Sive Morten

Special Consultant to the FPA

- Messages

- 18,699

Fundamentals

Reuters reports the dollar jumped to an 11-1/2-year high against a basket of currencies on Friday as robust U.S. employment growth fueled expectations that the Federal Reserve was closer to raising interest rates.

The euro fell below $1.09 for the first time since September 2003. It was last at $1.0862, off 1.50 percent for the day.

The dollar accelerated after the government reported that U.S. nonfarm payrolls grew by 295,000 in February, exceeding expectations of 240,000 new jobs. The unemployment rate fell to a more than 6-1/2-year low of 5.5 percent.

"We feel the economy is in a position for the Fed to begin normalizing policy," said Sam Bullard, senior economist at Wells Fargo Securities in Charlotte, North Carolina. "We think it is on the path to make a rate change in June."

U.S. interest rates futures signaled that investors were placing more bets the Fed might raise rates this summer, though they have not fully priced in such a move until late 2015.

Markets are pricing in something less dovish," said Nick Verdi, currency strategist at Standard Chartered Bank in New York.

U.S. bond yields, relatively high in comparison to European rates and a key attraction for foreign investors, also rose sharply after the unexpectedly strong employment report.

The euro has been in a long slide and slipped below $1.10 on Thursday, when the European Central Bank set a Monday start for its 1.1 trillion euro bond-buying program, designed to lower euro zone interest rates and spur growth.

The 30-year Treasury fell sharply in price, which lifted its yield to 2.8703 percent, a high not seen in more than two months.

CFTC data shows nothing drastical yet, since it was released on 3rd of March – before NFP release. We just see shy increase in long position while short positions remain the same. It means that our “Short-to-Total” ratio has decreased slightly from previous 83,8%. But this does not help us much. It will be interesting to see how positions of investors has changed after NFP release and first tranche of EU QE on 9th of March.

Open interest:

Shorts:

Shorts:

Longs:

Longs:

It seems that this is not best times for EUR. It stands after pressure from multiple sides – USD becomes stronger, inner problems, such as Greece, not stable pace of economy growth, absence of unite position on geopolitical questions among EU members and instability on eastern borders lead to EUR drop.

Currently Greece question has moved on second plan, but situation there is far from solution. This situation is important mostly not because of pure financial perspective of Greece, but because of geopolitical situation. Here and there we hear separation callings – Greece, Spain, Flanders, North Italy etc. Of cause there is a different degree of callings but precedent is here and financial tensions in Greece are very dangerous issue.

Reuters reports that Greece sent its euro zone partners an augmented list of proposed reforms on Friday but EU officials said several more steps were required before any release of aid funds to a country that Prime Minister Alexis Tsipras says has a noose around its neck.

Struggling to scrape together cash and avoid possible default, Athens made a 310 million euro partial loan repayment to the International Monetary Fund, while Tsipras pleaded to be allowed to issue more short-term debt to plug a funding gap. Greece is running out of options to fund itself despite striking a deal with the euro zone in February to extend its EU/IMF bailout by four months.

European Central Bank President Mario Draghi has refused to raise a limit on Athens' issuance of three-month treasury bills which Greek banks buy with emergency central bank funds. He said on Thursday the EU treaty prohibited indirect monetary financing of governments. "The ECB has still got a rope around our neck," the leftist Greek premier complained in an interview with German magazine Der Spiegel released on Friday. If the ECB continued to object, it would be assuming a grave responsibility, he said.

One key condition for Greece to receive any more euro zone money is for Athens to reach an agreement with its three international creditors - the euro zone, the ECB and the IMF - on the implementation of reforms agreed by the previous government. Such talks have not even begun yet.

Greece must repay a total of 1.5 billion euros to the IMF over the next two weeks against a backdrop of dwindling tax revenues, frozen bailout funds and economic stagnation. Three other instalments are due on March 13, 16 and 20.

So Greece shows patience yet, but how long they could force themselves to show it. As more pressure will be on new Greece government and president as stronger radical sentiment will appear and pre-election Seriza rhetoric could become a reality.

Ukraine turmoil leads to stronger disagreement in EU. While Poland, UK call for strict being in the wake of US policy – France, Germany, Hungary and some other EU members start to understand all hazards of this way and now are trying to act as independent players on geopolitical scene running for their own interests.

Meantime situation in Ukraine is also far from stability. OCSE was needed to ask for more powers – get heavy metal forces dislocation, just to name some. There was a strong concern announced in UN Security Council about fake pullback of heavy metals by Ukrainian side. Also there was reasonable and not very comfortable question asked – if we tend to demilitarization, why we need US troops in Ukraine? So, situation is blur and far from transparency. All these moments obviously are not supportive for EU currency.

