Bitcoin Fundamental Briefing, May 2021

Intro

It seems that the not very long history of the cryptocurrency market now is split into “before” and “after” collapse that has happened recently. After a 50% drop is no sense to talk a lot about institutional investors’ interest, capitalization of Greyscale fund, and other things because they are do not matter already. But what is the matter?

The new reality of the cryptocurrency market is a matter. There is no need to be the prophet to understand that all investment society and the financial world are shocked by the fast and furious collapse on the asset that was promising a strong long-term rally just a few days ago, and everything was cloudless.

Now, cryptocurrency should get a new place and a new role in the modern financial world. The reality appears to be far from hopes and naïve views or surface conclusions on the unbreakable position of Bitcoin. Once this new reality and new treatment of cryptocurrencies will be formed, it turns up again if the financial world keeps the faith in cryptos or turns to internal wobbling near the bottom.

Currently, too few publications on this subject as big whales do not know how to deal with current situation, which is a significant risk factor for cryptocurrencies. Hopefully, the plunge will become an occasional hiccup, and we continue to enjoy the rally. Still, there are few factors exist now that could make investors’ life more difficult.

Market overview

Investors in Bitcoin are experiencing one of its rockiest weeks ever after a string of negative headlines, with prices swinging as much as 30% in each direction Wednesday alone, when it fell as low as $30,016, the least since January. Even with the gyrations, Bitcoin is still up more than 250% in the past year.

The turbulent stretch began after Musk said Tesla would no longer accept Bitcoin as payment for its electric vehicles, citing the coin’s intensive energy use. Another blow came when China reiterated a warning that it intends to crack down on cryptocurrency mining as part of an effort to control financial risks.

“Bitcoin has two problems, ESG and decreasing reliance on China, both of which could take some time” Edward Moya, senior market analyst with Oanda Corp., wrote in a note.

The latest warning from Beijing followed a statement earlier in the week disseminated by the People’s Bank of China that financial institutions weren’t allowed to accept cryptocurrencies for payment.

China has long expressed displeasure with the anonymity provided by Bitcoin and other crypto tokens. The country is home to a large concentration of the world’s crypto miners who use vast sums of computing power to verify transactions on the blockchain.

“It is no surprise that governments are not inclined to give up their monetary monopolies. Throughout history, governments first regulate and then take ownership,” Deutsche Bank macro strategist Marion Laboure wrote in a May 20. “As cryptocurrencies begin to seriously compete with regular currencies and fiat currencies, regulators and policymakers will crack down.”

The company said futures contracts and leveraged investment products would “temporarily” be not be available to new users from “a few specified countries and regions.” Huobi didn’t say which countries or regions would be affected.

Huobi will also stop selling crypto mining machines in China.

At JPMorgan Chase & Co., a team led by Nikolaos Panigirtzoglou reckons it’s premature to call the end of the Bitcoin selloff. Meanwhile, in a wide-ranging report, Goldman Sachs Group Inc. signaled that extreme swings hamper crypto’s appeal for institutional investors. And Medley Global Advisors LLC warned of the threat of spillovers if Bitcoin drops well below $20,000.

“It is too early to call the end of the recent Bitcoin downtrend,” the JPMorgan strategists wrote Friday, citing in part momentum signals and a lack of buying in Bitcoin funds and regulated futures.

Cryptos have suffered a range of blows in recent days, from Elon Musk’s criticism of Bitcoin’s energy use and about face on accepting it for payments, to heightened regulatory rhetoric from China.

Still, RBC derivatives strategist Amy Wu Silverman argued in a note Sunday that based on a measure of risk-adjusted returns known as the Sharpe ratio, Bitcoin has done better than shares in Tesla Inc., the SPDR S&P 500 ETF Trust or Invesco QQQ Trust Series 1.

Bitcoin, Ether and meme virtual currencies like Dogecoin are still sitting on major gains over longer time-frames, such as the past year — about 12,000%, in the case of Dogecoin.

For Ben Emons, managing director of global macro strategy at Medley Global Advisors in New York, Bitcoin is “firming its grip on markets through volatility, liquidity and correlation.”

Crypto’s Savage Swings May Deter Big Investors From Jumping In

Cryptocurrency investors argue that institutional buying is one more reason to be bullish. After Wednesday’s tumble, that’s becoming more and more implausible.

The problem is that mutual funds, insurers and pension funds are often seeking a particular level of volatility — or really, lack thereof — for their investments. If you have a pile of corporate cash, is it going to be OK to put some of it into an asset that can rise or fall 30% in a single day as Bitcoin did this week?

