Sive Morten

Special Consultant to the FPA

- Messages

- 18,690

Cyprus notes

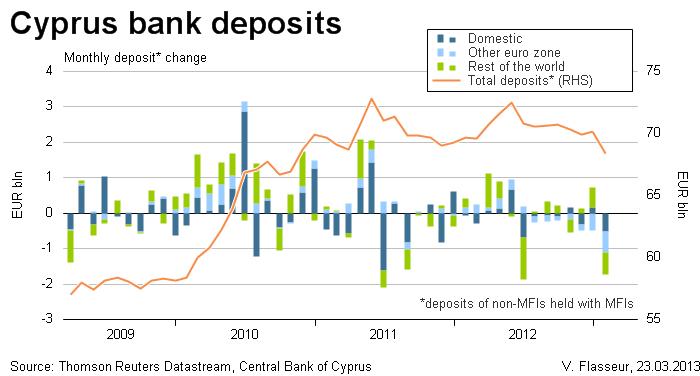

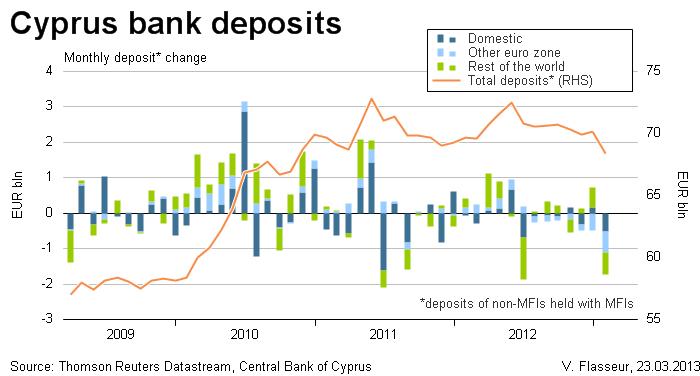

In the beginning of the research, let’s make some notes on Cyprus situation, since we’re very interested with it. To not dive in multiple scenarios, I will sub-divide them into two groups. First group depends on will be ECB bailout or not and second one – is what chances that Cyprus will leave EU.

1.Cyprus will get 10 Bln bailout. This is best-case scenario, but it has one problem – to get their own 5.8 Bln first and now there is now other chances as to return to the idea of tax on deposits. If Cyprus will get EU bailout, it will be able to stay with EU and liquidity inflow will be suggificient to compensate mass withdrawals that will follow anyway when banks will open. Besides, to deal with bankrupt country inside of EU will be much easier than with country outside of it. With this best-case scenario, deposits could start to return after first panic outflow, when confidence will start to restore gradually.

Some senior EU politician said that reforming of Cyprus banking system could be done with creating two large banks – “good bank” and “bad bank”. Good bank will join all well-performing loans and deposits under 100K that have government insuance deposit guarantee, while bad bank – non-perfoming loans and deposits over 100K that are not protected by guarantee. The EU official said deposits in the bad bank would have to be "haircut" by 30-40 percent. Even deposits up to 100,000 euros, in theory guaranteed by the Cypriot government, could not be paid out in full, because the island has no funds to back up its deposit guarantee.

Some senior EU politician said that reforming of Cyprus banking system could be done with creating two large banks – “good bank” and “bad bank”. Good bank will join all well-performing loans and deposits under 100K that have government insuance deposit guarantee, while bad bank – non-perfoming loans and deposits over 100K that are not protected by guarantee. The EU official said deposits in the bad bank would have to be "haircut" by 30-40 percent. Even deposits up to 100,000 euros, in theory guaranteed by the Cypriot government, could not be paid out in full, because the island has no funds to back up its deposit guarantee.

2. Second scenario if Cyprus will not get a bailout. This will be catastrophy for overall financial system, because government has now funds to satisfy possible withdrawals, even on insurance deposits below 100K EUR, although this is a legislative mere. Another negative moment here is that Cyprus probably will leave Eurozone in this case. Why is it possible, especially after Greece case? This could be explained by Cyprus economy structure. Cyprus has 8-times greater deposits than its GDP. Greece may be is a small part of total EU – just 2% of GDP, but Cyprus is 10-times smaller. Policymakers could think that this could become a one-off case, that would never be replicated elsewhere. If some sort of mass panic with withdrawal will take place somewhere else in EU – EU Central bank will give as much liquidity as situation will demand until calm down and restoring of confidence.

Currently I do not want even to touch the topic with launching domestic currency if bailout plan will fail. Even with best-case scenario it is not definitely known – will Cyprus banking system hold the mass outflow of assets that stands around 70B EUR and from that point of view – will 10B of EU help enough to stabilize overall situation? Hardly, I suppose, and actually what will happen after that has more interest for us.

Conversely, if there will be no bailout at all and banks will try stay closed longer – that could lead to mass and furious cyp-RIOTS as it was in Greece or even harder and odds of leaving EU will rise over 50%, as well as returning to Cyprus pound.

