Bitcoin Fundamental Briefing, September 2023

CLOUDY PERSPECTIVES, to say the least…

Activity on the BTC market is falling. Last month we’ve mentioned this process, but in September it has become even more evident with logical consequences. The hot news stream on cryptocurrencies has narrowed, as well as price performance. Market stands in very tight range, providing less chances for active trading. Any news, even not of a big scale, could trigger solid motion in any side, which still could be reversed in few days. More analysts speak on gloomy perspectives in anticipation of higher Fed interest rates for longer term. Even Glassnode, which usually neutral in assessment of market situation, acknowledges that some signs of loosing faith in happy future slowly raising among investors. As we’ve warned last time (and actually always talk about) – emotional reaction could boost prices and even push them significantly on the thin market, but emotions never could hold it there. Fundamental factors once again confirm that sooner rather than later but it take control over the market

MARKET OVERVIEW

Bitcoin extended its rally in the 1st half of September , rising above $27,000 for the first time since August. Other digital assets followed suit, with smaller tokens such as Solana, Litecoin and Bitcoin Cash rallying.

The largest digital token had ended positive on Sunday for the first week in five, and increased as much as 3.7% to $27,418 on Monday. Solana gained around 6%, Litecoin rose 6.5% and Bitcoin Cash jumped 8%.

“After a prolonged struggle at the psychological support of $25,000, Bitcoin managed to hold steady. Range traders will now be looking to take profits just above $30,000,” said Mati Greenspan, chief executive officer of Quantum Economics.

Some analysts are questioning how long this latest rally will last and as reported previously the level investors are watching on Bitcoin is $28,800.

“I don’t see a clear catalyst for the move up,” said Dessislava Ianeva, senior research analyst at Kaiko. “In the current low liquidity environment, relatively low buying/selling pressure could amplify spot price movements and spur liquidations on derivatives markets.”

Will Tamplin, senior analyst at Fairlead Strategies, says it’s prudent to not be overly optimistic about the recent gains in Bitcoin.

“Our short-term momentum indicators show improvement, but we are cautious regarding the sustainability of a rally since intermediate-term has deteriorated in recent weeks,” he said. “If Bitcoin can clear its 50-day moving average, currently near $27,400, it would increase our confidence in a short-term rebound.”

The level investors are now watching on Bitcoin is $28,800.

Any break below that level — Bitcoin’s low in both June and September — could lead a lot of investors to give up on the digital asset, according to Maley.“That $28,800 level is now the ‘line in the sand’ for the Bitcoin bulls,” he said.

Despite wins against the US Securities and Exchange Commission and new Bitcoin ETF filings, investors withdrew nearly half a billion dollars from cryptocurrency products over the last nine weeks.

The crypto market saw outflows totaling $54 million last week, making it the fifth consecutive week of selloffs, according to a new report by CoinShares. Bitcoin comprised 85% of outflows, reaching $45 million.

“A lot of investors are concerned that the crypto market has seen some good news in recent months and it has not helped the Bitcoin and others to rally at all,” Matt Maley, chief market strategist at Miller Tabak + Co., said in an email.

“When institutional investors are looking for asset classes that will help them in terms of performance in the last three or four months of the year, they’re not looking at cryptocurrencies anymore,” Maley said.

Volatility picked up in digital-asset markets as traders evaluated the prospect of crypto disposals by the defunct FTX exchange through its bankruptcy process.

FTX’s administrators have recovered about $7 billion in assets, including $3.4 billion of crypto. A court hearing is due on Wednesday to consider a plan to begin sales of tokens to help repay creditors, according to recent filings.

A presentation shows that FTX holds nearly $1.2 billion in SOL, the native token of the Solana network. The inventory also includes $560 million in Bitcoin, the largest crypto asset, and $192 million in second-ranked Ether.

September as a whole also tends to be the worst month of the year for digital assets. Bitcoin has dropped 6.2% on average over the month in the past decade, according to data compiled by Bloomberg.

Some chart patterns add to the case for a period of weakness for Bitcoin. An analysis based on plotting sessions when the token moves up or down by at least 1%, a so-called point and figure study, signals the $24,500 support level is under threat. If breached, the token is at risk of testing $24,000 and beyond that $21,400, according to the analysis.

Meanwhile, Franklin Templeton filed an application for a US spot-Bitcoin ETF. However, Stephane Ouellette, co-founder and CEO of FRNT Financial, doesn’t think it moves the needle.

“More ETFs just means that the market share is more split up, but doesn’t really change access for the investor,” Ouellette said.

It could be “difficult for Bitcoin to see a durable rebound” based on “weakened intermediate-term momentum,” Katie Stockton, founder of Fairlead Strategies LLC, wrote in a note.

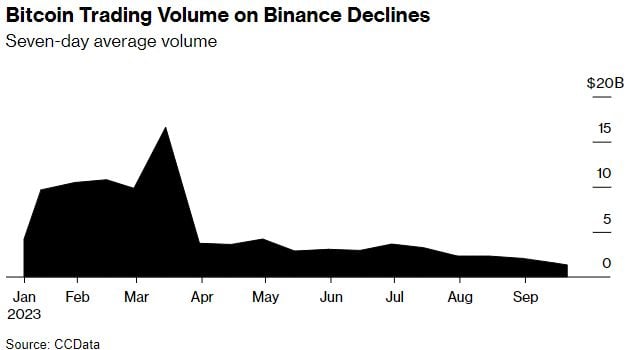

Cryptocurrency trading volume declined in August to the lowest level of the year, another sign of waning investor interest since the collapse of digital asset prices from all-time highs in late 2021.

The combined monthly volume of so-called spot and derivatives trading fell 11.5% to $2.09 trillion, and was the second-lowest monthly total since October 2020, according to data compiled by CCData.

Binance saw outflows of about 12,230 Bitcoin, worth around $330 million, since the beginning of August, according to CCData. It also saw outflows of about 198,200 Ether, worth around $323 million, per the researcher. Bitcoin accounts for about half the value of the estimated $1 trillion crypto market. Ether is the second largest cryptocurrency at around 20%.

“The (spot) trading volumes on centralized exchanges have remained low since April this year and are now comparable to the stagnant trading activity in the bear market of 2019,” CCData said in a report published Thursday.

Derivatives trading volume on centralized exchanges fell 12.3% to $1.62 trillion, the second lowest amount since December 2020, according to CCData.

Spot trading volume on centralized exchanges fell for the second consecutive month, dropping 7.78% to $475 billion, according to CCData, marking the lowest monthly spot-trading volume recorded since March 2019. Daily volumes on centralized exchanges reached $5.9 billion on Aug. 26, the lowest since Feb. 7, 2019.

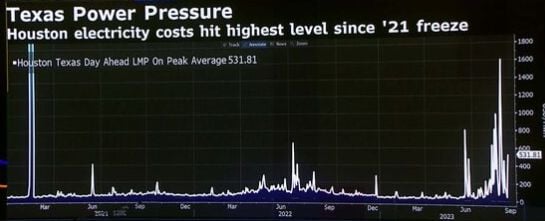

Texas Bitcoin miners, embroiled in a controversy over their energy-intensive operations, are shutting down most of their machines while the state grapples with its power crisis.

“We have consistently been seeing 90% plus curtailment of Bitcoin mining each day this week that power conditions tightened,” said Lee Bratcher, president of the Texas Blockchain Council. “The power that is not off is most power to the office buildings and backup systems that are on site and not the machines themselves.”

A brief bout of excitement over efforts by Grayscale Investments, BlackRock and others to launch the first US spot Bitcoin ETFs did little to alleviate the torpor.

JPMorgan’s British retail bank Chase will ban crypto transactions made by customers from Oct. 16 due to an increase in fraud and scams, the company said on Tuesday.

“We’ve seen an increase in the number of crypto scams targeting UK consumers, so we have taken the decision to prevent the purchase of crypto assets on a Chase debit card or by transferring money to a crypto site from a Chase account,” a spokesperson for the bank said.

Participants in the crypto industry began to prepare for the collapse of Binance – The Wall Street Journal. The world’s largest crypto exchange is melting before our eyes under pressure from American authorities. The activity of Binance.US has practically ceased, and in Europe more and more countries are banning the operation of the exchange on their territory. If Binance collapses, then crypto prices will collapse, experts say. WSJ writes:

● The crypto exchange is melting before our eyes. Over the course of a year, Binance fired 1.5 thousand employees, and over the past three months more than a dozen top managers have left it.

● Since the beginning of the year, Binance’s share of the cryptocurrency buying and selling market has decreased from 70% to 50%.

● What happens to the largest exchange will have huge consequences for the crypto industry.

MINING COST

JPMorgan has lowered its bitcoin production cost estimate following recent revisions to the Cambridge Bitcoin Electricity Consumption Index methodology.

“The current bitcoin production cost falls to around $18,000 with the new methodology vs. $21,000 with the old methodology,” JPMorgan analysts led by Nikolaos Panigirtzoglou wrote in a report on Wednesday. Accordingly, electricity price changes will now have a smaller effect on bitcoin mining costs, the analysts noted.

“We had previously calculated that each one cent per kWh [kilowatt hour] change in the electricity cost induces a $4,300 change in the bitcoin production cost. After the revised CBECI methodology, we see this sensitivity declining, but only modestly to around $3,800,” the analysts said.

“This sensitivity would mechanically double post the 2024 halving event,” they added.

That’s because the upcoming bitcoin halving event will cut the rewards miners receive in half, and any changes in electricity costs will have a larger impact on their overall expenses, making cost management even more critical for miners.

JPMorgan reiterated Wednesday that the halving event could be a stress test for bitcoin miners, especially given the high sensitivity of the bitcoin production cost to electricity costs.

FORECASTS

In recent review Glassnode writes that investors Confidence Slides.

- A super-majority of Short-Term Holders are now underwater on their position, with a new indicator suggesting negative sentiment dominates this cohort at present.

During the rally above $30k, this metric reached complete profit saturation for the first time since the Nov-2021 all-time high. However, since selling off below $26k in recent weeks, more than 97.5% of STH supply is now held at a loss, being the deepest level since FTX collapsed.

From this perspective, we can see that the cost basis of STHs who are spending fell below the cost basis of holders as the market sold off from $29k to $26k in mid-August. This suggests a degree of panic and negative sentiment has taken hold in the near term

Summary and Conclusions by Glassnode

The Bitcoin market is experiencing a non-trivial shift in sentiment, with almost all Short-Term Holders now underwater on their supply. This has resulted in a negative shift in sentiment, with investors spending now having a lower cost basis than the rest of the cohort. This suggests a degree of panic is dominating this group, which is the first time since FTX collapsed.

Several metrics suggest that 2023 has seen a positive, but low momentum influx of new capital and new investors. This speaks to the persistent uncertainty coming from the macro-economic conditions, regulatory pressures, and tightness of liquidity across all markets.

AS A BOTTOM LINE

Now it is too many nervousness around cryptocurrencies. And maybe real situation is not so gloomy as it is shown in media. Markets always have a tendency to overreact on some news and put too much emotions. After FTX collapse everything was going wrong – multiple probes around Coinbase and Binance from SEC, Binance out from the US, now SEC itself and G. Gensler under the probe in Congress and possible retirement. Uncertainty about ETF approvements and too many hopes around this topic. Market is loosing capitalization very fast, especially NFT ones – it seems that “tulip fever” comes to an end. WSJ writes about sunset of Binance which should have bad consequences for the whole market. Coming BTC halving in 2024 will make strong impact on miners activity etc. Wherever you’re looking right now – negative everywhere. All in all – It is easy to been lost in this wood.

At the same time, Binance crash is nothing new to us, because two months ago, when we were considering all this legal claims and probes , we’ve said that the US will eliminate all rivals to control crypto market. And ETF of big whales, such as Fidelity, BlackRock and now is Franklin Templeton – is the step in this direction. When you have pocket largest exchange, such as Coinbase and all major storage of spot BTC are on the accounts of 4-7 big companies, you totally control this market.

But if to keep emotions aside, and just look at how market perception was changing about cryptocurrencies, we suggest that it is difficult to speak about BTC rally any time soon. What a background or factor could trigger it? US default? Massive US Dollar devaluation? Whatever will happen BTC takes the last place in a queue of attractive assets, as investors first will aim on real assets, such as stocks and commodities. BTC is too virtual. Formally, put the plug off the socket and it disappears. In a period of massive collapse and panic, everybody will be looking for something material that could be held in hands.

Speaking about fundamental background, hopefully you read our FX and Gold weekly reports where we explain everything in details. BTC is just another market but it is driven by the same economical fundamental laws, that mostly are based on interest rates. US economy is deteriorating, which is becoming evident and safety margin is melting fast. US have no other ways but to make a deep reform of domestic production sector, returning everything back from China. Middle Asia (ex India and China) are not as attractive because it has very low purchasing power among population. US currency is stop backing by Chinese goods on a background of confrontation and fighting for global domination. It means that the stream of “empty” US Dollar back to US will widen.

Now the Fed and US Treasury are trying to resolve the problem of national debt via its devaluation. The major idea is to put the loss on the shoulders of its holders by raising yields and pushing price down. Second task is to force everybody to buy debt. Then, when it will loose 70%+ in value start massive QE. Rate will have no meaning and could be held at high level.

This strategy probably will last for some time more as US economy doesn’t show any signs of collapse yet. Inflation will turn up again soon and Fed will get reasons once again to keep rate hike, pushing debt value down and promising high yield to new holders.

With this environment, investors will have to sell other assets to plug holes in their accounts and compensate US debt devaluation in marked-to-market portfolios, dropping of collateral values and margins. Drop of stocks, gold now is a by product of this process. And with this environment, non-interest bearing BTC has no chances to rally, at least until this process will be over.

All these moments makes us think that downside continuation on BTC market has more chances to happen than upside reversal. We suggest that ETF adoption will have only temporal effect, mostly emotional, because it doesn’t change the valuation of underlying asset (i.e. BTC). . In fact, this is just a tool, the way of investing. Keep it short, we think that the time for investing in BTC has not come yet That’s our 2 cents on BTC market. Let’s keep watching how it goes.

Author Profile

Sive Morten

At the Forex Peace Army, he is known as an author of Forex Military School, which quite unique free forex trading course. We do not know of any other free forex trading education covering such a broad spectrum of forex market concepts in such details while keeping it easy to understand and practically use.

As if that wasn't enough, he is the part of the Shoulders of Giants Program. He shares with his fellow traders at FPA his view and forcast of the Gold Market, Currency Market, and Crypto Market in form of weekly analytics and daily video updates.

* Complete Forex Trading Course by Sive Morten >>

* Sive Morten Forex , Gold , and Crypto Analysis >>

Info

678 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023