“You’re looking at volatility levels that are four times that of gold or of equities, and this is going to make it prohibitive for a lot of corporate treasurers and institutional investors who think that they can do a significant size holding in this,” said Joyce Chang, JPMorgan global research chair, on Bloomberg Television. “This type of volatility still compared to other asset classes is outsized for most institutional investors.”

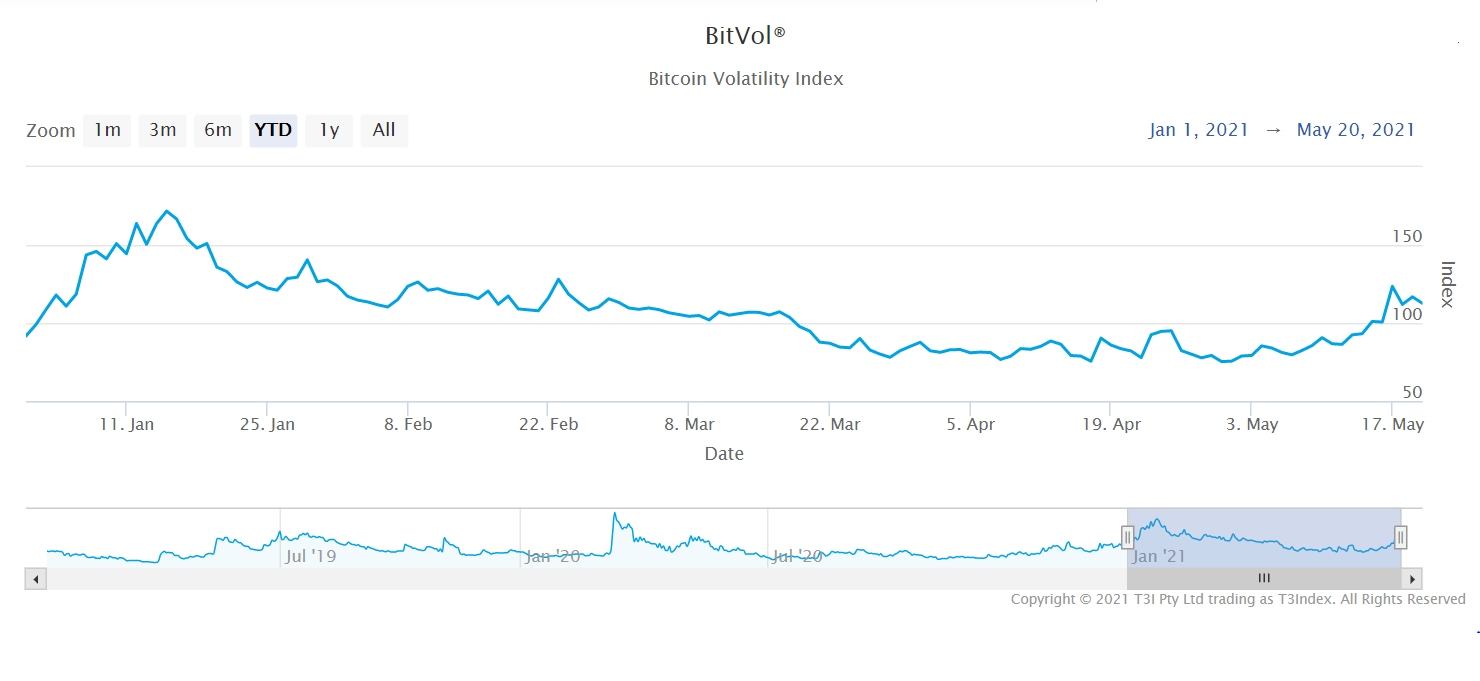

The T3 Index’s BitVol Index, which measures expected swings in the price of Bitcoin, rose above 100 last Saturday for the first time since March. That compares with the Cboe Volatility Index or VIX, which at 20.56 is still well off peaks in February, March and earlier this month in a range of 28 to 32.

Financial firms from Goldman Sachs Group Inc. to Bank of New York Mellon Corp. and Saxo Capital Markets Pte. are citing client demand among reasons to boost their cryptocurrency offerings. The asset class still holds some attraction, particularly with Ether up about threefold since the start of the year and Bitcoin about 30% higher in an era of low yields, but days like Wednesday make the argument for Bitcoin as “digital gold” or a “store of value” look somewhat tenuous.

Some are making long-term commitments to crypto, which means they aren’t that troubled by frequent ups and downs, said Diogo Monica, the president of institutional digital-asset platform Anchorage Digital.

