LiteFinance

About LiteFinance

LiteFinance is a universal broker that has provided trading services since 2005. The company’s trading conditions suit any category of traders, no matter their goals and skills. LiteFinance offers manual and algorithmic trading tools, a brand platform for trading and copy trading, and favorable conditions for beginner traders.

Rundown on LiteFinance’s trading conditions

LiteFinance is an ECN broker that transmits client positions directly to liquidity providers and global ECN platforms. The broker’s trading conditions:

- The minimum deposit on all types of an account is 50 USD.

- STP, ECN and Demo accounts

- Leverage up to 1:1000 for Forex assets. Leverage is set individually as a margin percentage for commodities, cryptocurrencies, stocks and stock indexes. Available leverage values are shown in the specifications.

- Five-digit quotes

- Spreads start from 1.8 points in STP accounts and 0 points in ECN accounts.

- Market Execution

- Minimum trading volume: 0.01 lots

- Margin Call/Stop Out – 100%/20%

There are no limits on trade duration, Stop length, and trading strategies. Scalping, algorithmic high-frequency trading and hedging/locking are allowed.

Markets

LiteFinance’s arsenal includes over 180 trading assets: major currency pairs, exotic pairs, cross rates, stocks and stock indexes, oil, metals, and the 100 most capitalized cryptocurrencies. Stock instruments are mainly focused on the markets in Europe and the USA. Still, the list also includes some of the rare Forex instruments belonging to the Asian markets, such as the indexes of Australian, Hong Kong, and Japanese exchanges.

LiteFinance’s trading accounts

The broker provides the following account types:

- CLASSIC. It’s a standard STP account for beginner and professional traders. Trades are transmitted directly to liquidity providers that guarantee trading volumes enough to satisfy any demand even during abnormal fundamental volatility. That excludes slippages and maintains spreads at the declared levels without sudden increases. Spreads start from 1.8 points.

- ECN. These are accounts for professional trading, also often used to scalp and trade using robots. Trades are transmitted to electronic ECN platforms and executed at 30-50 ms, with spreads starting from 0 points. That’s one of the best trade execution speeds in the industry. As an additional bonus, the interest of 2.5 per annum is paid on the account balance.

To find out more about the platforms’ features, gain more experience, and test strategies, one can open as many demo accounts as they want.

Trading platforms:

The LiteFinance broker provides Metatrader 4 and Metatrader 5 trading platforms and its own brand platform.

- МТ4. One of the best Forex platforms for beginner and professional traders. Its set of features is intuitive and easy to use. The platform also allows algorithmic trading and has a built-in tester of strategies. Advantages: an opportunity to copy the MQL5.Community’s signals and hundreds of technical indicators, scripts, and advisors developed in MQL4.

- МТ5. It’s a polished version of MT4 where you can trade futures, use a more functional tester of strategies, and place more pending orders.

Both platforms can work on Windows/Mac desktops and Android/iOS devices.

LiteFinance platform’s features

The LiteFinance platform works in a browser and is integrated into the Client Area. It’s mainly intended for beginner traders. The platform features the most demanded trading functions to open trades in a few clicks. It also includes a social trading service so you can choose a trader from the ranking and copy their trades on your account automatically. Find out more about the platform without registration using this link.

Let’s take a look at the platform’s menu and tabs.

Trading

This section contains the available trading assets with their main features:

- Buy/sell price

- Price change in %. You can set a 1-day, 1-week, 1-month price change display, or any other.

- Market sentiment — the long/short positions ratio in percent.

- Volatility over a set period in %. You can view the cards of assets on the screen and compare their volatility.

- Spread — the current spread value for 5-digit quotes.

You can open trades in one click in this tab, having set a trading volume in advance. To access charts, technical analysis tools, graphical tools, or time frames, you need to click on the card of an asset.

Whichever tab you are in, you will always have your financial statistics and results shown at the bottom of the screen. The deposit and withdrawal features are there as well.

Copy trading

That’s a section for copy trading services. It includes the ranking of traders whose signals you can copy into your trading account. The traders at LiteFinance that meet the minimum requirements, such as trading in a real account and open information on trading results, can be ranked in this system.

The copy trading service works in the following way:

- You choose a trader whose trades you would like to copy. The screen above shows every trader’s general parameters:

- Number of days is an account’s lifespan.

- Risk level from 1 to 10 is calculated based on the maximum drawdown value, number of unprofitable trades, etc.

- Overall profitability.

- Trader’s commission — the percent to be deducted from your profit for copying the trader’s signals. Unprofitable positions do not involve any commissions.

- Number of investors subscribed to the trader’s signals.

- Trader and investors’ total capital

The data can be filtered and ranged in ascending or descending order. A trader’s card displays an equity chart and a trading history.

2. Copy trading. If you wish to set your copy trading parameters, click on a trader’s card and set a copy trading type on the control panel on the right.

You can copy a fixed trading volume, a % of the trading volume, or a volume proportional to your funds. You can copy as many traders as you want and stop copy trading anytime.

Profile

That’s a section that contains a trader’s profile data. You can check your registration period, portfolio, or profitability history information and verify your profile. The information you fill in in the “About me” section will be available to other users. That’s an important section if you plan to become a provider of copy trading signals.

Finance

That’s a transaction management section where you can see all the information on payment methods, deposits, withdrawals, or transfers between accounts. You can withdraw or deposit money in one click from the trading section of the platform as well, but this section provides the fullest information on your financial operations.

Training

This part is mainly intended for beginner traders. It covers the basic topics about technical and fundamental analysis and contains the following subsections:

- Lessons. This subsection includes a few blocks devoted to the basic trading theory and terms, prediction methods, trend trading, the Elliott wave theory, and technical indicators. There is a consolidation test at the end of each section.

- Webinars. Dozens of webinars dealing with technical analysis, money management, trading, and analytics.

- Glossary — terms and definitions

- FAQ — answers to the most often asked questions.

LiteFinance’s site also features a blog where daily analyses of major trading assets and useful articles are published.

Sections for trading accounts – MetaTrader

That’s an account management section where you can

- See the list of all opened real and demo accounts — account balance, funds used in open trades, leverage. You can also see which of your current accounts is used as the main (displayed on the platform with trading statistics) and from which account trades are copied.

- Open as many real or demo accounts as you wish. Once opened, an account can be linked to MT4/MT5 or become the main one so that you can open trades on the LiteFinance platform.

- Change the parameters of your account, such as the trader’s password, the investor’s password, and leverage.

МТ4/МТ5 installation files can be downloaded here too.