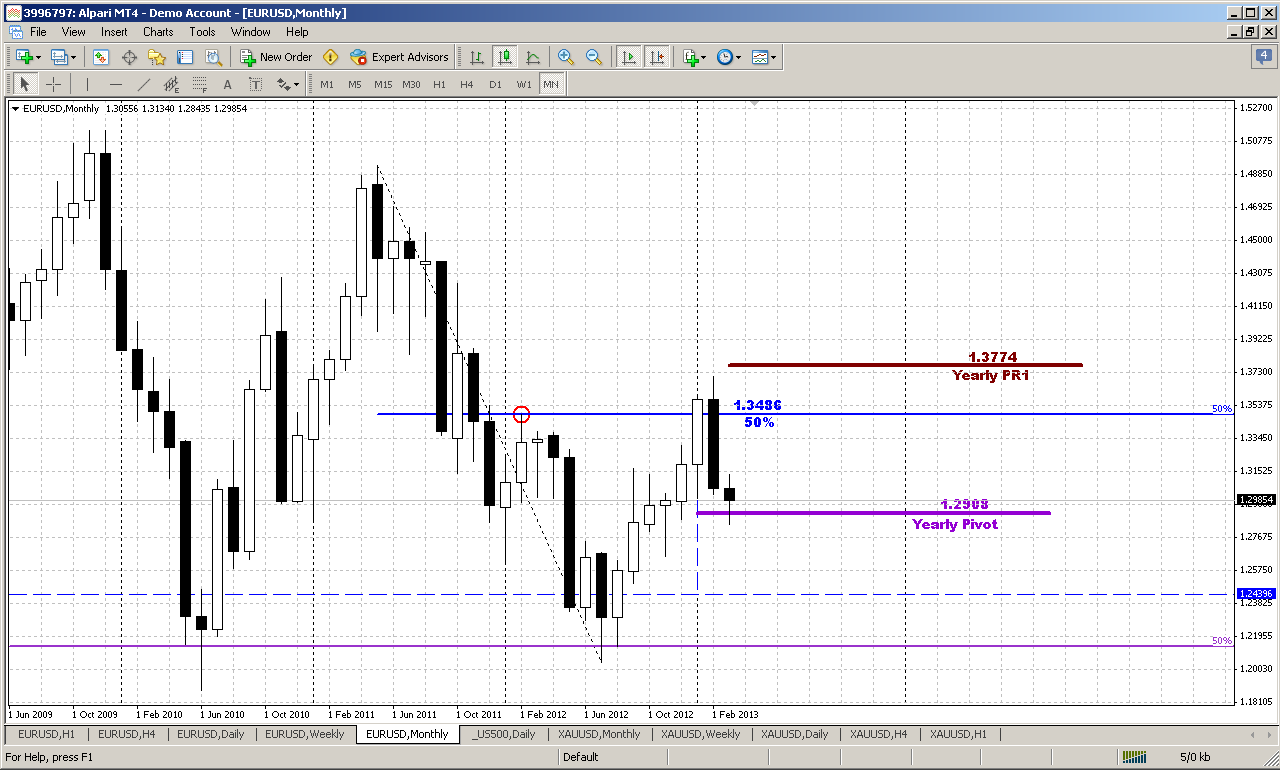

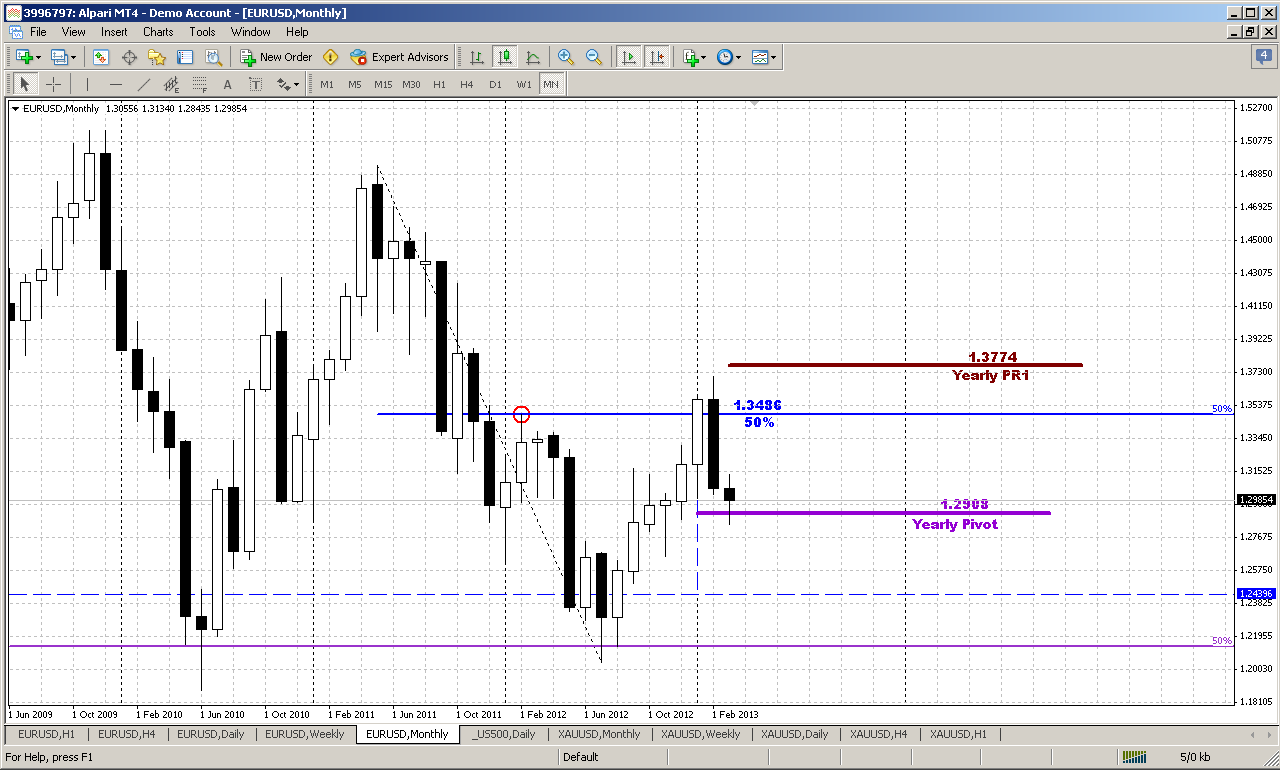

Monthly

Now we’re passing to technical picture, but guys, be careful with taking it as a guidance to trading on coming week. Better to miss the opportunity rather than lost the capital as Joe DiNapoli says. Anyway – be sensitive to news and fundamentals and pull the trigger when you’re absolutely sure – trade either before news or after them.

On monthly time frame we do not see any significant changes just yet. As we’ve noted on week before – market by February close has confirmed and finally formed bearish engulfing pattern right at major 50% resistance area. On previous week it has been triggered by close below engulfing low, at least nominally. It is important since technically this lets us to stick with this pattern and understand when we can speak about bullish or bearish trend. Thus, until market will not take 1.3730 high – it is difficult to tell about re-establishing of bullish trend here. The minimum target usually is a length of the bars and it points on 1.2450-1.25 area.