However, JPMorgan’s Chang reiterated that volatility would be a top concern, given the needs of big investors and companies.

“It’s still pretty prohibitive particularly on the corporate side to look at this as a more institutional holding,” she said.

Professor Angel went further.

“Unless cryptos are a core part of their business — like in a crypto mining firm — a firm has no apparent comparative advantage over anyone else in speculating in crypto,” he said. “Boards and shareholders generally prefer that companies concentrate on where they have a comparative advantage and not get distracted in unrelated areas.”

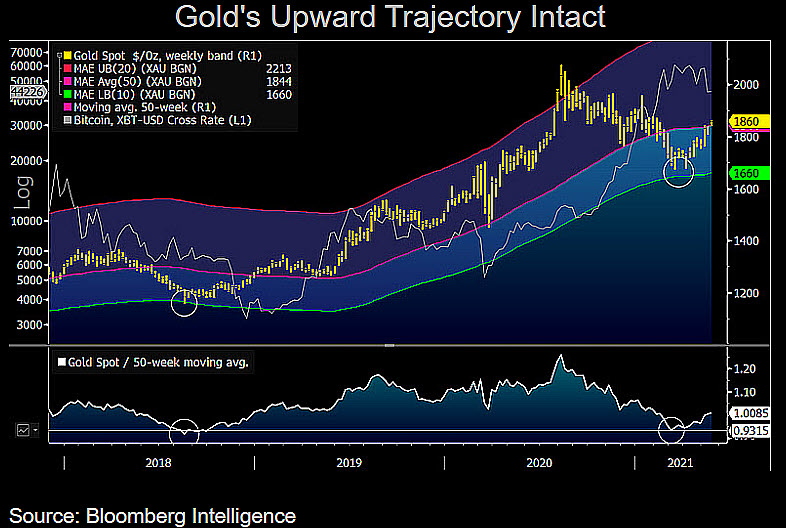

One-day swings of 31%. A slump amid a jump in U.S. inflation. Ever more critical regulatory scrutiny. Bitcoin delivered all of these in the past few days, undermining its claimed role as a portfolio hedge rivaling gold.

While true believers still tout Bitcoin’s merits as a store of value akin to digital bullion, recent events show how controversial that view is. The largest token has shed 40% after hitting a mid-April record, and its volatility compared with the precious metal jumped during this week’s cryptocurrency rout.

“This week’s crypto plunge and rebound was a wake-up call. Bitcoin will still act like a leveraged risk-on trade and not a proper inflation hedge,” said Edward Moya, senior market analyst with Oanda Corp.

Gold, meanwhile, is heading for a third weekly gain, bolstered by a weaker dollar and wavering Treasury yields, which boost the allure of non-interest-bearing bullion. It’s also benefiting from the crypto crash, according to Brian Lan, managing director of Singapore-based dealer GoldSilver Central Pte.

A mid-week report from blockchain analysis firm Chainalysis showed over half of the $410 billion spent on acquiring current Bitcoin holdings occurred in the past 12 months. About $110 billion of that was spent on buying it at an average cost of less than $36,000 per coin. That means the vast majority of investments aren’t making a profit unless the coin trades at $36,000 or higher.

“The stakes are much higher now than they were in the past,” Philip Gradwell, chief economist at Chainalysis, said in an email. “This week’s price fall means that a lot of investments are now held at a loss. This is going to be a serious test for recent investors, but so much is at stake now that there is the incentive and resources to address the problems in crypto that prevent it from becoming a mature asset.”

Felix Dian is in fighting spirits after this week’s crypto meltdown. Like many pros, the former Morgan Stanley trader says Bitcoin’s volatility actually shows why hedge funds are in the digital-currency game: To ride boom and bust cycles with diversified bets so clients don’t get killed at times like this.

“We had kept dry powder,” he said in an interview from London. He took advantage of Wednesday’s price collapse and bought Bitcoin when it was trading around $35,000.

Charles Erith, who worked for 24 years in Asian emerging markets before jumping to crypto, said the speculative froth was flushed out this week. He bought Bitcoin as prices were plunging.

“At $35,000, we felt it’s a reasonable level at which to be adding,” said Erith, who runs ByteTree Asset Management in London. “It’s obviously not regulated and it’s a very young asset, but I don’t think this is going to be a revisit of 2018.”

Data from research firm Chainalysis shows professional investors used the crash as an opportunity to start buying at cheap levels, helping put a floor under the market. Big investors bought 34,000 Bitcoin on Tuesday and Wednesday after reducing holdings by as much as 51,000 bitcoin in the last two weeks, according to data from Chainalysis.

