IvanGlobalPrime

Company Representative

- Messages

- 36

Hi all,

Find my latest market thoughts (all charts in the link)

Also, find the recap in video format

Market Thoughts Sept 28: USD Strength Assisted By Italy, Month & Quarter-End Flows

Key Themes at Play in the Forex Market:

Find my latest market thoughts (all charts in the link)

Also, find the recap in video format

Market Thoughts Sept 28: USD Strength Assisted By Italy, Month & Quarter-End Flows

Key Themes at Play in the Forex Market:

- The market transitioned from the FOMC into its new focal point, the Italian budget deficit. From very early in the European session, a clear clash of views over the spending targets by the Italian coalition government led to a major sell-off in the Euro that lasted until the very last minutes of NY.

- It was this broad-based weakness in the shared-currency and assisted by other flow-related factors, that benefited the USD throughout as the top performer. In the Italian conundrum, the Deputy PM Di Maio eventually reported that the government had reached an agreement on a 2.4% deficit GDP target for 2019, confirming the disappointment by the market and well manifested through EUR price action.

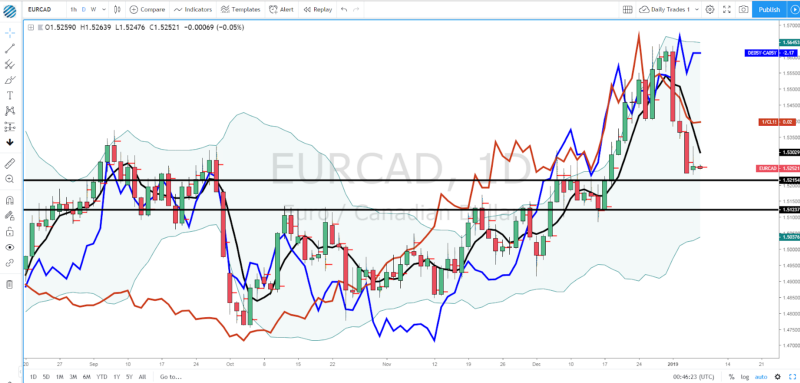

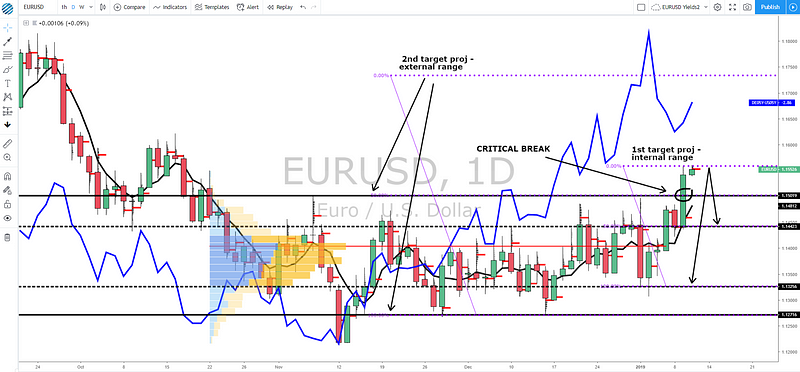

- A quick look at the currency pairs leave no ambiguity, the USD stormed back with tremendous strength, as reflected by the 120 pips sell-off in the EUR/USD. The Sterling followed suit and if 1.3050 now gives in, the cracks in the daily bullish structure will be evident. Meanwhile, USD/JPY printed a very commanding bullish outside day, negating the FOMC’s bearish reaction; note, this move is in line with the pick up by large specs to play longs as per the latest CoT data.The Aussie was inevitably dragged towards 0.72, as was the Kiwi down to 0.68, while surprisingly, the Swiss Franc, which continues to behave strongly correlated to the Euro, had a terrible day, and we see USD/CHF now testing the 100dma. The Canadian Dollar put up a fight against the USD, rejecting 1.3050. Despite the USD strength, Oil held firm above 72.00, which comes in stark contrast with the performance of Gold, hitting a one month low. Global equities saw gains on Thursday, as the Nikkei 225 breaks above 24k, the DAX 30 printed a bullish outside day and is now retesting the 100dma, while SP500 recovered the FOMC-led losses, up +0.3%.