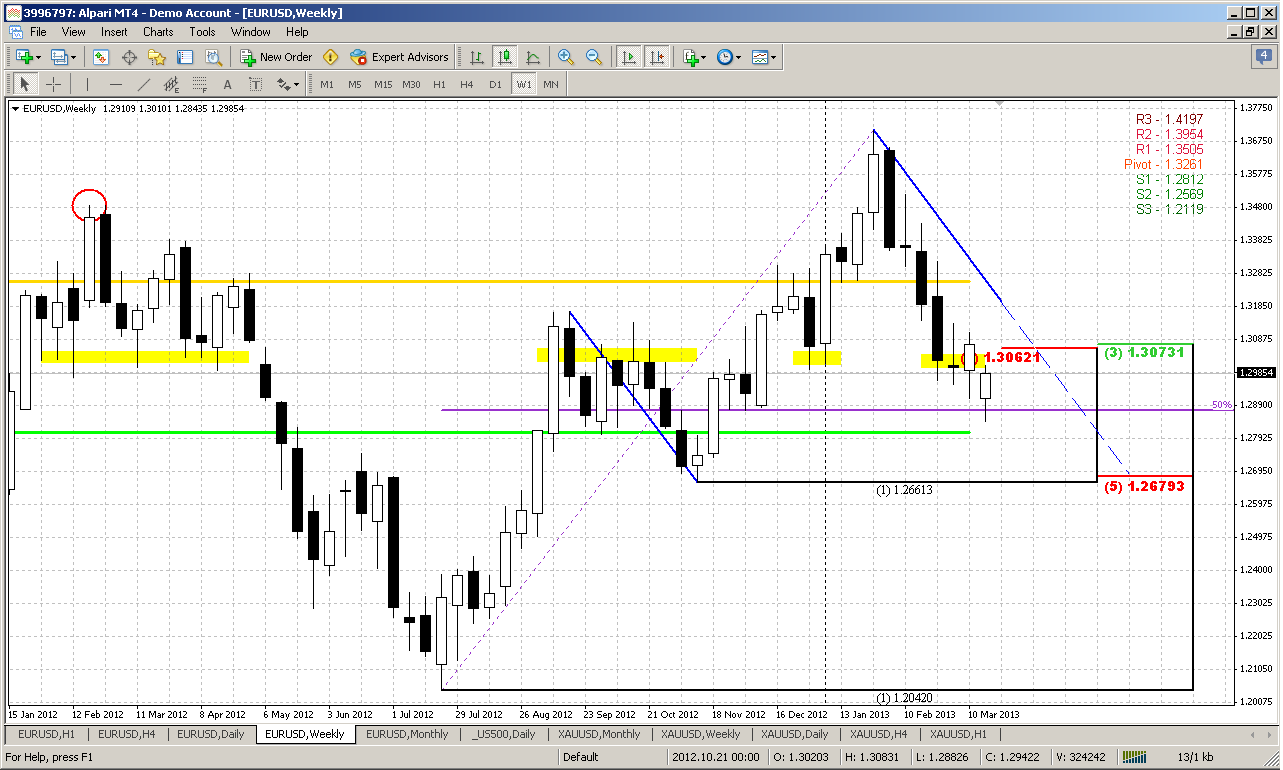

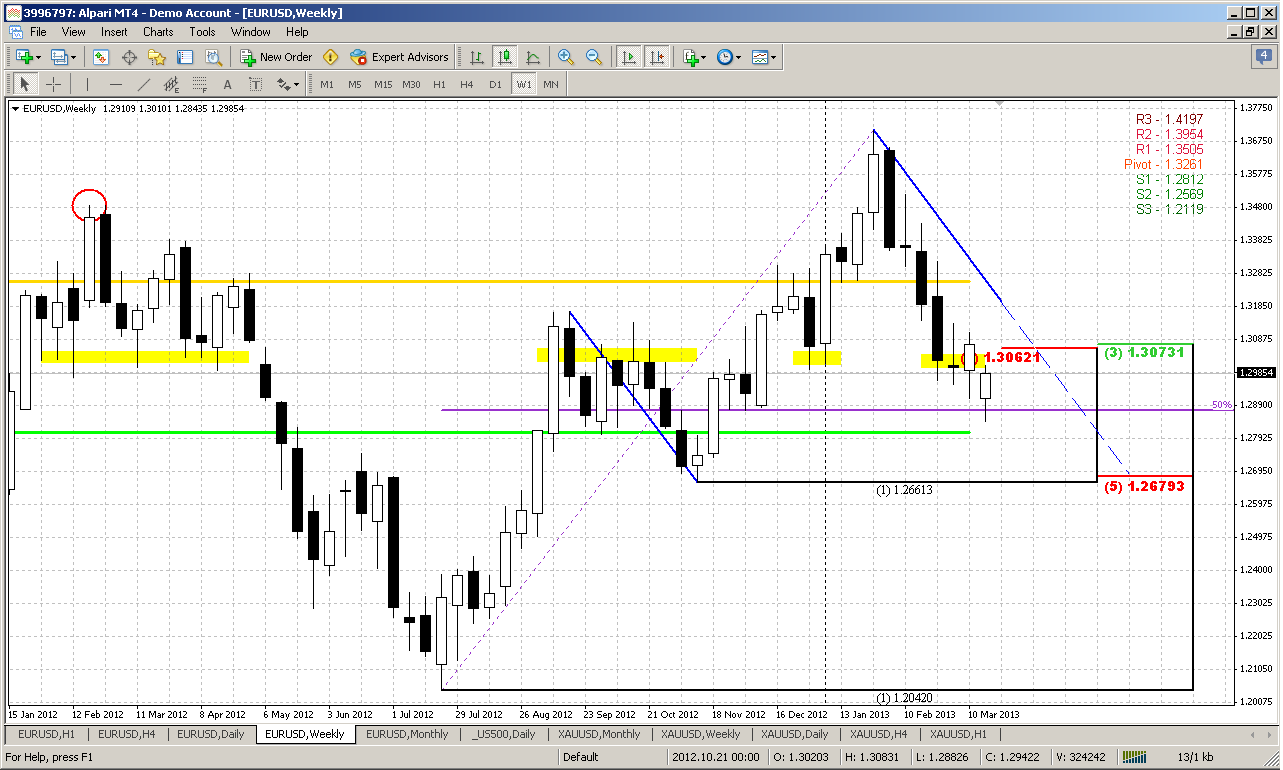

Weekly

Trend is bearish here, market is not at oversold. On previous week market has open with solid gap down, as you remember and it looks like K-support area has been broken. Price has touched major 50% support here that is also an area of 1.2908 Yearly Pivot Point. Also it is important that market has broken solid natural support/resistance area and not shows some kind of retesting of it.