Technicals

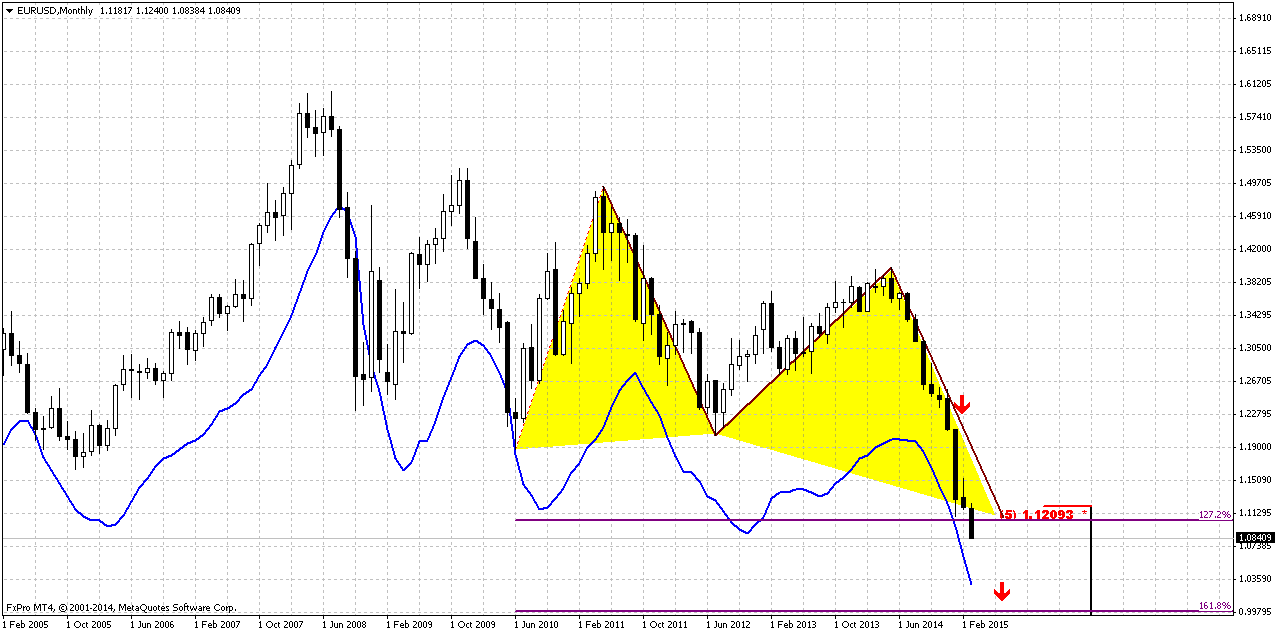

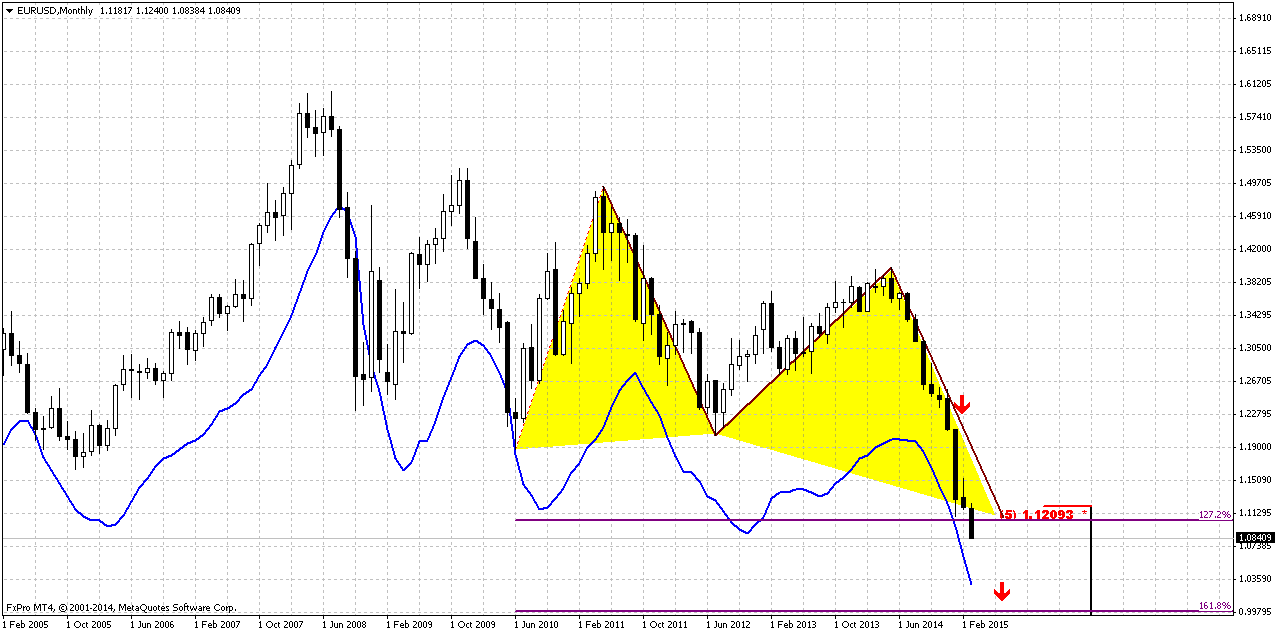

Monthly

Speaking in two words – miracle has not happened. EUR has collapsed. Although we have expected that EUR will continue movement to parity but this should happen a bit later, after retracement up. So our hopes were completely deceived and market just miserably dropped lower through very strong support area. This shows us how market really weak is.

January was dreadful month for EUR. We have plunge that we haven’t seen since 2008 crisis. EUR has passed through YPP and YPS1 with a blink of an eye – it needs just 3 weeks to pass through yearly barrier. Right now currency has passed through rock hard support area – monthly oversold, major 5/8 Fib level, AB=CD target and 1.27 extension target.

Still as we have said previously, despite whether we get retracement or not - downward action will continue. EUR has dropped to 1.27 butterfly target too fast. Odds suggest continuation to 1.618 extension. By the way, the same suggestion we could make based on AB-CD. CD leg is also too fast. But where does it stand? Right – at 1.0 point, parity. This is our next destination point by far. Market action right now is very fast. EUR passes for week distances that previously it has passed for months. As market has passed through major support area and not at oversold, we probably should start to search opportunities for short entry with target around parity.

