What is Forex Trading and How Does It Work?

Have you ever paid attention to the small inconvenience of exchanging money for a holiday trip? Let’s say you live in continental Europe and want to visit the United Kingdom, you’ll have to exchange euros for pounds, right?

By stepping into your local money exchange and completing your transaction, you’ve been part of the largest financial market in the world – the foreign exchange market.

What is Forex?

The foreign exchange market, also called forex or FX for short, is a global marketplace where currencies from all over the world are traded. According to the Bank for International Settlements, the forex market has a daily turnover of around $5 trillion – that is a number with 12 zeros and dwarfs all other financial markets by size.

Unlike the stock market, the forex market is an over-the-counter market where currencies are traded between buyers and sellers without a centralized exchange. Instead, large financial institutions and small traders trade directly with each other, with the current exchange rate reflecting the balance of supply and demand.

What is Traded on Forex?

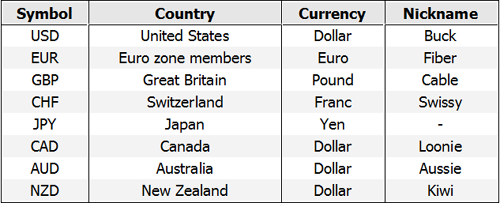

The forex market is the world’s marketplace for currencies. While there are over a hundred currencies used worldwide, only a handful of them are major currencies with the highest daily trading volume on the forex market.

Those currencies are the US dollar, Canadian dollar, British pound, euro, Swiss franc, Japanese yen, Australian dollar, and the New Zealand dollar.

Note that all of those currencies come from developed economies with strong imports and exports, which makes it no wonder that those currencies are also the most-traded in the world. Since major currencies are highly-liquid, they usually have low trading costs and are a popular choice of forex traders who’re just getting their feet wet with trading.

Major currencies also have widely available and detailed market reports used by forex traders to analyze the market. The US dollar, which is the most liquid currency in the world, is often affected by market reports published by the United States. Changes in the US dollar can often influence other currencies and commodities, which makes it so important for forex traders to follow those market reports.

Other currencies that are traded on forex usually come from developing countries, such as the Turkish lira, the Russian ruble, the Brazilian peso, or the Mexican peso. While you can also trade those currencies, bear in mind that they’re significantly less liquid than major currencies which may increase your trading costs.

Characteristics of Major Currencies

Each major currency comes with a specific set of characteristics. Here’re the most important points you need to know about major currencies:

US Dollar (USD): The most traded currency in the forex market. Most commodities are priced in US dollars, making it an important currency for traders and dealers around the world. The US dollar is also often used as a safe-haven in times of political and economic turmoil.

Canadian dollar (CAD): The Canadian dollar is often correlated with the price of oil since Canada is a major oil-producing country.

British pound (GBP): The currency of the United Kingdom is correlated with developments in the European Union since it has a strong economic relationship with continental Europe. The pound is also somewhat correlated with the price of natural gas and Brent crude.

Euro (EUR): Also called the single currency, is the common currency of the Eurozone. The euro is often affected by political and economic developments in its southern countries, such as Spain, Italy, and Greece. While the Eurostat publishes important market data regularly, forex traders often follow reports from Germany (the largest economy of the Eurozone) to get a feeling of how the currency could perform.

Swiss franc (CHF): Switzerland is considered one of the safest and most neutral countries in the world with a developed economy and high trade surplus. It’s no wonder that the Swiss franc is a safe-haven for investors around the world to park their capital in times of economic turmoil in the world.

Japanese yen (JPY): Just like Switzerland, Japan has a strong export-oriented economy with a high trade surplus. It’s traditionally a low-yielding currency but attracts capital flows from all over the world when global risk appetite deteriorates.

Australian dollar (AUD): The Australian economy is linked with China, exporting loads of natural resources to the country, including iron ore and copper. This makes the Australian dollar highly connected to developments in the Chinese economy. A strong economy in China usually leads to a strong Australian dollar, and vice-versa.

New Zealand dollar (NZD): The New Zealand dollar is linked to the price of milk and other dairy products, of which New Zealand is a large producer and exporter. In addition, since the NZD is usually a high-yielding currency, it tends to fall against other major currencies in times of reduced risk appetite.

Who is Trading on Forex?

Many market participants have an interest to trade currencies. The largest players in the forex market include governments and central banks, financial institutions, multinational companies, and investors and retail traders.

- Governments and central banks: Those are major players in the forex arena given their size and ability to influence the market. Governments often buy debt securities denominated in other currencies worth billions of dollars, making them one of the largest traders in the market.

