What is the Best Cryptocurrency to Mine

Introduction

For those who don’t know, mining is the process of using your computing power to support the network of a cryptocurrency and verify transactions. For cryptocurrencies which use proof of work – the miners’ computers perform mathematical computations which are very difficult to perform but easy to validate, and this is the system by which new transactions are validated and added to the blockchain. As a reward for verifying the transactions, proof of work coins release new coins periodically (for Bitcoin it is every 10 minutes) to the miner that solves the computations the fastest. Therefore the more computing power a miner has, the better the odds of solving the calculations the fastest and receiving the next block reward.

If you are seriously considering mining cryptocurrencies, there are a few different criteria that you should consider when deciding which cryptocurrency to mine.

Profit

Profit is a crucial factor to consider when deciding the best cryptocurrency to mine. Although some users may have a go at mining cryptocurrency early on at a loss just so they can learn more about it, in the long term it is not very sustainable. There are various profit calculators online you can use to check what is profitable to mine before you start, allowing you to make a more informed decision. Factors the profit calculators take into consideration are your hash power, power usage, electricity costs and what fees you are paying to any mining pools.

Also, make sure you do your research when deciding which coin is best for you to mine. As a few Google searches such as ‘best cryptocurrency to mine 2019’, ‘best coin to mine 2019’, ‘mining cryptocurrency 2019’, or ‘how to mine most profitable coin’ may bring up lots of articles suggesting coins and telling you how profitable they are. However, people may have written these with a vested interest in that coin doing well and could have been published by the teams behind the coins themselves. So take everything you read about what is the best digital currency to mine with a pinch of salt.

Mining Difficulty

To understand how mining difficulty works, we need to think more about the blocks of transactions themselves, which we mentioned early. A block is a group of transactions, which is then added to the blockchain once miners have verified it. A new block is added to the blockchain at regular intervals as explained above (approximately every 10 minutes for Bitcoin). So if there are lots of miners competing why don’t they ever complete the computations more quickly and add new blocks to the chain more frequently than every ten minutes? And vice versa if there are fewer miners. The reason blocks are added to the Bitcoin (and other) network approximately every 10 minutes is because of the mining difficulty.

The mining difficulty is the difficulty of the computations that miners have to solve to verify transactions. If there are lots of miners on a network competing to verify transactions and add new blocks to the blockchain, the difficulty of the computations they have to solve automatically increases. If fewer miners are competing the difficulty drops, this means the amount of time in between blocks remains relatively constant. This is why you can no longer successfully mine Bitcoin on your laptop anymore (although you could still try) because too many other people have joined in and the difficulty is too hard for an ordinary laptop to solve. So you want to check the mining difficulty before you start and whether you have the equipment needed to be successful.

Hardware

Your existing hardware is a significant factor to consider. If you are using a CPU to do your mining, you want to try and find a cryptocurrency that is CPU minable only. If you try and mine a cryptocurrency with a CPU which others are mining with GPUs and ASICs you are likely to have a pretty miserable time. ASICSs stands for Application Specific Integration Circuits. This is hardware that can only be used to mine cryptocurrency, so because it has been developed for that sole purpose, CPUs and GPUs are unable to compete.

If you are considering purchasing new hardware to do your mining, then you want to make sure you are getting the most bang for your buck, as that will have an impact on how profitable you are and how long it takes you to recoup what you have paid. If you are looking to purchase ASICS, two of the most popular are the Halong Mining DragonMint 16T and the Antminer S9. A lot of new miners buy their equipment second hand on eBay to save money. If you are buying equipment for your mining make sure it can mine the cryptocurrency you want to mine before you purchase it.

Electricity Costs

Electricity costs are an essential factor to consider – albeit one which you may be unable to do much about. If you live in an area with high electricity costs, you are not going to be able to make as much profit as someone in an area with lower electricity costs mining the same coin as you with the same equipment.

When you are running your cryptocurrency profitability calculations, you can see the impact electricity costs have if you play around with your electricity cost in the calculations. There is unlikely to be anything you can do about this so if you live in electricity with high electricity costs you may need to consider either not mining at all or looking for less popular coins to mine. For example, if you have high electricity costs, it will be much harder for you to make a profit mining something like Bitcoin or Ethereum.

Coin Value

The value of the coins you are mining should not be underestimated, especially for the smaller coins. If you are mining smaller cryptocurrencies and it costs you more to mine them than they are worth then what is the point? You could buy them for less on an exchange! You should also try and make sure you are mining something which is relatively liquid and has a daily volume on cryptocurrency exchanges which sufficient enough for you to sell any amounts you mine relatively quickly. There is no point mining for a paper profit if when the time comes to sell your coins, no one wants to buy them.

It is worth mentioning that I have seen people mine smaller cryptocurrencies as a way of getting in early on small projects which are not yet listed on exchanges, in the hope that when they do get listed, and the coin grows in popularity, their holdings which were once worthless can be sold at a considerable profit. Of course, this is much higher risk than mining better-known coins so do your research with any coins you mine and be prepared to mine coins which never actually become worth anything, so consider this when deciding the best crypto currency for mining.

Crypto Mining Profitability Calculators

There are various profit calculators online you can use to check how profitable (or not) you can expect to be before you start, allowing you to make a more informed decision. Factors the profit calculators take into consideration are your hash power, power usage, electricity costs and what fees you are paying to any mining pools. Here are a few different calculators you can use to help you find the most profitable cryptocurrency to mine:

CryptoCompare

CrytoCompare allows you to calculate your coin mining profitability for Bitcoin, Ethereum, Monero, Zcash, Dash, and Litecoin.

CryptoCompare includes most of the critical variables so should be able to give you a reasonable estimate of your daily and monthly profitability, which you can then use to work out how long it will take for you to pay for any hardware etc. If you are unsure what you hash power is for the calculation, you can calculate it here. The rest of the inputs required for the calculation should be reasonably straightforward.

CryptoCompare is a excellent and easy to use calculator, with the only drawback being if you want to calculate your expected profitability for one of the cryptocurrencies other than Bitcoin, Ethereum, Monero, Zcash, Dash, and Litecoin.

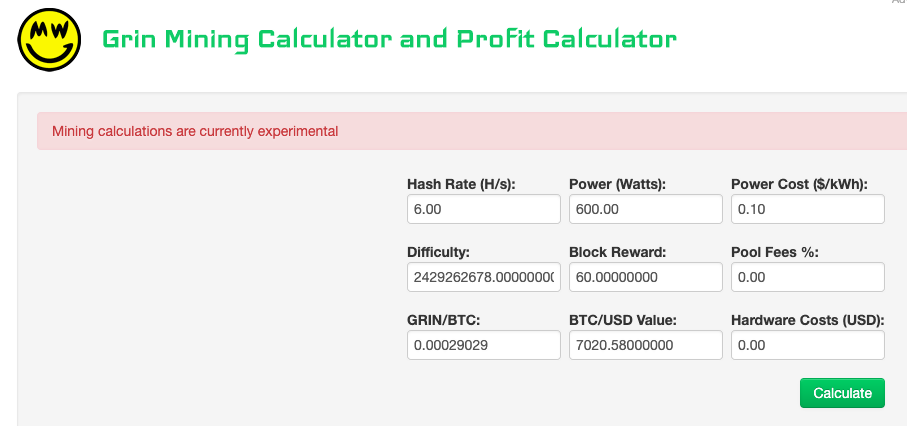

CoinWarz

CoinWarz is a mining calculator that offers a much more extensive choice of cryptocurrencies (over 190) to calculate your expected mining profit for; however, it is slightly less intuitive to use than CryptoCompare. It does, however, allow you to factor in your hardware costs, which is very useful if you are starting.

One of the useful features of Coinwarz is that as well as calculating your expected profitability, it calculates your estimated days to generate one block mining on your own (i.e., without being in a mining pool), days to make one BTC worth of the cryptocurrency you are mining and days until you break even (even if the answer is never).

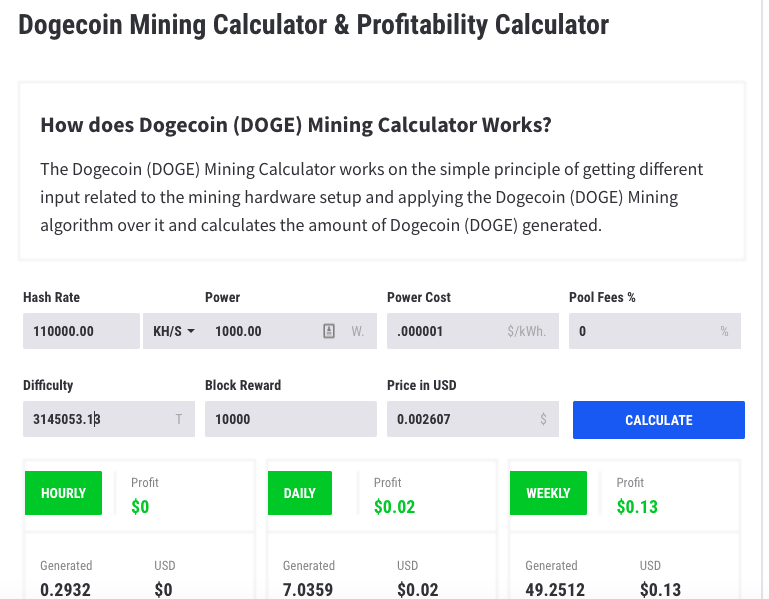

Cryptoground

Cryptoground has mining calculators for over 100 different cryptocurrencies. It is similar in its usability to Coinwarz but is more than sufficient and will calculate your hourly, daily, weekly and yearly profit.

It is worth noting that for all of the above calculators, you should check all of the variables yourself to make sure the correct information is input. As most of the data is pre-populated (price, hash rate, block reward, etc.), it may not be the most up to date information, and the only way to know it is correct is to check it. Otherwise, you could end up making the wrong decision for what cryptocurrency to mine as a result.

I would say CryptoCompare is probably the most straightforward calculator to use so if you are looking at mining a cryptocurrency which they will perform the calculation for then run it on there. Otherwise, it is probably just a matter of using whichever calculator has the cryptocurrency you are looking to mine. If a coin you are looking at is not on any of the above calculators, then try doing a quick Google search, e.g. ‘Nuls cryptocurrency mining profitability calculator.’

Best Cryptocurrency to Mine with CPU

Mining with a CPU only can be challenging. If you are looking to mine a more significant or well-known coin, you are likely only going to be able to successfully mine the ones which are ASIC resistant, such as Monero. If you do mine an ASIC resistant coin, you would be much better off mining it with a GPU instead of a CPU.

You can mine coins with a CPU which are not ASIC resistant however if you want to do this then your chances of successfully mining a block of a more significant cryptocurrency (e.g., Ethereum) on your own is minimal. Therefore you should probably consider joining a mining pool instead to do this.

The most profitable coin to mine with CPU is likely to be one of the few coins that are CPU only, such as AEON, or you could mine newer cryptocurrencies, where not many people are mining them yet so even if you are on a CPU your odds of successfully mining blocks are much higher. It is worth noting that if you are mining newer cryptocurrencies with a CPU, you ought to be careful of what you are downloading onto your hardware, as you could quickly end up downloading malware onto your equipment inadvertently. For a list of coins that you can successfully mine with a CPU see http://cpucoinlist.com/.

If you are looking for new coins to mine, be sure to continue researching once you have found a coin to mine, as a lot of the projects you select are likely to fail, and the best cryptocurrency to mine August 2019 may not be the best cryptocurrency to mine now. You should also note that the easiest cryptocurrency to mine 2019 might not be the most profitable cryptocurrency to mine 2019, as it could be easy to mine for a reason, and all the coins you are mining may turn out to be worthless. Therefore you should diversify if you are looking to use this strategy, and do not mine the same coin for too long.

Best Cryptocurrency to Mine with GPU

If you are mining with a GPU, you are likely to be most successful with ASIC resistant large cap coins such as Monero and Vertcoin, and AION (AION is not strictly ASIC resistant, but its Equihash algorithm works well with GPUs). As mentioned above you can also join a mining pool if you want to mine coins that are also mined by ASICs, and you can mine newer cryptocurrencies.

Scrypt vs. SHA-256

So which is the best crypto to mine? There is no straightforward answer as it depends on your circumstances, so I will now go through some of the better known minable coins explaining who is likely to have the most success mining them. This should hopefully help you answer what cryptocurrency should I mine?

Before we do that though it is worth outlining the difference between the two main (although by no means the only two) algorithms used by most proof of work coins, Scrypt and SHA-256, essentially the SHA-256 algorithm requires more difficult computations, has fewer errors, and is therefore slower and favours ASICs who can perform the calculations quicker then CPUs and GPUs.

Scrypt is a quicker and easier algorithm to perform, which means CPU and GPU miners are more likely to be able to solve the computations first. So ASICs have less of an advantage, and therefore ASIC miners tend to mine SHA-256 coins over Scrypt coins. It is worth noting that doubts exist over the security and authenticity of cryptocurrencies using the Scrypt algorithm instead of the SHA-256. So if you are wondering is Scrypt mining profitable, the answer is yes if you are mining on a CPU or GPU, but not if you are looking to purchase ASICs.

Bitcoin

Bitcoin is the first cryptocurrency, and it uses a proof of work (explained above) algorithm. Currently, the block reward is 25 Bitcoins, so 25 Bitcoins are released every 10 minutes. However, this will drop to 12.5 every 10 minutes in 2020, as the block reward halves every 210,000 blocks.

It is not possible to make any cryptocurrency list without including Bitcoin. Unfortunately, however, Bitcoin is unlikely to be the easiest coin to mine for most people. This is because Bitcoin mining is now extremely competitive due to all the ASICs trying to mine it, and therefore the difficulty is extremely high. Unless you are using ASICs, your attempts to mine Bitcoin are unlikely to be successful. Bitcoin uses the SHA-256 algorithm. Although Bitcoin is far from the best profit cryptocurrency, it could be useful to mine it for a little bit (at a loss) if you are new and looking to learn more about Bitcoin.

Ethereum

Ethereum is the first smart contracts platform; the fundamental idea of it is that it is programmable money. Ethereum is the second largest cryptocurrency behind Bitcoin. The Ethereum block reward is 3 ETH per block (expected to drop to 2 in the next update), and the average block time is 17 seconds. Ethereum uses a mining algorithm called Ethash but intends to switch to a proof of stake mining algorithm instead. Please note Ethereum Classic is a fork of Ethereum and an entirely different cryptocurrency, so if you want to know the Ethereum Classic profitability, this article does not cover that.

Ethereum can be successfully mined with GPUs (NVIDIA and AMD GPUs are recommended) although profits are unlikely to be very high, as you will be competing with ASICs. You can mine Ethereum either individually or by joining a mining pool. Due to the ETH difficulty, you should not try mining Ethereum using CPUs.

Monero

Monero is a privacy-focused cryptocurrency, which is 100% untraceable (unlike Bitcoin where if you know a users address you can view their entire transaction history on the blockchain). This makes the cryptocurrency fungible, as each Monero is worth the same amount as another, as no one knows what its history is, whereas some Bitcoins are ‘tainted’ if they have a past that is linked to websites such as Silk Road. Monero is probably the most popular and widely used of all the privacy coins currently in existence.

Monero has a block time of 2 minutes per block, with a block reward of 3.38 XMR. Monero is ASIC resistant and therefore great for GPU and CPU miners. Monero uses a mining algorithm called Cryptonight.

Electroneum

Electroneum is a British cryptocurrency that is primarily mobile-based and therefore potentially the easiest mining coin. Electroneum was developed for use on mobile gaming and online gambling. Electroneum received a lot of support and publicity in the 2017 ICO boom, including from John McAfee.

The Electroneum block reward is 7573 ETN, and the block time is 202 seconds. Electroneum is ASIC resistant so can be mined on a CPU, GPU, and even a mobile phone, so is arguably the easiest cryptocurrency to mine if you don’t have the best hardware or are just starting. Like Monero, Electroneum uses the Cryptonight algorithm.

Zcash

Zcash is another privacy-focused cryptocurrency, using zero knowledge cryptography called zk-SNARKS. Unlike Monero, Zcash allows for private and non-private transactions. Zcash has come under criticism for its controversial founders’ reward, where 10% of all the coins mined go to the founders.

Zcash has a block reward of 12.5 ZEC and a block time of 2.5 minutes. Although you will be competing with ASICs if you mine Zcash with a GPU or CPU, it is still one of the most profitable cryptocurrency large cap coins to mine – and has come under criticism for this due to the high inflation rate it has, with over $400,000 of new ZEC issued every day. Zcash uses a mining algorithm called Equihash.

Dogecoin

Dogecoin is known in the crypto community as the meme coin, as it was initially developed as a joke. However, it has since taken on a life of its own. There are well over 100 billion Doge in circulation (with over 5 billion new Doge added every year), with a value of $0.002762, or 38 Satoshis, at the time of writing. Dogecoin remains popular due to its speed and ability to function well for micro-tipping.

Dogecoin has a block reward of 10,000 Doge, with a block time of 1 minute. The Dogecoin mining industry is not as advanced as the Bitcoin mining industry, so although Dogecoins can be mined with ASICs, there is much less hardware which does the mining, and they are a lot harder to find, as although Dogecoin is proof of work, like Bitcoin, it uses a different algorithm. Therefore Bitcoin miners cannot mine Dogecoin also. As a result of this, you can mine Dogecoin either on a CPU or GPU (although a GPU would yield better results), either individually, or by joining a mining pool. Dogecoin uses Scrypt technology in its mining algorithm.

Vertcoin

Vertcoin is a cryptocurrency that focuses on areas where it thinks Bitcoin is not truly decentralized. Vertcoin is ASIC resistant and tries to prevent large mining pools from developing, making Verge arguably the best altcoin for GPU mining. Vertcoin views itself as a hedge against Bitcoin mining centralization.

