Bitcoin Fundamentals – Briefing March 2019

Source: http://www.scandinaviastandard.com

In March, the overall sentiment deteriorated given that the month saw fewer positive events in the crypto sphere. High hopes were resting on institutional investors entering the market, but there has not been any forward movement in this area.

Not all news was negative, of course, but we are noticing fatigue in the optimism observed at the beginning of the year.

So let’s run through the month’s main events, starting with some good news before we report on the most important developments in the Bitcoin market.

I. The Positive Side

Eurex to launch crypto futures

A European exchange giant is gearing up to jump on the crypto futures bandwagon. In recent weeks, Eurex – a major derivative exchange – has been meeting with market makers about new products, sources told “The Block.” It appears that they are planning to launch futures tied to Bitcoin, Ethereum, and XRP imminently.

A few months ago, this news would have been perceived as very positive, but now that Bitcoin futures are already on the CME, it has no significant impact on the market. The reality is that there are many places where one could trade, but the number of traders remains the same. What the crypto market needs most is liquidity and expansion by involving more members and their money, not just trading infrastructure.

Mizuho’s digital currency to take on payment rivals next month

Megabank Mizuho is teaming up with roughly 60 financial institutions across Japan – together, they host 56 million user accounts, which serve directly as digital wallets on the J-Coin Pay platform. “The arrival of all these new entrants is eroding the common-sense notion that payment services are provided by financial institutions,” Mizuho CEO Tatsufumi Sakai said.

The shopper will scan a QR code at checkout and be charged through the J-Coin Pay app, with a unit of the currency fixed at a value of 1 yen (1 cent). The user can transfer money from a J-Coin wallet to a bank account free of charge, unlike Line Pay that charges a fee, for example. Signing up for J-Coin Pay will not require a screening as required by credit cards. It will also be open to users age 18 or younger – an advantage the company says will let it cater to “the needs of a wide range of ages.”

Jesse Lund says BTC will cost $1 million

According to Jesse Lund, Head of Blockchain & Digital Currencies at IBM, Bitcoin’s price should exceed $5K by the end of 2019. He expects the upside trend to accelerate, potentially reaching $1 million per BTC. In that scenario, 1 Satoshi would equal the US 1 cent and, with total capitalization reaching $20 billion, corporate payment systems could drastically change.

We remind our readers that, in August 2018, IBM announced the creation of the Blockchain World Wire payment system based on Stellar’s protocol. It has been suggested that the new system of international payments could be used by 97% of all banks in the world.

Japanese E-Commerce giant Rakuten’s new payment app seems to support crypto

According to Rakuten’s presentation material for the fourth quarter and the full year of 2018, the latest version of the app will feature “all payment solutions embedded into one platform.” Company representatives reported that the firm was “considering entry into the cryptocurrency exchange industry” since Rakuten believes “the role of cryptocurrency-based payments in e-commerce, offline retail, and in P2P payments will grow in the future.”

Although the app update does not explicitly mention crypto support, the company’s specification that “all payment solutions” will be supported on the platform implies support as a part of its subsidiary, Rakuten Payment.

Billionaire Tim Draper reacts to JP Morgan launching cryptocurrency

As we saw in last month’s briefing, JP Morgan announced trials with their own cryptocurrency JPM Coin. Tim Draper reacted to the announcement on FOX Business with the following: “Not many Bitcoin knockoffs have worked particularly well, but they all add to the interest in Bitcoin.” He also compared the news to “a bellwether akin to Apple welcoming IBM into the PC business.”

A venture capitalist who was right about investing in Skype, Hotmail, and Tesla, Draper has poured hundreds of millions into Bitcoin over the years because he believes blockchain technology will be the centerpiece of our new “virtual world.”

“This is going to be the biggest change in the history of the world, and it’s so exciting. I thought the internet was super exciting, but this is going to completely change everything, and the government itself is going to change, ”Draper told FOX Business last May.

Despite Bitcoin’s rapid price drop from $20,000 in December 2017 to approximately $3,800 today, Draper believes that, by 2022, Bitcoin will hit $250,000. He said that the price increase would be driven by the public realizing that they want and need a global, decentralized, and secure currency.

“It’s time to consider crypto,” says pension and endowment adviser

In last month’s briefing, we reported that two pension funds have invested in Bitcoin – this was treated as very positive news by the crypto community. Now we have new comments on this topic.

According to Cambridge Associates, a consultant for pensions and endowments, institutional investors should consider dipping their toes into cryptocurrencies. “Despite the challenges, we believe that it is worthwhile for investors to begin exploring this area today with an eye toward the long term,’’ said analysts at Boston-based Cambridge. “Though these investments entail a high degree of risk, some may very well upend the digital world.’’

Dukascopy Bank launches cryptocurrency

“We got to know that Japanese Mizuho Bank has equally announced their token to be unveiled on the same day. We accept the challenge and move the date of the launch to the 28th of February – one day in advance,” Dukascopy Bank said in a statement.

