Forex trading robots: what are they and how do they work?

Trading the markets can become a tedious effort, especially if you follow the same routine every day. You look at the charts, search for the same setups every day, set the same target and stop loss levels, and then enter a trade. If you have been doing this for a long time, then you will probably be looking for a way to automate those steps. In such a case, what you need is a trading robot that can implement that routine on your behalf.

Trading robots are software programs that trade for you even when you are away from the screen, or they help you in your trading by giving you alerts when certain incidents take place in the market. Those incidents can vary depending on your strategy and needs. For example, a common alert is when a crossover happens on the MACD indicator. You can program the trading robot to any specific signal or alert you want. A trading robot is a great tool that spares you plenty of time and scans the market on your behalf, giving you the opportunity to do something else while they trade for you.

Trading robots are usually programmed with a trading algorithm, which tells the robot when to buy and when to sell. In addition to the buying and selling rules, the algorithm usually includes many other rules such as money management techniques. Those techniques include the size of each trade in relation to the capital in the account, rules for scaling in and out of positions and other risk management measures.

The most common trading robots out there are called Expert Advisors (EAs), and they can be used on the popular MetaTrader 4 (MT4) platform or MetaTrader 5 (MT5). You can find many of those trading robots on the market that is accessible on MT4 and MT5 (by simply clicking on the market tab). Some of those EAs are free to download and use while others are paid for. The market on both MT4 and MT5 offers you a wide selection of EAs to choose from. Scalpers, long term traders, and all in between can find trading robots that meet their needs.

EAs on MT4 and MT5

There are many similarities and differences between MT4 and MT5. Both offer good trading experience and give you access to a large market of tools. However, the MT5 includes two more pending order types, which are buy stop limit and sell stop limit. Those are pending orders that are only placed in the market if the price reaches a certain price level. MT5 includes 8 more technical indicators and 13 more graphical objects. It also offers more timeframes, among other good features that are not available in MT4. As for testing robots (EAs), MT5 offers more accurate back-testing results. This is because the testing on MT5 is multithreaded (which makes the testing process faster), and it can test the strategy or EA on multiple currencies at the same time with real ticks. It should be noted, however, that MT4 EAs do not typically work on MT5 without some needed modifications. You will need to convert your MT4 EA before it can work on MT5.

How to assess trading robots before choosing one

When assessing a trading robot to install or purchase, there are many performance indicators to look at. Those indicators usually fall into either one of two categories: profitability and risk. Those indicators help you choose a trading robot that matches your risk tolerance level while still being able to achieve your trading objectives. Often, you will need to strike a balance between the two categories of indicators.

On your MT4 or MT5 platform, you can go to the “market” tab, and then go to the “experts” tab. There you will see all the available EAs on the market. Once you find an EA that you like, you can click on it to see more details. There you will see a description of the EA and its strategy. Under the “screenshots” tab, you can see details about the EA’s performance.