“People that were borrowing money to invest, they were wiped from the system,” said Kyle Davies, co-founder at Three Arrows Capital in Singapore. His firm bought more Bitcoin and Ether as prices of the tokens tumbled this week.

“Every time we see massive liquidation is a chance to buy,” he added. “I wouldn’t be surprised if Bitcoin and Ethereum retrace the entire drop in a week.”

Over in Paris, Loan Venkatapen, founder of Blocklabs Capital Management avoided Bitcoin, but bought Ether, Solana and other assets connected with the decentralized finance movement as they sold off.

“Bitcoin is not dying, but we expect productive blockchain assets such as Ethereum or Solana to challenge Bitcoin dominance in the coming months,” he said.

How it is started

By hindsight analysis it seems that the brightest predictor was an indicator of accounts amount with balance above 1K BTC by Glassnode. It starts to decline sharply within 1-2 months before collapse has happened, Coindesk reports:

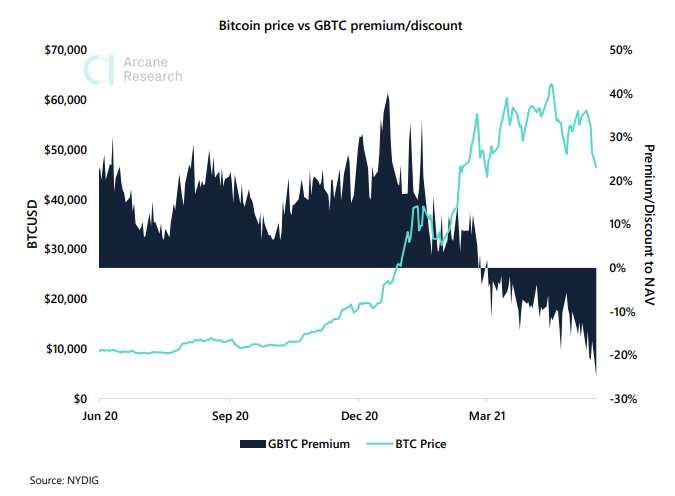

There was other indirect signs that something wrong is going on. For instance Greyscale shares has reached the largest discount to the BTC price just few days before the collapse and it was starting to rise also within few months:

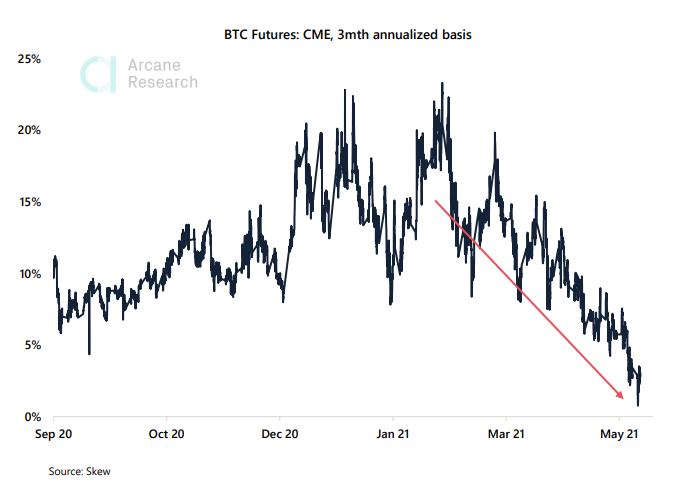

Contango on CME BTC futures was melting through the same period that also indicated bearish sentiment, according to Arcane Research:

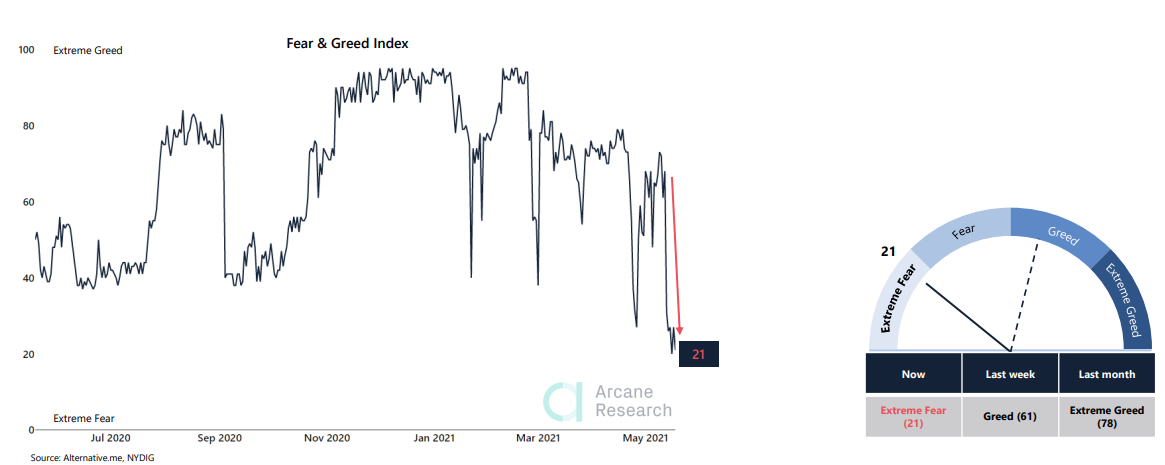

As a result Arcane’s analysts have come to conclusion that market stands at high fear levels:

Market sentiment after collapse

Glassnode provides great report with in-depth analysis of ongoing processes through collapse.

“On-chain we can observe a notable bifurcation of reactions, with newer market entrants panic selling and realising losses, whilst long term holders appear relatively un-phased by the news. There are many supply and demand dynamics that resemble the 2017 macro top however with unique differences that will challenge the conviction of both bulls and bears.”

The number of entities that are currently in profit provides insight into the cross section of the market that is underwater. We can observe that this correction has lead to over 23% of on-chain entities (unique, separate wallets) being at a loss, which compares to only three up-trending periods since 2016.

Newer market entrants have panic sold and realised significant loses on their coins.

The total count of addresses holding a non-zero BTC balance has also pulled back by -2.8% from the recent all time high of 38.7M addresses. A total of 1.1M addresses have spent all coins they held during this correction, again providing evidence that panic selling is currently underway.

Long Term Holders are Buying this Dip

In almost perfect opposition to new entrants panic selling, long term holders appear to be buying the dip and accumulating cheaper coins. Whilst the count of non-zero addresses has fallen during this correction, the number of addresses that are in accumulation have increased by 1.1% since the recent low. Accumulation addresses are defined as those which have at least two incoming transactions but have never spent any coins.

Similarly, the supply held by long term holders (LTH) has returned to accumulation mode, a pattern that again resembles the 2017 macro top. What this chart is largely reflective of are buyers who purchased coins in late 2020/Jan 2021 and have not spent their coins. As the supply of LTHs starts to rise, it indicates that the volume of coins maturing beyond 5 months of dormancy, exceeds the volume old coins that are spent to realise profits.

The current LTH owned supply is over 2.4M BTC (8% a proportion of circ. supply) more than it was at the 2017 peak. This indicates that a large volume of coins have moved to and remain in illiquid cold storage and this trend is continuing.

Overall, the Bitcoin market is in a historically significant correction. There are strong signals that short term holders are leading with panic selling, however long term holders are stepping in to buy the dip and their confidence is largely unshaken.

The PoW energy consumption narrative is nuanced to say the least, and what follows will be a test for the whole Bitcoin market’s conviction.

Anthony Pompiliano from Morgan Creek Digital also provides his in-depth analysis on money flow at the crush day and tells that big whales have used the drop for increasing long-term positions.

I decided to put together a deep dive into what actually happened from an on-chain perspective and how the bull market remains intact. I still stand 100% on the claim that the bull market still has a long way to go. Hope you enjoy.

There are several key takeaways from this letter:

- Exchange flows flipped bearish following the recent FUD

- Coins that sold were young, many of which were sold at a loss

- The sudden price drop was driven by liquidations

- Leverage is now wiped out

- Coins sold are now in process of accumulation, exchange flows are no longer bearish

- The bull market remains intact

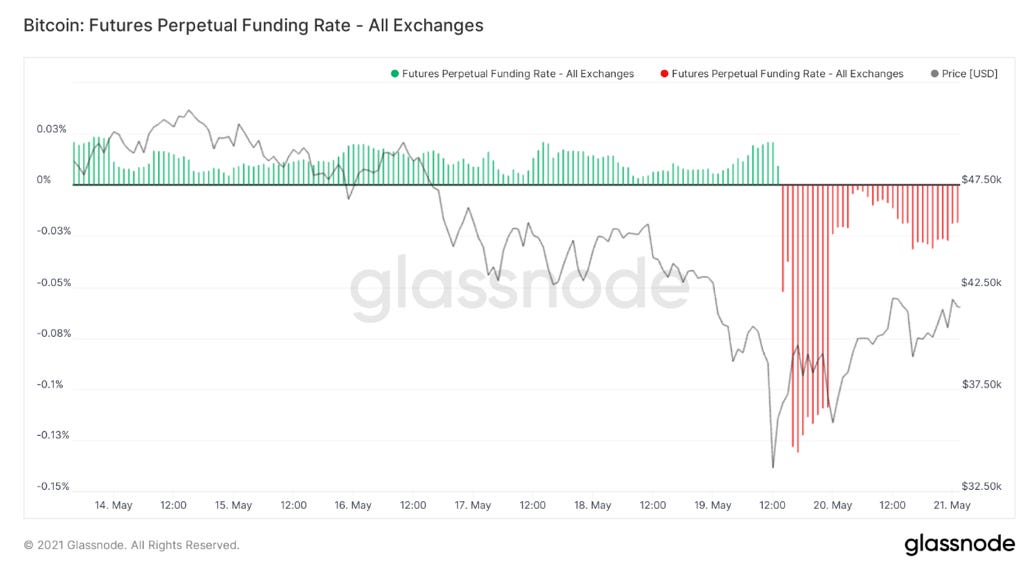

Although I obviously didn’t see the dip coming, (I have been bullish the past few weeks) I think it was somewhat obvious that we were going to see a big liquidation wick once those traders kept trying to leverage long each dip. This was viewable through funding rates staying positive throughout the descent, (until Wednesday morning) but since the huge flush funding rates have stayed negative.

By the way, the fact that funding rates are still negative means majority of traders are short right now, and given that we haven’t seen any major short liquidations, it is very possible that we are setting up for a pretty big-short squeeze… If spot can push us up to initiate the cascade of course.

During the flush, over $300M in longs got liquidated within 10 minutes. This cascade of liquidations, aka the flush, was why the price drop was so rapid. In total, $9,408,072,338 of leverage has been wiped out peak to trough.

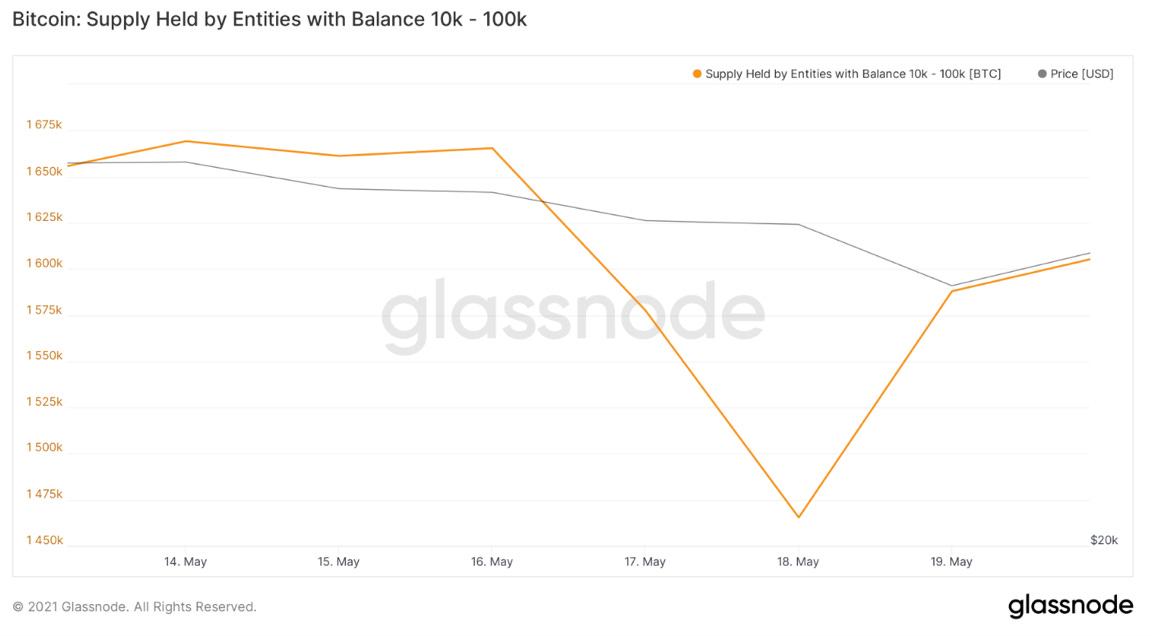

The cohort that did the most buying throughout the dip was entities holding 10k-100k BTC. This cohort added 122,588 BTC to their holdings in aggregate on Wednesday.

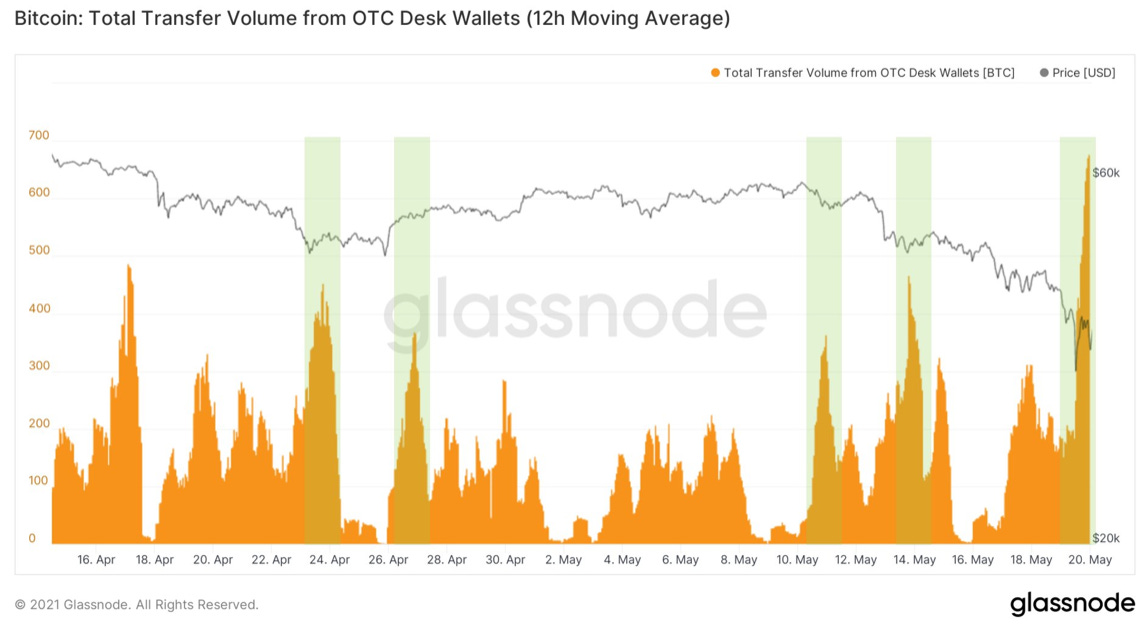

Since Wednesday, exchange flows have normalized and are no longer bearish. OTC desk outflows spiked during the dip, showing strong buying from high net worths/institutions.

The last and arguably most important metric to fundamentally see why this is not the bottom is looking at pure on-chain volume at different price levels. At the end of bull markets when there is a blow-off top, there is very little volume distribution. Over the last 2-3 months there was a ton of volume in the 40k-60k range, especially between 53k-58k. Over 25% of supply has moved above 40k in total.

In conclusion, this event was unexpected from my perspective but became obvious we were going to go further after seeing traders try to leverage long each dip. We have a large leverage reset and wipeout of weak hands. At this point it’s just going to take some time for those young coins recently sold to find a new home. Still bullish for the remainder of the bull run. Until next time.

Big institutional investors are dumping bitcoin and going back into gold, JPMorgan says

Institutional investors are dumping bitcoin in favor of gold, reversing a recent trend that’s played out over the last two quarters, according to a new report from JPMorgan.

Based on open interest in CME bitcoin futures contracts, the firm said large investors are shifting away from bitcoin after favoring the digital currency over gold beginning last fall.

“The bitcoin flow picture continues to deteriorate and is pointing to continued retrenchment by institutional investors,” JPMorgan wrote in a note to clients. “Over the past month, bitcoin futures markets experienced their steepest and more sustained liquidation since the bitcoin ascent started last October.”

Gold’s 20% discount to its 2020 record high is sufficient for a resumption of a bull market for the metal, as we see it, but store-of-value newcomer Bitcoin is likely to remain a headwind to its upside.

Asset managers express caution on cryptocurrency after price swings

UBS Wealth Management, Pimco, T Rowe Price and Glenmede Investment Management were among the firms that have expressed reservations in recent days about the potential of cryptocurrency investments.

“Our stance with clients is the 10-foot pole rule: stay away from it,” said Jason Pride, chief investment officer of private wealth at Glenmede. “I don’t think the Fed and other regulators are fans of the current market structure for cryptocurrencies.”

Rob Sharps, president and head of investments at T Rowe Price, told the Financial Times: “Crypto has an impact across capital markets, and we’re capital markets experts. Ultimately, the mandates we manage for clients are not well suited for investing in cryptocurrencies, and we recognise the high level of speculation in this space.”

“The volatility of crypto is stratospherically high and we often see that, when equities sell off, so does bitcoin and that means it is not a good portfolio diversifier,” Pride said.

Nicholas Johnson, portfolio manager for commodities at Pimco, took issue with bitcoin advocates who praised it as an inflation haven after cryptocurrencies rallied while gold fell in price.

“This idea that crypto is an inflation asset is curious,” he said. “Inflation assets underperformed in recent years while cryptocurrencies did very well. People are looking for a reason to justify why crypto has gone up.”

“We expect more stringent policy and regulatory controls ahead for crypto as it becomes more mainstream,” UBS Wealth Management said, adding that the price volatility that followed the Tesla announcement “highlights risks companies face if they take on crypto balance sheet exposure”.

Tom Jessop, head of digital assets at Fidelity, which has been more receptive to cryptocurrencies, nevertheless cautioned that such investments were still in the early stage of development.

“We refer to bitcoin as an aspirational store of value and it’s an adolescent in terms of its development due to the extreme volatility,” he said. “Some investors are willing to accept the volatility as they see bitcoin as a long-term venture opportunity.”

SocGen says bitcoin’s place in a portfolio ‘remains highly contested,’ gold is a better stabilizer

“It comes as no surprise that the place of Bitcoin in any investment portfolio remains highly contested, precisely because of its erratic price movements,” Societe Generale’s Alain Bokobza and Arthur Van Slooten wrote in a Thursday note.

Bokobza and Van Slooten argued that the risks to bitcoin “remain on the downside,” citing factors such as potential regulation ahead, which the two characterized as the “biggest threat” looming for the cryptocurrency.

For its part, Societe Generale currently assigns a 5% direct weighting to gold in its multi-asset portfolio as a stabilizer.

In the case of rising inflation, gold can “partially offset capital losses on bonds,” the analysts said. Furthermore, gold also has a “protective role in partially offsetting losses” on stocks in the events of either runaway inflation or a return to deflation.

“History shows that over time the price of gold closely tracks real bond yields,” the analysts said. “Also, the price ratio of copper (the most cyclical metal) to gold (the most defensive) has proved a neat model for anticipating higher US Treasury yields.”

Other Top News

Kraken has to report about transactions over $20K for tax supervision authorities

A federal court in the Northern District of California entered an order today authorizing the IRS to serve a John Doe summons on Payward Ventures Inc., and Subsidiaries d/b/a Kraken (Kraken) seeking information about U.S. taxpayers who conducted at least the equivalent of $20,000 in transactions in cryptocurrency during the years 2016 to 2020. The IRS is seeking the records of Americans who engaged in business with or through Kraken, a digital currency exchanger headquartered in San Francisco, California.

The U.S. Treasury Department on Thursday announced that it’s taking steps to regulate cryptocurrency markets and transactions. China has already been cracking down on the sector since 2017.

Conclusion

So a lot of important information above and a lot of things to think about. The primary conclusion that we could do is that the market kept a bullish trend by far. The collapse was significant, but it hasn’t crushed the main levels, letting BTC stay on the upside course. This is the major positive conclusion that we could make.

But we also have enough negative conclusions. The first is, institutional activity will decrease, and this makes a negative impact on recovery. It becomes slower and more extended. Lack of regulation and high dependence on chaotic government decisions, such as China’s ban, make the crypto market very vulnerable. This is not acceptable for institutional capital.

The second is political risks. The primary concern stands around the reasons that forced China to make such an unpopular decision. As you understand, such decisions are not taken just occasionally. Mr. Xi not just woke up and thought, “Let’s ban Bitcoin today.” Some serious background exists, and it seems that China indeed sees some risk for its financial safety. Miners could theoretically move to other countries, but I wouldn’t be surprised if other developed countries follow the Chinese example, trying to put under strict control of the cryptocurrency market. Political is the most critical risk by our thoughts right now.

Finally, the coming interest rates tightening cycle will become the headwind for cryptocurrencies as well. CPI release has shown strong sensitivity to inflation, and rising of the interest rates put BTC in competition with interest-bearing assets, such as bonds. With the background that we have, hardly Bitcoin has any valuable advantage.

It means that the market mostly remains “individual” mainly, with the solid activity of Hedge Funds. Based on the crush scale and results of the collapse, it seems it was not a deadly blow, we already see some signs of recovery, but equilibrium is very fragile. All things that we’ve said here work only if the situation stands as it is right now. Any new “surprise” from China or another country of the same manner – and the situation could become worse.

Now market should inhabit with the new reality, new price level, and new structure. It needs time for accommodation. Thus, within few weeks hardly we will see strong directional action. Let’s be patient. Still, as we’ve said in our multiple daily updates – it is the time for long-term accumulation, and fundamental background supports this view.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

677 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023