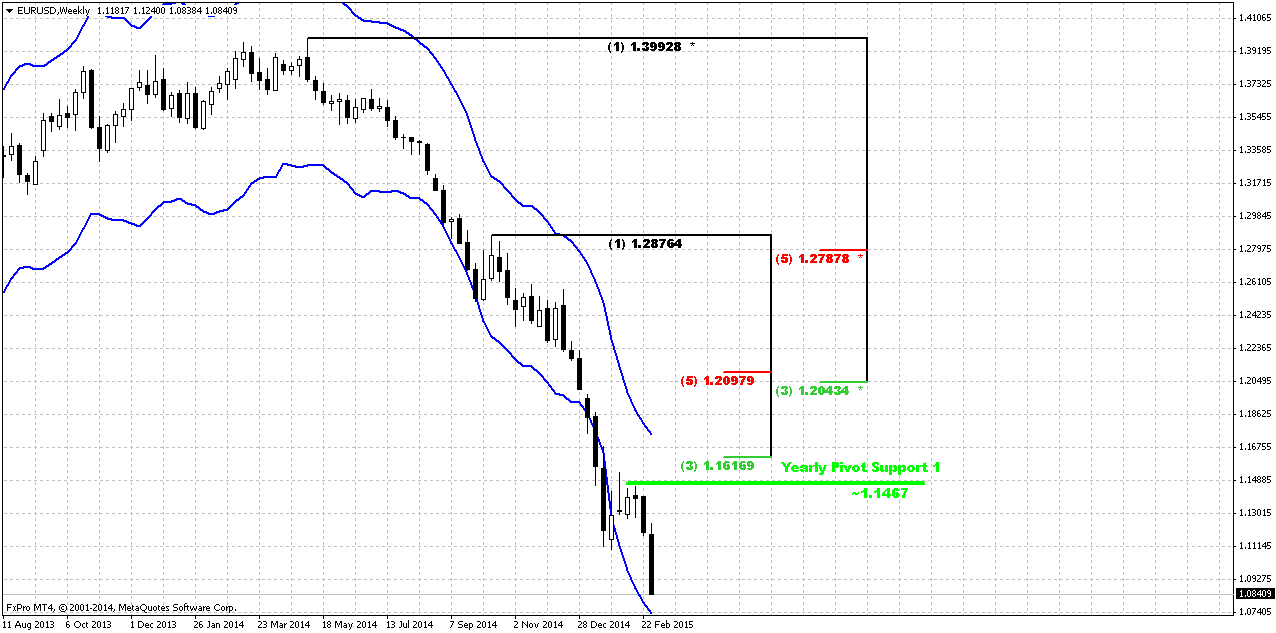

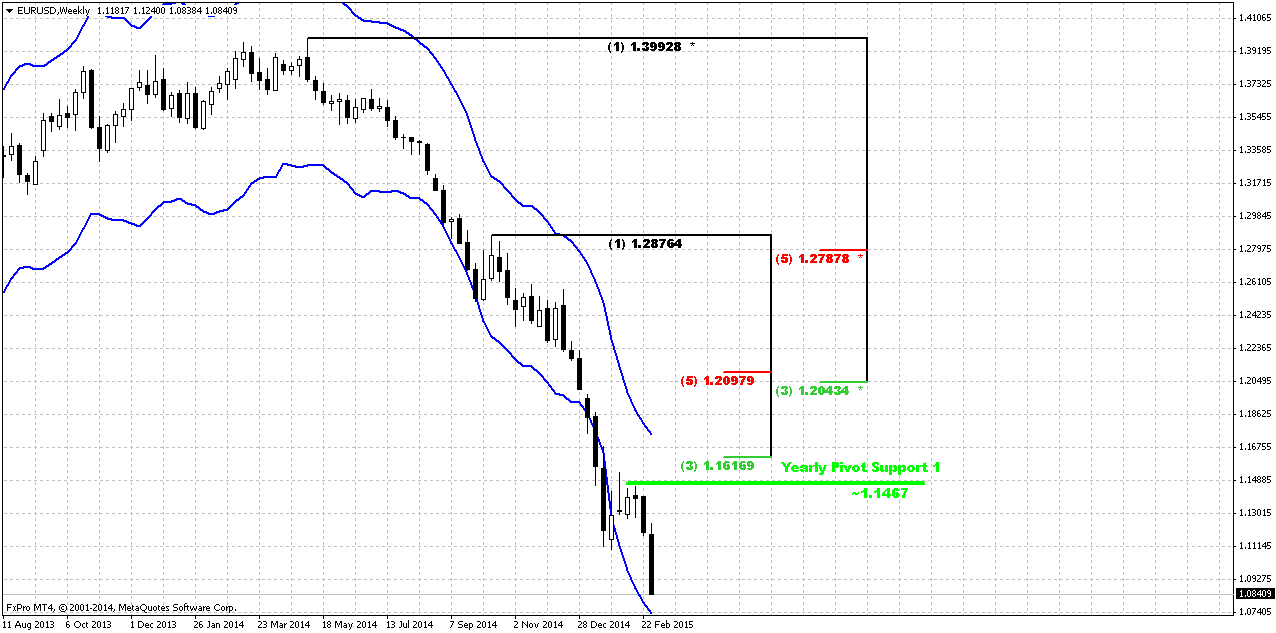

Weekly

So, guys, on previous week we had big plans for weekly chart and expected DRPO “Buy” pattern that nicely could confirm monthly pullback setup. But we haven’t got any DRPO, market just dropped lower. Could we suggest that DRPO is still possible? Is it too big difference between bottoms? Probably yes. The problem mostly stands even not with big difference between bottoms of DRPO, but in market mechanics. DRPO is pattern that based on capitulation of bears. But here we do not see it – even more, we see that bears take control over market. We see only 1 possibility for DRPO here – if market within next week will show unprecedented upside action to 1.16 area of Fib resistance and YPR1. Other words we need the same issue that we’ve discussed yesterday – move above former lows. But now this move has to be fast and thrusting. If this will not happen – we will start chances to take short position and sell rallies.

And finally just few observations – take a look what a minor bounce was from oversold at monthly Fib support, butterfly and AB=CD completing points. Market just re-tested YPR1. Now EUR stands below this former support cluster – what the chances on upside reversal? It seems that hardly they will be very significant. Next FOMC meeting will come on 17-18th of March and investors mostly will wait for it.