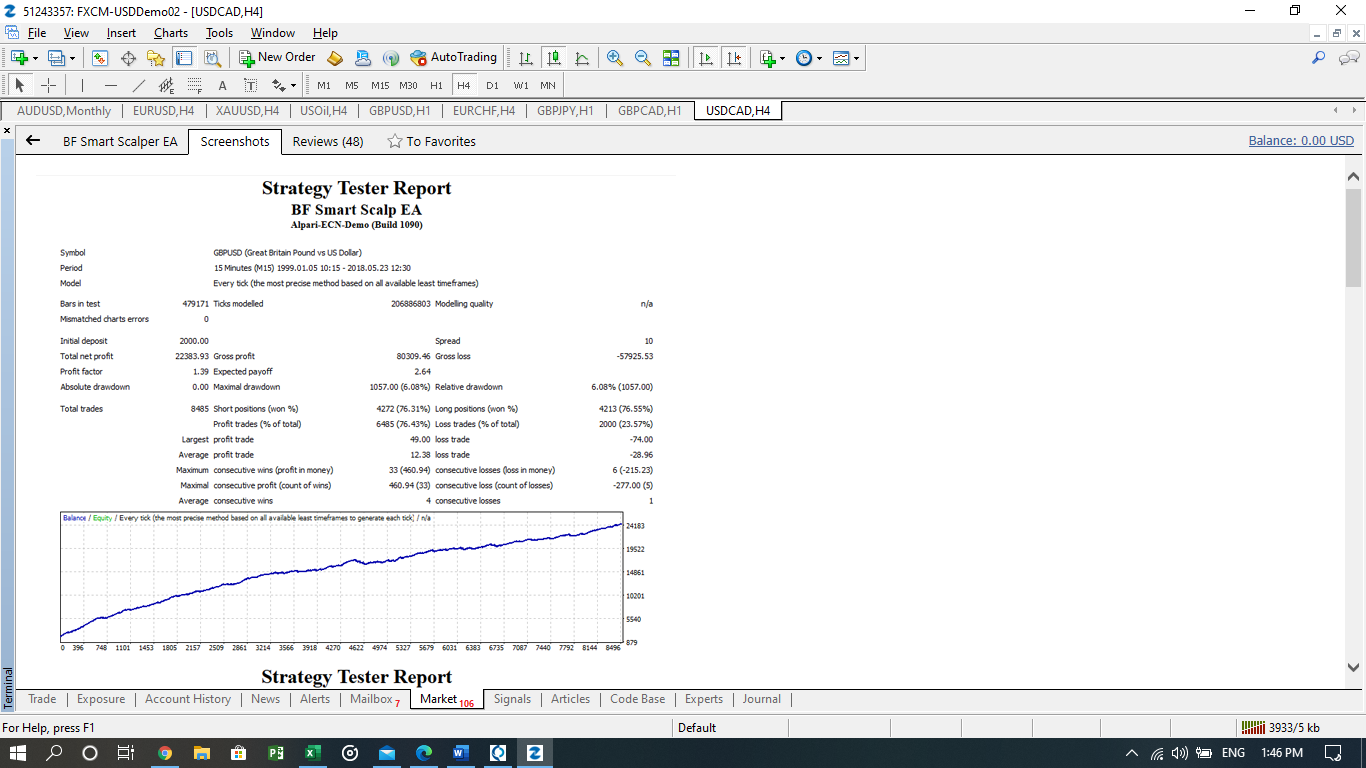

The screenshots are usually taken from the back-testing results. Below is one example.

In the above test report, you can see a lot of useful information. The back-tester on MT4 allows you to test an EA on each currency pair individually, to help you see which currency pairs are most suitable for the EA. In the above report, the EA was tested on the GPBUSD pair. You can see the timeframe that the robot was tested on, which was 15 minutes in the above case. The testing model is quite important as the test results can vary greatly based on the model. The above chosen model is “every tick”, which means that the back-tester has gathered and taken into account every price data point at the tick level. The “every tick” model produces the most accurate and precise test results. This means that the results you get when you actually use the EA on your account won’t vary much from the test results. In other test models, the tester gathers fewer data points, and thus the quality of the results is negatively affected.

The test results also include the initial deposit, which you can set manually when preparing the test. It is recommended that you use the same initial despot in the test as the actual deposit you plan to have in your account. This would give you realistic expectations about the actual results when you start using the robot. On the test report, you will also be able to see the number of wining trades, the number of losing trades, the gross loss, and gross profit. The profit factor is simply the return you usually make on investing one dollar. If your profit factor is, for example, 1.39, then for each dollar you invest you are making 39 cents (or 0.39 USD) in profit. Your profit factor should be above 1. Otherwise, any number below 1 indicates that you are incurring a loss. The maximal drawdown shows you how much equity has declined from its peak value in dollar terms. The relative drawdown shows you how much equity has been lost from peak value in percentage terms. Both numbers are useful for managing your capital, and the drawdown should be the primary metric you rely on when assessing a robot. The profit factor, and other profitability measures, should come in second.

What if you have a strategy and you want to make a trading robot to implement it automatically?

If you have a successful trading strategy and you want to automate it, then you do not necessarily need to have coding experience. There are many programs – some of which are free- that can help you in making your own EA based on your own strategy. A simple google search with the term “free expert advisor builder” can show you many possible options for building your trading robot for free. A disadvantage, however, with those trading robot builders is that they often allow you to insert a limited number of rules into the EA. This is not a problem if your strategy is based on a few rules, but it can be limiting if you are applying a complicated strategy with many rules.

The builder will often enable you to download a file which you will need to place in your MT4 data folder. After that, you can run tests on the robot. The test will enable you to verify the results and then optimize them. Optimization will enable you to select the best parameters and settings for your robot to get maximum profitability from it.

In addition to the EA builders, many brokers usually offer programs that help you develop your own trading robot through what is called a wizard. You simply enter the rules and other details of your strategy and the program will write the code, which the robot will then execute. Moreover, some companies offer automated trading services, where you simply make a deposit and the broker will gather the funds into one pool, and the funds are then traded automatically by a single robot.

Companies offering this service usually show you the results generated by the trading robot beforehand. Those results are usually the actual results rather than bask-tested results. However, future performance does not have to be a replication of past performance and it may vary. Therefore, it is strongly advised that you dig deeper and understand the trading approach before committing funds to a robot that you often cannot control.

The need for a private server to keep running your trading robot

After you have chosen and tested your trading robot (EA), you will need a virtual private sever (VPS) to use the robot on your account. Otherwise, it will only execute trades when your MetaTreder platform is open and connected to the internet. With a VPS, your trading robot will be working and executing trades all the time on your behalf even if your computer is turned off.

Most forex brokers offer VPS as a service, which you can rent for a monthly fee. This fee is around 5-25 USD depending on the provider. Regardless of the price, it is important to check the quality of the server and execution. High slippage, technical errors, and poor execution can distort the results you get from your EA. Getting a high-quality VPS ensures you get an optimal outcome.

Advantages and disadvantages of trading robots

One of the greatest benefits of using a trading robot is that it minimizes emotions when trading. Your robot won’t change the stop loss level or close the trade early on just because the market fluctuated excessively. The robot will usually commit to the levels you set it to commit to, and psychological factors will be eliminated.

Despite this advantage, most trading strategies work in specific market conditions and do not work in others. As a result, the outcome that your trading robot produces can vary from one period of time to another. Perhaps, your robot works well in trending markets, but its results will be very mediocre in sideways markets. Although you can program your robot to change its strategy based on market conditions, traders often prefer to intervene from time to time to optimize the results. In such a case, the robot would be a semi-automated robot.

Semi-Automated robots

Semi-automated trading robots will usually require some degree of trader involvement. For example, the robot can give you an alert when a certain incident takes place in the market, such as when the momentum indicator of the Ichimoku cloud goes below the cloud from the top. Then, when you see the alert you can either enter a trade or ignore it. The semi-automated systems offer the benefits of the fully automated systems while avoiding some of the shortcomings. They also give the trader a bigger room for decision making in the trading process.

Fundamental analysis and trading robots

Most trading robots available on the market rely on technical signals for entry and exit of trades. This is because those technical rules and signals are easily programmable. While those robots are useful, they come with their own weaknesses. Mainly, they lack insights from fundamental analysis. Ignoring the fundamentals can be costly and may lead to being on the wrong side of the market. Most robots are not advanced enough to incorporate fundamental analysis into their algorithms.

Although some trading robots can trade when important economic data is released, this is not the same as comprehensive fundamental analysis. Traders who conduct sound fundamental analysis usually rely on many indicators such as growth trends, the performance of various sectors in the economy, inflation figures, prospects for rate cuts or hikes, and many others to choose a direction. Such an analysis is much more difficult to write in code than a simple strategy based on technical analysis. This explains why the majority of trading robots are based on technical indicators for the most part.

The fact that fundamental analysis is often missing from the code of the robot makes it more reasonable to use a semi-automated trading robot than a fully automated one. Generally speaking, robots that work on shorter timeframes, such as scalping robots, should work better, as fundamental factors usually have more impact on larger time frames. Market fluctuations in the opposite direction of major fundamental themes can happen in the short term, but they are less likely to persist over the long term.

This is not to say that machine learning and artificial intelligence are not able to conduct technical and fundamental analysis on your behalf. Indeed, robots are responsible for higher trading volumes than before on the market today. And after all, both technical analysis and fundamental analysis are forms of data analysis, something within the realm of artificial intelligence. However, such advanced robots are still not easily available on the market at a reasonable price.

Final words

Trading robots can be very helpful, but you need to check that you have all the elements of success first. Those elements include a robust and reliable virtual private server, a good robot that is based on a good trading method, and a good broker that offers you low spreads (especially if you use a scalping EA). Once you find all those elements, test the robot on a demo account for a reasonable period of time first, and only use the robot on a live account if the results are satisfactory.

Moreover, ensure you select a robot that fits your personality. If you are a short-term trader, then you should be looking for a robot that scalps the market (a short term strategy). If you are a medium-term trader, then you probably need a swing trading robot. If you are a long-term trader, then often you can perform your own analysis once every couple of weeks, and the robot may be unnecessary.

Last but not least, even if you have a good robot, it can be wise to stay abreast of key market themes. A change in sentiment from risk-on to risk-off, for example, can significantly affect the results of trading on the Yen pairs. Thus, you may need to adjust the parameters of the robot every now and then depending on the prevailing theme.

All in all, robots are useful tools, but human intervention remains indispensable in most cases.

Sources:

https://www.investopedia.com/articles/active-trading/081315/how-code-your-own-algo-trading-robot.asp

https://www.mql5.com/en/articles/586

https://www.forexnewsshop.com/automated-vs-manual-trading-superior-approach/

Author Profile

Fat Finger

My name is Phat Fin Ge, but most people just call me Fat Finger or Mr. Finger.

Many years ago, I was a trader on the Hong Kong Stock Exchange. I became so successful that my company moved me to their offices on Wall Street. The bull market was strong, but my trading gains always outperformed market averages, until that fateful day.

On October 28th, 1929, I tried to take some profits after Charles Whitney had propped up the prices of US Steel. I was trying to sell 10,000 shares, but my fat finger pressed an extra key twice. My sell order ended up being for 1,290,000 shares. Before I could tell anyone it was an error, everyone panicked and the whole market starting heading down. The next day was the biggest stock market crash ever. In early 1930, I was banned from trading for 85 years.

I went back to Hong Kong to work at my family's goldfish store. Please come and visit us at Phat Goldfish in Kowloon, only a 3 minute walk from the C2 MTR entrance.

I thought everyone would forget about me and planned to quietly return to trading in 2015. To my horror, any error in quantity or price which cause a problem kept getting blamed on Fat Finger, even when it was a mix up and not an extra key being pressed. For example, an error by a seller on the Tokyo Stock Exchange was to sell 610,000 shares at ¥6 instead of 6 shares at ¥610,000. That had nothing to do with me or with how fat the trader's finger was, but everyone kept yelling, "Fat Finger! Fat Finger!" In 2016, people blamed a fat finger for a 6% drop in the GBP. It really was a combination of many things, none to do with me or anyone else who had a wider than average finger.

Now that I can trade again, I'm finding forex more interesting than stocks. I've been doing some research on trading forex and other instruments and I'll be sharing it here.

If you see any typing errors, you can blame those on my fat finmgert. If you see any strange changes in price, it's not my fault.

Info

683 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023