Bitcoin Fundamental Briefing, August 2023

FACTS IS A STUBBORN THING

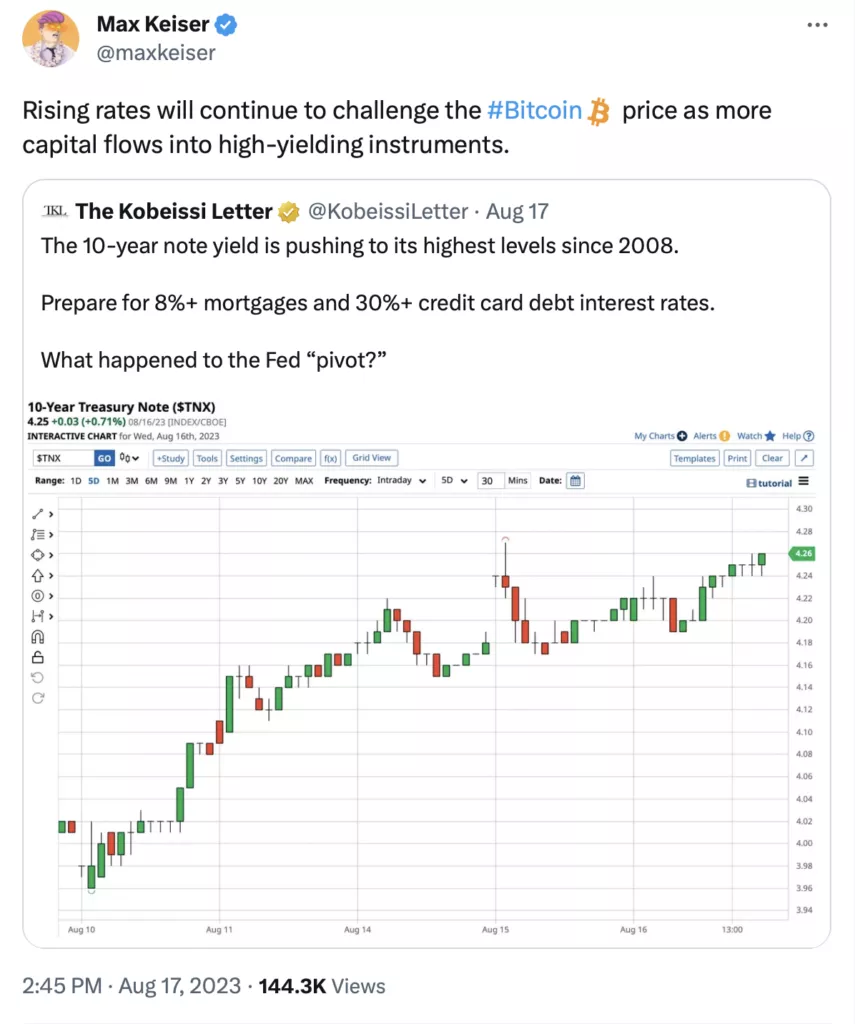

This month we do not have a lot of hot headlines, especially on cryptocurrency markets. BTC has shown one of the biggest collapses in history, by dropping to 25K area again and no speculations on ETF subject or “soft landing” or even “Fed pivot” haven’t helped. But somehow BTC has collapsed as soon as US 10-year yield hits 4.4%. This example once again proves that fundamentals overcome and dominate over all other factors and rumors on the long run.

Here we have to appeal to our FX and Gold markets weekly reports where we constantly and in detail explain our fundamental view on the US economy and most liquid assets performance. Those who read them know that we expect rising of the inflation, higher rates for longer, rising of the US Dollar and even more hikes from the Fed. All these topics are beyond of the scope of this report, but they explain why we have bearish view on BTC in medium term perspective and suggest that no ETF approvement will help to resolve this problem. And we’re not alone with our suggestion. Overall market performance shows that investors are not interested with investments in cryptocurrencies right now, despite that price stands around 25-26K area. And we can’t accuse them. US T-bills and notes give 1.8% risk premium over S&P dividend yield now. What non-interest bearish BTC could offer investors right now?

