Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,098

AUD/USD: the instrument is consolidating near 0.6650 27.03.2023

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on AUD/USD for a better understanding of the current market situation and more efficient trading.

Current trend

The AUD/USD pair shows a slight increase, trading around 0.6654. Last Friday, the instrument showed a rather active decline, returning to the previous local lows of March 16, and the reason for the appearance of corrective dynamics in the US currency was the March macroeconomic statistics on business activity in the US manufacturing and services sectors. In addition, the technical factors of fixing long positions in the asset played in favor of the American dollar.

In turn, the macroeconomic statistics on Australian business activity indices turned out to be weak. The Services PMI from Commonwealth Bank in March adjusted from 50.7 points to 48.2 points, while analysts expected a decrease to 49.9 points, the Manufacturing PMI corrected from 50.5 points to 48.7 points with a forecast of deceleration to 50.3 points, and the Composite PMI declined from 50.6 points to 48.1 points. On Tuesday, investors will evaluate the February data on the dynamics of Retail Sales, assuming a possible slowdown in the figure from 1.9% to 0.4%. Also on this day, Luci Ellis, the chief economic advisor to the Governor of the Reserve Bank of Australia (RBA), will make a speech.

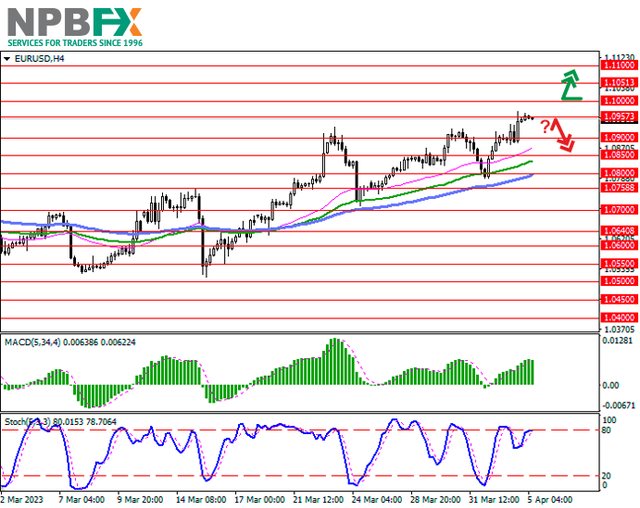

Support and resistance

Bollinger Bands on the daily chart show flat dynamics. The price range is narrowing, reflecting mixed trading in the short term. MACD reversed downwards having formed a weak sell signal (located below the signal line). Stochastic shows a more confident decline, but at the moment it is rapidly approaching its lows, indicating risks of the British currency being oversold in the near future.

Resistance levels: 0.6650, 0.6700, 0.6750, 0.6800.

Support levels: 0.6624, 0.6600, 0.6563, 0.6500.

Trading tips

Long positions can be opened after a breakout of 0.6650 with the target of 0.6750. Stop-loss — 0.6600. Implementation time: 2-3 days.

A rebound from 0.6650 as from resistance, followed by a breakdown of 0.6624 may become a signal for opening of new short positions with the target at 0.6563. Stop-loss — 0.6660.

Use more opportunities of the NPBFX analytical portal: analytics

You can find more actual analytical reviews on other popular currency pairs, metals and CFDs on the NPBFX online portal. Daily analytics with charts, current market prognoses and trading scenarios in the Feed section are available. Get free and unlimited access to the online portal after registering on the official website of NPBFX Company.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on AUD/USD and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on AUD/USD for a better understanding of the current market situation and more efficient trading.

Current trend

The AUD/USD pair shows a slight increase, trading around 0.6654. Last Friday, the instrument showed a rather active decline, returning to the previous local lows of March 16, and the reason for the appearance of corrective dynamics in the US currency was the March macroeconomic statistics on business activity in the US manufacturing and services sectors. In addition, the technical factors of fixing long positions in the asset played in favor of the American dollar.

In turn, the macroeconomic statistics on Australian business activity indices turned out to be weak. The Services PMI from Commonwealth Bank in March adjusted from 50.7 points to 48.2 points, while analysts expected a decrease to 49.9 points, the Manufacturing PMI corrected from 50.5 points to 48.7 points with a forecast of deceleration to 50.3 points, and the Composite PMI declined from 50.6 points to 48.1 points. On Tuesday, investors will evaluate the February data on the dynamics of Retail Sales, assuming a possible slowdown in the figure from 1.9% to 0.4%. Also on this day, Luci Ellis, the chief economic advisor to the Governor of the Reserve Bank of Australia (RBA), will make a speech.

Support and resistance

Bollinger Bands on the daily chart show flat dynamics. The price range is narrowing, reflecting mixed trading in the short term. MACD reversed downwards having formed a weak sell signal (located below the signal line). Stochastic shows a more confident decline, but at the moment it is rapidly approaching its lows, indicating risks of the British currency being oversold in the near future.

Resistance levels: 0.6650, 0.6700, 0.6750, 0.6800.

Support levels: 0.6624, 0.6600, 0.6563, 0.6500.

Trading tips

Long positions can be opened after a breakout of 0.6650 with the target of 0.6750. Stop-loss — 0.6600. Implementation time: 2-3 days.

A rebound from 0.6650 as from resistance, followed by a breakdown of 0.6624 may become a signal for opening of new short positions with the target at 0.6563. Stop-loss — 0.6660.

Use more opportunities of the NPBFX analytical portal: analytics

You can find more actual analytical reviews on other popular currency pairs, metals and CFDs on the NPBFX online portal. Daily analytics with charts, current market prognoses and trading scenarios in the Feed section are available. Get free and unlimited access to the online portal after registering on the official website of NPBFX Company.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on AUD/USD and trade efficiently with NPBFX.