Bitcoin Fundamental Briefing, June 2023

WIND OF CHANGE?

This time, guys, we make a specific report, trying to understand, whether we really stand at decisive point and cryptocurrency world never remains the same, or, it will just an episode, similar to many other ones that we saw previously. Of course, as usual, we discuss some new forecasts, changing of market statistics and many other things that we usually do in every report. At the same time, hardly we become an original, pointing that BlackRock ETF topic has exploded the net and fairly treated as the most important event , at least in recent two years.

So, very soon we should know whether this is really the wind of change for the market, signaling over ending of the crypto winter, or not yet. And despite how unpleasant it could sound, but control is in the hands of the SEC. according to Bloomberg Intelligence, the SEC has a maximum of 240 days to decide on the BlackRock’s application.

MARKET OVERVIEW

Month has begun with deep negative tone. It was seemed that no light at the end of the tunnel. SEC has filled the legal claim, started probes against Binance and Coinbase. All these steps were just a continuation of the SEC longer-term strategy to tight regulation over crypto market. Market depth is down a whopping 78%. Market makers vacated instantly, leaving hardly any liquidity, Kaiko said

Belgium’s FSMA regulator on Friday ordered Binance to cease offering any virtual currency services in the country, adding to pressure on the world’s biggest cryptocurrency exchange.

“The FSMA has therefore ordered Binance to cease, with immediate effect, offering or providing any and all such services in Belgium,” it added in a statement.

France is also probing Binance, which has decided to quit the Dutch market because it had been unable to meet registration requirements to operate as a virtual asset service provider.

But closer to the end of the month, situation has changed drastically. Binance itself has filed a claim against the SEC. Besides, Binance and Binance.US entered an agreement with the U.S. Securities and Exchange Commission to ensure U.S. customer assets remain in the United States until a sweeping lawsuit filed this month by the SEC is resolved.

Even more, later some Senators and Congressmen have called for investigation and probes over G. Gensler and possible abuse of authority.

So basic… #FireGary and de-politicize the world’s biggest and best capital markets. This should be a unifying, nonpartisan plan to restore focus on the mission. Who will be the first Democrat to cosponsor? Tag someone.

Finally, IMF has changed its mind concerning cryptocurrencies ban, that previously was mentioned few times in different IMF reports. Now they tell –

While a few countries have completely banned crypto assets given their risks, this approach may not be effective in the long run. The region should instead focus on addressing the drivers of crypto demand, including citizens’ unmet digital payment needs, and on improving transparency, by recording crypto asset transactions in national statistics.

Very soon sentiment has changed drastically due to the BlackRock ETF file, which has provided most powerful boost to the market in recent couple of years probably. And, indeed, we could say that this could become an epic event, potentially if… file will be approved by the SEC.

The world’s largest asset manager on June 15th, applied for the iShares Bitcoin Trust, according to a filing with the US Securities and Exchange Commission. Coinbase Global Inc., the biggest crypto exchange in the US, would act as custodian. The ETF, should it launch, would trade on Nasdaq.

Bitcoin hit its highest level in a year amid renewed fervor for digital assets despite a slew of challenges for the industry.

The original digital currency crossed above $31,013, its 2023 peak, to reach its highest level since June 2022, Bloomberg data show. The token is up by almost 90% since the start of the year, though still more than 50% below an all-time high of almost $69,000. Other cryptocurrencies followed suit, with Ether also rallying.

It’s a remarkable development — and show of resiliency — for a market that many had written off as being on the verge of extinction following a number of high-profile and high-impact scams and company fallouts that left the industry besmirched among investors.

“From the ardent Bitcoiner’s perspective, the token’s most fundamental investment thesis is playing out: inflation, monetary mismanagement, banking crises, sovereign debt anxiety, US-dollar-reserve-status questions are all playing a role in giving Bitcoiners an ‘I told you so’ moment,” said Strahinja Savic, head of data and analytics at FRNT Financial. “I would not describe rallying to new all time highs despite the challenging environment, but rather because of it.”

Most recently, it’s been news about BlackRock Inc.’s shock filing for a US spot Bitcoin exchange-traded fund that’s reignited fervor for crypto, with some in the market hoping that such a product — which currently doesn’t exist — gets approval from regulators. An approval — whatever its odds — would mark a win for fans who have for years longed for such an investment product.

“BlackRock’s filing is big news for Bitcoin due to its close ties with regulators and a very strong ETF-approval track record,” wrote K33’s Bendik Schei and Vetle Lunde. “It’s also worth noting that BlackRock would not dedicate time and resources to this filing if they did not view the probability of long-term strength from BTC, and thus strong inflows, as substantially high.”

They added: “An approval would profoundly impact the market structure of Bitcoin, as it would reduce the barriers for financial advisors to offer exposure to BTC through an accessible investment vehicle with daily creations and redemptions delivered by a trusted issuer.”

Other recent news also reinforced crypto believers’ faith in the rally. A new crypto exchange backed by firms including Citadel Securities, Fidelity Digital Assets and Charles Schwab Corp. — called EDX Markets — said it’s gone live. And, among other pieces of news, JPMorgan Chase & Co. expanded one of the most high-profile projects to bring blockchain technology to traditional banking, introducing euro-denominated payments for corporate clients using its JPM Coin.

On Twitter,where a lot of crypto discourse takes place, a number of users cited FOMO — “fear of missing out” — as part of the recent price surge, whereby some investors jump into the market because they are watching others reap the benefits of the rally and want to take part in it.

But the fact that the industry is facing harsh regulatory oversight has not dissipated, despite all the renewed hype over prices surging.

The SEC has set its sights on the crypto space following last year’s numerous instances of scams and fallouts of once-vaunted companies, including FTX and a number of lenders. It’s led to a mass exodus by retail investors in particular, who have collectively lost billions of dollars in the wake of the revelations and implosions.

Trading volumes have dried up as a result. In May, the combined spot and derivatives trading volumes on centralized exchanges fell more than 15% to $2.4 trillion, according to CCData. Spot trading volumes alone dropped nearly 22% to $495 billion, notching the lowest monthly reading since March 2019, the researcher said in a report.

“Given the thin liquidity and the relatively scant amount of BTC available to new entrants (no eager sellers at these levels), even a tiny uptick in large investor interest would be enough to move the price,” said Noelle Acheson, author of the “Crypto Is Macro Now” newsletter.

Others point out that hype around a potential spot-Bitcoin ETF has come and gone in the past, without regulators ever approving such a product. (??)

“People are speculating BlackRock’s heft in the financial markets will help them get approval. I am not quite there yet,” said Michael O’Rourke, chief market strategist at JonesTrading. “The SEC has been aggressively cracking down on the crypto space, it seems a bit early for such an about-face.”

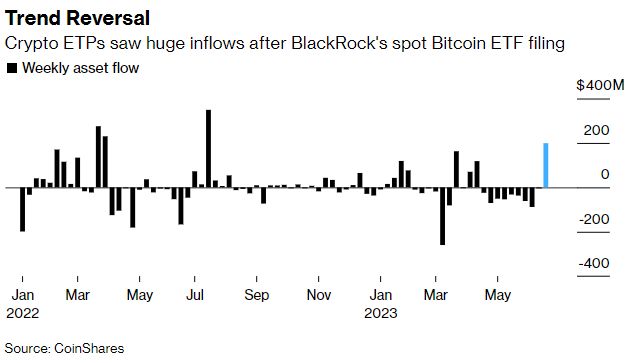

Digital-asset investment products added $199 million last week, the biggest weekly inflows in nearly a year, as a flurry of applications for spot-Bitcoin exchange-traded funds in the US sparks renewed interest in the space.

The inflows are the highest since July 2022 and follow nine consecutive weeks of outflows, according to a report from digital asset manager and crypto research firm CoinShares. About $187 million, or 94% of the total flows, went to Bitcoin. Total assets under management now stand at $37 billion — the highest since before the collapse of Three Arrows Capital, the data shows.

“We believe this renewed positive sentiment is due to recent announcements from high profile ETP issuers that have filed for physically backed ETFs,” CoinShares wrote in the Monday report.

Why would the biggest asset manager on the planet file for a fund that will only be rejected? BlackRock “likely didn’t make the decision lightly,”Bloomberg Intelligence analysts noted. Indeed, the investment giant “may know something” as to the SEC’s thinking that us mere mortals don’t, The ETF Store’s Nate Geraci pointed out.

That line of reasoning seems to be prevalent among rival ETF issuers. Bitwise, WisdomTree and Valkyrie were quick to file plans for similar products, while Invesco Ltd. renewed its application for the physically-backed Invesco Galaxy Bitcoin ETF. In an industry as saturated as the $7 trillion US ETF market, the first-mover advantage is crucial.

Four is – the number of investment firms (and counting) that applied with the SEC to start a spot Bitcoin ETF since BlackRock filed its own application on June 15. Hearing them out –

“The innocent are paying for the sins of the guilty.”

TO BE OR NOT TO BE (ETF)

It is really big passion around this topic now. Meltem Demirors, the Head of Strategy in CoinShares writes in twitter –

Last week’s @BlackRock spot Bitcoin ETF filing was big news! But, it’s not the only story. many of the largest financial institutions in the US are actively working to provide access to Bitcoin and more.

a quick glance — $27 trillion of client assets here!

They are – Fidelity, JP Morgan, Morgan Stanley, BofA, Goldman, Invesco. And, as we’ve said – Fidelity already goes with the path of BlackRock. This will be Fidelity’s second attempt at such a product. In 2021, it filed for a bitcoin spot exchange-traded fund called the Wise Origin Bitcoin Trust but was denied by the U.S. Securities and Exchange Commission in early 2022.

Ark Invest thinks that BlackRock’s filing for a spot bitcoin ETF earlier this month could be a “significant turning point in bitcoin’s path to institutional acceptance,” Ark Invest said in an emailed note on Monday.

“BlackRock’s decision to file for a Bitcoin ETF signals that large institutional players are positive on the long-term outlook for the digital asset,” Ark analyst Yassine Elmandjra wrote.

“While it looks much like previous ETF filings, BlackRock worked with Nasdaq to distinguish its application with a unique surveillance-sharing agreement designed to prevent the risk of bitcoin-related market manipulation,” Elmandjra said. “Based on our research, however, other applicants will be able to amend their filings with similar agreements at little cost.”

The HSBC branch in Hong Kong announced the possibility for its clients to trade ETFs for bitcoin and Ethereum, which were listed on the local stock exchange. Currently, cryptocurrency ETFs listed in Hong Kong include CSOP Bitcoin Futures ETF, CSOP Ethereum Futures ETF, and Samsung Bitcoin Futures Active ETF.

United States-based crypto exchanges, including Coinbase and Binance.US — both of which were sued by the Securities and Exchange Commission last week — could potentially face regulatory pressure to register with the agency, according to JPMorgan strategists.

“Eventually, the SEC position might be confirmed by lawmakers and Coinbase, Binance.US and other U.S. exchanges would have to register as brokers and most cryptocurrencies would be treated as securities,” JPMorgan strategists led by Nikolaos Panigirtzoglou wrote in a note on Thursday. “This could be more onerous and more costly for the crypto industry but there could be positives as well, as crypto markets would be subjected to similar regulations applied to traditional markets such as equities and thus offer more transparency and investor protection.”

JPMorgan strategists said the SEC efforts increase the need for U.S. lawmakers to develop a clear regulatory framework this year. Without such clarity, crypto activity in the U.S. will likely shift outside the country and into decentralized entities, and venture capital funding for crypto will remain limited, according to the note.

Regulations will be positive as “it would clear the industry from bad practices and bad actors, which in turn is necessary for the industry to mature and see more institutional participation,” according to strategists.

If the SEC wins the battle, that could result in exchanges delisting these tokens and limiting their respective blockchains’ potential development, according to JPMorgan strategists, who said that could benefit Ethereum.

“Given that most of the tokens targeted by SEC are Ethereum competitors, often called in the crypto world Ethereum killers, [last] week’s SEC actions raise the chance that Ethereum would further increase its dominance in smart contract blockchain space,” strategists said.

The same opinion comes from ex Micro Strategy CEO, Michael Saylor:

Regulatory clarity is going to drive Bitcoin adoption by eliminating the confusion & anxiety that has been holding back institutional investors. Bitcoin dominance will continue to grow as the Crypto industry rationalizes around $BTC and goes mainstream. “The public is beginning to realize the near future of bitcoin. The next logical step for the cryptocurrency is to grow tenfold, and then again by the same amount,” he said.

The Federal Reserve chair said that payment stablecoins are money, and that the central bank should play a role in approving their issuance in the U.S.

“We do see payment stablecoins as money,” he said in testimony in front of the House Financial Services Committee on Wednesday, adding that the central bank should play a role in approving stablecoin issuance. “We believe that it would be appropriate to have a quite robust federal role in what happens in stablecoins going forward, and leaving us with a weak role and allowing a lot of private money creation at the state level would be a mistake.”

MARKET STATS

Based on recent Glassnode report, analyzing the fund flow attributed to top exchanges in the US and Asia, shows a strong accumulation during Asia trading hours, while the US markets have shown weaker demand in 2023.

Analysis of short-term holder behavior in 2023 suggests market psychology has shifted from the bearish environment of 2022, with the recent rally springing off their cost basis, which acted as support.

In recent weeks, the SEC has been applying pressure to the top two cryptocurrency exchanges in the US. However, this week saw a gold rush of spot Bitcoin ETF applications lead by Blackrock, the largest global asset manager. In response, BTC has rallied from $25k to over $31k, reaching new yearly highs.

The rally was led by traders in US 🔵, followed by traders in EU 🟠, and lastly in Asia 🔴.

As a gold rush of institutional-grade ETF applications are filed in the US, we have seen early signs of a revival of US-led demand. This comes after a period of weaker relative US demand in 2023, with top exchanges in Asia seeing the strongest accumulation year to date.

With the prospect of a new large acquirer of spot BTC on the table, we developed a framework for assessing the available volume of BTC supply, and a toolkit to assess the expansion (or contraction) of new demand.

We close by examining the behavior of the Short-Term Holder cohort, and observe that their market psychology appears to have shifted from the bear market blues of 2022. Their actions speak to a newfound perception of ‘break-even’ levels as an opportunity to add to positions, rather than to liquidate into whatever exit liquidity is available.

We can also see a strong reaction in the Short-Term Holder MVRV indicator, reacting strongly off the break-even level of MVRV = 1.

This ratio is currently at 1.12, suggesting that, on average, the short-term holder cohort is sitting on a 12% profit. The risk of market corrections tend to rise when this metric exceeds levels of between 1.2 (~$33.2k) and 1.4 (~$38.7k), as investors come into increasingly large unrealized profits.

OUR TWO CENTS

We think that it would be proper to start with the one piece of news from the crypto world went unnoticed:

A new cryptocurrency exchange backed by firms such as Citadel Securities, Fidelity Digital Assets and Charles Schwab Corp. has launched and could change the landscape of the digital asset market amid increased U.S. control over the sector.

Because actually it puts the foundation for the whole logic of our view. The event itself is significant in that the creators of the exchange are the largest broker, the largest investment-pension firm with multi-trillion assets and the largest market maker. The creation of their own trading infrastructure by the largest players is another signal that the crypto is definitely not going anywhere. At least in the coming years, for sure, no matter how the SEC wants to drive out the ungodly Chinese Binance.

More precisely, even the fact that they want to drive out the Chinese stock exchange is another confirmation that the market is being redrawn in favor of their own. Recent IMF statement, concerning cryptocurrencies ban tells that this asset class will be with us for a long time, since the IMF proposes to include it in national statistics. This is the first point.

Second… Concerning Blackrock ETF. Recall that a lot of people have already applied for ETF registration with the SEC. Both pure cryptians and giants like Fidelity Investments and all were denied registration under the pretext of “the asset is not protected from price manipulation,” although futures ETFs were allowed several times.

BlackRock offers the new scheme. The custodian (type of depository) will be Coinbase, and the price will be taken from it to determine the value of the assets of the ETF and the BTCs will be bought on it.

I don’t know if it has anything to do with hitting the head of the SEC Gensler, but if they do get permission, it will be a bomb. Let me remind you that all the BTCs on all spot exchanges are now only 777 thousand pieces. That is, by $20 billion.

If an ETF does appear, then 0.1% of all funds managed by Blackrock will be enough to take them from the market.

But it is also important that as soon as they are allowed to register an ETF, then everyone who was denied this before will stupidly submit similar applications and SEC will not be able to refuse them. So ETFs will start to grow like mushrooms after the rain.

In general, it is reasonable to suggest a price up, if by that time the acute phase of the crisis does not break out (!!!). And there they will already connect the media and tell why there will be a native and it is necessary to invest money in these funds.

If the information about FIdelity file will be confirmed, then they clearly know something, because it is mentioned that they want to copy the application submitted by Blackrock.

If they really plan to submit a similar application to Blackrock, then this is either for luck, or they understand that the scheme proposed by Blackrock is wealthy and passable.

Third is – tighter Regulation… is it good or bad? Above we’ve head few opinions from JP Morgan, Micro Strategy that regulation is a good sign, that should open road for institutional money into cryptocurrencies.

If the regulator seriously brings cryptocurrencies to the status of the securities, this will entail an audit, disclosure, showing beneficiaries, reporting, and so on. In 90% of cases it will turn out that the king is naked. That is why they “mercy” over the BTC and declared it not a security but a commodity.

In a word, the regulation of crypto exchanges will reduce their number by several times, and the recognition of cryptocurrencies as securities will blow away their value a little less than completely (as with NFT) and in addition will send their anonymity to the trash, by the way. Institutionals may come to the market, but most likely to mess up, or after the collapse. Remember the story of bitcoin futures – everyone was waiting for them to be introduced and the price would rise. But it fell. Institutional miracle has not happened.

Based on recent J. Powell words concerning altcoins, we suspect that regulation should go on the way of altcoins’ destruction and work for re-distribution of the money into big three – ETH, BTC, USDT and maybe 1-2 more. The big cryptocurrencies, in turn, will be put under control of limited amount of big ETF’s from BlackRock, Fidelity and some others. New EDX exchange will play the dominant role in BTC pricing and provides technical background as depositary institute, market-maker and exchange. SEC, Fed, CFTC are trying to make a circled market, throwing out all the others. Thus, Coinbase probably should stay while Binance is under significantly higher risk of closing.

Regulation will only add the opportunity to buy spot BTCs, including ETFs with spot BTC. The creation of an ETF will reduce the number of free flowing BTCs traded on exchanges and create a deficit, which supports idea of the rally.

Reducing the number of crypto exchanges, will increase the level of regulation and concentration. Larger regulated exchanges – less scam.

Everything sounds great, but… what would you said if plan stands absolutely different. For example:

- SEC Sues Binance and CEO Zhao for Violating U.S. Securities Regulations”

- June replenishment of TGA Treasury bills in the amount of more than $1 trillion, causing a liquidity shortage

- Launch of the Fed Now network in July

- Regulatory authorities increase the capital requirements of Banks by 20%

- Reduction of the money supply M2

3 elements required to implement CBDC Digital :

- Global dollar deficit

- Massive Insolvency Crisis

- Destruction of the Crypto Ecosystem

All recent events are fit to this scenario either. Yes, we have some deviation from this plan by US Treasury, as its borrowings are not as fast as it was announced, but still, everything goes with this way.

And Big ETFs with new EDX exchange could mean total re-shaping and re-structuring of the crypto market, putting it under tight control of the SEC& Co by the hands of BlackRock, Fidelity and others. So we need to see first, the result of committee vote on a comprehensive bill to establish a regulatory framework for cryptocurrency products in the coming weeks.

The Binance destiny probably is a key to this riddle. It is 10-15 times bigger than FTX. The collapse will lead to the death of most crypto exchanges. The crypto market in 2022 was $2.5 trillion, and most of it is built on a leverage ratio of 10:1. It is few times larger than Lehman (600 Bln) or CDO market (400 Bln).

As Gary Gensler recently said –

We don’t need more digital currencies… we already have a digital currency called the US dollar. For many centuries, it has never happened that the economy and the public needed more than 1 means of transferring value.

CONCLUSION

So, here is the riddle guys. And its beauty that it does not have direct answer by far. The process is just started and we’re in the beginning of the way. Above we’ve shown you that things stand not as simple as everybody thinks – “if we get big spot ETF, then BTC goes to the moon”. But few things we could suggest with high degree of certainty:

BlackRock does nothing occasionally. Hence, its file should be approved by the SEC, which, in turn, should trigger emotional rally right after approvement;

In longer term ETF itself doesn’t mean BTC rally, because institutional money have to go there. IT is not BlackRock will buy BTC from its own, but its clients. But now they do not do this. So, Initiating of ETF doesn’t mean “to the moon” in longer term, after dust will settle.

Long term US government plan about cryptocurrencies are not known by far. There are two major scenarios but it is too few information to say definitely which one is correct. No major juridical decisions are made yet, as well as any legal acts. Everything is still on a stage of discussion.

In short-term, based on Glassnode analysis and our recent technical update, we consider 36-38K area as most probable target for mid term. SEC has 240 days to make a decision on ETF, but hardly they will wait for so long. As BlackRock has made the file – general decision is made.

If all this stuff is a trap – it will be closed later, when big money already will be invested. Now, based on Glassnode analysis, market is still thin, participation in rally is low. So, it is too early to clap the trap. Thus, it is relatively safe to buy in the beginning. But overall situation is very tricky, and I would say dangerous, and with a lot of uncertainty. It is really big game around and somehow it is involved in US financial system, if now the major players are SEC, FED, CFTC and others.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

646 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023