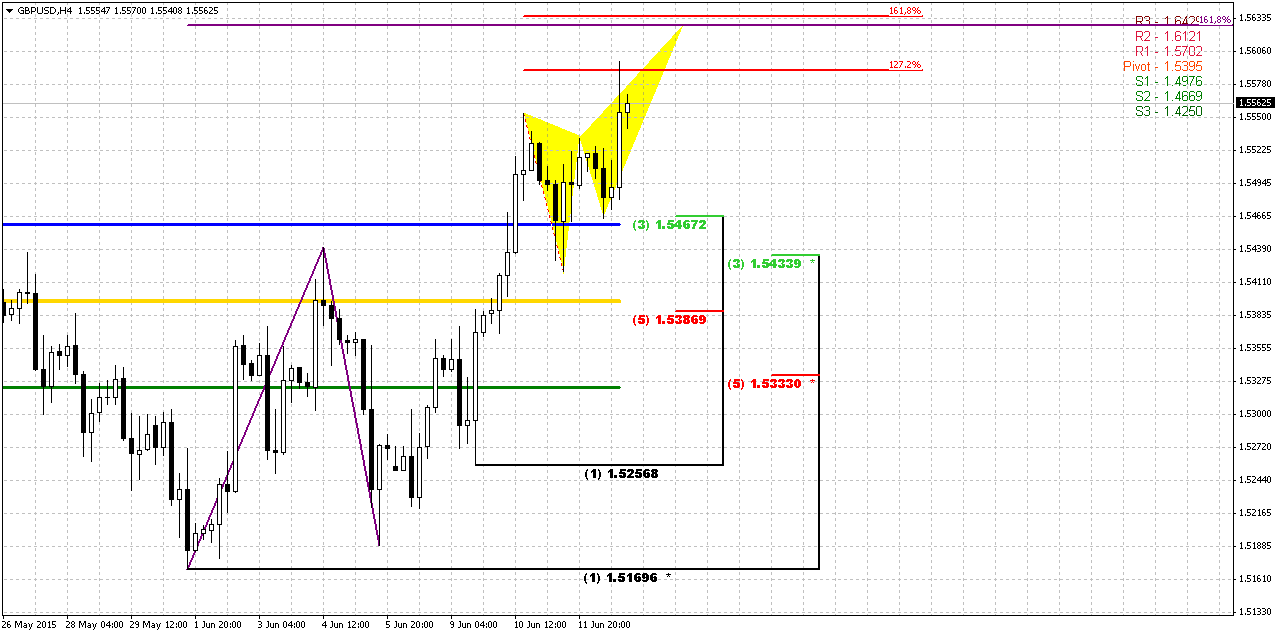

4-Hour

Before market will reverse down on daily chart – here it probably will drift slightly higher. AB-CD target has not completed yet and GBP is forming Butterfly “Sell”. 1.27 point already has been reached, and 1.618 agrees with AB-CD one. Thus, GBP shows a lot of setups as for scalpers as for daily traders. Thus, scalpers could search chances for short entry somewhere from 1.5630 area. Then we will be watching for retracement down. Post probable area will be around 1.54-1.5440 area – former tops, K-support and MPP& WPP.

Conclusion:

Long term picture tells that also current upside action mostly is retracement, since it is driven by closing of short positions but not new inflows on GBP. Still, it seems that upside action still has chance to continue and next long-term destination point is 1.60. Long term charts show potential for different patterns, such as monthly B&B “Sell”, daily butterfly, intraday patterns etc… From that standpoint Cable looks very interesting compares to other currencies.

Meantime, we expect slightly higher level first, something around 1.5630 and then retracement down to 1.54-1.5440 area in the beginning of the week.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Reuters reports euro inched higher against the dollar on Friday as Greece said it was getting closer to a deal on its debt, which could stave off default for the cash-strapped country.

On Friday, a Greek government official said the country was ready to submit counterproposals and is closer than ever to an agreement with its creditors.

"The news gives hope Greece can avert default and stay in the eurozone," said Joe Manimbo, senior market analyst at Commonwealth Foreign Exchange in Washington. "The euro seems to be at its best when there is good news on Greece."

Earlier in the session, the euro had been under pressure after German Chancellor Angela Merkel said a strong currency made it harder for the likes of Spain and Portugal to reap the benefits of economic reform.

