Bitcoin fundamentals briefing – March 2020

Mad Dash for Cash – March 2020

An analysis of the Bitcoin market is neither simple nor easy at the moment, mostly because the forces at play extend well beyond the crypto sphere. The dive that we are experiencing applies to all markets – equities, commodities, even gold.

This is one of those times in history when the markets are not driven by the usual influences. They are reacting to psychological pressures and fundamental processes that translate into massive cash transfers across the globe.

We are witnessing a “mad dash for cash” or a huge run on the US dollar. At a time of enormous devaluation, when asset prices collapse, and all central bank rates hover around zero, cross-border investing is rendered useless. Investors require great liquidity to close margin positions, support cross-border trading, export, and import. Rather than looking for a return on their investments, they are focused on the return of their investments.

Obviously, Bitcoin is not immune to this environment. During last year’s prosperous times, investors were treating BTC as a venture product, testing the waters, watching how the market would develop, and so on. When the liquidity turmoil started, all ventured products were closed, and a vast amount of cryptocurrencies was sold off.

Still, March has seen some noteworthy events that we will include in our briefing.

The Positive

Cryptocurrency Now Fully Legal in South Korea

On March 5, an amendment to the Act on Reporting and Use of Specific Financial Information was passed in South Korea, marking the entry of crypto trading and holding into the legal system. A restructuring of the domestic blockchain industry is expected to take place as a result.

Exchanges, trusts, wallet companies, and ICOs are now required by law to have a real-name verification partnership with an approved Korean bank. Real-name accounts prevent money laundering by assigning a verified individual to a bank account, which can be used to withdraw and deposit fiat currency from and to a crypto exchange. Also, companies are required to obtain an information security management system (ISMS) certification.

Hyperledger Announces New Members, Including Walmart

Hyperledger is an open-source collaborative effort created to advance cross-industry blockchain technologies. It enables organizations to create industry-specific applications, platforms, and hardware systems to support their transactions by offering enterprise-grade, open-source distributed ledger frameworks, libraries, and tools.

Hyperledger announced the addition of eight new members: Aiou Technology, Clear, Conduent, Joisto Group, Tangem, Tokenation, and Walmart. Sanjay Radhakrishnan, Vice President, Walmart Global Tech remarked:

“Walmart is excited to participate in open-source communities coming together to create scalable and adaptable technology. We’ve seen strong results through our various deployments of blockchain, and believe staying involved in open source communities will further transform the future of our business.”