MARKET OVERVIEW

Bitcoin fell below $26,000 for the first time in two months as risk aversion weighs on the cryptocurrency market with global government bond yields climbing to the highest in about 15 years.

“When you throw in what is happening in the bond market, it becomes easy for Bitcoin prices to soften,” Edward Moya, senior market analyst at Oanda, said in a note.

The slide has almost erased most of the gains registered in the wake of BlackRock’s surprise filing for an Bitcoin ETF on June 15. After surging 72% in the first quarter, Bitcoin has declined about 9% since the end of March. The token tumbled 64% last year amid a series of industry scandals and bankruptcies.

“There aren’t enough good headlines coming out of crypto to get people excited,” said Michael Safai, partner at quantitative trading firm Dexterity Capital. “Conversely, rising interest rates and weakened risk appetite are pushing non-crypto-native traders towards safer assets.”

“There was optimism earlier in the week that a resolution to the Grayscale Bitcoin ETF would come this week but that passed with nothing coming out,” Shiliang Tang, chief investment officer at crypto investment firm LedgerPrime, said. “Furthermore traditional markets have been weak all week with SPX and tech selling off, 10-year rates reaching highs and the dollar catching a bid, and China credit and econ data weakness, all of which are negatives for risk assets.”

Crypto traders are now focusing on the $25,000 level for Bitcoin, below which options positioning suggests another cascade of liquidations could hit.

“With limited catalysts to push Bitcoin higher in the short term, a fall below $25,000 could put bears in charge, and if the rout in global risk assets continues, Bitcoin could face further downside,” said Josh Gilbert, market analyst at trading and investing firm eToro.

A Wall Street Journal report citing documents that Elon Musk’s SpaceX has sold off its Bitcoin holdings after writing down $373 million also weighed on sentiment. It wasn’t clear from the Journal report when SpaceX had sold its Bitcoin.

The slump sparked a broad decline across all of crypto, leading to more than $1 billion in liquidations and putting Bitcoin on pace for its worst week since November and crypto exchange FTX’s collapse.

The largest single liquidation order happened on Binance, and was worth $55.92 million, Coinglass said in its website. The total amount of Bitcoin liquidations was the biggest for a single day since the market turmoil of June 2022, CoinDesk reported.

The slide has almost erased the gains registered in the wake of BlackRock’s Inc.’s surprise filing for a Bitcoin ETF on June 15.

The carnage — fueled by the prospect of prolonged high interest rates and exacerbated by thin crypto trading — was a reminder of the various threats that continue to stalk digital assets, from hostile regulators to a broader rout in risk assets. And even as Bitcoin has recovered smartly from last year’s lows, many investors are still sitting out, depriving the market of the breadth and depth that are key ingredients for a sustained bull run.

“There are still significant amounts of macro uncertainty keeping investors away, and liquidity is still thin,” said Noelle Acheson, author of the “Crypto Is Macro Now” newsletter and former head of market insights at Genesis Trading. “Bottom line, there’s not yet enough conviction.”

As central banks continue to raise or maintain high interest rates, the appeal of traditional financial investments like short-dated US Treasuries and other bonds have drawn focus away from crypto bets as investors chase a risk-off attitude.

“Global macro is going to continue to weigh in,” said Fadi Aboualfa, head of research at crypto custodian Copper Technologies Ltd.

Some crypto bulls say the sector could benefit from situations such as China’s deteriorating property sector, which has become a primary concern from a macro perspective. Ultimately though, what’s bad for the global economy is likely also bad for crypto.

“If the stock market drops accelerate, crypto is also likely to suffer in sympathy as investors choose to lock in profits with whatever they can and sit in high-yielding cash until the dust settles,” said Acheson. “The dust will settle, however, most likely sooner in the crypto market than in the stock market as investors recalibrate the relative risk of each asset group.”