Analysis of harmonic swings shows that current move down is much faster than previous one. And market has exceeded the length of harmonic swing down. As we’ve discussed many times, it is quite often when market doubles harmonic distance as it breaks it. That’s why, actually this swing calls as “harmonic”. Following to that logic – the destination here is major 5/8 support at oversold – 1.2680 area. This is stand rather close to the target of monthly engulfing pattern.

Despite how bearish overall action looks – now we have to keep in mind possible Cyprus surprises. Thus, there are some reasons for upward action also exist. First is untouched MPP, although there is just single week till the end of the month. Second is – monthly bearish engulfing pattern. In most cases market shows at minimum 3/8 retracement before starting to the target of the pattern. This could become “pain or gain” bet guys, because as announce on Cyprus will be made – this will be either big white or black candle and all our riddles will be resolved.

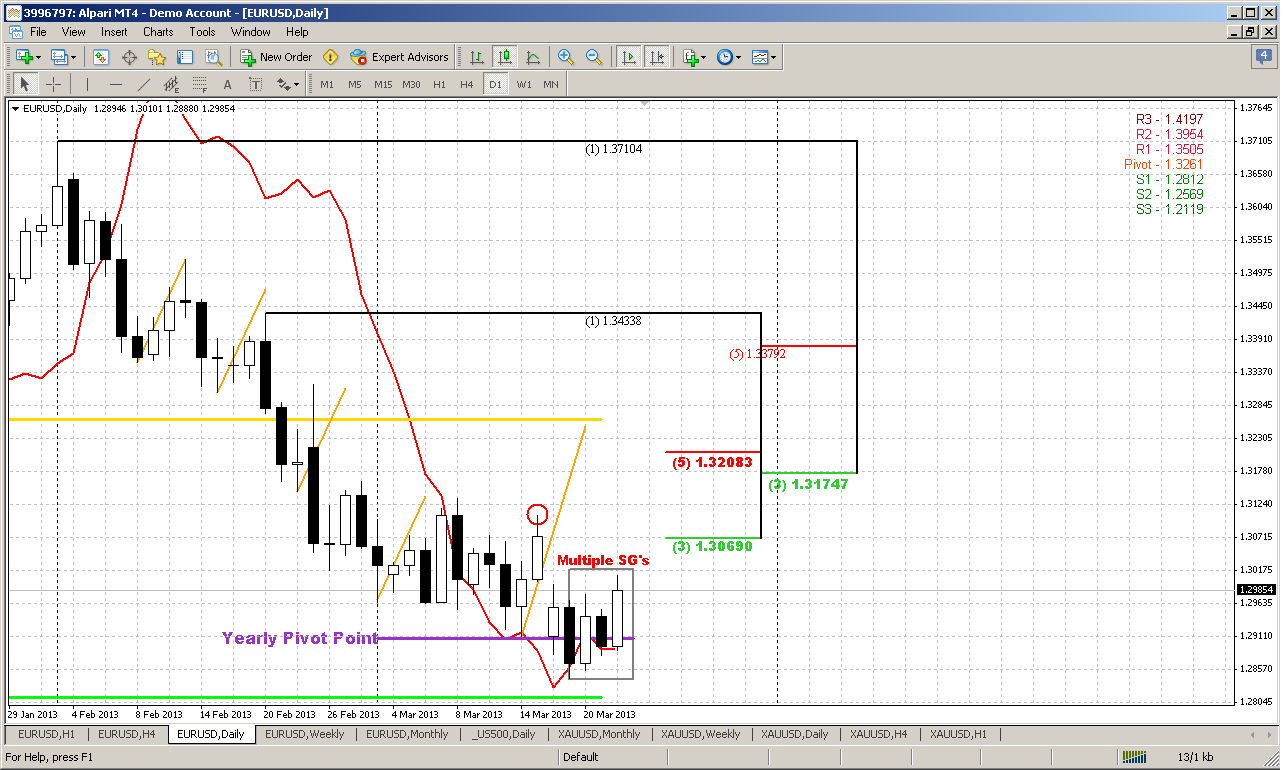

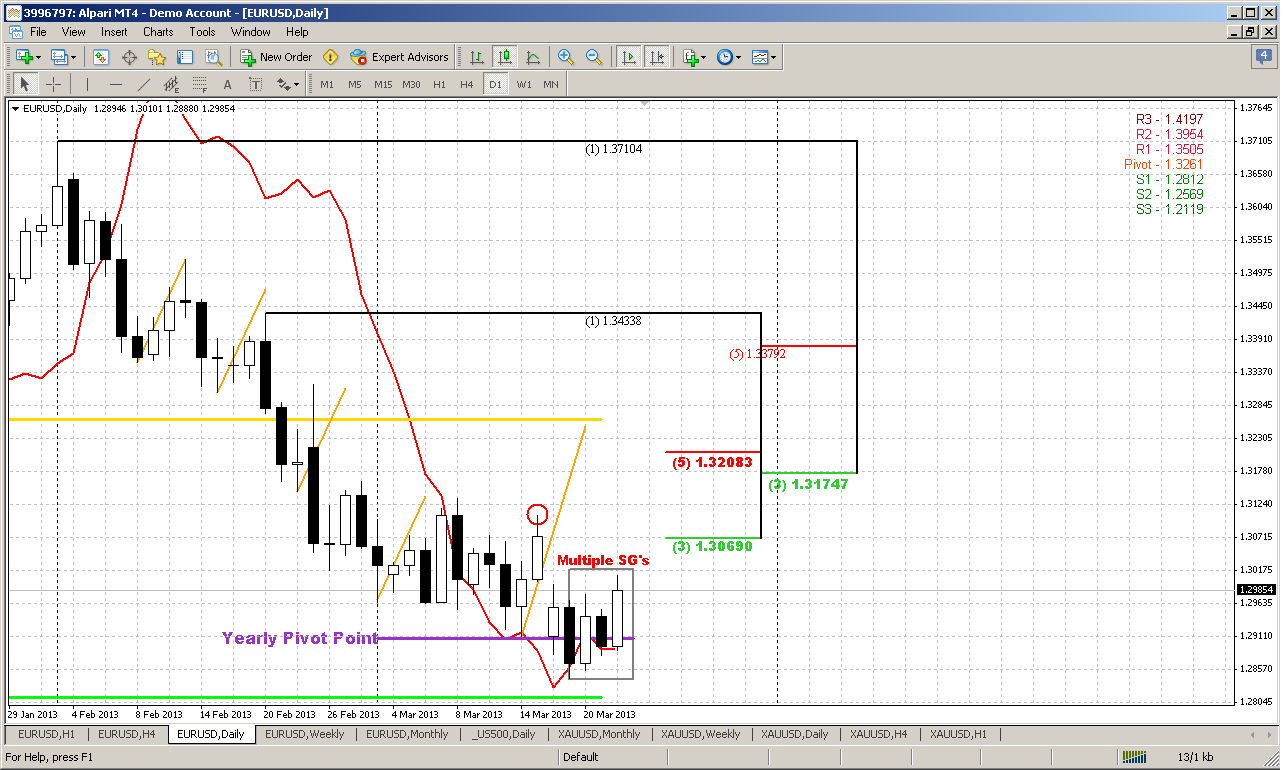

Daily

Daily is an interesting picture currently and not just because of stop grabbers. Trend is bullish and yes we have four side by side bullish stop grabbers that have the target in a red circle. Theoretically they have to lead market to this target. But – nearest 1.3069 Fib resistance is not just fib level. Take a look at former weekly chart – this is broken former K-support and natural strong support area that now will be a resistance. Will market reach 1.3175-1.3208 area - difficult to say.