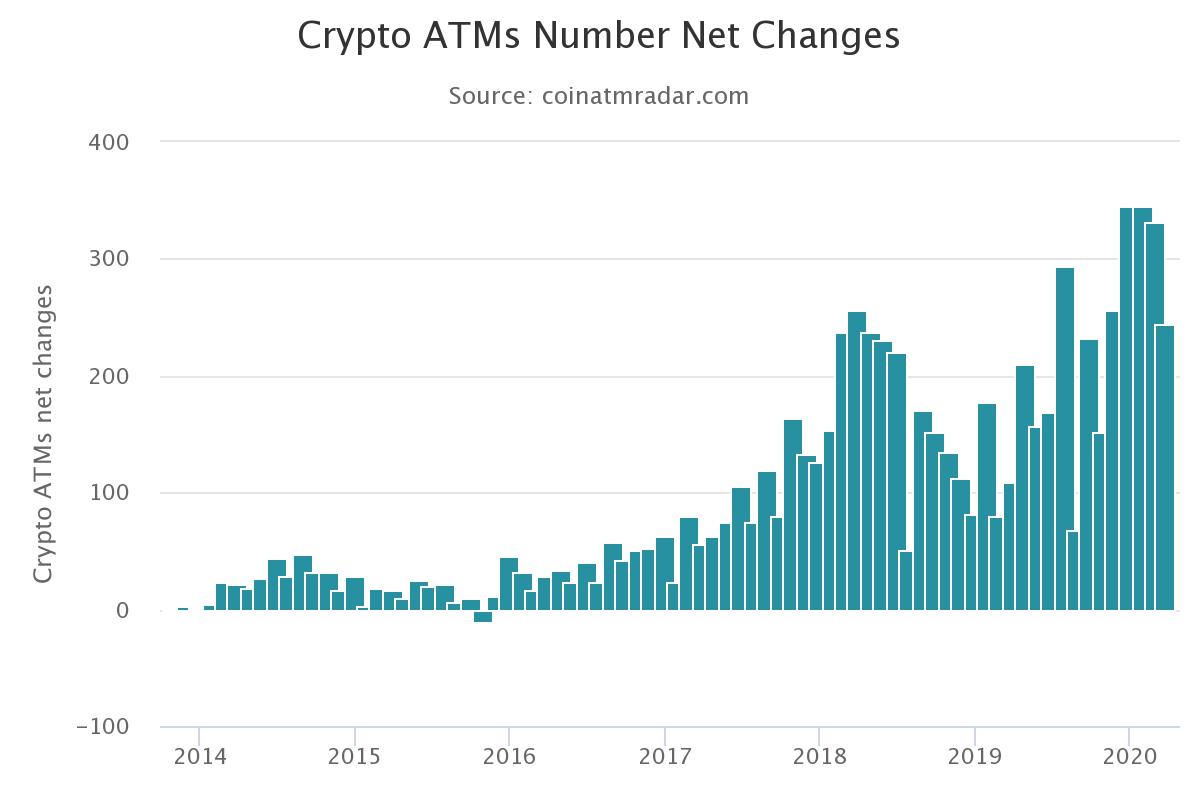

Crypto ATMs In The World Exceed 7000

As the following chart published by CoinATMRadar.com indicates, the number of crypto ATMs has jumped by 15% since November 2019:

BaFin Classifies Crypto As Financial Instrument

Germany’s Federal Financial Supervisory Authority (BaFin) has classified digital assets as financial instruments. According to their statement:

“[Virtual currencies are] a digital representation of a value that has not been issued or guaranteed by any central bank or public body and is not necessarily linked to a currency specified by law and that does not have the legal status of a currency or money, but is accepted as a medium of exchange by natural or legal persons and can be transmitted, stored and traded electronically.”

Lloyd’s Launches New Crypto Wallet Insurance Solution

Lloyd’s syndicate Atrium, in conjunction with Coincover, has launched an insurance policy to protect crypto held in online wallets against theft or hacks. The first of its kind, the policy offers flexible limits that start as low as £1,000. It has a dynamic limit that increases or decreases with price changes. This means that the insured will always be indemnified for the underlying value of their managed crypto asset, even if its price fluctuates during the policy period.

Honeywell Tracking $1 Billion In Boeing Parts On A Blockchain

Boeing has added more than $1 billion-worth of airplane parts to Honeywell’s GoDirect Trade, a blockchain platform designed to confirm the origin of the parts and ensure they comply with safety standards.

Unlike the Bitcoin blockchain, which anyone can build on, users must be given access to the GoDirect platform, a process that general manager Lisa Butters says “takes about two minutes.” Once the storefront is created, trusted companies can load their excess and obsolete materials directly to the platform (similar to Amazon) via an API, or by transferring a text file to Honeywell.

Bakkt Completes $300 Million Series B Financing

On March 13, Bakkt announced that it raised an additional $300 million from investors like Intercontinental Exchange, Microsoft’s M12, PayU, Boston Consulting Group, Goldfinch Partners, CMT Digital, and Pantera Capital. According to their statement, they have the “potential to unlock nearly $1 trillion of digital assets when the Bakkt app launches this summer.”

Italian Bank Opens Bitcoin Trading During Lockdown

The growing adoption of cryptocurrencies and the COVID-19 outbreak have encouraged Italy’s Banco Sella to launch a Bitcoin trading service. The trading is conducted via the bank’s Hype platform, with the bank acting as an intermediary that mitigates the security risks with crypto exchanges.

With the country in lockdown, the bank is capitalizing on a growing interest in Bitcoin as a safe way to transfer money internationally. Approximately 1.2 million Italians are already using Banca Sella’s Hype. Now, not only will they be able to buy and sell Bitcoin but also use it to pay for goods and services.