Similarly, central banks may decide to buy or sell foreign currencies in the open market in an attempt to tweak the exchange rate of their domestic currency. Forex traders often follow central bank meetings to decide whether to buy or sell a particular currency.

- Financial institutions: Just like governments and central banks, financial institutions play an important role in the daily turnover of the forex market. Those institutions include large banks, hedge funds, mutual funds, pension funds, and others.

- Multinational companies: Large companies that have businesses across the world often use the forex market to hedge their exposure to foreign currencies. In addition, multinational companies have to repatriate their overseas earnings back to their domestic country, which involves buying and selling of foreign currencies.

- Investors and traders: Finally, investors and traders act in the forex market essentially as speculators, looking for profit opportunities in rising or falling currencies. Some estimates say that around 50% of the total forex turnover can be accredited to speculative flow, while small retail traders account for up to 5% of the total trading volume.

How are Currencies Quoted?

Currencies can’t be traded on their own. Instead, currencies are always traded and quoted in pairs, such as EUR/USD (euro vs US dollar), GBP/USD (British pound vs US dollar), or CAD/JPY (Canadian dollar vs Japanese yen), to name a few.

In a forex pair, the first currency is called the base currency, and the second currency is referred to as the counter-currency. An exchange rate always shows the price of the base currency expressed in terms of the counter-currency.

For example, if the EUR/USD is currently trading at 1.20, this means that one euro costs $1.20 at the current exchange rate. Alternatively, we can say that one euro buys $1.20, or that it takes $1.20 to buy one euro.

A rise in the exchange rate reflects a rising base currency, falling counter-currency, or both. A fall in the exchange rate reflects a falling base currency, a strengthening counter-currency, or both.

Forex pairs can be grouped into major pairs, cross-pairs, and exotics. Major pairs include the US dollar as either the base currency or the counter currency of the pair while the second currency needs to be another major currency, such as in the case of EUR/USD, GBP/USD, or USD/JPY.

Cross-pairs include two major currencies except for the US dollar. Examples of cross-pairs are EUR/CHF, AUD/NZD, and GBP/CHF.

Finally, exotic pairs include less liquid currencies such as the Turkish lira, Russian ruble, or Czech krona. Those currencies are mostly traded against the US dollar, as this combination offers somewhat higher liquidity than matching exotic currencies with other less-liquid currencies.

Basic Forex Terminology Explained

- Pips – Pips are the smallest increment an exchange rate can rise or fall. In most pair, a pip is the fourth decimal place of an exchange rate. For example, if the GBP/USD pair rises from 1.3035 to 1.3042, this would represent a rise of 7 pips. A smaller measure is a pipette, which represents the fifth decimal place of an exchange rate. Ten pipettes form a pip.

- What is a Spread – So far, you have learned that an exchange rate represents the price of the base currency expressed in terms of the counter-currency. However, the exchange rate differs whether you’re buying or selling the pair. The buying price is usually quoted a few pips above the selling rate, with the difference between those two rates representing the profit of your broker. A typical exchange rate in the EUR/USD pair can be something like 1.1250/52, where 1.1252 is the buying exchange rate and 1.1250 the selling exchange rate. This difference is called the spread.

- Margin and Leverage – The forex market doesn’t move much on a daily basis. In a normal trading day, most pairs won’t move more than 1% from their opening price. That’s where leverage comes into play. Leverage allows you to open a much larger position than your initial trading account and to take advantage even of very small price movements. It’s not unusual that a forex broker offers a leverage ratio of 50:1 or 100:1, allowing you to open a position 50 or 100 times larger than your trading account.

Your broker will allocate a small portion of your trading account as the collateral for a leveraged position, which is called the margin. Once the position is closed, the margin will be returned to your trading account.

- Stop Loss and Take Profit Orders – Stop loss and take profit orders are pending orders that automatically close your open position once the pre-specified price is hit. A stop-loss order is designed to limit your total losses in case the market goes against you, while a take profit order closes a position in order to lock in profits. Stop loss and take profit orders have an important role in risk management and should be used with every trade you take.

- Position Size – The position size of a trade refers to the amount of base currency you’re willing to trade. In forex, position sizes are often expressed in lots, where one standard lot refers to 100,000 units of the base currency. For example, trading 1 lot of EUR/USD is equal to trading €100,000 worth of USD.

- Support and Resistance – Support and resistance levels are technical tools that represent levels of high-probability where the price might retrace. Support levels are levels where the price had difficulties to break below, while resistance levels form at levels where the price had difficulties to break above in the past.