- The moves in the USD today left me scratching my head, and I suppose this has to do with the juncture we found ourselves. The rolling into quarter and month-end led to a rebalancing of portfolios and when these readjustments occur, there is a risk for flows to play a role in market dynamics, leading to a temporary distortion of the usual behavior we are accustomed. Otherwise, the strength in the USD is hard to justify amid rising equities or the subdued performance by US bond yields.This is a time when foreign-denominated currency holders, the likes of banking institutions, must also hedge their exposure while in need to plan cash balance into year-end. This leads to lending being more restrictive (higher funding costs), resulting in cross-currency basis swaps to have an effect; this all underpins the USD too.

- The most powerful approach that as traders we can tap into is to seek congruence between the price action and fundamentals, only when we merge them together, we can gain more clarity and conviction. And I must say that judging by the performance of the Italian stocks on Thursday, with the MIB up by over 1.3%, along with the Italian bond yield up a mere 5bp to 2.87% from 2.85%, I think the Italian budget saga is soon going to become a sideshow that markets are going to look past. Remember, earlier this week, I also stressed how the market had spoken via higher Chinese equities or a jump in risk appetite despite the cancellation of trade talks between the US and China, implying that Chinese vs US trade war has become a secondary focus for now.

- There are many moving pieces, but I believe, the market is soon going to move away from the Italian budget impasse, as has done with China trade, and attention will quickly be moving back to fixed income, economic data, Brexit, and NAFTA to determine the next movements in capital flows and currency performances.

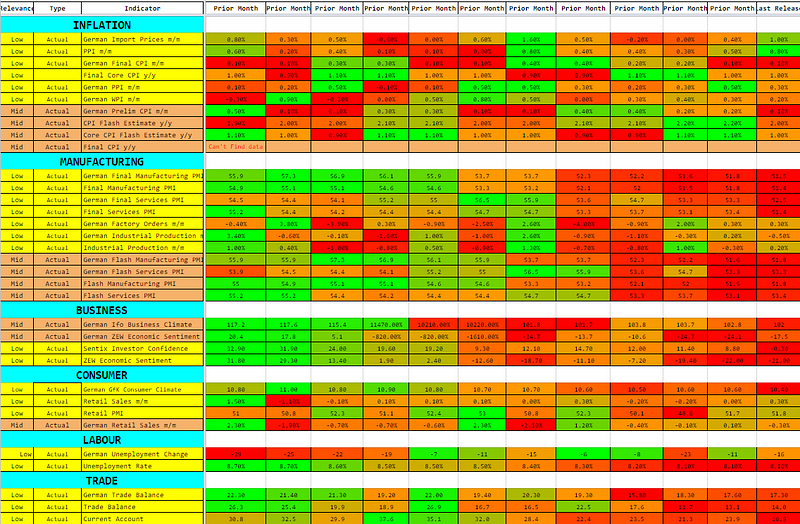

- In the data front, we saw some mixed data out of the US on Thursday. The US final GDP came unchanged at 4.2%, while US durable goods orders left a bitter/sweet taste, with the headline number at 4.5% vs 2% exp, while the core figures dropped to 0.1% vs 0.4%. Other second-tier data in the US gave traders reason for optimism, even if the US trade balance got deeper into the red, which is only going to worsen the rhetoric between the US and other trading partners. When it comes to Europe, the German CPI printed a strong number, coming at an annual reading of 2.3%, which will undoubtedly support the notion that the ECB is slowly but surely preparing the markets for an exit of its QE era and moving into a tightening phase mid-2019.

- On Brexit, there was an absence of fresh news in the negotiations. The fairly low volatility in the Sterling is a testament of that. The brinkmanship by UK and European politicians of trying to convince the other party about their own deal is a dangerous game currently at play. On Thursday, UK Foreign Minister Hunt reiterated that the chequers in the basis of any agreement, while EU’s Brexit negotiator Barnier keeps harping on the notion that they are still working with the goal in mind for an agreement with the UK to avoid a no deal.

- The NAFTA negotiations between the Canadians and the American went on another day without any breakthrough. A comment by the Canadian PM Trudeau that it’s still very possible to get a good and fair deal allowed the Canadian Dollar to perform better on Thursday. Looking at the big picture, the currency has been punished, especially this week, as the negotiations look set to drag on for weeks potentially. For now, the market has been discounting both countries to meet the deadline of Sept 30. The hints one gets from Trump’s random bluster is not the most promising, as he recently noted that Canada has treated the US very badly in trade, adding that they are not getting along at all with Canada’s trade negotiators.