Key Releases

United States of America

The US currency is strengthening against the yen today and has ambiguous dynamics paired with the euro and the pound.

Investors are waiting for today's speech by the head of the US Fed Jerome Powell in front of the Committee on Banking, Housing and Urban Affairs of the US Senate. It is expected that before approving his candidacy for the post of head of the US regulator for a new four-year term, Powell will answer questions from Senators who will be interested in the measures taken by the US Fed to combat high inflation. Thus, Powell can clarify the further steps of the regulator in the field of monetary policy. Currently, it is believed that the beginning of the rate hike may begin as early as March, and not in the summer or at the end of the year, as previously thought. Moreover, Goldman Sachs experts expect four increases at once during the year. In general, Powell's comments can cause a significant market movement.

Eurozone

The European currency is strengthening against the yen today and has ambiguous dynamics paired with the USD and the pound.

In the absence of significant economic releases, the attention of European investors is focused on the comments of representatives of the European Central Bank regarding the high inflationary pressure on the European economy. It should be recalled that in December, the consumer price index in the eurozone countries increased by a record 5.0%. Today, the head of the regulator, Christine Lagarde, said that she understands the concerns of citizens about high prices, and confirmed that they can trust the ECB in solving this problem. According to her, the bank stands for price stability, which is crucial for fixing inflation expectations and confidence in the currency. ECB Chief Economist Philip Lane said the ECB still does not expect inflation to exceed the 2.0% target in the medium term. The new governor of the German Bundesbank, Joachim Nagel, noted that the price increase may continue longer than expected. In general, European officials have not yet specified new ways to combat inflationary pressure.

United Kingdom

The British currency is strengthening against the yen today and has ambiguous dynamics paired with the USD and the euro.

December retail sales data from the British Retail Consortium (BRC) was published today. On an annualized basis, sales increased by 0.6%, which is better than market expectations (0.3%), but worse than the November growth of 1.8%. In general, BRC specialists are skeptical. They believe that retail trade will face significant pressure this year, as consumer spending will be restrained by rising inflation, an increase in energy bills and a tax increase coming in April. It should be noted that the British government is trying to mitigate inflationary pressure on the economy. Thus, The Times newspaper reported that the Ministry of Finance of the United Kingdom is considering the possibility of reducing the "green levy", which is levied on electricity consumption, in order to slow down the increase in prices in the energy market.

Japan

The Japanese currency is weakening today against its main competitors - the pound, the USD and the euro.

The focus of investors' attention remains the epidemiological situation in the country, which continues to be difficult. Prime Minister Fumio Kishida said today that the government will maintain the current strict restrictions on entry into the country until the end of February, although a number of exceptions may be made for humanitarian reasons. Currently, Japan has one of the strictest border regimes in the world, which prohibits residents from entering the country without Japanese citizenship, including foreign members of Japanese families and people permanently living in Japan. It is believed that this measure slows down the spread of the COVID-19 Omicron strain in the country. It also should be noted that according to the quarterly survey of the Bank of Japan, inflation expectations of Japanese households have risen to a two-year high. 78.8% of respondents expect prices to rise during the year, which gives investors hope that the Japanese regulator will still be able to push the inflation rate to the target level of 2.0%.

Australia

The Australian currency is weakening against the euro, the pound and the USD today, but is strengthening against the yen.

Australian economic data released today turned out to be controversial. Retail sales in November accelerated growth from 4.9% to 7.3%, which is higher than the 3.9% expected by investors. However, the positive effect of these data was offset by weak trade statistics. The volume of exports of Australian goods in November increased by 2.0%, and imports into the country increased by 6.0%, which led to a reduction in the trade surplus from 10.781 to 9.423B Australian dollars.

Oil

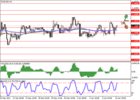

Oil quotes are trying to grow today.

Prices are rising due to the increasing optimism of investors. Market participants believe that the growth in oil demand will be maintained, since the governments of the leading consumer states are abandoning overly strict quarantine measures to curb the coronavirus pandemic caused by the Omicron strain. In addition, prices are supported by the slow increase in oil production by OPEC+ countries, which have not yet chosen their quotas, and interruptions in the supply of "black gold" from Libya. During the day, investors are waiting for the publication of a weekly report on the amount of oil reserves in the USA from API. Last time, the figure fell by 6,432M barrels. The continuation of the trend may give additional support to oil quotes.