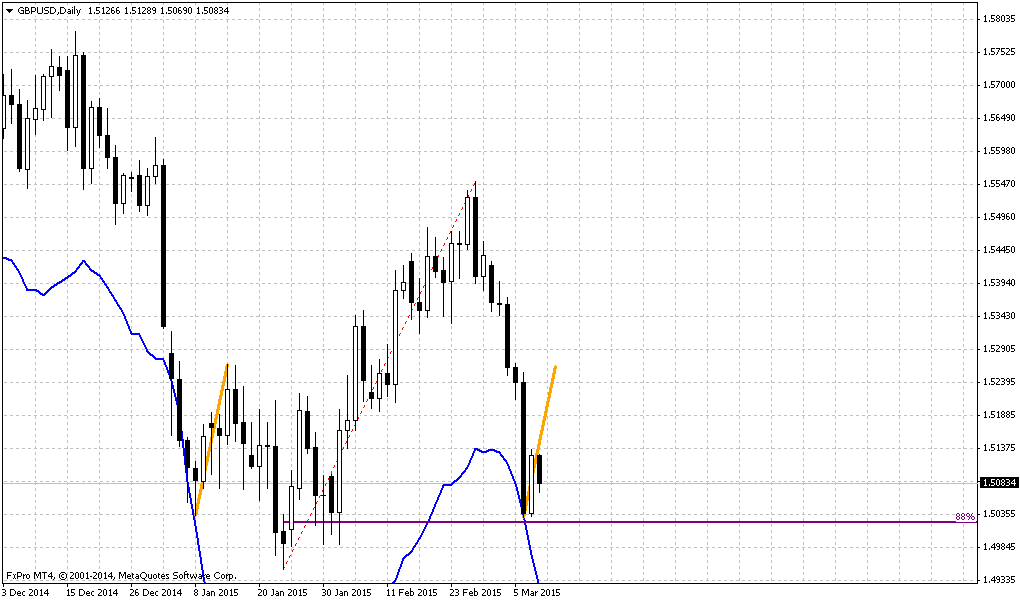

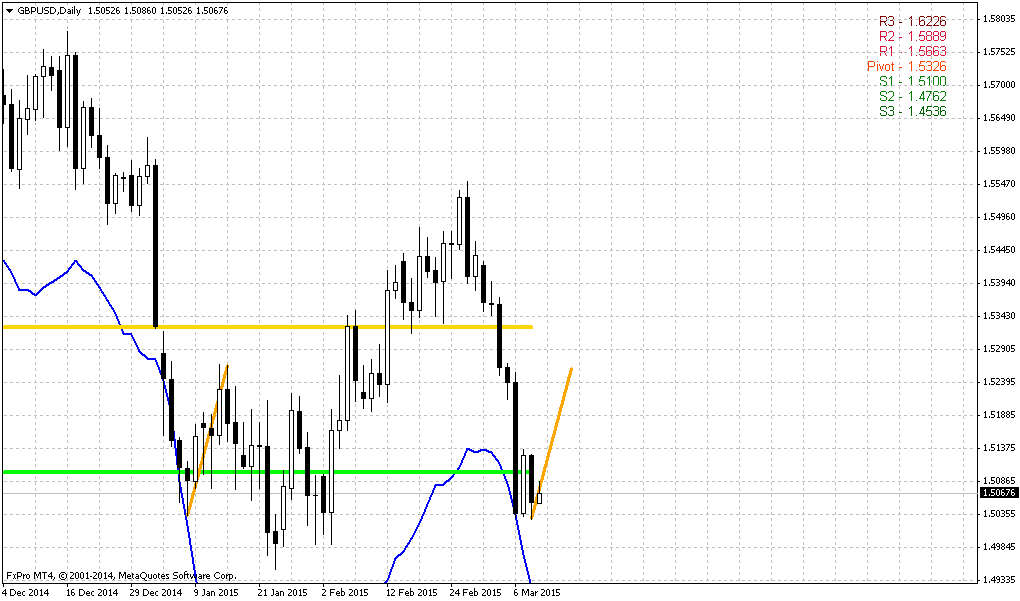

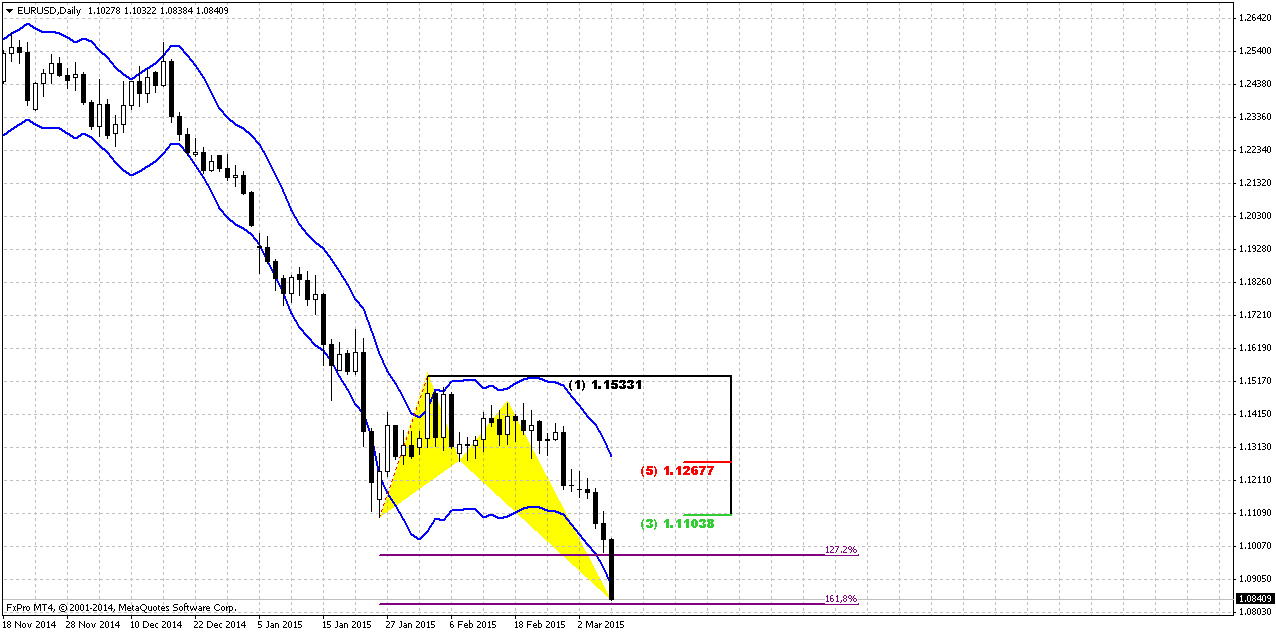

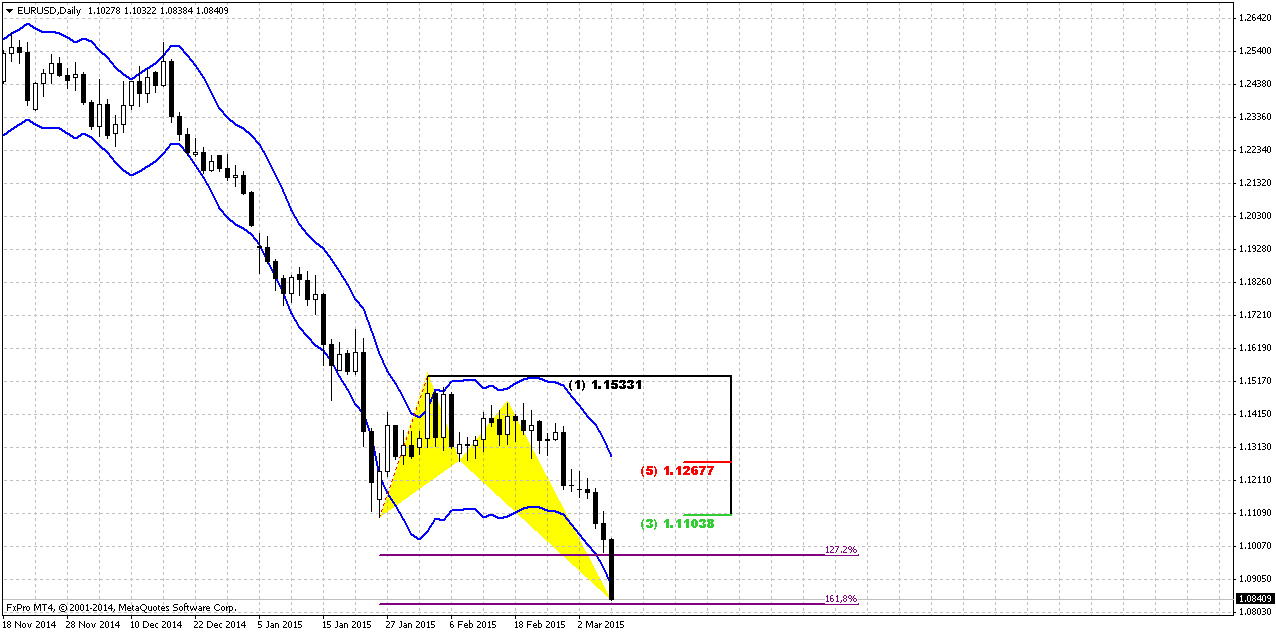

Daily

Daily chart clarifies, why we think that situation could change only if market will move back to 1.16 area. Trend is bearish at all time frames, but on daily chart market oversold and completed 1.618 butterfly “Buy”. Depending on type of reaction on this issue we will understand what to expect next. If bounce up will be lazy and market just will re-test 1.10 Fib resistance and former lows – downward action will continue. If, instead, upside action will fast and thrusting – this could lead to appearing of H&S pattern. So we need price return to 1.16 neckline to show us its pace. Still, on coming week hardly EUR will move above 1.12-1.13 area due existence of daily overbought and Fib resistance.

To be honest guys, I do not believe much in this upside reversal due reasons that we’ve explained above. Besides, even here – EUR has hit both butterfly extensions within single trading session. It is very difficult to call this action as “bullish”. But as we need to wait for rally anyway (either for short entry or to confirm reversal) – let’s see how this rally will develop.