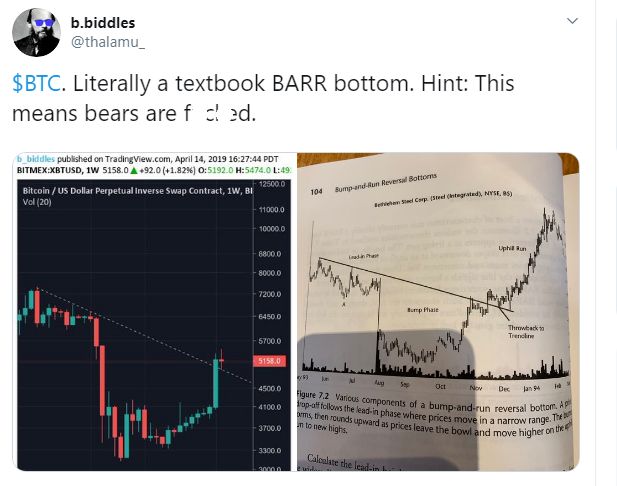

It’s Back! BTC Showed This Pattern Prior to 2019’s Explosion to $14K

On April 1, 2019, after the brutal Bitcoin bear market that brought the currency down by 80%+, something changed: BTC gained 25% in one day, in one of the largest moves in its history.

Many argued this was a result of manipulation, suggesting that BTC’s price would drop again. However, trader B.Biddles (handle @Thalamu_on Twitter) pointed out that the price action from late-2018 to the 25% gain formed a “textbook BARR bottom.”

You Can Now Use Coinbase Card With Google Pay

Android users can now add the Coinbase Card, a Visa debit card funded with crypto, to their Google Pay wallets. With the launch of Google Pay, Coinbase is the first company to enable users to make mobile payments using their crypto balances.

Coinbase Card payments using Google Pay are available to customers in the United Kingdom, Ireland, Belgium, Finland, France, Italy, Slovakia, Spain, Croatia, Czech Republic, Poland, Denmark, Norway, and Sweden. Other European countries will be added later this year.

The Negative

As already mentioned, the month’s negative events and reports relate mostly to the “dash for cash” and the global economic slowdown. As such, BTC is just another victim.

Next BoE Governor: ‘Be Prepared to Lose All Your Money’ With Bitcoin

Andrew Bailey, the head of England’s Financial Conduct Authority (FCA) and the next Bank of England governor, stated the following to members of the U.K. Parliament at a Treasury Select Committee hearing on March 4:

“If you want to buy Bitcoin, be prepared to lose all your money… [Bitcoin] has no intrinsic value.”

Bailey’s remarks directly echo those of billionaire Warren Buffett, who declared in an interview that Bitcoin has no value. However, in contrast to Buffett, who seldom speaks on the subject, Bailey has been consistent in his criticism of cryptocurrencies.

Halting $9.8 Billion in Theft Is Key to Crypto Growth

According to accounting firm KPMG, if the $245 billion crypto sector wants to keep growing, it needs to improve security.

At least $9.8 billion in digital assets have been stolen since 2017 due to lax security or poorly-written code, KPMG reported. The adoption of Bitcoin and Ether by institutional investors has made safeguarding the tokens more important than ever, said Sal Ternullo, co-leader of KPMG’s crypto-asset services and co-author of the report:

“Institutional investors especially will not risk owning crypto assets if their value cannot be safeguarded in the same way their cash, stocks, and bonds are.”

Among the first companies to offer custody services are Fidelity Investments, Intercontinental Exchange, Coinbase, and Gemini Trust.

Major Crypto Exchanges Lament Outsized Scrutiny From US IRS

On March 3, representatives of major crypto exchanges told the US Internal Revenue Service that they want to see clear regulations rather than vague suspicions. Coinbase’s executives said that they were subjected to excessive pushback. Jamison Sites of RSM agreed and stated:

“All the big players in this industry — Coinbase, Kraken — they’re very much startup companies. We’ve seen a number of our clients, we’ve seen a number of non-clients who talk to us — it’s hitting their bottom lines.”

Sites offered a hypothetical instance of overregulation:

“Imagine if email in the 80s, when all these startups were coming in, imagine that the US Postal Service came in and said ‘hey, this is unlawful delivery.’”

Lisa Askenazy Felix, head of global tax for Coinbase, summarized:

“I think most of us in the room would agree that there is no clarity today.”

Blockchain Summits Postponed

Following the escalation of the COVID-19 outbreak, blockchain summits have been postponed or rescheduled:

- Paris Blockchain Week Summit has been postponed to December 2020.

- Bitcoin 2020 has been postponed from March 27 and 28, 2020, to Q3 of 2020.

