Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,095

EUR/USD: the euro is trying to keep growing 07.11.2022

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on EUR/USD for a better understanding of the current market situation and more efficient trading.

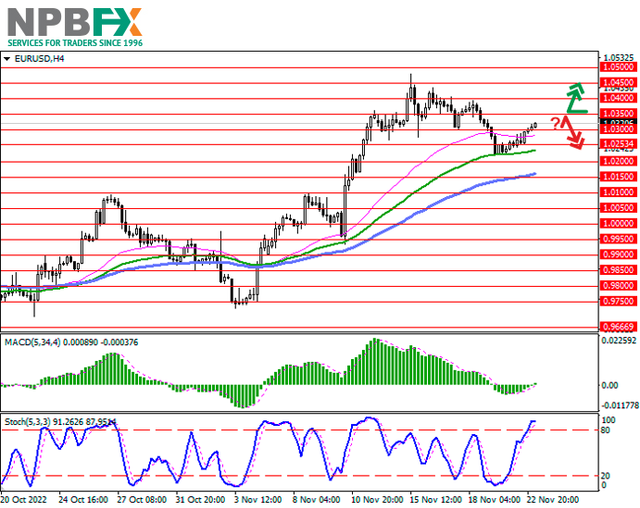

Current trend

The European currency shows a weak growth, developing a strong "bullish" signal formed at the end of last week. The EUR/USD pair is testing 0.9940 for a breakout, trying to update Friday's local highs.

The instrument is significantly supported by the report on the US labor market for October, which reflected the growth in the number of Nonfarm Payrolls by 261.0 thousand against the expected increase by 200.0 thousand, while the September figure was adjusted from 263.0 thousand to 315.0 thousand. At the same time, the report indicated an increase in the Unemployment Rate in October from 3.5% to 3.7%, while the forecast was 3.6%. Thus, given the relatively optimistic situation on the labor market, investors strengthened their confidence that in the near future the US Federal Reserve may slow down the pace of interest rate increases. At the same time, there is no need to talk about any pause in the cycle of adjustments to the value yet, which was clearly reported by the Chair of the regulator, Jerome Powell, the day before.

In turn, moderate support for the euro last Friday was provided by macroeconomic statistics from Europe on business activity in the services sector from S&P Global. In October, the Services PMI in the euro area increased from 48.2 points to 48.6 points with neutral forecasts, and the Composite PMI in the Manufacturing sector over the same period corrected from 47.1 points to 47.3 points.

Last week it became known that after Russia sent additional volumes of gas to a pipeline branch in Turkey, the official representative of the President of the country, Ibrahim Kalyn, said that European countries can receive "blue fuel" through the Turkish hub, and the country is ready to make such a proposal already in the near future, which can help the European industry, which is experiencing a significant shortage of energy. In September, the EU Producer Price Index rose by only 1.6%, which led to a slowdown in the annual rate to 41.9% from 43.3%, and in October an even greater decline is expected, which indicates increased pressure on the industrial sector.

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is narrowing from below, reflecting the mixed dynamics of trading in the short term. MACD has reversed to growth having formed a new buy signal (located above the signal line). Stochastic is showing similar dynamics; however, the indicator line is already approaching its highs, indicating the risks of overbought euro in the ultra-short term.

Resistance levels: 0.9950, 1.0000, 1.0050, 1.0100.

Support levels: 0.9900, 0.9850, 0.9800, 0.9750.

Trading tips

Long positions can be opened after a breakout of 0.9950 with the target of 1.0050. Stop-loss — 0.9900. Implementation time: 2-3 days.

A rebound from 0.9950 as from resistance, followed by a breakdown of 0.9900 may become a signal for opening of new short positions with the target at 0.9800. Stop-loss — 0.9950.

Use more opportunities of the NPBFX analytical portal: E-book

If you just recently started to be interested in trading on FOREX and would like to deepen your knowledge, an electronic Beginner's Guide to FOREX Trading will be an excellent helper for you here. The book consists of 5 chapters and reflects fundamental concepts of the foreign exchange market to start successful trading. From the main chapters of the E-book you can learn about the concepts and history of FOREX, currencies and trend lines, technical indicators, types of orders, trading on news, psychology of trading, risk management and much more.

You can read a Beginner's guide to FOREX Trading online or download it free of charge from the NPBFX analytical portal in the "Education" section. In order to get unlimited access to the E-book and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on EUR/USD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on EUR/USD for a better understanding of the current market situation and more efficient trading.

Current trend

The European currency shows a weak growth, developing a strong "bullish" signal formed at the end of last week. The EUR/USD pair is testing 0.9940 for a breakout, trying to update Friday's local highs.

The instrument is significantly supported by the report on the US labor market for October, which reflected the growth in the number of Nonfarm Payrolls by 261.0 thousand against the expected increase by 200.0 thousand, while the September figure was adjusted from 263.0 thousand to 315.0 thousand. At the same time, the report indicated an increase in the Unemployment Rate in October from 3.5% to 3.7%, while the forecast was 3.6%. Thus, given the relatively optimistic situation on the labor market, investors strengthened their confidence that in the near future the US Federal Reserve may slow down the pace of interest rate increases. At the same time, there is no need to talk about any pause in the cycle of adjustments to the value yet, which was clearly reported by the Chair of the regulator, Jerome Powell, the day before.

In turn, moderate support for the euro last Friday was provided by macroeconomic statistics from Europe on business activity in the services sector from S&P Global. In October, the Services PMI in the euro area increased from 48.2 points to 48.6 points with neutral forecasts, and the Composite PMI in the Manufacturing sector over the same period corrected from 47.1 points to 47.3 points.

Last week it became known that after Russia sent additional volumes of gas to a pipeline branch in Turkey, the official representative of the President of the country, Ibrahim Kalyn, said that European countries can receive "blue fuel" through the Turkish hub, and the country is ready to make such a proposal already in the near future, which can help the European industry, which is experiencing a significant shortage of energy. In September, the EU Producer Price Index rose by only 1.6%, which led to a slowdown in the annual rate to 41.9% from 43.3%, and in October an even greater decline is expected, which indicates increased pressure on the industrial sector.

Support and resistance

Bollinger Bands in D1 chart demonstrate flat dynamics. The price range is narrowing from below, reflecting the mixed dynamics of trading in the short term. MACD has reversed to growth having formed a new buy signal (located above the signal line). Stochastic is showing similar dynamics; however, the indicator line is already approaching its highs, indicating the risks of overbought euro in the ultra-short term.

Resistance levels: 0.9950, 1.0000, 1.0050, 1.0100.

Support levels: 0.9900, 0.9850, 0.9800, 0.9750.

Trading tips

Long positions can be opened after a breakout of 0.9950 with the target of 1.0050. Stop-loss — 0.9900. Implementation time: 2-3 days.

A rebound from 0.9950 as from resistance, followed by a breakdown of 0.9900 may become a signal for opening of new short positions with the target at 0.9800. Stop-loss — 0.9950.

Use more opportunities of the NPBFX analytical portal: E-book

If you just recently started to be interested in trading on FOREX and would like to deepen your knowledge, an electronic Beginner's Guide to FOREX Trading will be an excellent helper for you here. The book consists of 5 chapters and reflects fundamental concepts of the foreign exchange market to start successful trading. From the main chapters of the E-book you can learn about the concepts and history of FOREX, currencies and trend lines, technical indicators, types of orders, trading on news, psychology of trading, risk management and much more.

You can read a Beginner's guide to FOREX Trading online or download it free of charge from the NPBFX analytical portal in the "Education" section. In order to get unlimited access to the E-book and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on EUR/USD and trade efficiently with NPBFX.