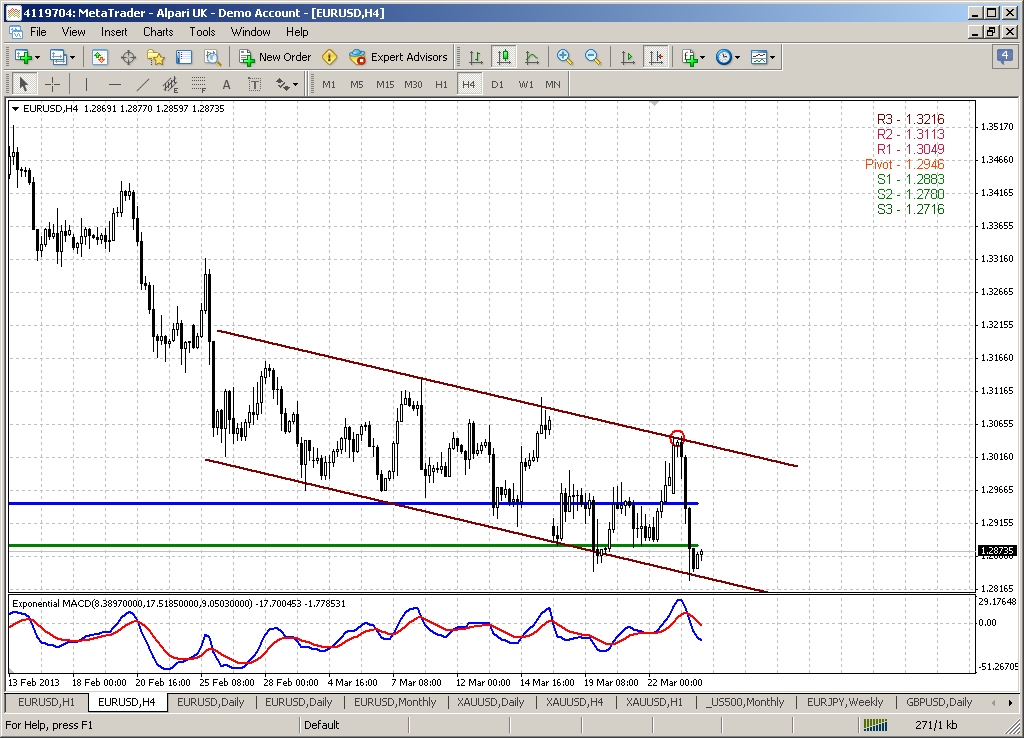

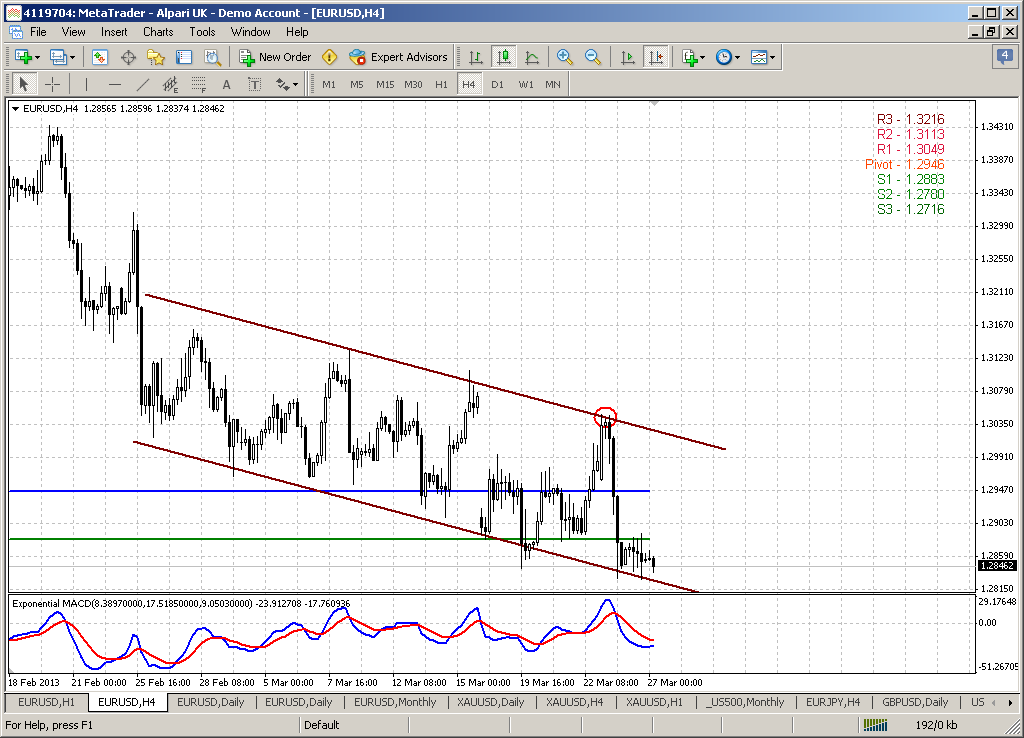

4-hour

Curious, bu here we see the same picture as on previous week with just another new low was made, but still inside of this channel. And this tells us the difference between possible conservative and aggressive tactics. The point is that whatever solutio will be taken on Cyprus – in medium term perspective this will be negative for EUR anyway. Hardly 10 Bln bailout will make EUR stronger to USD. Thus upward splash could be just a reaction on relatively positive news. So, conservative approach will be if you will not take a long position, because technically you can reason to take it only above 1.3108 high, but this will be very close to minimum target. Taking into consideration overall bearish sentiment it seems that better will be to wait reaching of resitsance and search for Short sell opportunities. Conversely – take short postion if market will show downward acceleration.

If you’re thrill-seeker (in a good sense) – technically you have the reason enter long, mostly due daily stop grabbers and pattern on hourly chart. May be you already have long position as we’ve discussed on Friday...