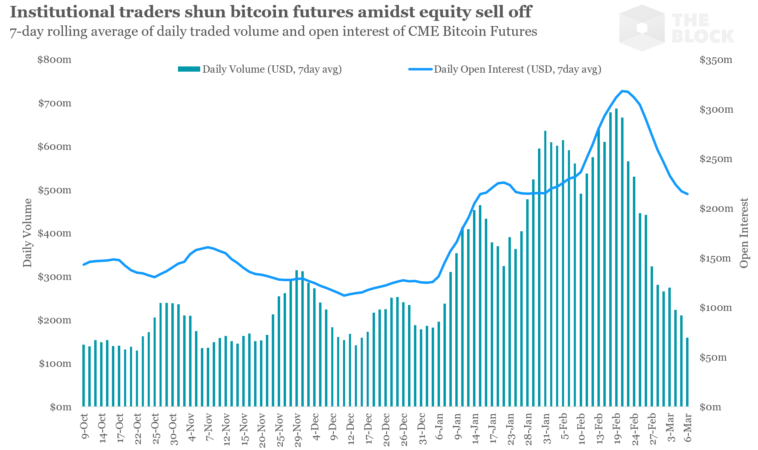

Institutional Investors Shun CME Bitcoin Futures As Coronavirus Roils Global Markets

As investors look for safety amid the global coronavirus outbreak and plunging equities markets, they don’t appear to be turning to Bitcoin, at least on the institutional side.

Bitcoin has long been touted as a non-correlated asset. Some proponents also saw it as a safe haven during broader market turmoil. But recent events have put both views to the test. As noted by The Block’s Ryan Todd:

“Looking at CME Group Bitcoin Futures data, which is – in my view – the current easiest and cleanest product for traders, traditional hedge funds, and large asset managers to get exposure to Bitcoin, you’d expect that if institutional investors were starting to express belief in Bitcoin as gold 2.0, we’d see outsized volumes and open interest grow in the product during the last two weeks.”

But that hasn’t happened, as the data in the following chart indicates:

The daily volume for CME Bitcoin Futures peaked the day before US equities reached all-time highs (February 19) at over $1 billion in volume, prior to the current fall to 75%. The CME Bitcoin Futures market printed its lowest volume day in 2020, while the 7-day rolling open interest is down 25% in the past two weeks.

CME Bitcoin Options Volume Hits Record Low; Bakkt Goes Weeks With No Trades

The Chicago Mercantile Exchange (CME) traded its lowest daily volume on record with only three Bitcoin options contracts, a notional amount of 15 Bitcoin (approximately $80,000). This was significantly lower than the previous low of $125,000 on January 24. Meanwhile, Bakkt has seen no options trading activity since February 27.

Although heightened volatility typically fuels demand for hedging instruments like options, the opposite has happened in the case of Bitcoin on the regulated US exchanges – as volatility has skyrocketed, volumes have dropped sharply.

The drop seems to have been caused by institutional traders treating Bitcoin as a source of liquidity during the massive stock market sell-off, which triggered a multitude of margin calls. According to Tom Lombardi, director at digital asset management firm Wave Financial:

“Last week’s market rout saw institutional investors selling many risk assets, including Bitcoin. CME is a regulated platform designed for traditional investment managers seeking Bitcoin exposure without a priority of ownership or utilization, and therefore saw a drop in volume as their customers led the flight to cash.”

Adaptive Capital Closes After It ‘Took A Big Hit’ During Last Week’s Bitcoin Plunge

Crypto hedge fund Adaptive Capital “has made the decision to close operations and return the remaining funds to investors,” the firm wrote. “We are convinced that the risks of continuing operations in such an unstable environment outweigh the potential benefits.”

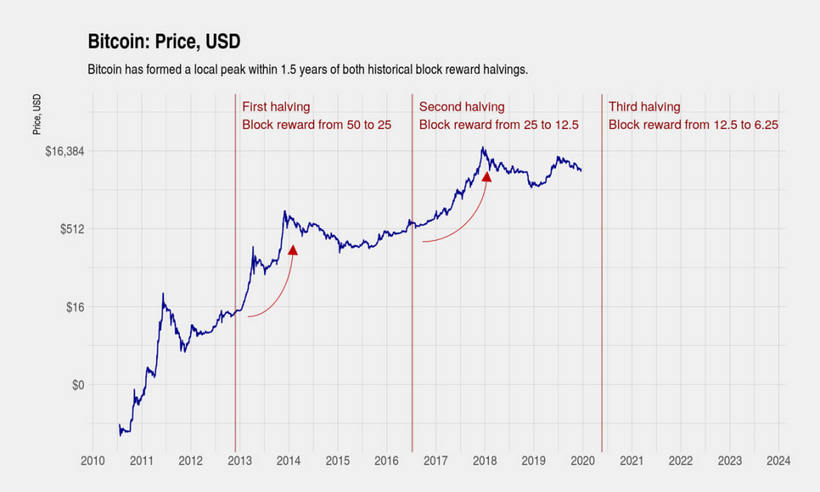

Halving Will Lead To Consolidation And Takeovers

In an extensive interview given to Stephan Livera, founder of blockchain consulting and content strategy firm Adaptive Analysis John Lee Quigley shared his perspective on mining in general and after the halving. He posited that – as a result of the double impact of price and reward drop – private mining is likely to be destroyed or subjected to hostile takeovers by large companies or pools. In his own words:

“So this price drop we’ve seen on Thursday will probably wipe out a lot of miners. We haven’t seen the difficulty estimates, and drop just yet, or a lot of miners would probably be forced to turn off their rigs. The miners who are lowest on the cost curve would probably acquire these rigs and the hash rate which comes offline, difficulty is going to adjust them words and then the big miners are in a great position again because the hardware they have acquired on the hardware they’ve deployed is now mining at a lower difficulty level so they have greater returns.

They have to pay high accounting fees to the big four to meet the financial reporting standards. And I believe they were probably mining at $8,000 or $9,000 per Bitcoin mined, and then Charles Edward released a methodology and indicator on trading view, which estimates the average price or average cost of production based on the energy draw that Cambridge are estimating. And I believe it was about $6,500. He estimated the average cost of production across the industry was, so this price drop, is the biggest miners are remaining profitable, but a lot of those in the middle and small end are just now unprofitable and will be forced to go offline.”

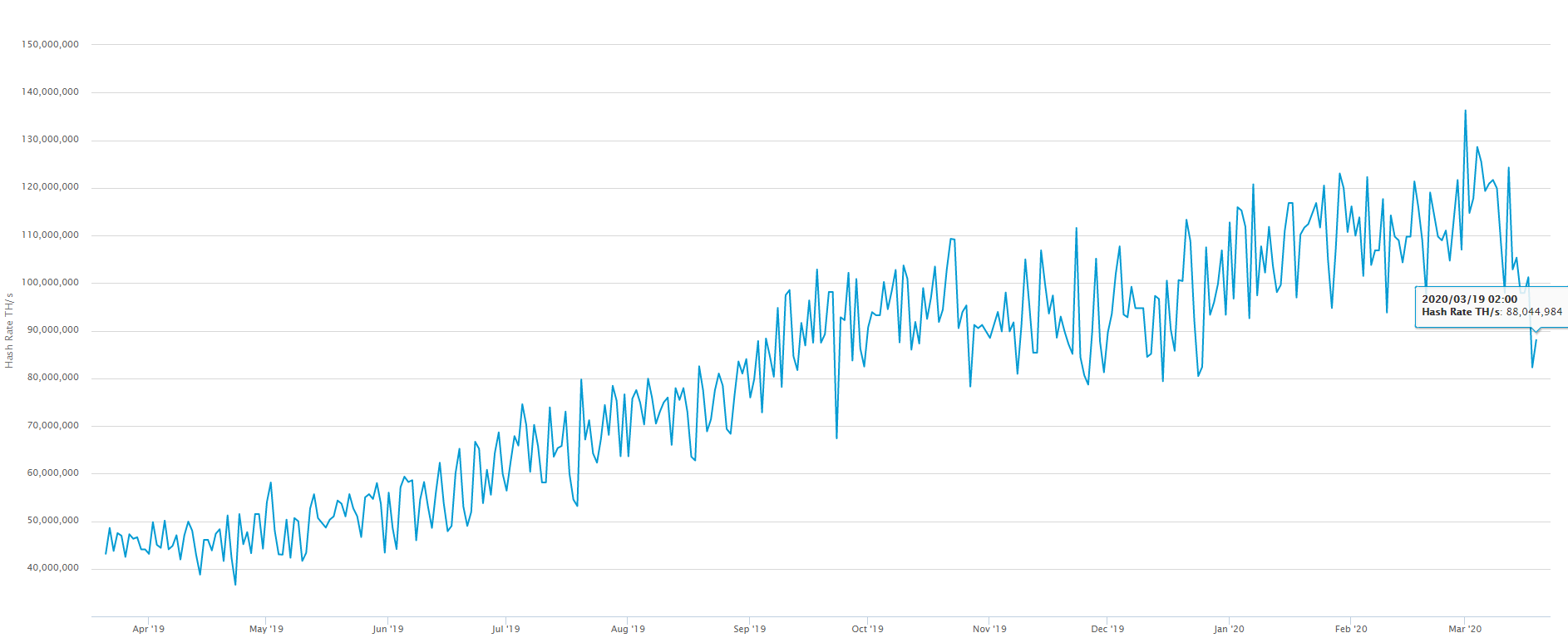

Bitcoin Miners Facing Double Whammy of Reward Cuts After Plunge

With BTC down by almost 40% to $5,350, the miners whose rigs provide one-third of all the power to the network have gone into the red, according to Chris Bendiksen, head of research at digital-asset manager CoinShares. This couldn’t come at a worse time. In May, new coin rewards will automatically drop to half, exacerbating the losses unless the price rallies.

