Antony_NPBFX

NPBFX Representative (unconfirmed)

- Messages

- 1,099

Cisco Systems Inc.: technical analysis 19.04.2023

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on Cisco Systems Inc. for a better understanding of the current market situation and more efficient trading.

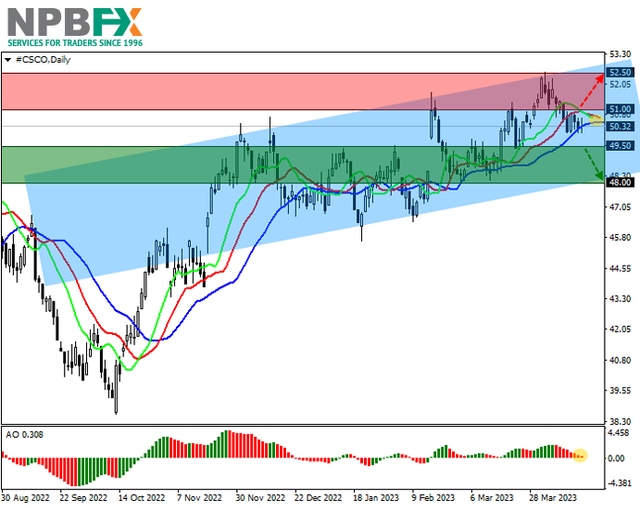

Shares of Cisco Systems Inc., an American manufacturer and supplier of network equipment for large holdings and telecommunications companies, are correcting at 50.32.

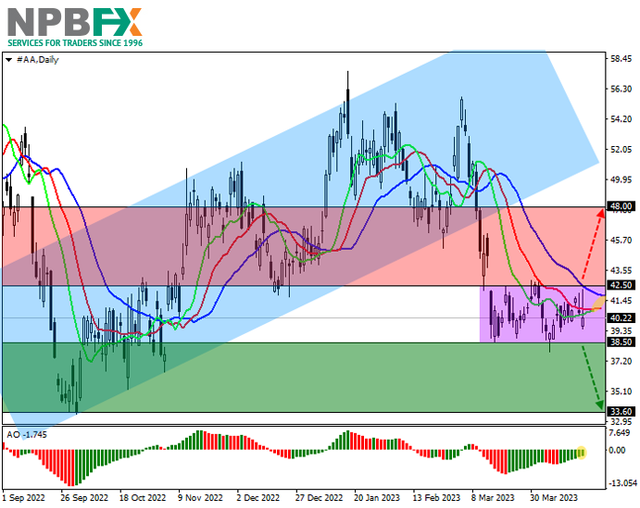

On the daily chart, the price is forming a downward wave within the global ascending channel with dynamic boundaries 48.00–53.00.

On the four-hour chart, it is clear that the downside potential may increase, as the quotes are approaching the local low of 49.50, which is the only obstacle for the “bears”. The probability of growth will increase if the asset consolidates above the local maximum at 52.00.

Technical indicators are ready to give a sell signal: fast EMAs on the Alligator indicator are approaching the signal line, and the AO histogram is forming corrective bars, reaching the transition level.

Trading tips

Short positions may be opened after the price drops and consolidates below 49.50 with the target at 48.00. Stop loss – 50.50. Implementation period: 7 days or more.

Long positions may be opened after a reversal, growth, and consolidation of the price above 51.00 with the target at 52.50. Stop loss – 50.50.

Use more opportunities of the NPBFX analytical portal: E-book

If you just recently started to be interested in trading on FOREX and would like to deepen your knowledge, an electronic Beginner's Guide to FOREX Trading will be an excellent helper for you here. The book consists of 5 chapters and reflects fundamental concepts of the foreign exchange market to start successful trading. From the main chapters of the E-book you can learn about the concepts and history of FOREX, currencies and trend lines, technical indicators, types of orders, trading on news, psychology of trading, risk management and much more.

You can read a Beginner's guide to FOREX Trading online or download it free of charge from the NPBFX analytical portal in the "Education" section. In order to get unlimited access to the E-book and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on Cisco Systems Inc. and trade efficiently with NPBFX.

Good afternoon, dear forum visitors!

NPBFX offers the latest release of analytics on Cisco Systems Inc. for a better understanding of the current market situation and more efficient trading.

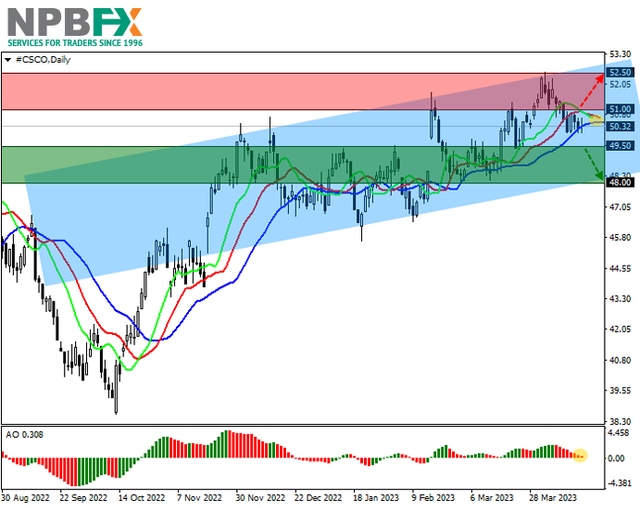

Shares of Cisco Systems Inc., an American manufacturer and supplier of network equipment for large holdings and telecommunications companies, are correcting at 50.32.

On the daily chart, the price is forming a downward wave within the global ascending channel with dynamic boundaries 48.00–53.00.

On the four-hour chart, it is clear that the downside potential may increase, as the quotes are approaching the local low of 49.50, which is the only obstacle for the “bears”. The probability of growth will increase if the asset consolidates above the local maximum at 52.00.

Technical indicators are ready to give a sell signal: fast EMAs on the Alligator indicator are approaching the signal line, and the AO histogram is forming corrective bars, reaching the transition level.

Trading tips

Short positions may be opened after the price drops and consolidates below 49.50 with the target at 48.00. Stop loss – 50.50. Implementation period: 7 days or more.

Long positions may be opened after a reversal, growth, and consolidation of the price above 51.00 with the target at 52.50. Stop loss – 50.50.

Use more opportunities of the NPBFX analytical portal: E-book

If you just recently started to be interested in trading on FOREX and would like to deepen your knowledge, an electronic Beginner's Guide to FOREX Trading will be an excellent helper for you here. The book consists of 5 chapters and reflects fundamental concepts of the foreign exchange market to start successful trading. From the main chapters of the E-book you can learn about the concepts and history of FOREX, currencies and trend lines, technical indicators, types of orders, trading on news, psychology of trading, risk management and much more.

You can read a Beginner's guide to FOREX Trading online or download it free of charge from the NPBFX analytical portal in the "Education" section. In order to get unlimited access to the E-book and other useful instruments on the portal, you need to register on the NPBFX website.

If you have any questions about trading instruments, you can always ask an analyst in the online chat on the portal and get a free consultation of an experienced specialist.

Use the current recommendations of analysts on Cisco Systems Inc. and trade efficiently with NPBFX.