Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,098

GBP/USD: the pound is trying to recover its positions 20.06.2022

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on GBP/USD for a better understanding of the current market situation and more efficient trading.

Current trend

The British pound is showing weak growth against the US currency, recovering from a significant decline last Friday. GBP/USD is testing 1.2250 for a breakout, waiting for new drivers to appear on the market.

Moderate support for quotes last week was provided by the results of the meeting of the Bank of England on the interest rate. Officials, following the US Federal Reserve, continued to actively tighten monetary policy in order to curb rapid inflation, which was caused by the limited labor market and pricing strategies of large national companies, as well as increasing global tensions against the backdrop of an escalation of the military conflict in Ukraine. The regulator adjusted its interest rate by another 25 basis points to 1.25% and made its fifth consecutive increase since December 2021, becoming the first major bank to be "hawkish" since the start of the coronavirus pandemic. It is worth noting that three members of the Committee voted for a more significant adjustment of the value by 0.50%, but in the end the votes were distributed in the same way as at the May meeting. At the same time, inflationary risks for the UK remain quite high, and economic growth rates are rapidly slowing down, threatening a full-fledged recession. Current forecasts suggest that UK GDP will contract in Q2 2022 by 0.3%, which is not much less than in May.

Investors are waiting for the publication of May statistics on the dynamics of consumer prices in the UK on Wednesday. Current forecasts suggest that inflation will slow down in the monthly terms from 2.5% to 1.9%, but accelerate YoY from 9% to a new record high of 9.1%.

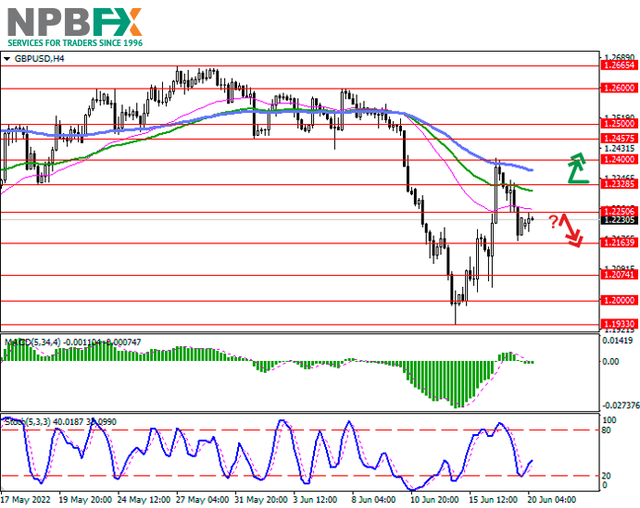

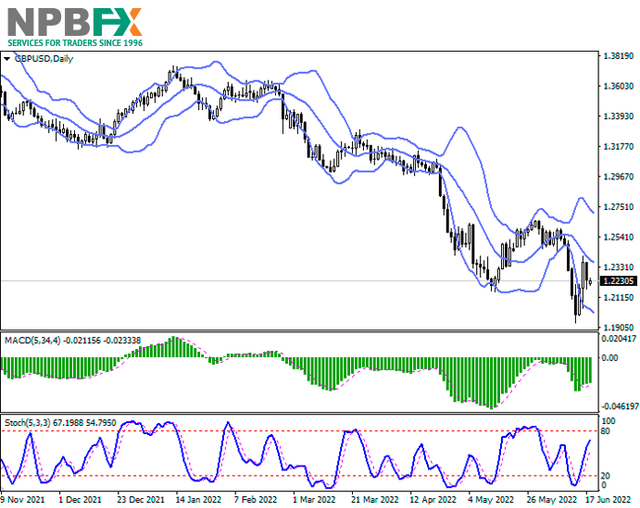

Support and resistance

Bollinger Bands in D1 chart demonstrate quite active decrease. The price range is almost unchanged, but it remains rather spacious for the current level of activity in the market. MACD is growing preserving a weak buy signal (located above the signal line). Stochastic keeps its upward direction but is rapidly approaching its highs, which reflects the risks of overbought GBP in the ultra-short term.

Resistance levels: 1.2250, 1.2328, 1.2400, 1.2457.

Support levels: 1.2163, 1.2074, 1.2000, 1.1933.

Trading tips

Long positions can be opened after a breakout of 1.2328 with the target of 1.2500. Stop-loss — 1.2250. Implementation time: 2-3 days.

A rebound from 1.2250 as from resistance, followed by a breakdown of 1.2163 may become a signal for opening of new short positions with the target at 1.2000. Stop-loss — 1.2250.

Use more opportunities of the NPBFX analytical portal: weekly FOREX forecast

You can learn more about the current situation on GBP/USD and get acquainted with the weekly analytical forecast in the "Video reviews" section on the NPBFX portal. Weekly video reviews contain trends, key levels, trading recommendations for such popular instruments as AUD/USD, EUR/USD, USD/CHF, USD/JPY. In order to get free and unlimited access to video forecast and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on GBP/USD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on GBP/USD for a better understanding of the current market situation and more efficient trading.

Current trend

The British pound is showing weak growth against the US currency, recovering from a significant decline last Friday. GBP/USD is testing 1.2250 for a breakout, waiting for new drivers to appear on the market.

Moderate support for quotes last week was provided by the results of the meeting of the Bank of England on the interest rate. Officials, following the US Federal Reserve, continued to actively tighten monetary policy in order to curb rapid inflation, which was caused by the limited labor market and pricing strategies of large national companies, as well as increasing global tensions against the backdrop of an escalation of the military conflict in Ukraine. The regulator adjusted its interest rate by another 25 basis points to 1.25% and made its fifth consecutive increase since December 2021, becoming the first major bank to be "hawkish" since the start of the coronavirus pandemic. It is worth noting that three members of the Committee voted for a more significant adjustment of the value by 0.50%, but in the end the votes were distributed in the same way as at the May meeting. At the same time, inflationary risks for the UK remain quite high, and economic growth rates are rapidly slowing down, threatening a full-fledged recession. Current forecasts suggest that UK GDP will contract in Q2 2022 by 0.3%, which is not much less than in May.

Investors are waiting for the publication of May statistics on the dynamics of consumer prices in the UK on Wednesday. Current forecasts suggest that inflation will slow down in the monthly terms from 2.5% to 1.9%, but accelerate YoY from 9% to a new record high of 9.1%.

Support and resistance

Bollinger Bands in D1 chart demonstrate quite active decrease. The price range is almost unchanged, but it remains rather spacious for the current level of activity in the market. MACD is growing preserving a weak buy signal (located above the signal line). Stochastic keeps its upward direction but is rapidly approaching its highs, which reflects the risks of overbought GBP in the ultra-short term.

Resistance levels: 1.2250, 1.2328, 1.2400, 1.2457.

Support levels: 1.2163, 1.2074, 1.2000, 1.1933.

Trading tips

Long positions can be opened after a breakout of 1.2328 with the target of 1.2500. Stop-loss — 1.2250. Implementation time: 2-3 days.

A rebound from 1.2250 as from resistance, followed by a breakdown of 1.2163 may become a signal for opening of new short positions with the target at 1.2000. Stop-loss — 1.2250.

Use more opportunities of the NPBFX analytical portal: weekly FOREX forecast

You can learn more about the current situation on GBP/USD and get acquainted with the weekly analytical forecast in the "Video reviews" section on the NPBFX portal. Weekly video reviews contain trends, key levels, trading recommendations for such popular instruments as AUD/USD, EUR/USD, USD/CHF, USD/JPY. In order to get free and unlimited access to video forecast and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on GBP/USD and trade efficiently with NPBFX.