Miners with mostly new gear are likely to survive, Bendiksen said, but those with “previous generation ones, they are starting to sweat a little. If the prices remain like this, the halving will finish them off.”

Bitcoin’s hash rate has already dropped nearly 20%, according to Blockchain.com. Sale Irwin, chief executive officer of Greenidge Generation LLC, which runs a mining farm, said:

“Based on our estimates, anyone using Antminer S9 or older generation miners is unprofitable unless their power cost is lower than 4 cents/kWh. The drop in hash rate over the past 24 hours can be attributed to this dynamic, especially given the widely-accepted assumption that S9 miners still constitute the majority of miners in operation.”

As miners shut down, the security of the network may also decrease. Since their machines are confirming transactions, when fewer miners are safeguarding the network, it might be easier for bad actors to start double-spending coins, for example.

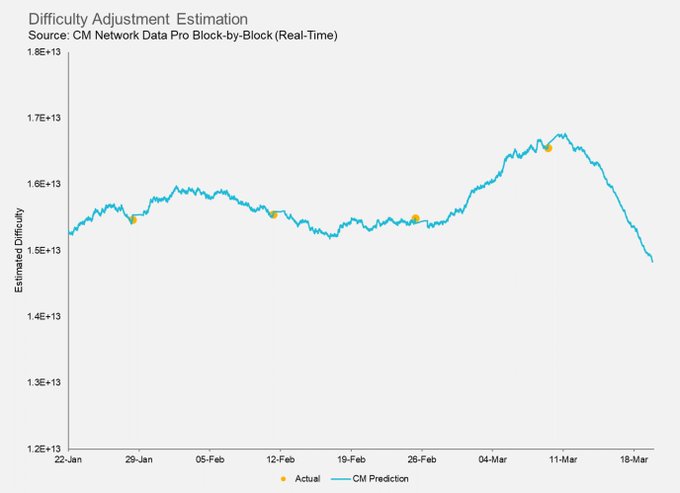

Coinmentrics analysts forecast significant drop in difficulty

“With less than one week to the next difficulty retarget, BTC difficulty looks like it will drop over 13% to its lowest level of 2020, based on recent and current hash rate levels,” Coinmetrics.io tweeted on March 20.

BTC’s average block time has increased to 13 minutes for two consecutive days, with some blocks taking over 90 minutes to find.

The Top 5 Cheapest Places To Mine Bitcoin

According to a March 9 tweet by Bitcoin trader and tech entrepreneur Jacob Canfield:

“As the price of #bitcoin drops, the efficiency of the markets will take over. Here are the Top 5 Cheapest places to mine Bitcoin the five cheapest places to mine BTC are:

- Venezuela – $531

- Trinidad and Tobago– $1,190

- Uzbekistan – $1,788

- Ukraine – $1,852

- Kuwait – $1,983

Many can mine above $4,000 and be profitable.”

