- Forex, Gold, BTC Market Analysis | Trading Signals

- Sive Morten- Currencies, Gold, Bitcoin Daily Video

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Forex FOREX PRO WEEKLY, March 16 - 20 , 2020

- Thread starter Sive Morten

- Start date

-

- Tags

- silly tag

Mr. Sive, thank you for your insights, we sure do live in interesting times now. My two cents are, that as you said these things were in the making for a long time now, with all the low-interest rates, money printing, FED repo markets operations and things down to personal levels like student debt, healthcare (this two things especially in the US) as well as all this IPOs and start-ups to which investors were throwing all the cheap money at. Eventually, the bubble was gonna pop, now the virus in mass media will be used as the cover for all the things wrong in the world, and how things were brilliant before it, and people will applaud governments and bankers for printing money and helping them, hack there will be some Nobel prize winners among them in few years while their wealth is being stolen from them.

I agree with what you are saying, although I can’t fully comprehend or imagine what the future of financial markets and the world will look like, but we for sure are at the major turning point.

Also I hope you made some nice profits from DAX Shorts after the daily AB=CD you were showing us a while back

I agree with what you are saying, although I can’t fully comprehend or imagine what the future of financial markets and the world will look like, but we for sure are at the major turning point.

Also I hope you made some nice profits from DAX Shorts after the daily AB=CD you were showing us a while back

Last edited:

Tryingtrader

Sergeant

- Messages

- 205

Hi everyone, standby for a MASSIVE fiscal and monetary response from central banks and governments, not just in America, but all around the world. This is going to mess up the normal trading patterns we are used to. Yup, it's inflate or die time... the WuFlue is the perfect excuse for trillions of "New" money to enter the system and interest rates to zero or less - until it all blows up. Inflation is necessary so the governments can pay back their debts with money that is worth a lot less than they borrowed!

Sorry guys, I had some personal setbacks and couldn’t post or trade for almost a month, but I still followed the markets and updated my COT spreadsheet. This is what I am looking at right now. Things that are happening right now are far beyond the scope of my simple analysis, but can still give at least some insight.

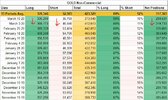

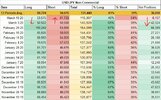

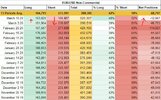

GOLD:

Non-Commercial traders decreased both their Long and Shorts positions on Gold, the decrease in Shorts was greater which led to a decrease in Net Long positions.

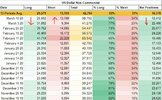

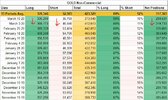

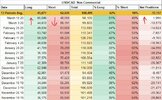

DXY:

A massive drop in Net long positions on DXY last week, Non-Commercial traders closed some of their Long positions and added to their Short positions.

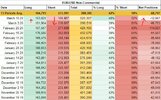

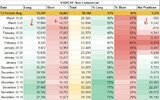

EURO:

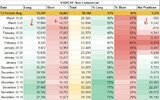

Like Mr. Sive mentioned in his report, there was a massive closing on Short positions by Non-Commercial traders last week, now Net positions barely stand in negative territory.

One thing that I noticed is Euro appreciated almost in relation to all other currencies except for CHF. I don’t want to post a lot of pictures here but you can take a look at the graphs of EUR/USD, EUR/GBP, EUR/RUB,...

Look at the chart of EUR/CHF, it looks to me like we could move lower to the XOP target on EUR/CHF in Longer-term view.

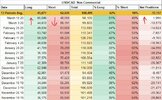

CAD:

Non-Commercial traders increased their Long positions and closed some Short positions, Net positions now stand in positive territory.

On the technical side, XOP target has been hit now I will be waiting for a retracement before trying to go Long.

CHF:

Non-Commercial traders decreased both their Long and Short positions, the decrease in Longs was greater which led to an overall decrease in Net positions which now stand in negative territory.

On the technical picture uncompleted XOP target with larger 0.382 and 0.618 FIB confluence. The market retraced sharply last week but didn’t engulf the previous weekly candle.

On the 4H timeframe, we have AB=CD retracement to FIB confluence where I am taking a Short position.

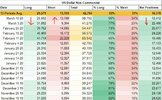

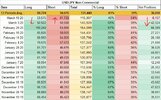

JPY:

And lastly, JPY, where Non-Commercial traders closed around 40% of their Long positions and added to their Short positions which let to a big decrease in Net Positions.

GOLD:

Non-Commercial traders decreased both their Long and Shorts positions on Gold, the decrease in Shorts was greater which led to a decrease in Net Long positions.

DXY:

A massive drop in Net long positions on DXY last week, Non-Commercial traders closed some of their Long positions and added to their Short positions.

