Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,096

AUD/USD: the Australian dollar retreats from record lows 14.10.2022

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on AUD/USD for a better understanding of the current market situation and more efficient trading.

Current trend

The Australian dollar shows moderate growth, retreating from the record lows of April 2020, updated the day before, when AUD/USD fell to 0.6170. The instrument reacted to the publication of US data on inflation, which increased the likelihood of the US Federal Reserve continuing its policy of tightening monetary stimulus.

The Harmonized Consumer Price Index (excluding food and energy) in the US accelerated in September from 6.3% to 6.6%, ahead of forecasts at 6.5%. In turn, expectations for inflation in Australia in October, published by the Melbourne Institute, did not change compared to the previous month and amounted to 5.4%, while analysts expected growth to 5.8%.

The focus of investors today is statistics on inflation in China. The Consumer Price Index in annual terms in September rose by 2.8% after rising by 2.5% in the previous month, and in monthly terms added 0.3% after falling by 0.1%, while analysts expected growth by 0.4%. At the same time, the Producer Price Index for the same period slowed down from 2.3% to 0.9%, while the forecast was for an increase of 1.0%. China's monetary authorities are in no hurry to follow the general trend of raising interest rates, and such inflation statistics are likely to only strengthen the regulator's position in the near future.

The President of the World Bank, David Malpass, predicted a possible recession in the global economy as early as 2023 against the backdrop of a slowdown in developed countries and an increase in household debt burden due to the depreciation of national currencies. In addition, the agency predicts that about 7.0% or 570.0 million people will fall into extreme poverty (day spending does not exceed 2.15 dollars a day), noting that the coronavirus pandemic was a turning point that stopped a long period of reduction poverty, and the rapid pace of inflation and the escalation of the military conflict on the territory of Ukraine, which has become a catalyst for rising food prices, only aggravate the situation.

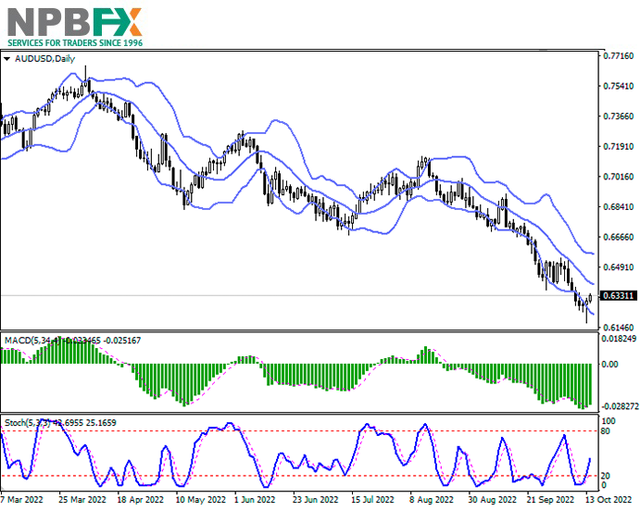

Support and resistance

Bollinger Bands in D1 chart demonstrate a moderate decrease. The price range is slightly narrowing, reflecting the ambiguous dynamics of trading in the short term. MACD has reversed to growth having formed a new buy signal (located above the signal line). Stochastic shows more active growth and is currently located approximately in the center of its area, signaling in favor of the development of corrective growth in the nearest time intervals.

Resistance levels: 0.6362, 0.6450, 0.6522, 0.6572.

Support levels: 0.6250, 0.6200, 0.6140, 0.6100.

Trading tips

Long positions can be opened after a breakout of 0.6362 with the target of 0.6522. Stop-loss — 0.6280. Implementation time: 2-3 days.

A rebound from 0.6362 as from resistance, followed by a breakdown of 0.6250 may become a signal for opening of new short positions with the target at 0.6140. Stop-loss — 0.6310.

Use more opportunities of the NPBFX analytical portal: weekly FOREX forecast

You can learn more about the current situation on Apple Inc. and get acquainted with the weekly analytical forecast in the "Video reviews" section on the NPBFX portal. Weekly video reviews contain trends, key levels, trading recommendations for such popular instruments as GBP/USD, EUR/USD, USD/CHF, USD/JPY. In order to get free and unlimited access to video forecast and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on AUD/USD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on AUD/USD for a better understanding of the current market situation and more efficient trading.

Current trend

The Australian dollar shows moderate growth, retreating from the record lows of April 2020, updated the day before, when AUD/USD fell to 0.6170. The instrument reacted to the publication of US data on inflation, which increased the likelihood of the US Federal Reserve continuing its policy of tightening monetary stimulus.

The Harmonized Consumer Price Index (excluding food and energy) in the US accelerated in September from 6.3% to 6.6%, ahead of forecasts at 6.5%. In turn, expectations for inflation in Australia in October, published by the Melbourne Institute, did not change compared to the previous month and amounted to 5.4%, while analysts expected growth to 5.8%.

The focus of investors today is statistics on inflation in China. The Consumer Price Index in annual terms in September rose by 2.8% after rising by 2.5% in the previous month, and in monthly terms added 0.3% after falling by 0.1%, while analysts expected growth by 0.4%. At the same time, the Producer Price Index for the same period slowed down from 2.3% to 0.9%, while the forecast was for an increase of 1.0%. China's monetary authorities are in no hurry to follow the general trend of raising interest rates, and such inflation statistics are likely to only strengthen the regulator's position in the near future.

The President of the World Bank, David Malpass, predicted a possible recession in the global economy as early as 2023 against the backdrop of a slowdown in developed countries and an increase in household debt burden due to the depreciation of national currencies. In addition, the agency predicts that about 7.0% or 570.0 million people will fall into extreme poverty (day spending does not exceed 2.15 dollars a day), noting that the coronavirus pandemic was a turning point that stopped a long period of reduction poverty, and the rapid pace of inflation and the escalation of the military conflict on the territory of Ukraine, which has become a catalyst for rising food prices, only aggravate the situation.

Support and resistance

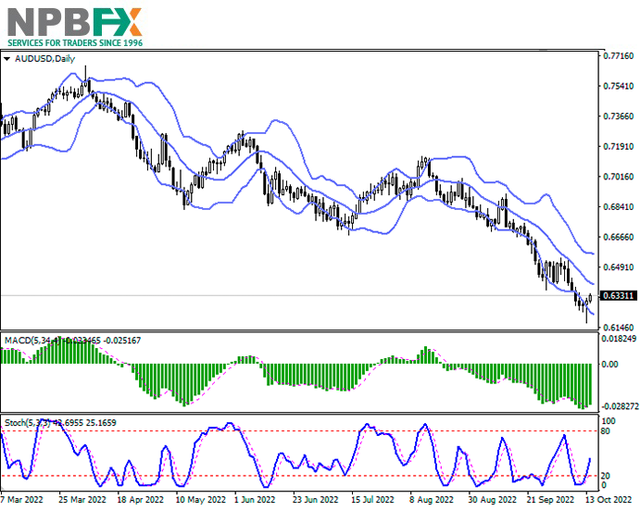

Bollinger Bands in D1 chart demonstrate a moderate decrease. The price range is slightly narrowing, reflecting the ambiguous dynamics of trading in the short term. MACD has reversed to growth having formed a new buy signal (located above the signal line). Stochastic shows more active growth and is currently located approximately in the center of its area, signaling in favor of the development of corrective growth in the nearest time intervals.

Resistance levels: 0.6362, 0.6450, 0.6522, 0.6572.

Support levels: 0.6250, 0.6200, 0.6140, 0.6100.

Trading tips

Long positions can be opened after a breakout of 0.6362 with the target of 0.6522. Stop-loss — 0.6280. Implementation time: 2-3 days.

A rebound from 0.6362 as from resistance, followed by a breakdown of 0.6250 may become a signal for opening of new short positions with the target at 0.6140. Stop-loss — 0.6310.

Use more opportunities of the NPBFX analytical portal: weekly FOREX forecast

You can learn more about the current situation on Apple Inc. and get acquainted with the weekly analytical forecast in the "Video reviews" section on the NPBFX portal. Weekly video reviews contain trends, key levels, trading recommendations for such popular instruments as GBP/USD, EUR/USD, USD/CHF, USD/JPY. In order to get free and unlimited access to video forecast and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on AUD/USD and trade efficiently with NPBFX.