"The ongoing shift back and forth about Greece has kept the euro weak the last few days," said Minh Trang, senior currency trader at Silicon Valley Bank in Santa Clara, California. "There should be a little more downside."

The dollar reacted little to fresh data on U.S. inflation and consumer sentiment, even though both reports were seen as positive for the greenback.

U.S. producer prices in May recorded their biggest increase in more than 2-1/2 years as the cost of gasoline and food rose.

U.S. consumer sentiment, meanwhile, rose more than expected, a survey showed. The University of Michigan's preliminary June reading on the overall index on consumer sentiment was 94.6, up from the May reading of 90.7.

The data reinforced expectations that the Federal Reserve will raise interest rates at least once this year.

Next week, the Fed meets for a two-day policy meeting. Investors are hoping the Federal Open Market Committee will provide an indication of the timing of first rate hike.

A more hawkish Fed is likely to underpin the dollar, said Jane Foley, senior FX strategist at Rabobank in London, although she added that the rise in the greenback between July and April might already have acted as monetary tightening.

Foley said the dollar's strength could affect the timing of the Fed's rate increase.

Speaking on UK, guys, the major economy topic is still BREXIT. The only major ratings agency still to give Britain a top-notch credit rating said on Friday it risked a downgrade due to Prime Minister David Cameron's decision to hold a referendum on whether to leave the European Union.

Standard & Poor's lowered the outlook for Britain's triple-A rating to negative from stable on Friday, saying the EU vote

"represents a risk to growth prospects for the UK's financial services and export sectors, as well as the wider economy".

Widespread dissatisfaction with the EU within Cameron's Conservative Party, and among many voters, prompted him in 2013 to promise to re-negotiate Britain's membership of the bloc and hold a referendum on the revised terms by the end of 2017.

But the referendum was in question until the Conservatives unexpectedly won a clear majority in last month's election, as other major parties had opposed it.

Opinion polls suggest around a third of Britons want to leave the 28-member bloc, which Britain joined in 1973.

Sterling weakened by around a third of a cent against the dollar after the news.

Britain's finance ministry said "resolving the uncertainty around Britain's relationship with the EU" via a referendum was central to its economic plans.

S&P said that if Britain looked likely to leave the EU, it could cut Britain's rating by more than one notch, and said sterling risked losing its status as a global reserve currency.

As well as hurting Britain's economy, leaving the EU would damage Britain's ability to finance its large stock of public debt and its current account deficit, S&P said. The latter ballooned to a record 5.5 percent of gross domestic product in 2014, largely due to low returns on Britain's investments elsewhere in the EU.

"The U.K. government's decision to hold a referendum on EU membership by 2017 indicates that economic policy-making could be at risk of being more exposed to party politics than we had previously anticipated," S&P added.

Supporters of Britain leaving the EU say it is important for national sovereignty reasons and that the economy would grow faster if the country was free to agree its own trade deals with foreign countries and scrap some EU regulations.

S&P said a negative outlook meant there was at least a one-in-three chance of a downgrade in the next two years.

Maintaining Britain's triple-A credit rating was a key aim for the Conservatives when they came to power in 2010 in a coalition with the centrist Liberal Democrats.

But a failure to reduce the budget deficit as fast as planned due to slow economic growth led to Moody's and Fitch Ratings downgrading Britain to one notch below AAA in 2013.

S&P warned of the threat facing Britain's rating from an EU referendum when it raised its outlook for UK debt last year on the basis of stronger economic growth. Since then Moody's has also said the EU vote posed a risk.

CFTC report shows shy changes in sentiment. Open interest is decreasing, as well as long and short speculative positions. Now they are approximately equal. It is interesting that speculative positions stand just for 25-30K contracts. This is very small value. While open interest stands for 200+K. Current upside action on GBP should be treated as retracement, since it stands on background of falling open interest. Another interesting issue here is hedgers’ short position. Hedgers open position against the trend and their short position is growing, while all other positions are falling. It could tell that some upside progress is still possible here…

Open interest:

Technicals

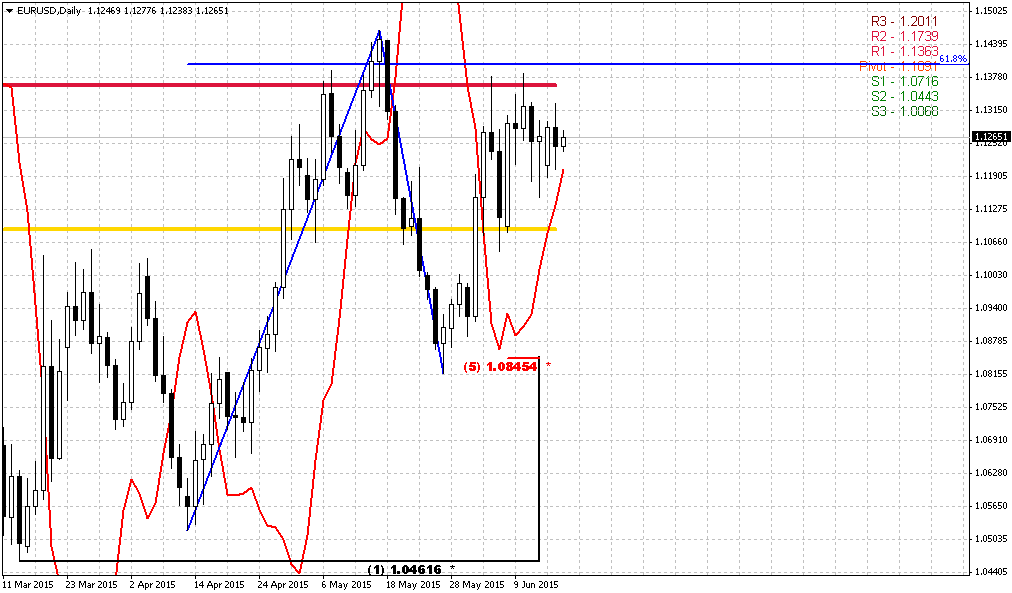

Monthly

Since our recent discussion GBP shows some important changes. In the beginning we continue to keep our long-term analysis that we’ve made in December 2013 in our Forex Military School Course, where we were learning Elliot Waves technique.

https://www.forexpeacearmy.com/forex-forum/forex-military-school-complete-forex-education-pro-banker/30110-chapter-16-part-v-trading-elliot-waves-page-7-a.html

Our long term analysis suggests first appearing of new high on 4th wave at ~1.76 level and then starting of last 5th wave down. First condition was accomplished and we’ve got new high, but it was a bit lower – not 1.76 but 1.72. This was and is all time support/resistance area. Now we stand in final part of our journey. According to our 2013 analysis market should reach lows at 1.35 area. Let’s see what additional information we have right now.

Trend is bearish here, but GBP is not at oversold. Couple of months ago market has reached strong support area – Yearly Pivot support 1 and 5/8 major monthly Fib level. Market gradually struggling through YPS1 but it seems that first attempt to pass through it has failed. It means that we could meet meaningful pullback in nearest future. Although in long term it will not mean the capitulation of the bears. This will be probably just temporal pullback, respect of support and correction after unsuccessful attempt to pass through support right on first challenge. CFTC data also tells on the same as we’ve discussed above.

New information here is downward thrust. Occasionally I’ve counted the number of bars there, and guys, it has 8 black candles. Theoretically this thrust is suitable for B&B “Sell” pattern. We do not mention DRPO, since we come to conclusion that current upside action is retracement and it can’t lead to appearing of DRPO on monthly chart. I’m not sure about B&B, it looks a bit shy on overall picture, but this pattern is definitely the one that we should monitor. Some of you were hurry to treat May candle as B&B, but right now we see that market has closed below 3x3 DMA and uncompleted B&B condition, since we didn’t get 3x3 DMA penetration. Right now, June month could fix it. Appearing of B&B harmonically build in our overall view of possible downward continuation.

Beyond B&B we have also bullish engulfing pattern that usually suggests upside development in the shape of AB-CD pattern on lower time frames.

In fact here we have just one major downward destination point. Monthly chart give us just single AB-CD pattern with nearest target at 0.618 extension – 1.3088.