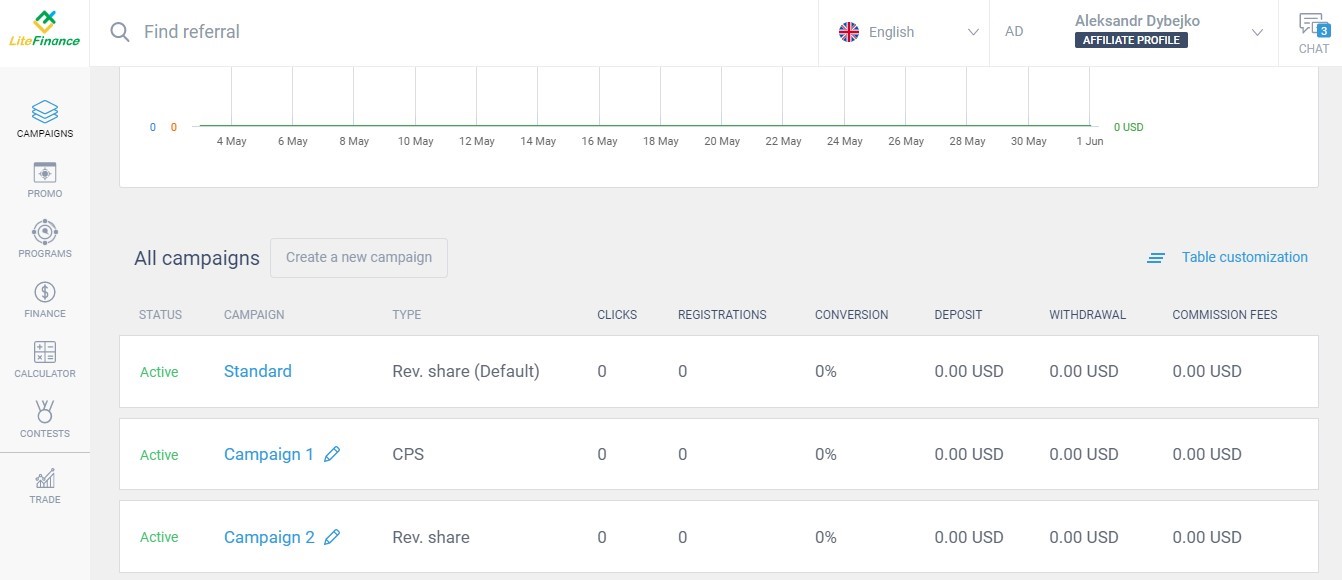

Affiliate

That’s a section for participants in affiliate programs: those who attract new traders to LiteFinance and earn a reward. The section has the following features:

- Customer acquisition statistics per campaign. You can launch as many campaigns as you want and assign them different parameters: the number of clicks, registrations, conversion rates, and earned commissions.

- Visual representation of affiliate statistics displaying visits, registrations, and commissions over a certain period.

- Affiliate commission calculator.

This section has a dedicated page with a control panel. Acquisition results can be assessed based on geography, acquisition channels, etc.

Built-in traders’ chats and channels

Fast access from the Client Area to communication channels:

- Support team. You can ask any questions directly in the chat.

- Traders’ chat. A channel for exchanging ideas and good vibes.

- Analysts’ opinions: trading signals, advice, ideas.

- Traders’ blog.

- LiteFinance’s news.

That’s an auxiliary section to get in touch with the company and other traders quickly. It’s located in the top-right corner of the platform.

Advantages and shortcomings of the LiteFinance broker

LiteFinance’s advantages:

- High transaction execution speed. Instant opening and closure even in abnormal volatility conditions. The broker is convenient for scalping and fundamental trading.

- Low entry threshold. Fifty dollars is relatively small money, but it’s enough to test the platforms on a real account.

- No money withdrawal fees. LiteFinance’s available payment methods are bank and electronic systems, such as WebMoney, Skrill, Neteller, and Perfect Money. The minimum payment/withdrawal amount is the equivalent of 10 USD. No other limits. You can place withdrawal requests anytime, and they will be processed in 24 hours. Deposits can also be made in cryptocurrency.

- LiteFinance’s easy-to-use trading platform. It has a straightforward interface, control menu, a comfortable color scheme, and easy-to-read fonts. The developers regularly add new technical indicators to the platform’s toolkit.

- Copy-trading service ranking: all is under control. The system ranks only real traders. LiteFinance does not impose any restrictions on strategies. Still, if an account is just a few days old and there is already a drawdown or a high deposit utilization rate, such an account will be assigned a corresponding risk level.

LiteFinance’s shortcomings:

- You cannot use advisors on LiteFinance’s platform. The platform can be used only for manual trading. The platform works in a browser, and you cannot add user indicators and trading advisors. However, the broker provides the МТ4/МТ5 platforms as well, and their set of functions is unlimited.

- No cent accounts. Cent accounts would be convenient for beginner traders: they could train themselves and test their strategies in real market conditions. Demo accounts idealize the market too much, so they are not well suited for testing. The broker may provide cent accounts in the future.

Despite the present shortcomings, LiteFinance makes a good impression. The broker does not put a “spoke in the wheel” by increasing spreads unexpectedly, drawing abnormal candles which trigger stop orders, or introducing restrictions. Slippages rarely occur, and if they do, they can be in the trader’s favor.

LiteFinance’s awards

The broker has been awarded by many financial and rating agencies in more than 16 years of its operation in global financial markets. LiteFinance’s trading platform has often been recognized as the “Best copy trading technology” and the “Best platform for retail traders.” The broker repeatedly wins the titles of the “Best ECN broker” and the “Best client service” in Europe, Asia, and Africa.

Review of affiliate programs

Every trader can earn an extra income from building a multilevel referral network. You can bring in new traders and earn a commission.

LiteFinance’s affiliate programs:

- Revenue Share. This program pays a reward of 15 USD per each lot traded by a referral + 10% of a subpartner’s profits. A partner can also set a cashback value and share a % of the earned commission with a referral.

- CPS. It’s a multilevel affiliate program that yields 50 USD per referral and + 10% of a subpartner’s profits.

- Regional representative. It is an offer for legal entities ready to develop their business under the LiteFinance brand.

The broker provides a referral link and free marketing materials, such as banners and logos, and helps a partner develop a simple landing site. The company also provides all necessary support. Conversion rates and statistics on affiliate programs can be tracked in the Client Area.

LiteFinance FAQs

What assets can one trade at LiteFinance?

Currency pairs, including cross rates, metals, oil, US and European stocks, global stock indexes, and over 25 cryptocurrencies. Passive investors can use the company’s social trading service.

Why was LiteForex renamed LiteFinance?

As the company’s goal is to expand further in Europe, Asia, and South America, it had to apply for new licenses to operate within local jurisdictions and fully comply with local laws. So, the broker changed its name following some regulators’ requirements. The rebranding has not impacted the broker’s service quality. On the contrary, LiteFinance plans to expand the range of its innovative services even more.

When was LiteForex renamed LiteFinance?

The rebranding was a step-by-step process that was fully accomplished in November 2021.

What commissions does LiteFinance charge?

The following commissions apply to LiteFinance’s real (live) accounts:

- Markup: the broker’s commission included in spreads (a spread equals the market margin plus a markup). Spreads are charged per trade. They are calculated in points, and the monetary value depends on one point value.

- Swaps. Swaps are fees for carrying a trade over to the next day. There can be triple swaps, too.

There are no deposit and withdrawal fees. The broker can pay back the deposit fees of some payment systems.

What platforms does LiteFinance provide?

The LiteFinance broker provides the world’s most popular trading platforms МТ4 and МТ5. They have a desktop and mobile version. The broker also has its own browser platform with simpler functions integrated into the Client Area.

Is LiteFinance a reliable broker?

Yes, it is. The company has been in the market since 2005. It continues its regional expansion, and the broker’s regulator has had no causes for complaints or objections so far.

How to make certain LiteFinance is reliable:

- Make a deposit of 50 USD, conduct two or three trades, and request a withdrawal. The money will be withdrawn at your first request.

- Install a script that defines the size of spreads and follow the company’s spreads in real time. You will see that LiteFinance’s spreads are as declared. Compare LiteFinance’s and TradingView’s quotes and make sure there are no abnormal candles or errors.

- Go to the regulator’s site and make sure there are no complaints about the broker.

LiteFinance operates in the European legal environment and is widely reputed as a reliable financial partner.

Where are LiteFinance’s offices located?

LiteFinance’s physical offices are in over ten countries, including Thailand and the Philippines. The complete information can be found in the “Contacts” section.

What is the minimum deposit at LiteFinance?

Fifty dollars in all accounts. With leverage up to 1:500, that’s enough for opening trades of the minimum volume in some assets, as per risk management rules.

What is the minimum spread at LiteFinance?

It depends on an account and asset. Raw spreads from 0 points are available in ECN accounts, but those accounts involve a commission per round lot. There are floating spreads in STP accounts starting from 1.8 points.

Author Profile

LiteFinance

Info

404 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, April 2024 Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023