Dukascoin tokens will be available initially as rewards for using Dukascopy’s Connect 911 messenger and the associated MCA accounts. The Forex bank announced that every client would receive five Dukascoins by opening an MCA account, while an equal amount would be granted for referrals. Dukascoin holders can either sell their coins or buy more on the market. They can also withdraw them from the bank to external blockchain wallets.

Julius Baer partners with SEBA Crypto AG for digital asset services

Swiss multinational private bank Julius Baer Group will partner with SEBA Crypto AG to take advantage of their innovative platform and capabilities. Aiming to meet increasing demand, they aim to provide their clients with leading-edge solutions in the area of digital assets.

Guido Buehler, CEO of SEBA, added: “We are very proud to have Julius Baer as an investor. SEBA will enable easy and safe access to the crypto world in a fully regulated environment. The cooperation between SEBA and Julius Baer will undoubtedly create value for the mutual benefit and to the clients.”

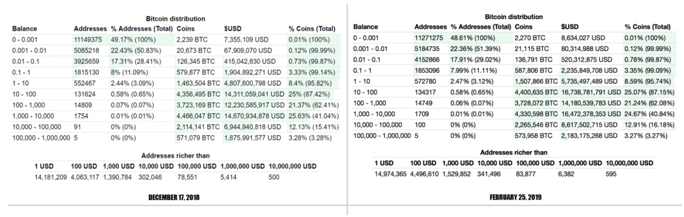

Whales accumulate thousands of coins in the last two months

With cryptocurrencies like Bitcoin Cash (BCH) and Bitcoin Core (BTC) losing significant value, large holders (a.k.a. the “whales”) have taken the opportunity to accumulate massive amounts of digital assets.

At the moment, the 100 richest addresses hold between 10,000 and 1,000,000 BTC, or 16.18% of all BTC in circulation. From December 17, 2018, to February 25, 2019, the five largest wallets, which belong to exchanges, increased by 2,879 BTC ($10.8 million). The remaining 95 whales (some of which are smaller exchanges) have accumulated 151,405 BTC ($572 million) in less than two months.

Crypto holders who have 100-1,000 BTC (14,749 addresses) seem to have given up coins to the much larger holders since wallets of this size have decreased from 72.13% to 62.08%.

Swissquote opens cryptocurrency custody service

In a press release, Swissquote announced the launch of a fully-integrated trading platform and depository of cryptocurrencies: “Following the successful start to cryptocurrency trading in mid-2017, this new service was then expanded further at the end of 2017. […] In an additional step, this service will be further enhanced from 21 March 2019, at which point it will be possible to transfer cryptocurrencies from external wallets to a Swissquote account and vice versa. Swissquote will, therefore, become a secure and technologically fully integrated cryptocurrency trading platform and depositary for private and institutional clients alike.”

Swiss SIX Group starts crypto trading

SIX Swiss Exchange, a major digital exchange in Europe, launches Bitcoin and Ethereum trading.

Yahoo!-backed crypto exchange launching in May

Taotao, which is 40% owned by a subsidiary of Yahoo! Japan, will initially trade Bitcoin and Ethereum, with margin positions available in three additional cryptocurrencies: Litecoin, Bitcoin Cash, and Ripple.

The move marks the internet giant’s first foray into the cryptocurrency exchange world, with Taotao having gained regulatory approval to launch on the Japanese market.

II. The Negative Side

Twitch removes Bitcoin and Bitcoin Cash as a payment method

In the last couple of weeks, Twitch silently removed Bitcoin and Bitcoin Cash as payment methods for subscriptions by removing Bitpay for all countries. Negative adoption strikes again, unfortunately.

BTC inefficient as a large-scale payment solution, says Spain’s Central Bank

A report authored by BDE’s Deputy General Director of Financial Innovation and Market Infrastructures, Carlos Conesa, concluded that Bitcoin is not efficient as a large-scale payment solution.

The report refers to decentralization and a lack of intermediaries as the primary limitations. It argues that decentralization requires a “process of intensive validation in the consumption of resources, which reduces system efficiency.” By comparison, “centralized systems with an intermediary trusted by the parties allow the design of much simpler and cheaper systems.”

CME CEO says only governments could lead cryptocurrency to success

In an interview given to Bloomberg, CME Group CEO Terry Duffy says that, until governments place controls, institutional investors are unlikely to be “gung ho” on the crypto market, which still lacks safety and clarity.

The world is not ready for crypto says Kaspersky

According to Eugene Kaspersky, CEO of cybersecurity firm Kaspersky Lab, “Cryptocurrencies are a great idea, but the world is not ready for them yet. The world must be united if we want to have encrypted currencies. At the moment, governments will want to control them. I believe that in the future, perhaps in 100-years’ time, all the world’s governments will be one government. States will unite under the [Government of the Earth], and only then we will have one currency. Some other currencies may be available, but on a global scale, the currency will be unified.”

“I think that in the future the currencies will be digital rather than paper,” he continued. “Today’s digital currencies, such as Bitcoin, cannot replace the current financial system, but some of the ideas and techniques on which these currencies are based can be used in the future currency with little modification, leveraging blockchain technology.”