The Technical View

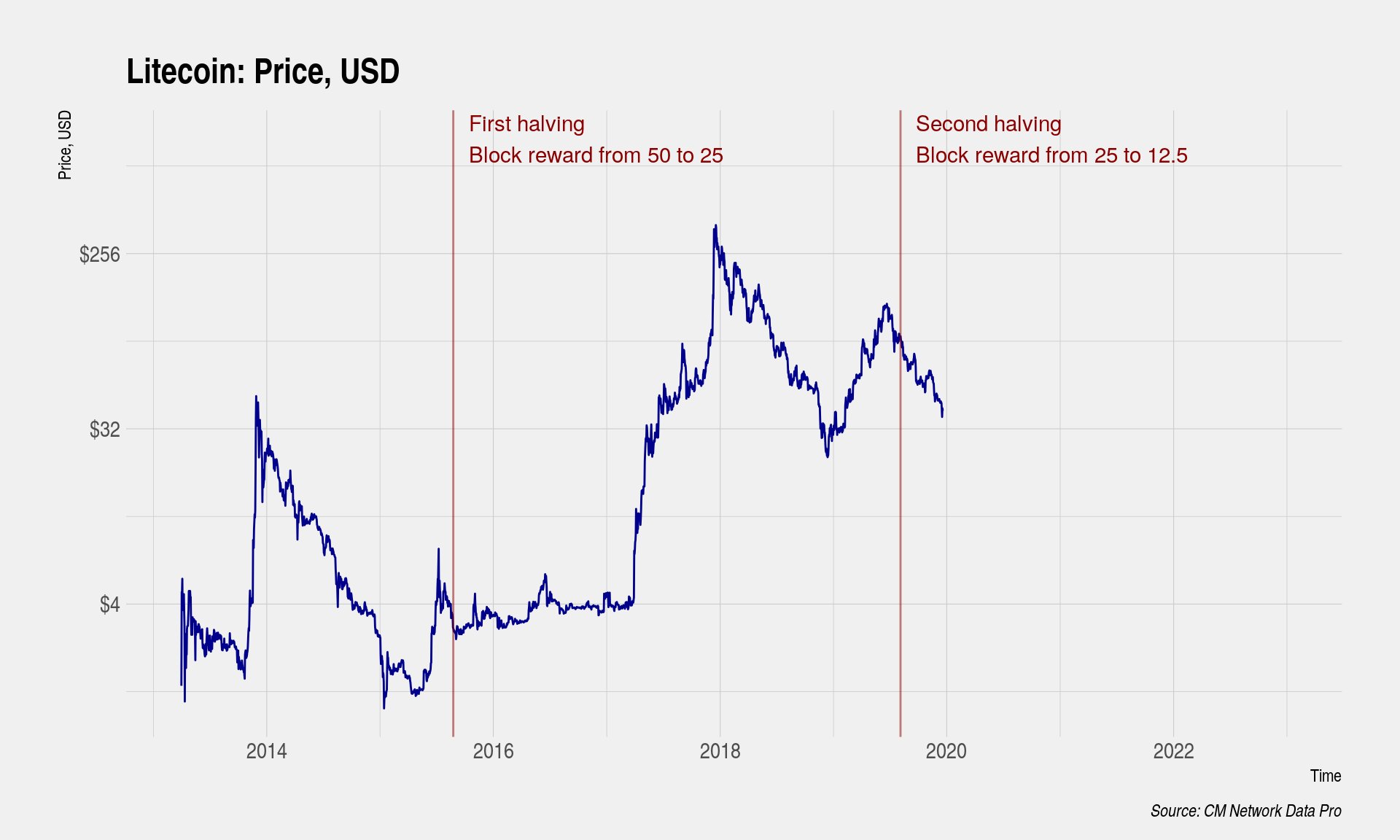

In our technical analysis, we look at the most intriguing scenarios regarding BTC’s performance. This time, we start with an arguable suggestion by Coinmetrics that Bitcoin halving could repeat Litecoin’s 2nd halving, when expectations of a rally were denied.

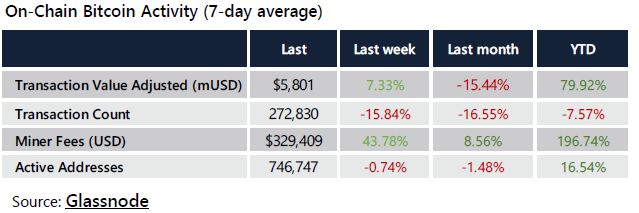

Arcane Research published their report for the February 20-March 20 period suggesting the following:

- The recent bounce does not indicate that BTC has turned a corner because the “fear and greed index” remains in the extreme fear area. Although the market has shown increased strengthening, investor confidence has not returned.

- The 7-day average real trading volume has more than doubled in the last week of the report’s period. A lot of Bitcoin is changing hands with extreme volatility. The 7-day average daily trading volume is getting close to the peak levels of 2019.

- We’ve seen large drops and a strong retrace for Bitcoin. This is, without a doubt, reflected in the 30-day volatility, which is pushing to new highs of almost 9%, which is very elevated, even for Bitcoin.

- COVID-19 and the oil supply shock have led to uncertainty in the global markets. All major indexes have nosedived. During the crash, Bitcoin closely mirrored stock market movements, printing its highest-ever 90-day correlation with the S&P 500 at 0.584. However, the most recent price action may indicate that Bitcoin is decoupling from the stock markets as its value returns to January 1 levels, while the stock markets remain stagnant.

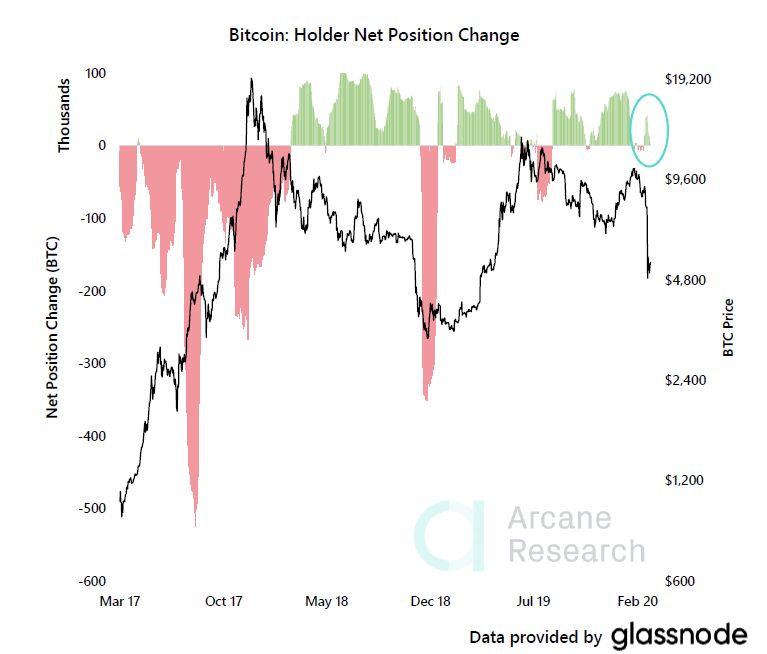

- Data provided by Glassnode shows that long-term holders are buying Bitcoin again. A metric called the “Holder Net Position Change” shows the monthly position change of long-term investors. The metric dipped below zero in February, as holders stopped accumulating. But in the last week (March 20), holders have started accumulating Bitcoin again.

Conclusion

This is a terrible but electrifying time for all markets, and especially for Bitcoin. In fact, this is the first serious test that the digital asset has faced on such a scale. The stock market has experienced many such tests since 1929, each one a little different but with a similar overall impact.

Can Bitcoin withstand the pressure and prove its worth? The digital asset being called to answer long-standing questions and prove or disprove certain hypotheses.

The current crisis confirms what we have suggested in a previous report – that BTC shares no features with gold and, according to Warren Buffet, has no intrinsic value.

At this moment of collapse, BTC shows a high correlation to an equity index, the S&P 500, in particular. This means that investors are treating it like an ordinary asset, stock, or currency, not as a safe haven or value-store like gold.

For some time, the expectation has been that interest in BTC and its derivatives would rise during times of increased volatility; however, at this historical juncture, the opposite appears to be true. Fearful investors are leaving BTC, dropping its trading volume to zero. This indicates that its safety has been highly overvalued or doesn’t exist at all. This also debunks the gold-like standing of cryptocurrencies.

Moreover, BTC is losing its attractiveness at the moment. People are focused on conventional assets like stocks, bonds, and commodities, while BTC takes a backseat.

Against the background of a massive collapse in all markets, we must take into consideration another two-prong risk specific to BTC, mining and halving. These two factors complicate recovery further, especially if BTC stands at a depressed price for a long time.

Despite all the above, the blockchain and BTC spheres are alive and continuing to develop. Forward movement indicates that the technology will likely survive and find applications in a variety of social spheres.

But as investors, we must answer the following question: In search of a bargain, what would we buy – precious metals, oil, blue chips stocks, or Bitcoin? Needless to say, our money is our vote of confidence.

We expect that BTC will drop to the 3.3K area and that the market will have difficulty bouncing back. Since investors are seeing the value-store and safety beliefs dissolving, we should be prepared for a slower recovery of BTC, compared to conventional markets. We should also be prepared for a drop in interest among institutional investors, whose money is critical to the expansion of the crypto market. When the dust settles, we may see BTC returning to the market like some secondary-quality stock.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

687 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023