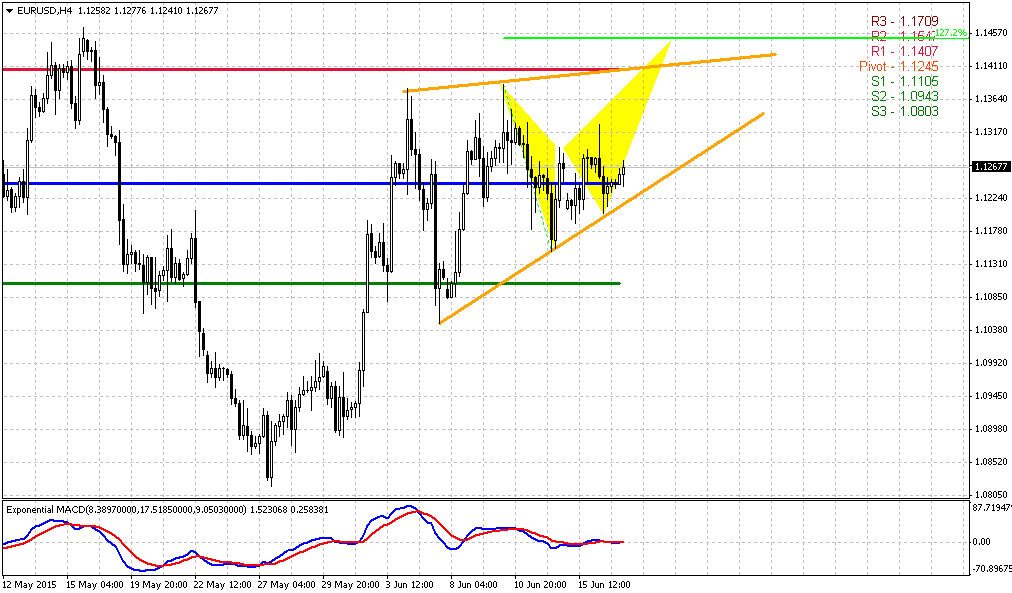

Weekly

Trend is bullish here. After solid upward action market has met overbought. That was a bit above K-resistance area (I do not have it on this chart) so we treat it as broken area. It means that right now we have only one major level if 5/8 Fib resistance, and may be 50%. Latter one may be even is more interesting for us. Since we treat upward action as retracement, there is no guarantee that GBP will complete AB=CD pattern totally. It could reach just 0.618 extension. That’s why we first will focus on 1.60 area - minor AB-CD target, weekly overbought and 50% Fib level.

And the last thing here… Take a look how market response on broken trend line – it has re-tested it and formed morning star pattern. This pattern is very welcome for us. First, is because it could support upside action by itself and second – because it clearly shows invalidation point. It will fail if market will drop below it’s low. If this will happen – Cable simultaneously will appear below neckline again and will change the shape of AB-CD pattern or even will lead to its total failure. For monthly B&B 1.60 level will be sufficient. Besides, 1.6084 is Yearly Pivot that will act as resistance now.

Daily

Daily has shifted bullish again. Market here is forming large rising wedge pattern that potentially is bearish but let market to continue upside action a bit more. May be you could recognize here a bit skewed H&S pattern. Still we wouldn’t advise to rely on it. H&S assumes full completion of upside AB-CD, while we do not sure that this will definitely happen, especially based on recent CFTC data.

Weekly morning star pattern has taken the shape of butterfly here. It points on the same target around 1.60 area. So while we’re waiting for big downward reversal somewhere in the future from 1.60 area, we could take long position. From that standpoint we’re interesting just with most recent swing up…

4-Hour

Before market will reverse down on daily chart – here it probably will drift slightly higher. AB-CD target has not completed yet and GBP is forming Butterfly “Sell”. 1.27 point already has been reached, and 1.618 agrees with AB-CD one. Thus, GBP shows a lot of setups as for scalpers as for daily traders. Thus, scalpers could search chances for short entry somewhere from 1.5630 area. Then we will be watching for retracement down. Post probable area will be around 1.54-1.5440 area – former tops, K-support and MPP& WPP.

Conclusion:

Long term picture tells that also current upside action mostly is retracement, since it is driven by closing of short positions but not new inflows on GBP. Still, it seems that upside action still has chance to continue and next long-term destination point is 1.60. Long term charts show potential for different patterns, such as monthly B&B “Sell”, daily butterfly, intraday patterns etc… From that standpoint Cable looks very interesting compares to other currencies.

Meantime, we expect slightly higher level first, something around 1.5630 and then retracement down to 1.54-1.5440 area in the beginning of the week.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.