How do Forex Traders Make Money?

Just like stock traders, forex traders aim to buy currencies at a lower price in order to sell them later at a higher price. Buying a currency pair always refers to buying the base currency and simultaneously selling the counter-currency.

For instance, let’s say the EUR/USD is currently trading at 1.1320 and your analysis shows that the pair could rise all the way up to 1.1450. In this case, you could buy the pair at 1.1320, set a stop-loss below that level and a take-profit at 1.1450. Once your take-profit gets triggered, your trade is automatically closed and you would make a profit of 130 pips.

The forex market also allows to short-sell a currency pair. In that case, you can also profit from falling prices in the market. If your analysis shows that the EUR/USD pair is likely going to fall from 1.1320 to 1.1220, you could short-sell the pair with a stop-loss above the current exchange rate and a take profit at 1.1320. If hit, the take profit order would close your trade with a profit of 100 pips.

Types of Analysis in the Forex Market

To do their homework and anticipate where exchange rates are heading, traders usually use two types of analysis: Technical and fundamental.

1. Technical analysts believe that the price-chart is all you need to make reliable trading decisions. Exchange rates adapt to fundamentals in real-time and the price-chart discounts all available data, making the analysis of fundamentals unnecessary.

While a large group of retail traders base their decisions solely on technical analysis, it’s important to bear in mind that changes in the fundamental data drive exchange rates up or down, form and reverse trends, and cause major support and resistance levels to break. This is especially true in the medium and long-term.

In the short-term and in the absence of major market reports, technical traders can have an edge and make profitable trading decisions. Popular technical tools include support and resistance levels, chart patterns, channels, technical indicators, price-action, and candlestick patterns, among others.

2. Fundamental analysts base their trading decisions primarily on fundamental data and use technical levels only as a tactical tool to find suitable entry and exit points (for stop loss and take profit orders).

Fundamental data include trends in interest rates, labor market statistics, inflation rates, soft market reports (such as consumer surveys), market positioning, and risk sentiment, to name a few.

Final Words

The forex market is the world’s marketplace for currencies. Currencies worth trillions of dollars are exchanging hands every single day, making forex the largest financial market in the world.

Some of the largest players in the market include governments and central banks, financial institutions, multinational companies, but smaller investors and retail traders still account for up to 10% of the total trading volume.

Although dozens of currencies are circulating around the globe, only a handful of them are considered major currencies with the largest daily turnover. Those are the US dollar, Canadian dollar, British pound, euro, Swiss franc, Japanese yen, Australian dollar, and New Zealand dollar.

Forex traders usually use two analytical disciplines to analyze the market: Technical and fundamental analysis. Whatever analysis you choose to get your feet wet in the forex market, always use stop-loss orders with all of your trades and only risk a small percentage of your trading account on any single trade.

Author Profile

Fat Finger

My name is Phat Fin Ge, but most people just call me Fat Finger or Mr. Finger.

Many years ago, I was a trader on the Hong Kong Stock Exchange. I became so successful that my company moved me to their offices on Wall Street. The bull market was strong, but my trading gains always outperformed market averages, until that fateful day.

On October 28th, 1929, I tried to take some profits after Charles Whitney had propped up the prices of US Steel. I was trying to sell 10,000 shares, but my fat finger pressed an extra key twice. My sell order ended up being for 1,290,000 shares. Before I could tell anyone it was an error, everyone panicked and the whole market starting heading down. The next day was the biggest stock market crash ever. In early 1930, I was banned from trading for 85 years.

I went back to Hong Kong to work at my family's goldfish store. Please come and visit us at Phat Goldfish in Kowloon, only a 3 minute walk from the C2 MTR entrance.

I thought everyone would forget about me and planned to quietly return to trading in 2015. To my horror, any error in quantity or price which cause a problem kept getting blamed on Fat Finger, even when it was a mix up and not an extra key being pressed. For example, an error by a seller on the Tokyo Stock Exchange was to sell 610,000 shares at ¥6 instead of 6 shares at ¥610,000. That had nothing to do with me or with how fat the trader's finger was, but everyone kept yelling, "Fat Finger! Fat Finger!" In 2016, people blamed a fat finger for a 6% drop in the GBP. It really was a combination of many things, none to do with me or anyone else who had a wider than average finger.

Now that I can trade again, I'm finding forex more interesting than stocks. I've been doing some research on trading forex and other instruments and I'll be sharing it here.

If you see any typing errors, you can blame those on my fat finmgert. If you see any strange changes in price, it's not my fault.

Info

199 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023