Introduction to Trading Plans

When starting out, it is typical for a beginner trader to focus all their efforts on finding a trading strategy or developing their own.

Many new traders will spend countless hours scouring the internet, watching video tutorials and studying courses in order to learn a strategy.

Often times, this can involve learning a strategy based on a certain indicator which promises the trader very appealing results. The trader will then begin using the strategy only to become frustrated when they are unable to achieve similar results.

Typically, at this point, the trader will then switch strategy, blaming it for not working. This can lead to a frustrating and time-wasting cycle of strategy hopping.

However, this issue is usually nothing to do with the strategy itself, and more to do with how the trader is organising their approach to the market.

Traders who typically find more success when starting out are those that use a trading plan.

What is a trading plan?

A trading plan is essentially a guide a trader creates to outline the specific way they are going to operate in the markets.

This will involve sections on strategy, risk management and trade management.

You can think of it the same way you would a business plan, you are essentially setting out how you are going to conduct your trading business.

Developing a trading plan:

Step 1: Strategy

The first piece of the puzzle in developing a trading plan is learning/developing a strategy.

When it comes to picking a strategy, most new traders believe that a strategy which delivers the highest results is the best one to use. However, in practical terms, there are many more important things to consider.

Just because another trader is successful with a strategy, that doesn’t mean that you will be successful with that same one too.

When picking a strategy to use, it is incredibly important to consider some key points such as: what is my risk tolerance like? How much time do I have to dedicate to trading? What are my strengths and weaknesses?

Understanding your own risk tolerance is key to picking the right strategy.

If you are someone with a lower risk tolerance, a higher volume trading strategy which involves lots of trade execution and high numbers of open trades is not going to suit you. In fact, it will make it harder for you to stick to your strategy at all.

In terms of time, this is key also. For example, a trader might wish to employ a scalping strategy which involves short term trades on the lower timeframes. However, if that trader has a full-time job or other commitments and is not able to trade the most liquid part of the day, the strategy is unlikely to be effective.

Considering your strengths and weaknesses is also very important in strategy choice. For example, if you are someone who likes to be very active and enjoys being busy in a fast-paced environment, swing trading on the higher timeframes where trades can be as infrequent as only 2 or 3 a week will increase the chances of you deviating from your plan.

Similarly, if you re someone who likes to take their time and enjoys planning and strategizing more than the action of trading itself, then the higher time frame swing trading approach is likely to be far better suited to you than a short-term scalping strategy

Step 2: Setting out trade criteria (market conditions, setup, entry method)

Within the plan, a trader should lay out clearly the specific criteria they need in order to execute a trade.

For example, if the trade is using a breakout strategy the criteria for a trade might look like this:

“Execute a buy trade if price breaks above a resistance level in a bullish trend” or “execute a sell trade if price breaks below a support level in a bearish trend”.

This section should also consider market conditions for the trader’s strategy.

For example, if the trader is operating a breakout strategy, this might include a note saying that a trend must be established in order to trade and trades should not be places in range bound markets as the momentum is not there for the strategy to be effective.

The key thing about laying out specific trade setup criteria is that it means the trader should not take any trade unless those specific criteria are present.

When trading without a trading plan, it is very common for new traders to get sucked into taking unplanned trades. This is typically as a result of spending too much time in front of the charts.

Step 4: Setting out trade management rules (stops, targets and active trade management)

Once the specific trade criteria have been established, the trader then needs to consider risk management details.

This should include notes on the specific entry method.

For example, “with the breakout strategy example, will the trader execute the trade as price breaks through the support/resistance level or will they wait for a price candle to close beyond the level before executing the trade?”

Along with this, the trader should outline the exact position size they will use, where they will place their stop and where they will place their target. These details are vital to achieving success in the forex market.

The stop loss and target placement will depend on the trader’s specific strategy.

A good strategy will focus on delivering a positive risk:reward ratio (this means that the trader will win more on a successful trade than they will lose on. Failed trade). This is achieved through having larger targets than stops.

For example, if the strategy has a stop loss of 40 pips and a target of 80 pips this means the trader a 2:1 risk reward ration which is great.

Once this has been established, the trader then needs to decide what position size they will use. This must be kept the same in order to benefit from the positive risk:reward ratio over time.

A position size of 1% of account per trade with a strategy which has a positive risk:reward ratio stands a good chance of being successful over time.