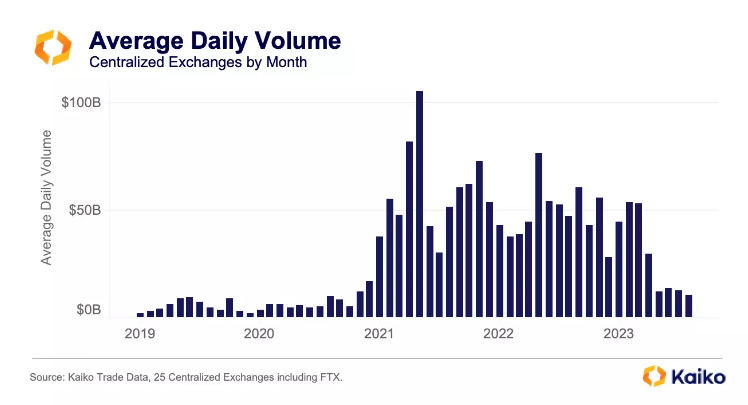

average daily spot volumes on centralized digital-asset exchanges over the past four months were the lowest since October 2020 — when Bitcoin was at about $10,000, according to research company Kaiko.

About 13% of crypto hedge funds have shut down so far this year, as weak performance and difficulties in accessing banking services weighed on the industry, according to data tracked by Switzerland-based investment adviser 21e6 Capital AG.

The digital gold market has reached a stage of extreme apathy and exhaustion, and volatility indicators have reached record lows. This is the conclusion reached by Glassnode analysts.

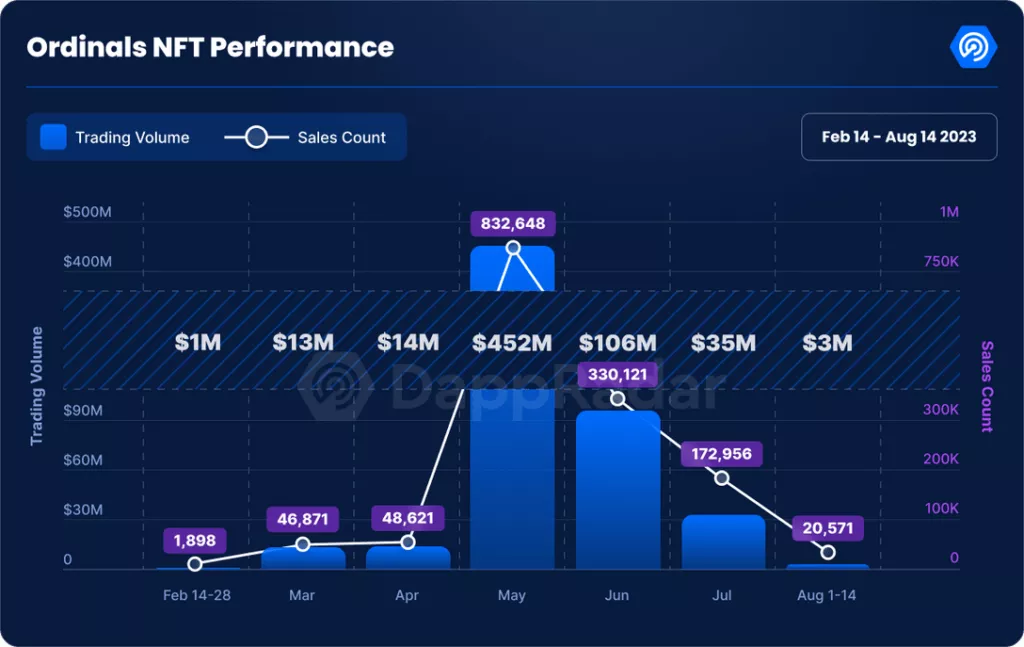

Over the past three months, the volume of trading and sales of Ordinals fell by more than 92% – to $35 million and 172,956 transactions in July. This is evidenced by the DappRadar report.