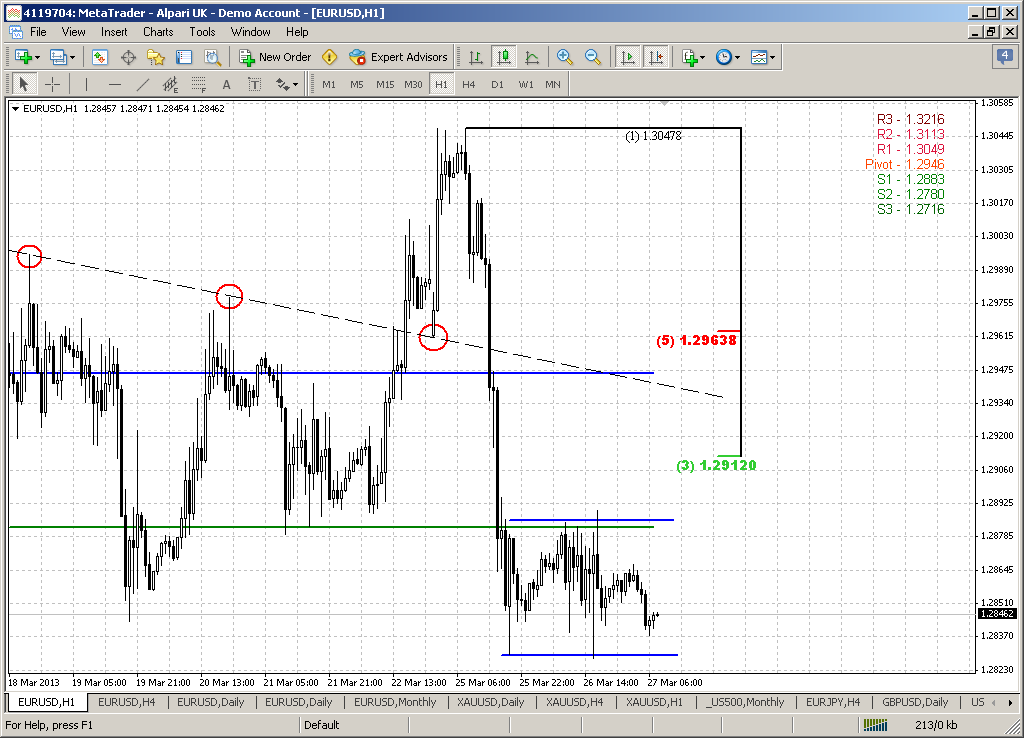

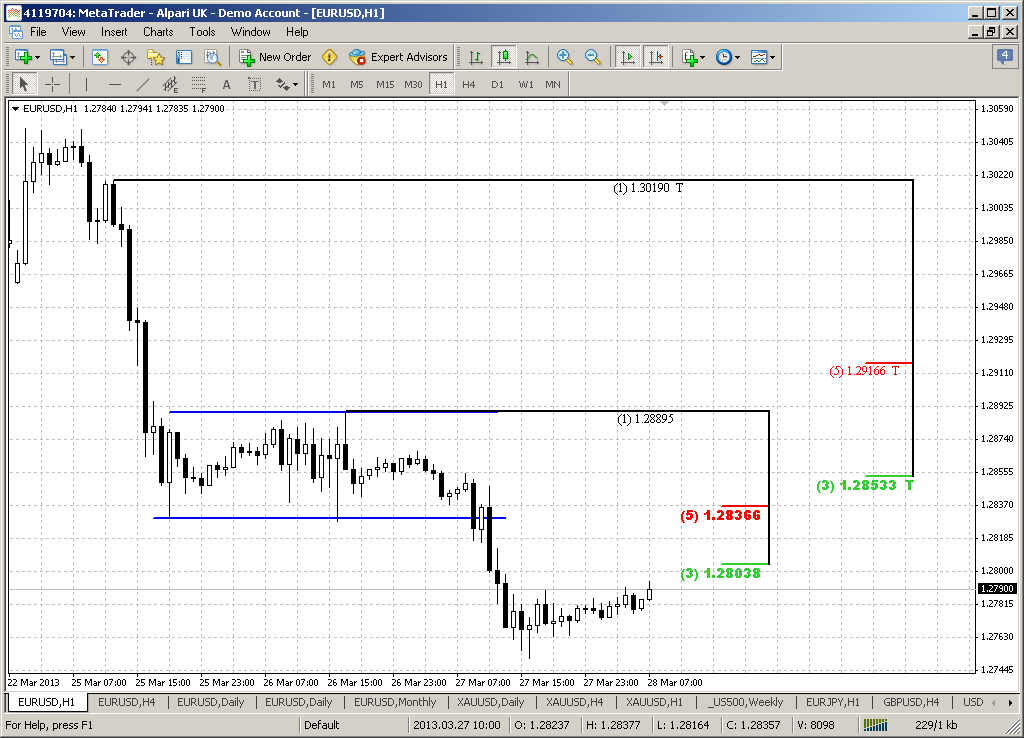

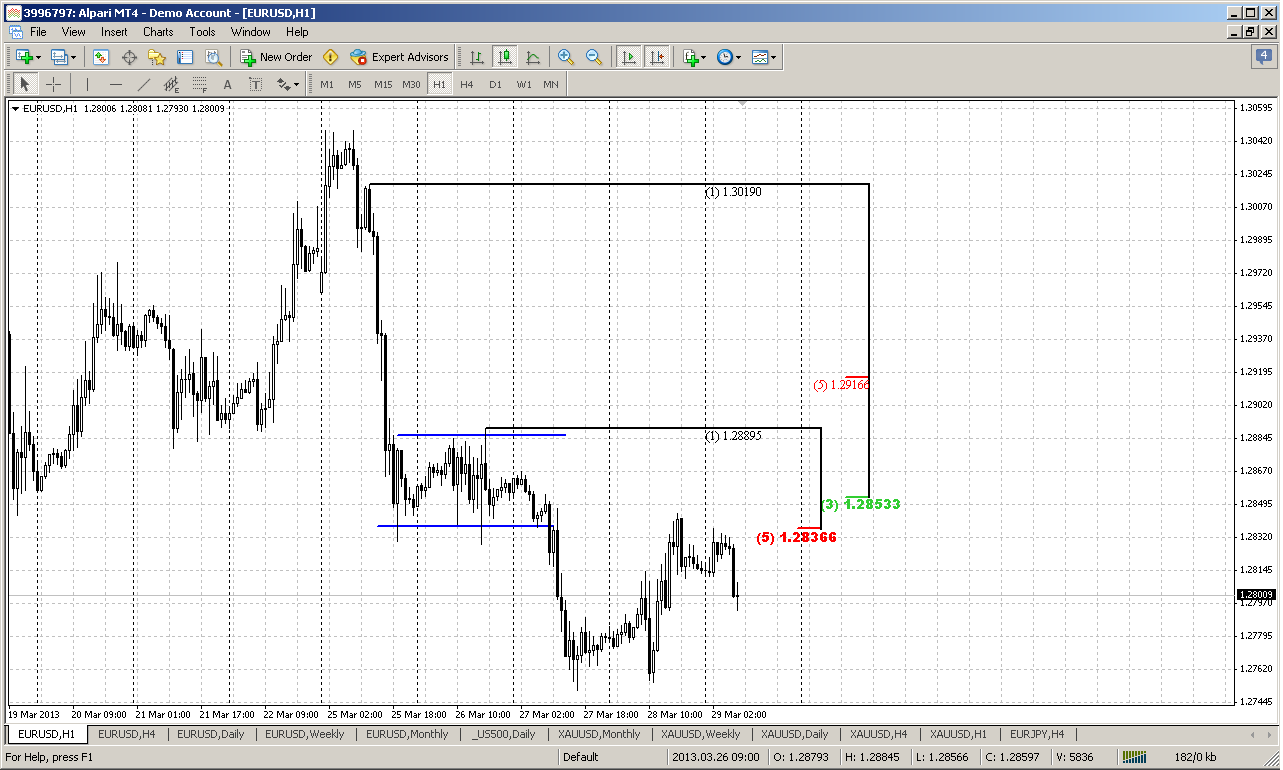

60-min

Although hourly chart has a pattern guys, it is not sufficient to justify and confirm the long entry with target above 1.3060-1.3080 area. The point is that whatever target from this reverse H&S pattern will take – it’s maximum target stands at 1.3080. Whether you will treat it as 1.618 AB-CD, 1.618 butterfly buy or as classical reverse H&S – the target will be 1.3070-1.3080. But as you can see – this is WPR1 and former strong support area that now will be a resistance. So, any positive news could lead market just to re-testing of former area but not to further upward action. From this standpoint – if you do not have long position and it doesn’t protected by breakeven stop loss (although it could be useless with gap opening) – it’s better sit on the hands and wait for enter oportunity with major trend.

Conclusion:

Long term picture is bearish, as well as trend and price action. Market now is driven by Cyprus turmoil. Although possibility for upward bounce has not been eliminated and market even shows nice bullish patterns – technically it is difficult to take long position that will be solidly justified and has acceptable risk/reward ratio. Since this possible bounce will be just retracement (at least should be) – it rises the question – is it worthy of this? That is a conservative approach. Active tactics suggests usual trading of patterns that we have now.

Finally – I want to remind you about EUR/JPY. There are two contradictive patterns there on weekly chart – confirmed DRPO “Sell” and bullish stop grabber. Speaking about DRPO – it has too low second top or we can say even that it has no second top. This subject was discussed ones on DiNapoli forum, and there was made a conclusion that this is probably not a DRPO, or LAL as maximum. So, be careful with it. If this will be really so and stop grabbers will work – we could get solid upward action there.

Guys, somehow I can't upload 4h chart, so add it as attachement.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

In the beginning of the research, let’s make some notes on Cyprus situation, since we’re very interested with it. To not dive in multiple scenarios, I will sub-divide them into two groups. First group depends on will be ECB bailout or not and second one – is what chances that Cyprus will leave EU.

1.Cyprus will get 10 Bln bailout. This is best-case scenario, but it has one problem – to get their own 5.8 Bln first and now there is now other chances as to return to the idea of tax on deposits. If Cyprus will get EU bailout, it will be able to stay with EU and liquidity inflow will be suggificient to compensate mass withdrawals that will follow anyway when banks will open. Besides, to deal with bankrupt country inside of EU will be much easier than with country outside of it. With this best-case scenario, deposits could start to return after first panic outflow, when confidence will start to restore gradually.