Warren Buffett says Bitcoin is a “delusion” that “attracts charlatans”

Berkshire Hathaway CEO Warren Buffet has been a long-time critic of cryptocurrencies. He called Bitcoin “probably rat poison squared,” ahead of the 2018 Berkshire Hathaway annual shareholder meeting. Buffett is not alone in his skepticism. Business leaders such as Bill Gates, economists Nouriel Roubini and Robert Shiller, and fund managers Ray Dalio and Howard Marks are among those who have questioned Bitcoin’s legitimacy.

SEC receives Bitwise report – 95% of crypto exchanges turnover is fake

A Bitwise report to the SEC reclaims that “the real market for Bitcoin is significantly smaller, more orderly, and more regulated than is commonly understood.”

According to the report, all the false data reported on sites such as CoinMarketCap cause individuals, companies, and regulators to view the crypto market as a $6 billion behemoth that is unpredictable, uncontrollable, and unable to be regulated. Bitwise claims that – after accounting for fake volume and wash trading – the crypto industry is relatively small and only completes about $273 million in daily trades.

Vitalik Buterin cashes out $40 million in ETH

According to the founder of Tetras Capital, Alex Sunnarborg, Ethereum’s Vitalik Buterin cashed out $40 million ETH out of his holdings. It should be noted that this was not a single transaction but several between June 2017 and February 2018. According to data collected by Etherscan, the activity was from Buterin’s main account.

Bakkt delay due to CFTC concerns over its planned custody of clients’ Bitcoin

According to information given to the Wall Street Journal by anonymous sources, in February, the CFTC told Bakkt that if it were to have custody over its customers’ crypto, it would have to take additional steps to comply. In particular, the CFTC would “require disclosures of the venture’s business plan and a public comment period, which would have further delayed approval.”

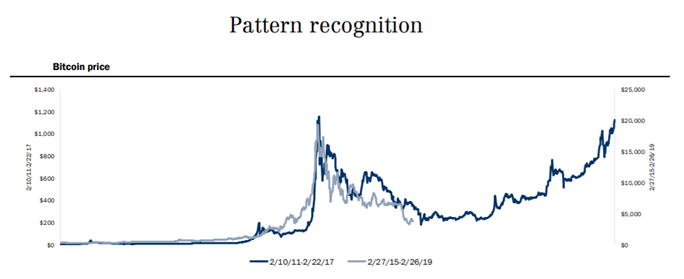

Bitcoin might be en route to $20,000

The “cherry on the cake” is an interesting technical observation made by Canaccord Capital markets and analysts on what to expect – either $5K or $3K level on BTC in the near future.

In a chart produced by Canaccord Genuity Capital Markets, we see a striking resemblance in trading patterns between the 2011-2015 and 2015-2019 periods. If the trend continues, HODLers (those who never sell their digital currency) could be set for a change in fortunes. But it may take a while.

“Looking ahead, if Bitcoin were to continue following the same trend as in the years 2011-2017, the implication is that Bitcoin would be bottoming approximately now and would soon begin climbing back towards its all-time high of ~$20,000, theoretically reaching that level in March 2021,” wrote Michael Graham and Scott Suh of Canaccord Genuity Capital Markets, in a research note to clients.

What will it be for Bitcoin – $5,500 or $3,000?

Although the world’s most popular cryptocurrency is still trading at its long-established range of approximately $4,000, a Switzerland-based cryptocurrency analyst, who goes by the Twitter handle “Crypto Krillin,” recently stated that the moment of truth for Bitcoin is near.

According to Krillin, either BTC will fly towards $5,500 or re-visit $3K. Krillin is not the only analyst who sees Bitcoin’s upside target around $5,500; Chepicap reported that “Galaxy,” another analyst on Twitter, hinted at an imminent surge of 35% to $5,500 to his nearly 50K followers.

Despite many analysts’ optimism about an upward breakout, a recognized trader known to the Twitter community as “The Crypto Dog,” recently stated that it is still possible for Bitcoin to drop to $3,500 in the short term, adding that market conditions have not changed.

The Bottom Line

The bottom line is that, at this moment, we see stagnation. Yes, new altcoins and exchanges are being launched but all this is infrastructure is useless without new funds.

The crypto world has problems in this area at the moment. What this means is that the market needs a shift, a jump to a new level, where participation of big global capital is possible. Without this shift, the stagnancy will likely continue or worsen. The longer the market remains motionless, the more the sentiment will deteriorate.

In regards to March in particular, we feel that the negative outlook is stronger because it is based on more important events. The prospects, which investors had placed so much hope on, have stalled – the launch of Bakkt, for example. Bitwise’s report about fake turnover, statements by the CME and various central banks on the role of government in the regulation, are not painting a positive picture.

All the above seems to be telling the same story: Big capital continues to postpone its entry in the market. Buterin cashing out half his ETH holdings doesn’t project a great deal of optimism either.

In closing, we view the overall sentiment as slightly bearish with a tendency to worsen if the situation doesn’t change. The market has grown tired from the endless expectation of big shifts and from waiting for the entry of institutional investors as promised by analysts, forecasters, and big banks. Under the current circumstances, we do not expect to see the bull trend of Bitcoin starting any time soon.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

974 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023