Limits and targets on account performance

It is also important to set out broader stops and targets in terms of your account performance.

For example, will you limit your risk each day/week/month to a certain level?

Your trading plan, for instance, might say – no more than 2 trades per day. In terms of losses the plan might say, if you go 5% down you stop trading for the month and reassess your strategy.

Similarly, will you set a daily/weekly/monthly target?

For example, the plan might say, if you have three winning trades in a week don’t take anymore trades that week. Or, if you go 10% up on the month, cease trading for the month.

A good trading plan will include notes on trade management such as, “how will I move my stop as the trade progresses?”

Eg: at the point that the trade is half-way to my target, I will move my stop to breakeven (entry level) to avoid letting the trade turn into a loser.

This should also include notes on how you will exit your trade, will you exit the full position at your target or will you partially reduce your position and then trail your stop to allow the trade the opportunity to move further into profit.

Special considerations

Within the trading plan it is also important to note any special considerations which will be useful when you are in live market conditions.

For example, how will you trade around news releases, will you enter a trade that sets up ahead of a major news release?

Will you enter a trade which sets up in response to the volatility around a major news release? If you have a trade open ahead of a news release will you close your position out (full or partial), will you move your stop?

These are the types of situations that can be very stressful in live market conditions and often lead to emotional trading.

However, if you dedicate time to really thinking about the different situations which can occur during live trading, you can build guidelines into your plan which will allow you to trade on a non-emotional basis.

Another such consideration is, “if I am stopped out of my trade, will I re-enter if the market moves back through my entry level? “

These are all situations which a successful trading plan can really help clarify so that the trader is not left operating on gut instinct while the market is moving.

Step 4: journaling (strategy performance, traders’ experience, market observations)

The final part of the trading plan should be a commitment to journaling.

Journaling each day’s trading is crucial to monitoring your strategy and ensuring that you are operating an effective trading plan.

Note down any thoughts or observations you had about the market each day, how your trading went, how you felt while you were trading – were you nervous to take a trade? Did you fail to follow your plan at all? Did you notice anything interesting about price action that day?

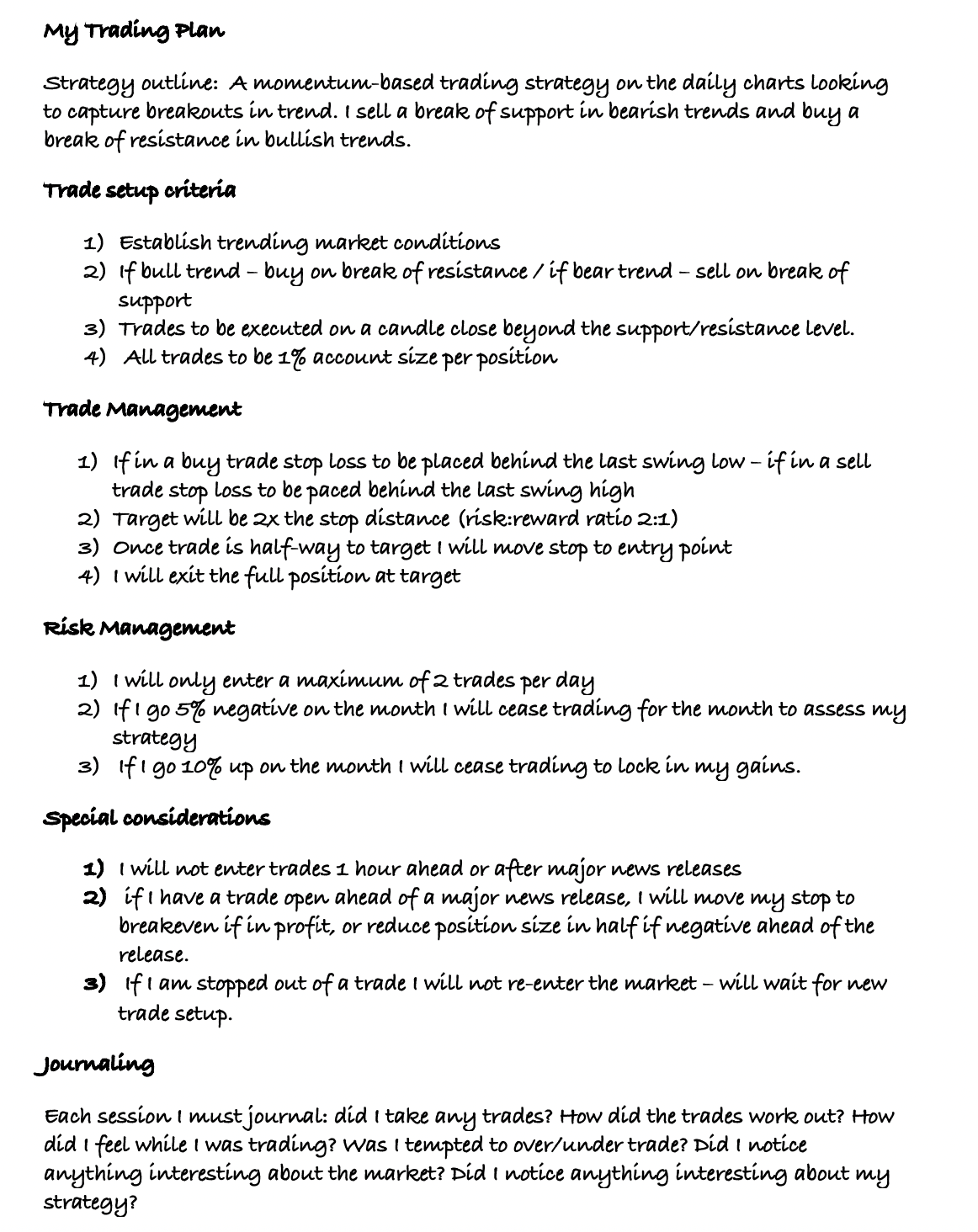

So based on the above, here is what the example trading plan would look like:

Helps monitor strategy performance

One of the biggest benefits of a trading plan is that it forces the trader to really focus on their strategy.

Many new traders who fail do so because they don’t have any uniformed approach to trading. One moment they might be taking a breakout trade, the next moment they’re placing a trade in response to a news release. Then, the moment after that, they’re placing a trade based on what an indicator is suggesting about the market.

Having a clearly outlined trading strategy means that trader has had to spend time studying or developing a trading strategy and testing it.

Based on positive testing results, the strategy is then incorporated into a trading plan. The trading plan (and specifically the journaling) will then allow the trader to monitor the performance of the strategy and will show up any strengths and weaknesses.

For example, if the trader finds they are being stopped out regularly but noticing that the market then tends to go in their favour shortly after, it is likely that the stop loss is too tight and needs to be adjusted.

Similarly, the trader might find that once price hits their target, it tends to continue further in their favour. This means the trader might benefit from increasing their target.

Any alterations to the trading strategy should then be reflected in an updated version of the trading plan.

Hopefully now you can see the benefits of using a trading plan and how clearly setting out your strategy and operations and journaling your trading will help you get the most out of your trading and ensure that your strategy is always effective.

Improves Trader Psychology

One of the main reasons many new traders fail is because they fail to appreciate the psychological difficulties of emotional trading.

When we talk about emotional trading, we are typically referring to two main traits which tend to negative impact results: over-trading and under-trading.

Over-trading refers to a situation where a trader is taking trades outside of their strategy. For example, if a trader is watching the charts and waiting for a setup, but the setup is not presenting itself, they might be tempted to take a random trade due to their desire to make money or be in the market.

While even a randomly placed trade can sometimes be successful, over time, these trades negatively impact results and negate the benefits of an otherwise successful strategy.

Similarly, if a trader is under-trading, they are not taking the trades outlined in their strategy typically because they “feel” like the trade won’t work out. This can be just as damaging to an otherwise successful strategy as over-trading.

Having the criteria for your trading strategy clearly outlined in your trading plan is a great way of removing these emotional tendencies.

While you might still occasionally deviate from your plan, over time, you will be able to develop the discipline and confidence to follow your plan and avoid emotional trading which can sabotage your returns.

Final Thoughts

The use of a well thought out trading plan is touted by all seasoned market professionals as not only the biggest turning point in the journey of being a trader, but also as the backbone of achieving and maintaining success in trading.

Taking the necessary time to develop a strategy and incorporate it into a plan plays an important role in helping new traders create a disciplined and professional approach to the trading.

Author Profile

James Harte

James has a strong interest in both fundamentals and technicals and uses both forms of analysis in generating and executing trade ideas, with trades generally lasting from a few hours to a few days.

Info

1308 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023