2. Second scenario if Cyprus will not get a bailout. This will be catastrophy for overall financial system, because government has now funds to satisfy possible withdrawals, even on insurance deposits below 100K EUR, although this is a legislative mere. Another negative moment here is that Cyprus probably will leave Eurozone in this case. Why is it possible, especially after Greece case? This could be explained by Cyprus economy structure. Cyprus has 8-times greater deposits than its GDP. Greece may be is a small part of total EU – just 2% of GDP, but Cyprus is 10-times smaller. Policymakers could think that this could become a one-off case, that would never be replicated elsewhere. If some sort of mass panic with withdrawal will take place somewhere else in EU – EU Central bank will give as much liquidity as situation will demand until calm down and restoring of confidence.

Currently I do not want even to touch the topic with launching domestic currency if bailout plan will fail. Even with best-case scenario it is not definitely known – will Cyprus banking system hold the mass outflow of assets that stands around 70B EUR and from that point of view – will 10B of EU help enough to stabilize overall situation? Hardly, I suppose, and actually what will happen after that has more interest for us.

Conversely, if there will be no bailout at all and banks will try stay closed longer – that could lead to mass and furious cyp-RIOTS as it was in Greece or even harder and odds of leaving EU will rise over 50%, as well as returning to Cyprus pound.

Monthly

Now we’re passing to technical picture, but guys, be careful with taking it as a guidance to trading on coming week. Better to miss the opportunity rather than lost the capital as Joe DiNapoli says. Anyway – be sensitive to news and fundamentals and pull the trigger when you’re absolutely sure – trade either before news or after them.

On monthly time frame we do not see any significant changes just yet. As we’ve noted on week before – market by February close has confirmed and finally formed bearish engulfing pattern right at major 50% resistance area. On previous week it has been triggered by close below engulfing low, at least nominally. It is important since technically this lets us to stick with this pattern and understand when we can speak about bullish or bearish trend. Thus, until market will not take 1.3730 high – it is difficult to tell about re-establishing of bullish trend here. The minimum target usually is a length of the bars and it points on 1.2450-1.25 area.

Weekly

Trend is bearish here, market is not at oversold. On previous week market has open with solid gap down, as you remember and it looks like K-support area has been broken. Price has touched major 50% support here that is also an area of 1.2908 Yearly Pivot Point. Also it is important that market has broken solid natural support/resistance area and not shows some kind of retesting of it.

Analysis of harmonic swings shows that current move down is much faster than previous one. And market has exceeded the length of harmonic swing down. As we’ve discussed many times, it is quite often when market doubles harmonic distance as it breaks it. That’s why, actually this swing calls as “harmonic”. Following to that logic – the destination here is major 5/8 support at oversold – 1.2680 area. This is stand rather close to the target of monthly engulfing pattern.

Despite how bearish overall action looks – now we have to keep in mind possible Cyprus surprises. Thus, there are some reasons for upward action also exist. First is untouched MPP, although there is just single week till the end of the month. Second is – monthly bearish engulfing pattern. In most cases market shows at minimum 3/8 retracement before starting to the target of the pattern. This could become “pain or gain” bet guys, because as announce on Cyprus will be made – this will be either big white or black candle and all our riddles will be resolved.

Daily

Daily is an interesting picture currently and not just because of stop grabbers. Trend is bullish and yes we have four side by side bullish stop grabbers that have the target in a red circle. Theoretically they have to lead market to this target. But – nearest 1.3069 Fib resistance is not just fib level. Take a look at former weekly chart – this is broken former K-support and natural strong support area that now will be a resistance. Will market reach 1.3175-1.3208 area - difficult to say.

4-hour

Curious, bu here we see the same picture as on previous week with just another new low was made, but still inside of this channel. And this tells us the difference between possible conservative and aggressive tactics. The point is that whatever solutio will be taken on Cyprus – in medium term perspective this will be negative for EUR anyway. Hardly 10 Bln bailout will make EUR stronger to USD. Thus upward splash could be just a reaction on relatively positive news. So, conservative approach will be if you will not take a long position, because technically you can reason to take it only above 1.3108 high, but this will be very close to minimum target. Taking into consideration overall bearish sentiment it seems that better will be to wait reaching of resitsance and search for Short sell opportunities. Conversely – take short postion if market will show downward acceleration.

If you’re thrill-seeker (in a good sense) – technically you have the reason enter long, mostly due daily stop grabbers and pattern on hourly chart. May be you already have long position as we’ve discussed on Friday...

60-min

Although hourly chart has a pattern guys, it is not sufficient to justify and confirm the long entry with target above 1.3060-1.3080 area. The point is that whatever target from this reverse H&S pattern will take – it’s maximum target stands at 1.3080. Whether you will treat it as 1.618 AB-CD, 1.618 butterfly buy or as classical reverse H&S – the target will be 1.3070-1.3080. But as you can see – this is WPR1 and former strong support area that now will be a resistance. So, any positive news could lead market just to re-testing of former area but not to further upward action. From this standpoint – if you do not have long position and it doesn’t protected by breakeven stop loss (although it could be useless with gap opening) – it’s better sit on the hands and wait for enter oportunity with major trend.

Conclusion:

Long term picture is bearish, as well as trend and price action. Market now is driven by Cyprus turmoil. Although possibility for upward bounce has not been eliminated and market even shows nice bullish patterns – technically it is difficult to take long position that will be solidly justified and has acceptable risk/reward ratio. Since this possible bounce will be just retracement (at least should be) – it rises the question – is it worthy of this? That is a conservative approach. Active tactics suggests usual trading of patterns that we have now.

Finally – I want to remind you about EUR/JPY. There are two contradictive patterns there on weekly chart – confirmed DRPO “Sell” and bullish stop grabber. Speaking about DRPO – it has too low second top or we can say even that it has no second top. This subject was discussed ones on DiNapoli forum, and there was made a conclusion that this is probably not a DRPO, or LAL as maximum. So, be careful with it. If this will be really so and stop grabbers will work – we could get solid upward action there.

Guys, somehow I can't upload 4h chart, so add it as attachement.

The technical portion of Sive's analysis owes a great deal to Joe DiNapoli's methods, and uses a number of Joe's proprietary indicators. Please note that Sive's analysis is his own view of the market and is not endorsed by Joe DiNapoli or any related companies.

Last edited: