Bitcoin fundamentals briefing, December 2019

The year flew by, and it was a challenging but interesting period for cryptocurrencies. We would say that the main theme of 2019 was trying to make sense of it all. When the initial euphoria started to fade, everyone came down to reality. BTC price collapsed, and investors and traders started wondering what comes next.

Everyone saw expansion as the future – in other words, making cryptocurrencies as universal as possible by involving traditionally-minded investors, increasing trading volume, opening new horizons of application, and rivaling traditional money in the longer-term, at least in some spheres.

At the same time, everyone began to see the enormous power that cryptocurrencies could wield for large companies like transnational banks and Facebook, which has access to every third person on the planet. It would not be an exaggeration to say that the conventional financial system could be challenged if Libra were adopted by the most active and progressive 30% of the world’s population.

Governments, political parties, and regulatory bodies recognize the dangers, even though the implications have yet to be fully contemplated and understood. It is highly unlikely that such enormous power will remain unexploited. Sooner or later, companies will find ways to use it because it provides very extensive, if not unlimited, possibilities in the financial and political spheres. Imagine printing your own money! How difficult would it be to elect a president or control millions of people? George Soros could not even dream of such power.

In short, two key factors are shaping the cryptomarket at present: one, the expansion of products which have already become classics, meaning Bitcoin, and two, preventing “private money” from being adopted by the masses.

The mood is improving…

Last month was slow in terms of events. Nevertheless, December presented a more positive sentiment, which is already reflected in the price of BTC and supported by the following developments:

WisdomTree launches physically-backed Bitcoin ETP

One sign of expansion comes from WisdomTree. The exchange-traded fund (“ETF”) and exchange-traded product (“ETP”) sponsor announced the launch of its first cryptocurrency product, a physically-backed Bitcoin ETP.

Alexis Marinof, Head of Europe, WisdomTree, said:

“We have been monitoring cryptocurrencies for some time and are excited to bring investors secure access to this developing asset class. We have seen enough to believe that digital assets, like Bitcoin, are not a passing trend and can play a role in portfolios.”

The WisdomTree Bitcoin ETP (BTCW) is listed on SIX, the Swiss Stock Exchange, with a total expense ratio of 0.95%. Shares will settle via the International Central Securities Depositary (ICSD).

A Plan to Decentralize Bitcoin Mining Again Is Gaining Ground

The next-gen mining protocol Stratum V2 aims to improve Bitcoin mining in several ways but mostly address one of the most pressing problems: mining pool centralization. It could significantly change how mining functions and add security and efficiency to pools.

At present, when one miner wins a block and the reward, the pool decides which transactions go into that block. Bitcoin experts worry that these centralized entities could censor transactions they don’t like. To prevent this, Stratum V2 supports “job negotiation,” which is modeled on Corallo’s BetterHash. This changes the relationship between the miner and the pool. Instead of pools deciding what transactions are added to blocks, the miners decide which ones to include. According to Bitcoin developer and educator Jimmy Song:

“If this protocol does everything it promises, ‘mining centralization’ as an argument will be completely dead.”

Ronaldo’s soccer club Juventus now has a token that gives its over 400M fans voting power

Cristiano Ronaldo fans can now use a token to participate in various inner-club transactions. Purchased through Socios.com’s app, $JUV gives holders the right to vote on certain club decisions.

Alexandre Dreyfus, founder and CEO of Socios.com, told The Block:

“99.9% of sports fans are not in the city/country of the team they are supporting. We created these fungible fans tokens to allow fans to have an influence over some fan-based initiatives.”

New Money Laundering Act – Banks can keep Bitcoin safe

A new area of business could open for German banks in 2020: the sale and custody of Bitcoin and other cryptocurrencies. The draft law passed by the Bundestag provides for corresponding relief, including extended application deadlines for the license.

Financial institutions will be able to offer their customers secure online banking in addition to classic securities like shares and bonds. Approval of the federal states for the new regulation is expected, and industry representatives are pleased. Sven Hildebrandt, head of DLC consulting house, said:

“Germany is well on the way to crypto heaven. German lawmakers are playing a pioneering role in regulating crypto-custodians.”

Andreas Antonopoulos indirectly confirms that CME were hurry to launch Bitcoin futures to blow the growing bubble

Bank of China issues special financial bonds worth 20 billion yuan for small and micro enterprises

In this issue, the Bank of China simultaneously used the self-developed blockchain bond issuance system, which is also the first domestic bond issue bookkeeping system based on blockchain technology. Issuers, some underwriters, and investors participate in the use of online operations such as bond issuance preparation, bookkeeping, and pricing placement.

The system uses the blockchain network to support on-chain interaction and deposit key information and documents during the bond issuance process. (The article is in Chinese – apply online translation option to read it).

ICYMI: Bakkt Bitcoin has renewed top trading volumes

In a tweet on November 28, the following figures were announced:

📈 Traded contracts: 5671 ($42.52 million, +148%) (New ATH 🚀)

🚀 All time high: 5671 (11/27/2019)

💰 Open interest: $4.16 million (+6%)

A few days later, a new top was achieved as we can see in the following chart:

For more on Bakkt, read the following interview:

How Bakkt aims to build digital asset ecosystem and consumer app

In terms of more specific news, we have had the following:

Iran leader urges deeper Muslim links to fight US ‘hegemony’

Iranian President Hassan Rouhani urged Muslim nations to deepen their financial and trade cooperation to fight what he described as “U.S. economic hegemony.” He proposed an Islamic financial system with Muslim countries trading in local currencies, as well as the creation of a Muslim cryptocurrency to limit reliance on the dollar and weather market fluctuation.

Yoshitaka Kitao, president and representative director of SBI Holdings, stated:

“Given that the digital asset has the characteristic of decentralized value, the highest priority upon establishing our digital asset ecosystem is to find trustable financial partners globally. The SBI Group, including its crypto-asset trading platform and other related business operating companies, will fully make use of the collaboration with Boerse Stuttgart Group, to well-establish the actual demands of the digital asset throughout the world.”

Fidelity launches cryptocurrency business in Europe

Fidelity Digital Assets has appointed Chris Tyrer to lead a push into Europe.

One of the world’s largest fund managers has formed a new UK entity to sell cryptocurrency services to European clients.

Congress Considers Federal Crypto Regulators In New Cryptocurrency Act Of 2020

The bill is called the “Crypto-Currency Act of 2020,” and the stated purpose is to clarify which Federal agencies regulate digital assets. Those agencies will notify the public of the Federal licenses, certifications, or registrations required to create or trade in such assets, and so on.

Not so positive news…

As already mentioned, the most negative events in December are related to regulation. Government and supervision entities see potential hazards not in Bitcoin per se but in the tools that cryptocurrencies could provide, mostly tokens, altcoins, and private cryptocurrencies, such as Libra.

As we can see in the following, government and regulatory bodies are continuing to apply “squeeze tactics.”

Fed’s Brainard: Facebook’s Libra faces ‘core set’ of regulatory hurdles

U.S. Federal Reserve Governor Lael Brainard launched an attack against Facebook’s Libra project, saying it faces a “core set of legal and regulatory challenges.” At a conference in Frankfurt, she said:

“What would set Facebook’s Libra apart, if it were to proceed, is the combination of an active-user network representing more than a third of the global population with the issuance of a private digital currency opaquely tied to a basket of sovereign currencies. Without requisite safeguards, stablecoin networks at global scale may put consumers at risk. […] Given the stakes, any global payments network should be expected to meet a high threshold of legal and regulatory safeguards before launching operations.”

China’s Tech Hub Shenzhen Kicks off Cleanup of Crypto-Related Companies

Remember what we said about Chinese President Xi’s rally in last month’s report? Be patient; time will put everything in its proper place.

Indeed, China has renewed its hardline approach to cryptocurrency trading and exchanges, with the People’s Bank of China (PBoC) announcing that any crypto-related activities discovered would be “disposed of immediately.”

In response to Beijing’s rigid anti-crypto stance, local governments have been intensifying the clampdown on activities with new regulations. For example, Weihai, a port city in Shandong province of eastern China, has a stern warning for investors: make sure you are really investing in blockchain innovation and not cryptocurrency masquerading as blockchain.

BANK OF CANADA GOVERNOR STILL BACKS CASH OVER CRYPTO

Stephen Poloz spoke about how technology affects the way Canadians make payments, pointing out that one the big advantages of cash is that it will still work even during power blackouts or cyber attacks. Banknotes will probably always be around to some degree, if only as a contingency during unusual events

AUSTRAC revokes first crypto exchange licences

Australia’s anti-money laundering agency AUSTRAC has revoked the licenses of three cryptocurrency exchange operators due to alleged criminal ties. The cancellation of the registrations, which took place in September, are the first to be revealed since the agency was given powers to monitor local exchanges at the end of 2017.

On the more technical side

Our customary look at the sector’s technical side offers few interesting headlines this month.

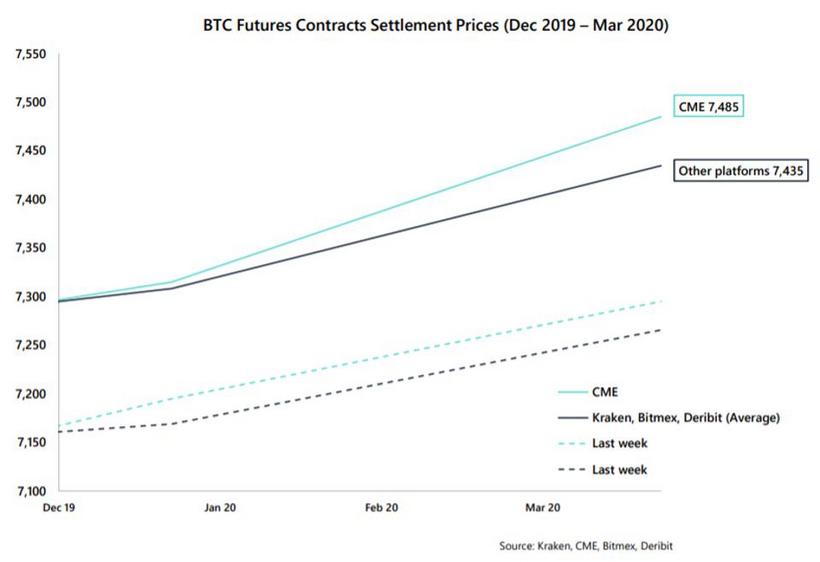

There’s Something Very Strange Going On With Bitcoin Futures

Researchers have recorded “unusual” moves in the Bitcoin futures market, with premium rates rising even as Bitcoin prices fall. This suggests that BTC price could be headed upward in 2020. Between November 29 and December 2, the premium on Bitcoin futures increased over 30%, while BTC price dropped around 6%.

Source: Forbes

As analysts at Arcane Research announced:

“The premium rates on Bitcoin March 2020 contracts have been increasing, although BTC price has decreased. This is not a common observation.”

Bitcoin Charts First Weekly Golden Cross in 3.5 Years

Bitcoin’s weekly chart is reporting a bullish golden cross of the 50- and 100-period moving averages. The widely-followed, but lagging, indicator may fail to attract buyers as broader market conditions are currently bearish. That said, crossovers are widely followed indicators and attract a significant amount of buying if the broader market conditions are supportive, as seen below:

Andreas Antonopoulos Analyzes Google’s Quantum Supremacy Threat to Bitcoin (BTC) and Crypto

Bitcoin and blockchain expert Andreas Antonopoulos isn’t buying into the fear, uncertainty, and doubt over Google’s “quantum supremacy.”

Google has reportedly built a quantum computer that can process certain calculations faster than any other computer on Earth. The breakthrough triggered concerns about a hypothetical device powerful enough to crack modern forms of encryption – spelling trouble for Bitcoin and the thousands of other cryptocurrencies based on blockchain technology.

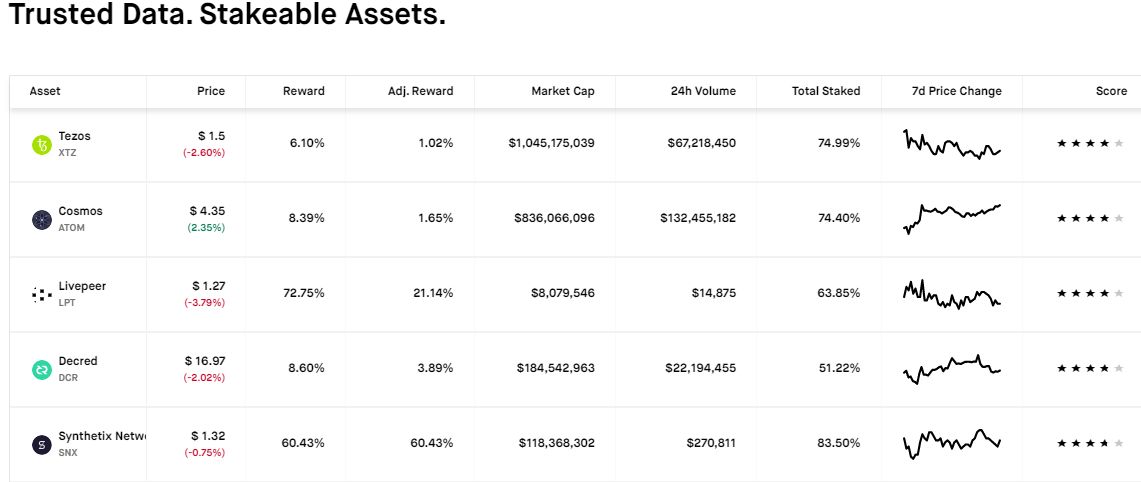

2020 Could Be the Year of Staking, Predicts Analyst

Could 2020 be the year of proof-of-stake (PoS) cryptocurrencies? According to one analyst, the market is currently overlooking its potential impact.

Proof-of-stake cryptocurrencies are posited as an alternative to proof-of-work mining, but are they viable in the long run? Staking has yet to take off in the cryptocurrency industry, despite being talked about for years. However, some are speculating that 2020 may be the year that this finally becomes an industry standard.

Passive Income is not a "meme".

This is how interest in passive income looks like. Do you see the trend? pic.twitter.com/AGtJmhGVAO

— Alex Krüger (@krugermacro) November 30, 2019

Also, Stakingrewards.com provides some great information on stake passive return in different cryptos. Here are the top 5 stakeable currencies:

Source: stakingrewards.com

In summary

All the above reconfirms the two key factors that we have identified, expansion and regulation.

With the “novelty effect” having faded, and cryptocurrencies turning to a more reasonable and slower price action, the next upside trend will hardly have the same velocity as the previous one. It will likely be slower but longer and more solid because it would not be driven by emotion but math and common sense.

Blockchain technology and cryptocurrencies are showing progress. The topic is certainly not dead, and interest is holding. We see an expansion of the market and interest from large companies to invest in digital assets. We suggest that the process will be slow, however. Those who made big money in the past on classic assets will not dive into new business blindly and will test “new” market for some time. In our view, the process has already started.

The main risk for digital assets is the enormous power they entail. This alarms governments and regulatory bodies, and over-regulation carries great risk. It could seriously impact the liquidity and applicability of the currencies. Take a look at China: regulators could shut down cryptocurrencies if they wanted to – I mean in the wider sense – by creating conditions, sanctions, and barriers that would be not acceptable for big funds and investors. Such a development could severely impede expansion, but let’s hope it won’t take place, at least in 2020.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

1767 Views 1 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023