EURO:

Like Mr. Sive mentioned in his report, there was a massive closing on Short positions by Non-Commercial traders last week, now Net positions barely stand in negative territory.

One thing that I noticed is Euro appreciated almost in relation to all other currencies except for CHF. I don’t want to post a lot of pictures here but you can take a look at the graphs of EUR/USD, EUR/GBP, EUR/RUB,...

Look at the chart of EUR/CHF, it looks to me like we could move lower to the XOP target on EUR/CHF in Longer-term view.

CAD:

Non-Commercial traders increased their Long positions and closed some Short positions, Net positions now stand in positive territory.

On the technical side, XOP target has been hit now I will be waiting for a retracement before trying to go Long.

CHF:

Non-Commercial traders decreased both their Long and Short positions, the decrease in Longs was greater which led to an overall decrease in Net positions which now stand in negative territory.

On the technical picture uncompleted XOP target with larger 0.382 and 0.618 FIB confluence. The market retraced sharply last week but didn’t engulf the previous weekly candle.

On the 4H timeframe, we have AB=CD retracement to FIB confluence where I am taking a Short position.

JPY:

And lastly, JPY, where Non-Commercial traders closed around 40% of their Long positions and added to their Short positions which let to a big decrease in Net Positions.

Sive Morten

Special Consultant to the FPA

- Messages

- 18,669

Thanks guys for all comments and views on the problem. Let's go together through it and see what our big friends have in their minds by steps that they are doing. Currently indeed - process is coming to global money printing for "virus fighting". Let's see what the next step will be. Right now we have few hypotheses and one of them suggests that force-major situation probably will be used somehow to nullify US debt, or strongly devalue it. How global fiscal system will change - this is the riddle yet to resolve.

Christina Ledger

Recruit

- Messages

- 197

thanks for sharing info here.

Ugyen Penjore

Private

- Messages

- 23

Thank you Sive. I have few questions since my country never saw a Recession. Do you think basic consumable prices (such as foods) will be affected by this? If it will, how should one prepare? I am currently looking for a college in Australia, do you think living cost and college expenses will be affected and how?

Thank you, Best Wishes

Thank you, Best Wishes

Sive Morten

Special Consultant to the FPA

- Messages

- 18,669

Thank you Sive. I have few questions since my country never saw a Recession. Do you think basic consumable prices (such as foods) will be affected by this? If it will, how should one prepare? I am currently looking for a college in Australia, do you think living cost and college expenses will be affected and how?

Thank you, Best Wishes

Hi mate, well, this is not just the crisis of production but consumption as well. May be I'm wrong, but I do not see reasons for price increase on food. Speaking on education expenses - it is difficult to answer, because its rather specific. In general it should not be affected too much, especially on global travelling ban. But, I'll not bet on it

Sive Morten

Special Consultant to the FPA

- Messages

- 18,669

Morning guys,

It is few that we could discuss today. On GBP is nothing new yet - we still watch for pullback. Thus, our weekly analysis stands without any changes.

On EUR market is trying to complete B&B "Buy" setup. Price action looks heavy, but still stands above major support area and keeps theoretical chances to complete upside action:

On 1H chart we could consider AB=CD pattern with 1.1275 target. I prefer to use closer standing OP, because of two reasons. First is - price action is choppy and heavy, and reaching of 5/8 resistance is not obvious. Second - 1.1275 level coincides with major 50% resistance (not shown here), which is favorite level for EUR. Upside action could be finalized by butterfly pattern.

Here we have to watch for "C" point. Drop below it significantly diminishes chances on upside continuation and mostly will mean the failure of bullish setup. EUR has to continue higher lows sequence to keep short-term bullish setup valid:

It is few that we could discuss today. On GBP is nothing new yet - we still watch for pullback. Thus, our weekly analysis stands without any changes.

On EUR market is trying to complete B&B "Buy" setup. Price action looks heavy, but still stands above major support area and keeps theoretical chances to complete upside action:

On 1H chart we could consider AB=CD pattern with 1.1275 target. I prefer to use closer standing OP, because of two reasons. First is - price action is choppy and heavy, and reaching of 5/8 resistance is not obvious. Second - 1.1275 level coincides with major 50% resistance (not shown here), which is favorite level for EUR. Upside action could be finalized by butterfly pattern.

Here we have to watch for "C" point. Drop below it significantly diminishes chances on upside continuation and mostly will mean the failure of bullish setup. EUR has to continue higher lows sequence to keep short-term bullish setup valid:

Similar threads

- Replies

- 11

- Views

- 261

- Replies

- 7

- Views

- 238

- Replies

- 7

- Views

- 205

- Replies

- 14

- Views

- 295

- Forex, Gold, BTC Market Analysis | Trading Signals

- Sive Morten- Currencies, Gold, Bitcoin Daily Video