May 2023 was the peak for bitcoin-NFT, when the turnover of tokens reached $452 million with 832,648 transactions. However, with the onset of summer, the indicators began to decline rapidly. In June, the trading volume fell to $106 million. In August, the value almost reached the bottom, reaching $3 million by the middle of the month.

A rare non-fungible token #8585 from the Bored Ape Yacht Club (BAYC) collection was sold for a record low of 153 ETH (~$254,000). The asset has lost 80% in value in 11 months.

In October 2022, this NFT was purchased for 777 ETH — about $1 million at the time of the transaction. Even taking into account the recovery of the market since last fall, the asset has fallen in price in the fiat equivalent by four times.

Mastercard and Visa companies refuse to issue payment cryptocurrency cards for Binance amid regulatory problems of the exchange. This is reported by Bloomberg.

Visa has closed the release of joint products in Europe since July, a representative of the crypto trading platform told the agency. Mastercard will completely stop cooperating with Binance in September.

Payment companies declined to comment on their decisions.

ETF HYPE

BTC fans can’t leave behind the thought about BTC ETF (Blackrock, Arc Fidelity, whatever) and that it definitely will push the BTC price to the moon:

If the US Securities and Exchange Commission (SEC) gives the green light to a bitcoin ETF, the first cryptocurrency will be able to overcome the $150,000 mark and approach $180,000. This was stated by co-founder of the analytical firm Fundstrat Tom Lee.

Exchange-traded funds based on digital gold have proven themselves internationally, but the support of the United States will be a cornerstone for the local crypto industry, the expert added.

“When a spot bitcoin ETF is approved, I think the demand for it will exceed the daily supply of the asset itself,” he explained.

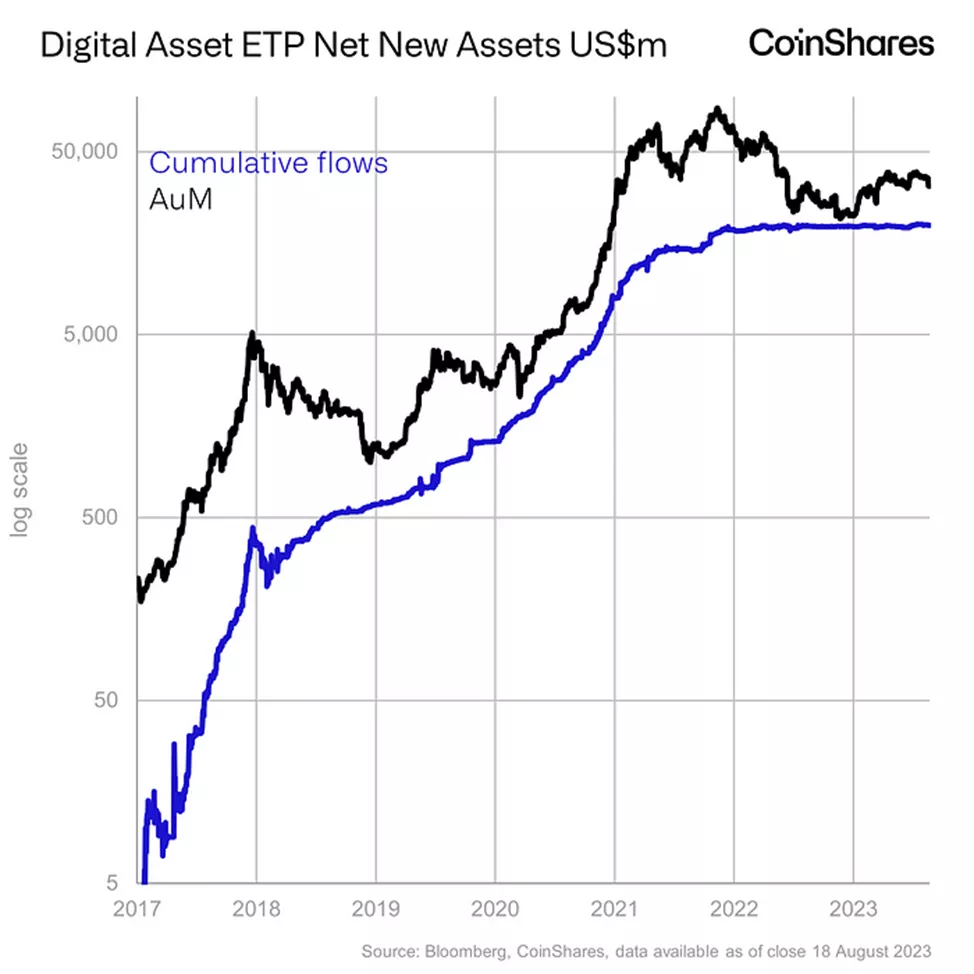

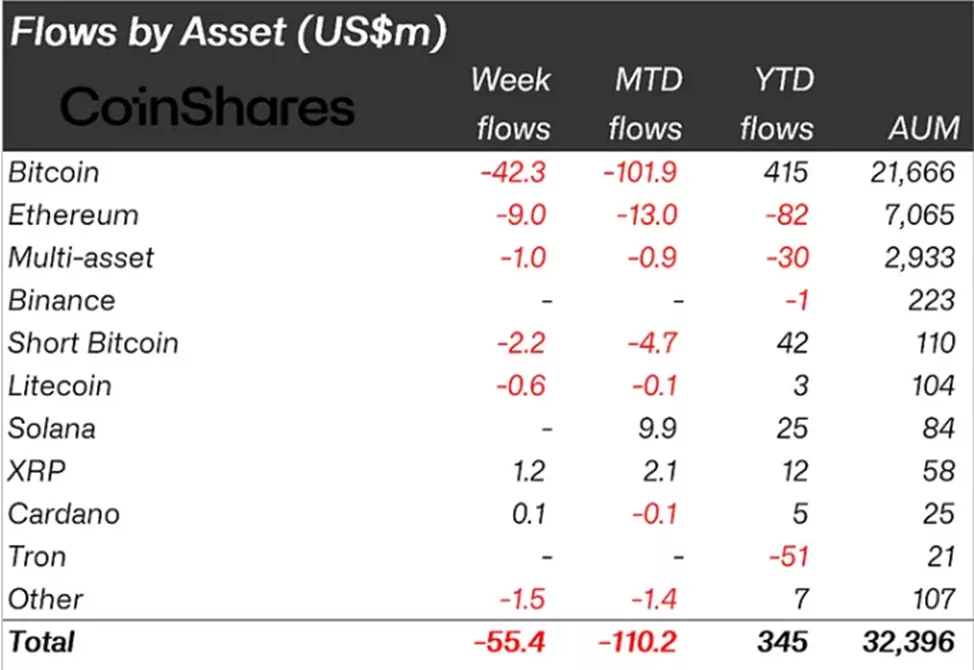

The outflow of funds from cryptocurrency investment products from August 12 to 18 amounted to $55.4 million against the inflow of $28.5 million a week earlier. This assessment was given by CoinShares analysts.

Analysts explained the sale by postponing the SEC‘s decision on the application to launch a bitcoin ETF from ARK Invest and 21Shares.

Trading volumes remained significantly below average due to seasonal effects, which kept prices vulnerable to large transactions.

As a result of the panic, the volume of assets for all products fell by 10%, to $32.3 billion, experts estimate. $42 million was withdrawn from bitcoin funds, which is one and a half times more than in the previous reporting period ($27 million).

The US Securities and Exchange Commission has not yet come to a decision on whether to approve the ARK 21Shares Bitcoin ETF application, delivering another delay for the long-awaited product.

The issuer had originally filed in April and regulators had until Aug. 13 to say whether they would approve, reject or delay on coming to a decision.

Bitcoin ETF candidates got another dose of disappointment when US regulators on Friday punted on making a decision on such a product. But the next time they hear from them might be just a few weeks away.

The US Securities and Exchange Commission needs to come to a conclusion on the Bitwise Bitcoin ETP Trust by Sept. 1, according to a Bloomberg Intelligence tally. Regulators can reject, approve or delay. Decisions for applications from BlackRock, VanEck, WisdomTree and Invesco are due just a day later, with others following closely behind.

Meantime, while everybody waits for ETF adoption in the US – we’ve got the first one in UK. The SEC appears to still be deliberating, but in the meantime someone else took advantage of the sudden hype around Bitcoin ETFs. London-based Jacobi Asset Management, led by BlackRock alumnus Martin Bednall, this month listed what it calls “Europe’s first spot Bitcoin ETF” on Euronext Amsterdam, a putative milestone that received decent media coverage.

But a more important question might be, how did investors react? Judging by the early results, the best answer seems to be that they didn’t, really. In the six trading sessions since the ETF (ticker BCOIN) listed, a total of just 4,409 units changed hands, according to data compiled by Bloomberg. The ETC Group Physical Bitcoin fund, traded in Germany (ticker BTCE), did more than 1.1 million in unit volume on Aug. 18 alone.

This makes us to remain skeptic on rosy suggestion of some persons that massive adoption of ETF in the US will lead to skyrocket price of BTC. Investors could do anything they want with BTC right now and ETF will be just additional way of investing and nothing more. By our view economical fundamentals now overrule any technical innovations and will determine the trend of cryptocurrency.

BTC FORECASTS

The recent sell-off in crypto markets is likely near an end, with long-position liquidations “largely behind us,” according to a research report by JPMorgan Chase & Co.

The fading of some positive legal and regulatory news induced a wave of selling in recent weeks that is “still reverberating,” though the unwinding appears to be at its end phase, based on open interest in CME Bitcoin futures contracts, analysts including Nikolaos Panigirtzoglou wrote on Thursday. A decline in open interest – the number of unsettled and active future contracts trading on exchanges – typically indicates a price trend is losing strength.

“As a result, we see limited downside for crypto markets over the near term,” they said. The pullback was also partly due to a broader correction in risk assets such as equities, induced by “frothy positioning in tech, higher US real yields and growth concerns about China,” the note said.

- The market experienced a violent sell-off last week, sending BTC prices below $25k, and ending a period of historically low volatility.

- The market has been slicing through several important price support models, putting the bulls on the back-foot.

- A primary driver appears to be a leverage flush-out in derivatives market, seeing over $2.5B worth of open interest cleared in just a few hours.

- Options markets have sharply re-priced volatility premiums from historical lows, although open interest remains remarkably stable.

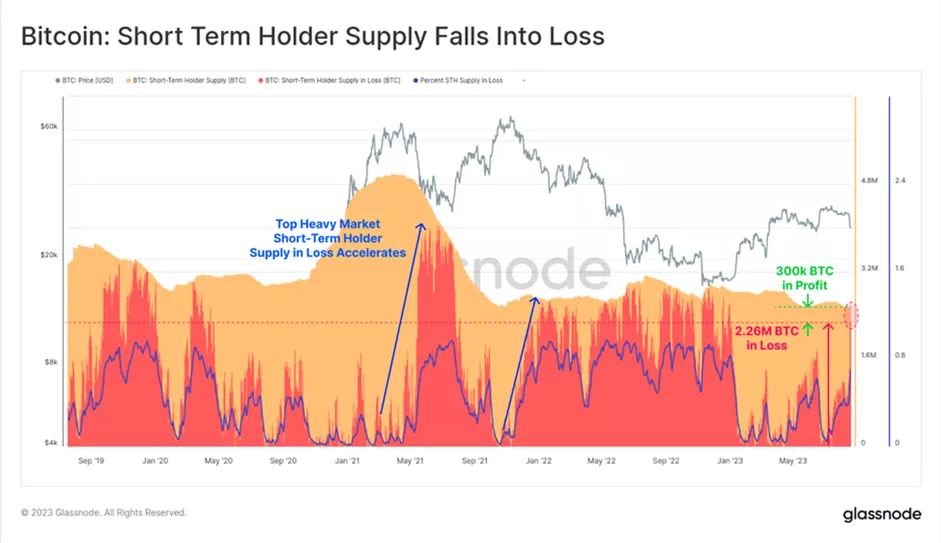

- Spot markets are still relatively ‘top heavy’, with over 88.3% of Short-Term Holder supply now held at an unrealized loss.

The sale lowered the price below the average purchase price of coins by speculators ($28,600). Historically, this level has provided support during sustained growth phases.

According to experts, the market has moved into a psychologically unstable position, taking into account the proximity of the realized price and the average level of purchases by hodlers ($20.3 thousand).

The share of coins with unrealized profits decreased from 73.3% to 60.5% — the lowest since March. 2.48 million BTC passed to the status of “unprofitable”.

Long-term investors did not react to the increased price fluctuations — the volume of bitcoins at their disposal has been updated ATH.

The supply on speculators ‘ wallets dropped to multi-year lows. The number of coins with unrealized profit decreased by 300,000 BTC, with a loss — it jumped to 2.26 million BTC

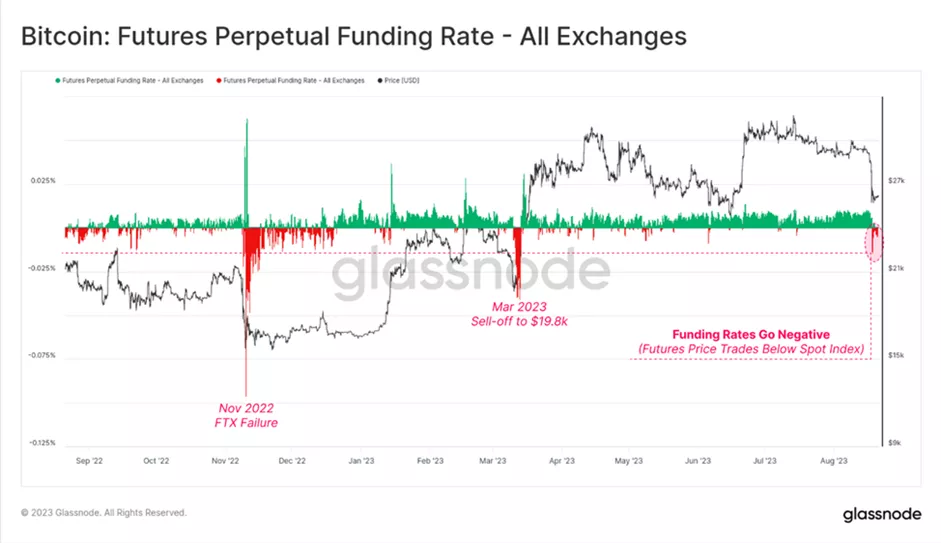

As a driver of the sharp drop, experts called liquidation in the bitcoin futures market in the amount of $2.5 billion. In this respect, they pointed out similarities to the FTX crash. As a result, the period of historically low volatility observed since July ended. The mentioned $2.5 billion is the equivalent of liquidating almost a quarter of the open interest at that time. This means a complete removal of the leverage formed in July-August, experts explained.

The volume of forcibly closed long positions in a few hours amounted to $230 million. The last time such large values were recorded was at the time of the Terra collapse in May 2022.

The perpetual contract market also faced liquidations of long positions. As a result, the funding rate went into negative territory. The last time such low values were observed was during the March sell-off, when the exchange rate fell below $20,000.

As a result, Glassnode concludes:

The Bitcoin market was shaken violently awake this week, selling off -7.2% on 17-Aug, making for the largest single day down move YTD. Many indicators point to a future market deleveraging as the most probable driver, with options traders also forced to rethink and reprice volatility premiums.

Long-Term Holders remain largely unfazed and unresponsive, which is a typical behavior pattern of this cohort during bear market hangover periods. Short-Term Holders however are of greater interest, with 88.3% of their held supply (2.26M BTC) now held at an unrealized loss. This is compounded by an acceleration in STH realized losses being sent to exchanges, as well as the loss of key technical moving average support, putting the bulls on the back-foot.

Renowned cryptocurrency expert Arthur Hayes has weighed in on the current state of Bitcoin, predicting a period of consolidation around the $25,000 mark in the coming months.

Considering the prevailing market conditions, Hayes acknowledged the possibility of transient volatility for Bitcoin. He projected that the cryptocurrency might experience consolidation throughout the current quarter.

“While there are those who speculate that Bitcoin’s value might drop below $20,000, I am inclined to believe that the initial phase of Q3 will be marked by fluctuation around the $25,000 mark. The capacity of the crypto market to endure these fluctuations will be directly linked to the extent of interest income seeking novel opportunities,” he stated.

Still over view is closer to classical metrics and statistics data, showing that BTC remains under pressure in nearest 12 months. Max Keiser expresses the opinion that is close to ours:

CONCLUSION

Here we provide some details to our view and why we have big doubts on Bitcoin appreciation any time soon. Concerning ETF – we’ve said everything above. Except big names, stand behind “ETF” brand – it can’t offer anything revolutionary. So, speculators could try to shake the boat in a moment of ETFs approvement by SEC, but we suggest that rally (if ever) will be very short-term. We even do not exclude the plunge of BTC when news will be released, as speculators will start selling “by fact” while now they are buying “by rumors”. All in all, we treat “ETF” factor as the secondary one, that has no decisive impact of BTC market conjuncture.

What is really does make sense is US-China separation and US domestic problems. We cover both subjects in our recent Gold and FX market reports that in detail explain what should happen soon. Keeping it short – we expect new inflation spiral, starting in September-October. CPI and PCE indexes should turn up again. This in turn will make the Fed to keep rates higher for longer time and even make 1-2 more rate hikes. Negative processes in US will accelerate. We expect rising poverty in population, because with exhausting of personal savings, 30% rates on consumer loans and $1Trln consumer debt – nothing could go well. People even take loans to buy food, toys etc. Consumption is dropping.

J. Powell has a bit problem right now. Since the Fed and US Treasury cut money supply at the pace that has never seen before – production and manufacturing sector meets outstanding deflation, that indicates contraction of the sector. Other words speaking – US production is dropping.

At the same time, people expect of wage increasing, which is spinning up inflationary expectations. But how wage will grow if production sector is contracting? Besides, recent CPI numbers show that inflation is gradually migrating out from production to service sector of economy.

It means that the Fed somehow has to stimulate production to support consumption, personal savings and raising wage. But if it will start doing it – inflation jumps immediately.

But if the industry falls, then the general level of wages, that is, the standard of living, falls (let me remind you, elections are just around the corner!). And we see results, including in real estate sales and demand for mortgages. What should they do here? And if the BRICS countries (whose GDP is already significantly higher than the G7 countries) start real actions to create an alternative currency system, what should they do?

If they will not stimulate the economy – current inflation level and drop of households’ prosperity will lead to poverty. Households already do not have savings. Inflation will go higher due unavoidable raise of crude oil prices. And recent accident on 3rd largest US Refinery Marathon tells that situation might become even worse.

But this is only the half of the story. US-China divorce is accelerating and now seems to become irreversible. At first stage it might be supportive to US Dollar, but not for Bitcoin, just because of USD domination in global settlement.

Once divorce will come to an end, supposedly closer to 2025 year, the huge 2-digits inflation will cover the US. But, on a background of 30-40% stock market collapse, very high interest rates, destruction of global finance system – hardly Bitcoin will become the asset that investors will recall first of all. The only thing that could let it to stay on the surface is relatively small capitalization – whole BTC market is around $700 Bln. It is small by modern measures. And investors could keep a bit in portfolios without selling too much and forget about it.

That’s being said, in fundamentals we trust, but not in hype around ETF and misteria talking that Bitcoin will hit 150K, 550K or $1Mln very soon, just because of somebody’s gut feeling without ability to provide any facts and reasonable explanations. As we’ve said in the beginning – facts is a stubborn thing…

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

688 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023