Vertcoin has a block reward of 25 VTC, with a block time of 2.5 minutes. Vertcoin can only really be mined with a GPU (also Vertcoin only supports AMD and NVIDIA graphics cards), as the mining algorithm makes CPUs and ASICs extremely inefficient, so if you have a GPU and are looking for arguably the best currency for GPU mining, Vertcoin could be an excellent choice. Vertcoin uses the Scrypt-N algorithm, which a modified version of the Scrypt algorithm.

Litecoin

Litecoin started life in 2011 when Charlie Lee forked the Bitcoin code to create Litecoin. Lee believed Litecoin would co-exist with Bitcoin and would be the silver to Bitcoin’s gold.

The main differences between Litecoin and Bitcoin are the 2.5 minute block time, the block reward of 25 LTC (although this is expected to decrease to 12.5 BTC in August, and the use of the Scrypt mining algorithm instead of SHA-256. The maximum number of Litecoins is capped at 84 million. Litecoin and Bitcoin have co-existed well so far, with Litecoin testing Segregated Witness and Lightning technology before it was included in the Bitcoin code.

Due to the use of the Scrypt mining algorithm, Litecoin can be successfully mined with a GPU (you are less likely to be successful with a CPU although it is still possible), however, due to the popularity of the coin you may be better joining a mining pool if you do wish to start mining. Of all the large-cap coins Litecoin is potentially the most profitable scrypt coin available for you to mine.

Dash

Like Litecoin, Dash also began its existence as a Bitcoin fork; it was initially named Xcoin before being rebranded to Darkcoin, and finally, Dash. Dash is a cryptocurrency that focuses on anonymous transactions, low fees (less than 1 cent), and high transaction speeds (1 second). Due to the high speeds and low costs, Dash is very popular in Venezuela. Dash is governed by its masternodes, who vote on proposals to help improve/popularise the currency.

Dash has 2.5 minute block times and a block reward of 3.11 Dash (although this decreases by 7.1% every year). Dash uses the X11 mining algorithm, which was developed by the founder Evan Duffield. Dash is not ASIC resistant (although it was initially intended to be) and therefore although it can be mined with a GPU, you will have more success if you invest in an X11 ASIC miner, such as the Antminer D3.

Conclusion

So what is the best cryptocurrency to mine? Well, that depends on a lot of factors as discussed above. What equipment do you have? What equipment are you able to invest in? What are your electricity costs? Are you able to spend plenty of time researching newer/smaller altcoins to mine which may increase considerably in value in the future? Are you okay making a loss so you can learn more about cryptocurrency? There is no one size fits all when it comes to mining, but hopefully, the above article helps you ensure you consider all the factors you need to and make the right decision for you about which cryptocurrency is best to mine.

Author Profile

Fat Finger

My name is Phat Fin Ge, but most people just call me Fat Finger or Mr. Finger.

Many years ago, I was a trader on the Hong Kong Stock Exchange. I became so successful that my company moved me to their offices on Wall Street. The bull market was strong, but my trading gains always outperformed market averages, until that fateful day.

On October 28th, 1929, I tried to take some profits after Charles Whitney had propped up the prices of US Steel. I was trying to sell 10,000 shares, but my fat finger pressed an extra key twice. My sell order ended up being for 1,290,000 shares. Before I could tell anyone it was an error, everyone panicked and the whole market starting heading down. The next day was the biggest stock market crash ever. In early 1930, I was banned from trading for 85 years.

I went back to Hong Kong to work at my family's goldfish store. Please come and visit us at Phat Goldfish in Kowloon, only a 3 minute walk from the C2 MTR entrance.

I thought everyone would forget about me and planned to quietly return to trading in 2015. To my horror, any error in quantity or price which cause a problem kept getting blamed on Fat Finger, even when it was a mix up and not an extra key being pressed. For example, an error by a seller on the Tokyo Stock Exchange was to sell 610,000 shares at ¥6 instead of 6 shares at ¥610,000. That had nothing to do with me or with how fat the trader's finger was, but everyone kept yelling, "Fat Finger! Fat Finger!" In 2016, people blamed a fat finger for a 6% drop in the GBP. It really was a combination of many things, none to do with me or anyone else who had a wider than average finger.

Now that I can trade again, I'm finding forex more interesting than stocks. I've been doing some research on trading forex and other instruments and I'll be sharing it here.

If you see any typing errors, you can blame those on my fat finmgert. If you see any strange changes in price, it's not my fault.

Info

2919 Views 1 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023