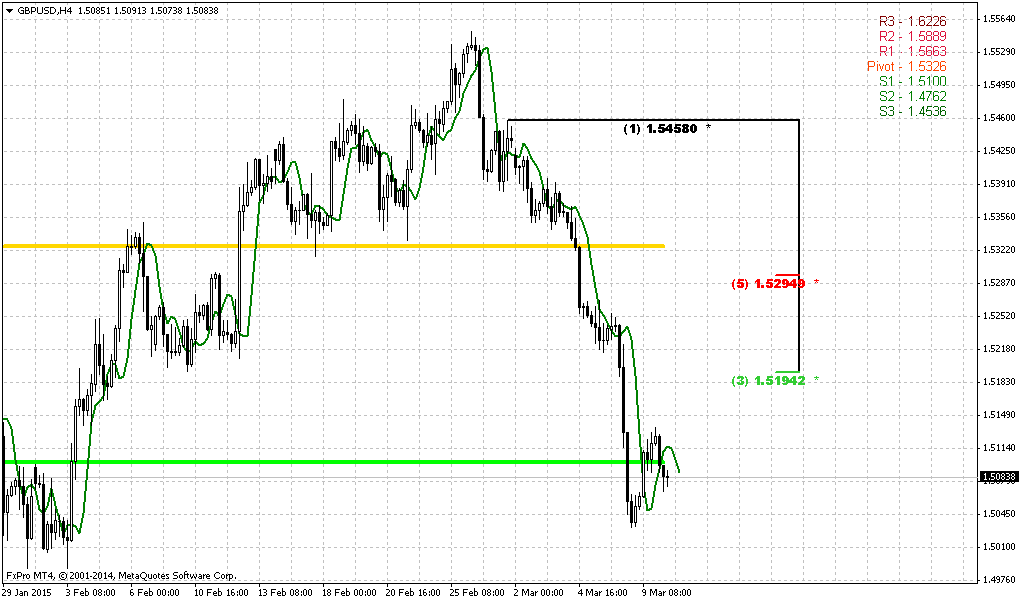

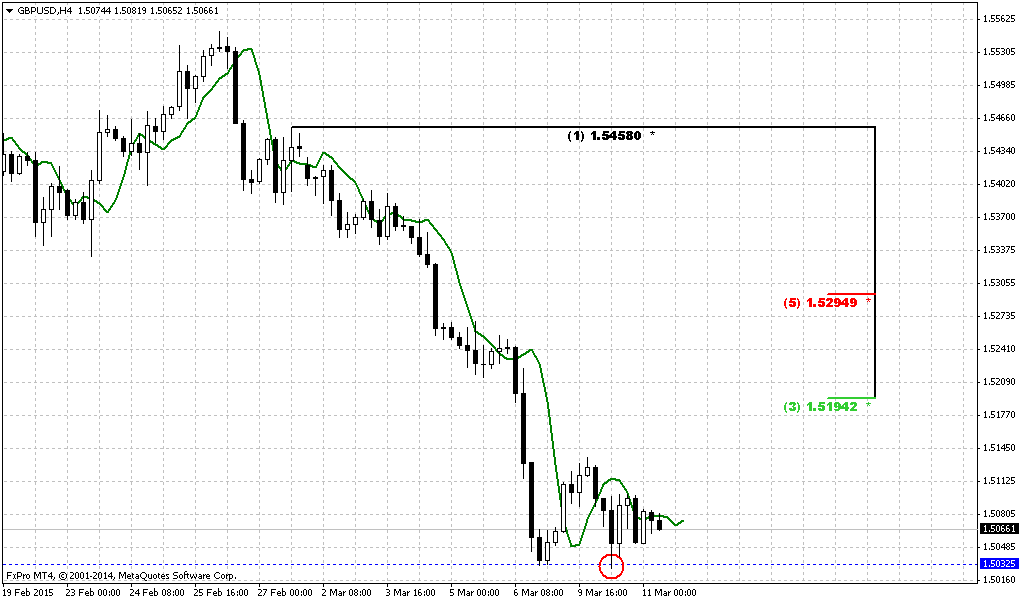

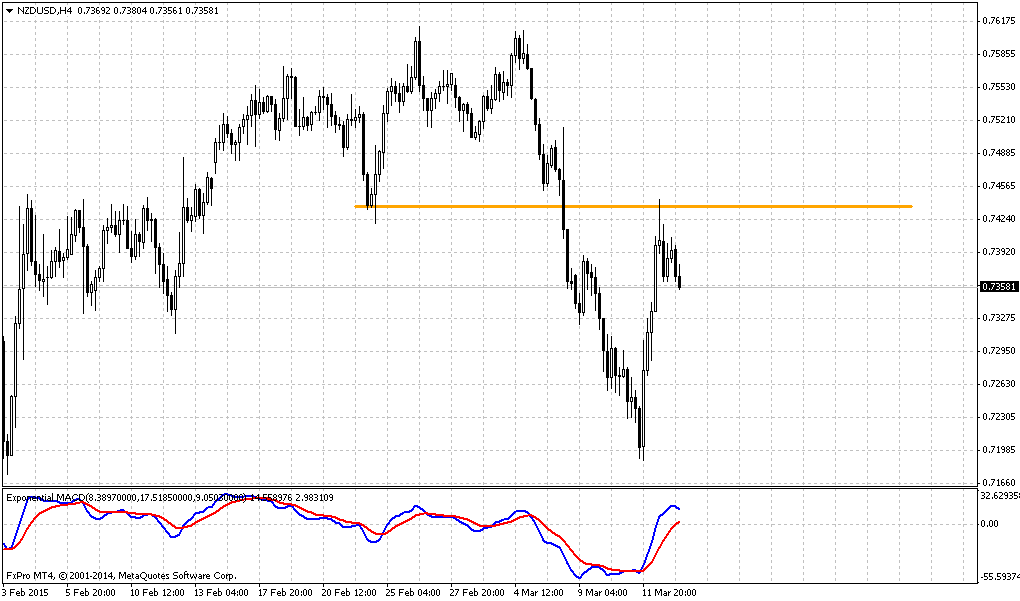

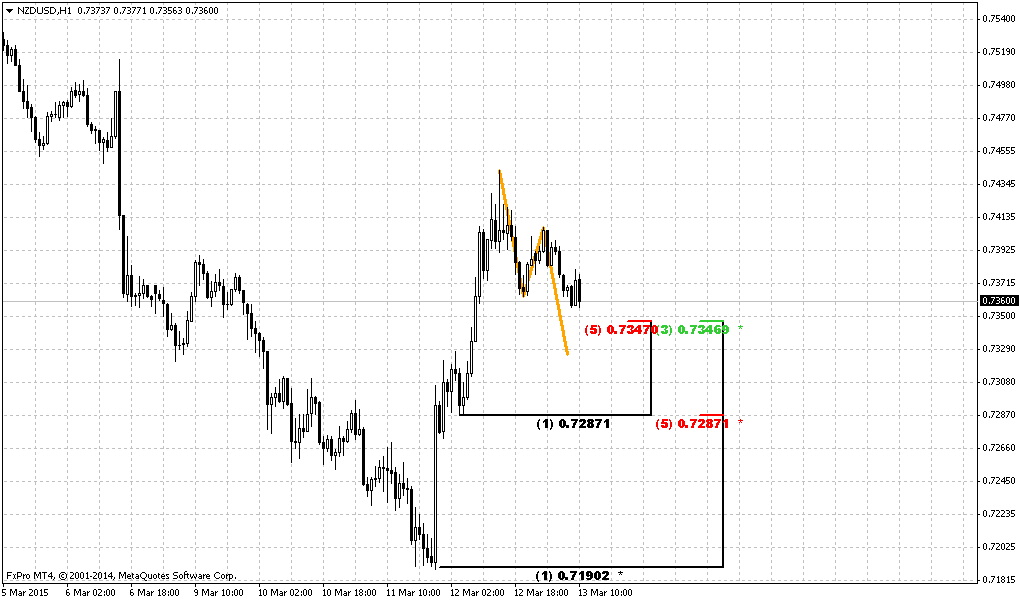

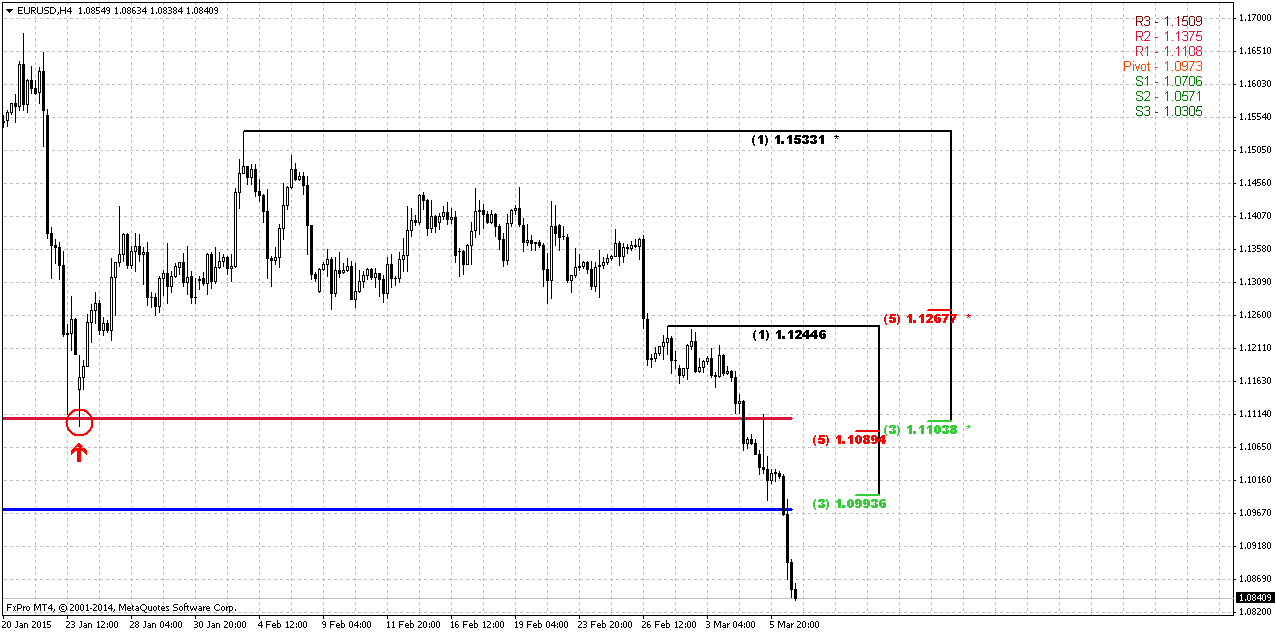

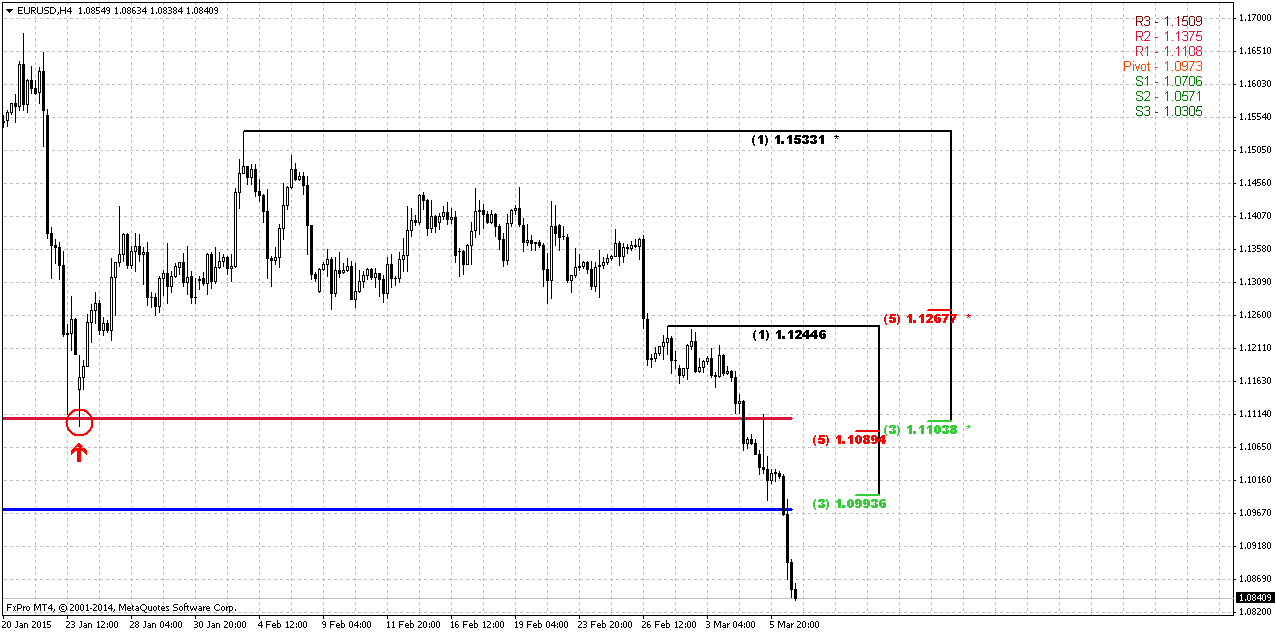

4-Hour

Intraday charts do not show yet any patterns. Trend here is bearish as well. Also we see that market has created K-resistance around former lows and WPR1. Scalp traders could watch for reversal patterns here and try to trade at least minor upside rally due daily butterfly. As market is oversold on daily chart – reaching of 1.10 resistance does not seem as impossible.

Conclusion:

Right now it is very difficult to understand how geopolitical and inner economical situation will impact on EUR. There are too many uncertainty and variables. In long-term perspective we expect parity.

Theoretically EUR has phantom chances drastically change situation, but it needs to show fast and furious rally right to 1.16 area. In this case EUR could form, say H&S pattern. Anyway we need some bounce up – either for taking short position if it will be slow, or to get demonstration of EUR bullish ambitions, if rally will be fast.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Reuters reports the dollar jumped to an 11-1/2-year high against a basket of currencies on Friday as robust U.S. employment growth fueled expectations that the Federal Reserve was closer to raising interest rates.

The euro fell below $1.09 for the first time since September 2003. It was last at $1.0862, off 1.50 percent for the day.

The dollar accelerated after the government reported that U.S. nonfarm payrolls grew by 295,000 in February, exceeding expectations of 240,000 new jobs. The unemployment rate fell to a more than 6-1/2-year low of 5.5 percent.

"We feel the economy is in a position for the Fed to begin normalizing policy," said Sam Bullard, senior economist at Wells Fargo Securities in Charlotte, North Carolina. "We think it is on the path to make a rate change in June."

U.S. interest rates futures signaled that investors were placing more bets the Fed might raise rates this summer, though they have not fully priced in such a move until late 2015.

Markets are pricing in something less dovish," said Nick Verdi, currency strategist at Standard Chartered Bank in New York.

U.S. bond yields, relatively high in comparison to European rates and a key attraction for foreign investors, also rose sharply after the unexpectedly strong employment report.

The euro has been in a long slide and slipped below $1.10 on Thursday, when the European Central Bank set a Monday start for its 1.1 trillion euro bond-buying program, designed to lower euro zone interest rates and spur growth.

The 30-year Treasury fell sharply in price, which lifted its yield to 2.8703 percent, a high not seen in more than two months.

CFTC data shows nothing drastical yet, since it was released on 3rd of March – before NFP release. We just see shy increase in long position while short positions remain the same. It means that our “Short-to-Total” ratio has decreased slightly from previous 83,8%. But this does not help us much. It will be interesting to see how positions of investors has changed after NFP release and first tranche of EU QE on 9th of March.

Open interest:

It seems that this is not best times for EUR. It stands after pressure from multiple sides – USD becomes stronger, inner problems, such as Greece, not stable pace of economy growth, absence of unite position on geopolitical questions among EU members and instability on eastern borders lead to EUR drop.

Currently Greece question has moved on second plan, but situation there is far from solution. This situation is important mostly not because of pure financial perspective of Greece, but because of geopolitical situation. Here and there we hear separation callings – Greece, Spain, Flanders, North Italy etc. Of cause there is a different degree of callings but precedent is here and financial tensions in Greece are very dangerous issue.

Reuters reports that Greece sent its euro zone partners an augmented list of proposed reforms on Friday but EU officials said several more steps were required before any release of aid funds to a country that Prime Minister Alexis Tsipras says has a noose around its neck.

Struggling to scrape together cash and avoid possible default, Athens made a 310 million euro partial loan repayment to the International Monetary Fund, while Tsipras pleaded to be allowed to issue more short-term debt to plug a funding gap. Greece is running out of options to fund itself despite striking a deal with the euro zone in February to extend its EU/IMF bailout by four months.

European Central Bank President Mario Draghi has refused to raise a limit on Athens' issuance of three-month treasury bills which Greek banks buy with emergency central bank funds. He said on Thursday the EU treaty prohibited indirect monetary financing of governments. "The ECB has still got a rope around our neck," the leftist Greek premier complained in an interview with German magazine Der Spiegel released on Friday. If the ECB continued to object, it would be assuming a grave responsibility, he said.

One key condition for Greece to receive any more euro zone money is for Athens to reach an agreement with its three international creditors - the euro zone, the ECB and the IMF - on the implementation of reforms agreed by the previous government. Such talks have not even begun yet.

Greece must repay a total of 1.5 billion euros to the IMF over the next two weeks against a backdrop of dwindling tax revenues, frozen bailout funds and economic stagnation. Three other instalments are due on March 13, 16 and 20.

So Greece shows patience yet, but how long they could force themselves to show it. As more pressure will be on new Greece government and president as stronger radical sentiment will appear and pre-election Seriza rhetoric could become a reality.

Ukraine turmoil leads to stronger disagreement in EU. While Poland, UK call for strict being in the wake of US policy – France, Germany, Hungary and some other EU members start to understand all hazards of this way and now are trying to act as independent players on geopolitical scene running for their own interests.

Meantime situation in Ukraine is also far from stability. OCSE was needed to ask for more powers – get heavy metal forces dislocation, just to name some. There was a strong concern announced in UN Security Council about fake pullback of heavy metals by Ukrainian side. Also there was reasonable and not very comfortable question asked – if we tend to demilitarization, why we need US troops in Ukraine? So, situation is blur and far from transparency. All these moments obviously are not supportive for EU currency.

Technicals

Monthly

Speaking in two words – miracle has not happened. EUR has collapsed. Although we have expected that EUR will continue movement to parity but this should happen a bit later, after retracement up. So our hopes were completely deceived and market just miserably dropped lower through very strong support area. This shows us how market really weak is.

January was dreadful month for EUR. We have plunge that we haven’t seen since 2008 crisis. EUR has passed through YPP and YPS1 with a blink of an eye – it needs just 3 weeks to pass through yearly barrier. Right now currency has passed through rock hard support area – monthly oversold, major 5/8 Fib level, AB=CD target and 1.27 extension target.

Still as we have said previously, despite whether we get retracement or not - downward action will continue. EUR has dropped to 1.27 butterfly target too fast. Odds suggest continuation to 1.618 extension. By the way, the same suggestion we could make based on AB-CD. CD leg is also too fast. But where does it stand? Right – at 1.0 point, parity. This is our next destination point by far. Market action right now is very fast. EUR passes for week distances that previously it has passed for months. As market has passed through major support area and not at oversold, we probably should start to search opportunities for short entry with target around parity.

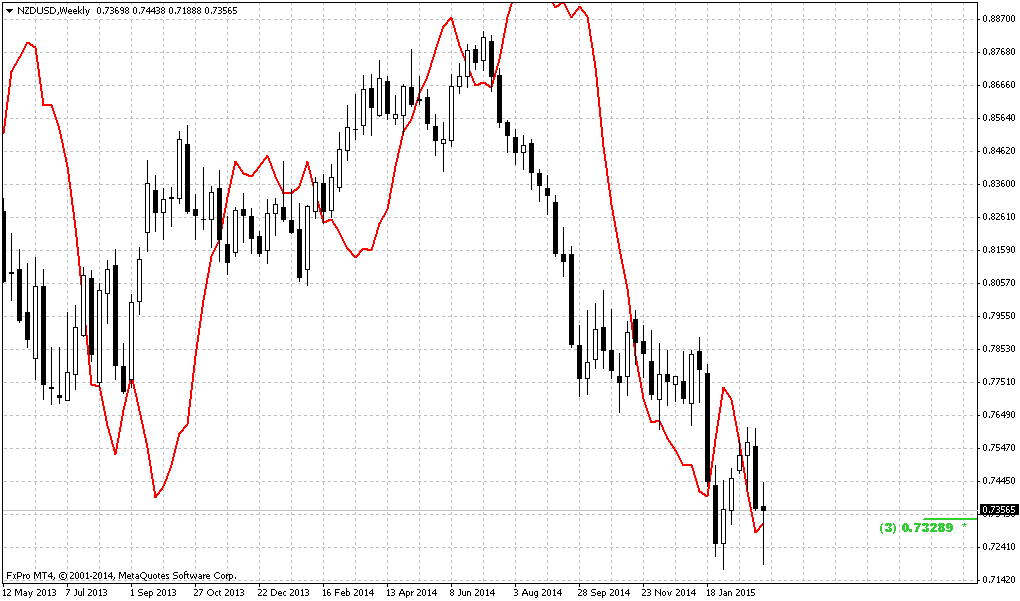

Weekly

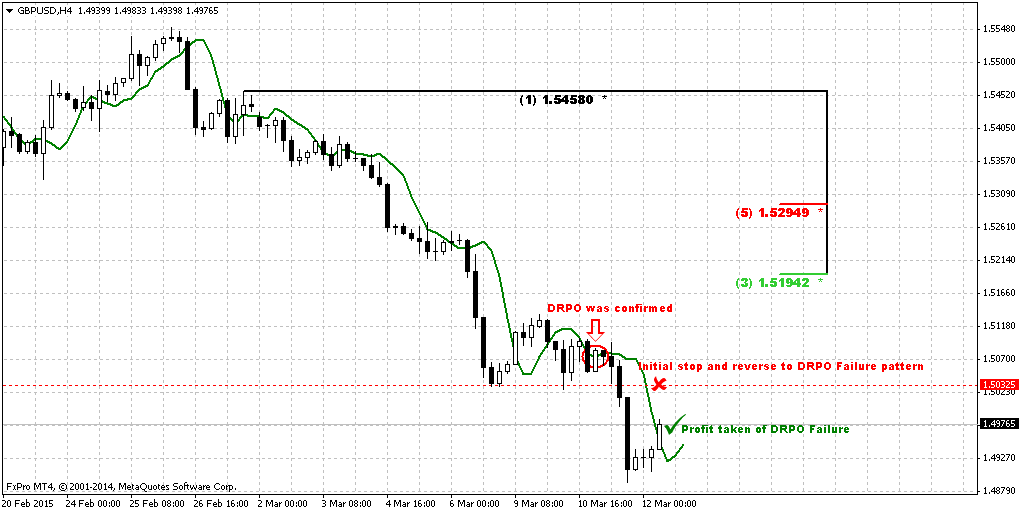

So, guys, on previous week we had big plans for weekly chart and expected DRPO “Buy” pattern that nicely could confirm monthly pullback setup. But we haven’t got any DRPO, market just dropped lower. Could we suggest that DRPO is still possible? Is it too big difference between bottoms? Probably yes. The problem mostly stands even not with big difference between bottoms of DRPO, but in market mechanics. DRPO is pattern that based on capitulation of bears. But here we do not see it – even more, we see that bears take control over market. We see only 1 possibility for DRPO here – if market within next week will show unprecedented upside action to 1.16 area of Fib resistance and YPR1. Other words we need the same issue that we’ve discussed yesterday – move above former lows. But now this move has to be fast and thrusting. If this will not happen – we will start chances to take short position and sell rallies.

And finally just few observations – take a look what a minor bounce was from oversold at monthly Fib support, butterfly and AB=CD completing points. Market just re-tested YPR1. Now EUR stands below this former support cluster – what the chances on upside reversal? It seems that hardly they will be very significant. Next FOMC meeting will come on 17-18th of March and investors mostly will wait for it.

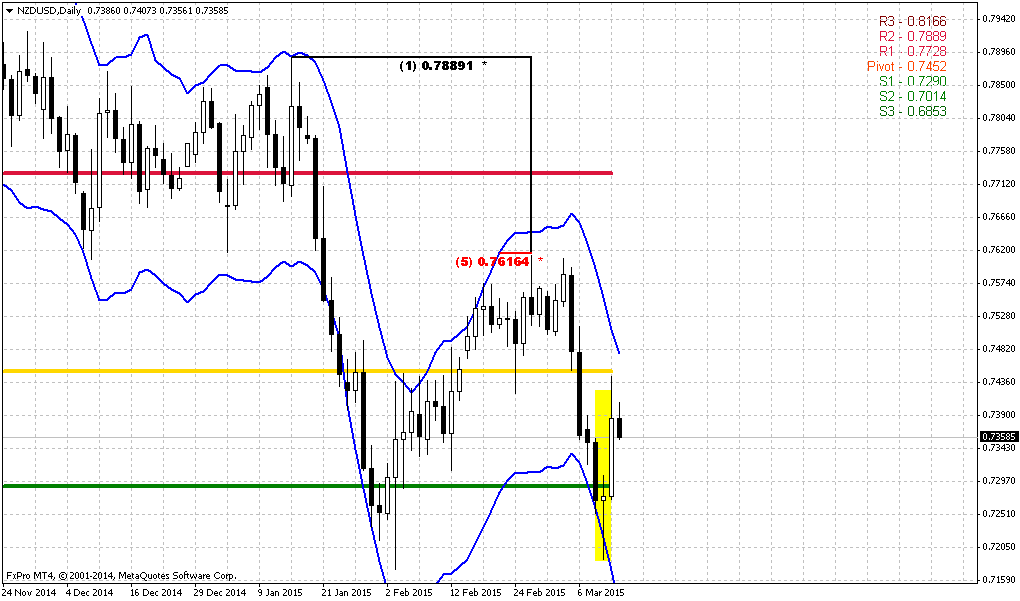

Daily

Daily chart clarifies, why we think that situation could change only if market will move back to 1.16 area. Trend is bearish at all time frames, but on daily chart market oversold and completed 1.618 butterfly “Buy”. Depending on type of reaction on this issue we will understand what to expect next. If bounce up will be lazy and market just will re-test 1.10 Fib resistance and former lows – downward action will continue. If, instead, upside action will fast and thrusting – this could lead to appearing of H&S pattern. So we need price return to 1.16 neckline to show us its pace. Still, on coming week hardly EUR will move above 1.12-1.13 area due existence of daily overbought and Fib resistance.

To be honest guys, I do not believe much in this upside reversal due reasons that we’ve explained above. Besides, even here – EUR has hit both butterfly extensions within single trading session. It is very difficult to call this action as “bullish”. But as we need to wait for rally anyway (either for short entry or to confirm reversal) – let’s see how this rally will develop.

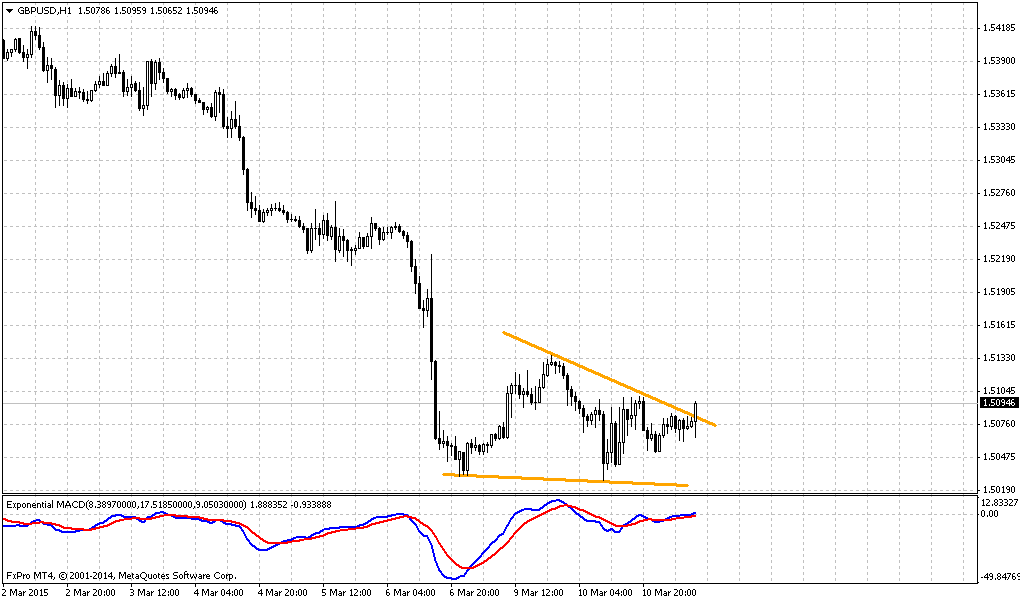

4-Hour

Intraday charts do not show yet any patterns. Trend here is bearish as well. Also we see that market has created K-resistance around former lows and WPR1. Scalp traders could watch for reversal patterns here and try to trade at least minor upside rally due daily butterfly. As market is oversold on daily chart – reaching of 1.10 resistance does not seem as impossible.

Conclusion:

Right now it is very difficult to understand how geopolitical and inner economical situation will impact on EUR. There are too many uncertainty and variables. In long-term perspective we expect parity.

Theoretically EUR has phantom chances drastically change situation, but it needs to show fast and furious rally right to 1.16 area. In this case EUR could form, say H&S pattern. Anyway we need some bounce up – either for taking short position if it will be slow, or to get demonstration of EUR bullish ambitions, if rally will be fast.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Last edited: