Mastering the art of price action trading in Forex market

Becoming a professional trader in the Forex market is a very challenging task. The novice traders often think the pro traders have access to insider information and thus they are able to make a consistent profit. But if you research on the successful trader, you will understand they are making money just by using a simple trading strategy.

The nature of the Forex market is dynamic and no one can predict the price movement of the financial asset with 100% accuracy. Even the mighty president of the United States can’t manipulate the price of a certain asset for a prolonged period of time. Just think with your logic and you will understand it’s not possible to change the performance of a certain country’s economy with few simple statements.

The professional forex traders prefer forex trading since they know this market is free from manipulations. You don’t have to learn to rocket since to become a successful trader. Just learn the basic of three major forms of market analysis and you will understand the perfect way to trade the market. Some of you might think indicator based trading strategy is the best way to earn money but in reality, indicators are nothing but a waste of money. Try to master price action trading system so that you can execute quality trades with a tight stop loss.

So what is price action trading?

Price action trading is nothing but using the different formations of the Japanese candlestick pattern to find the potential trade setups. Understanding the different formations of the Japanese candlestick pattern at the initial stage will be a little bit hard but if you focus on the psychological factors behind the formations of each candle, you will be able to make a decent profit. Today we will give you some easy steps which will help you to become a professional price action trader.

Analyze the higher time frame data

Being a new trader it’s very normal you will be trading the market in the lower time frame. The rookie traders prefer lower time frame data since it allows them to execute more trades. Overtrading is nothing but increasing your risk exposure. Even after using the price action confirmation signal it will be really hard to find quality trade setups in the lower time frame. To be precise, you have to become a position or long term trader to use the price action confirmation signal.

Though price action trading strategy tends to work best in higher time frame this doesn’t mean you will not be able to make a profit by executing a trade in the lower time frame. The professional scalpers use a simple technique called multiple time frame analysis to filter out the false candlestick pattern in the market. At the initial stage, doing the multiple time frame analysis will be extremely difficult but over the period of time, you can easily master these skills.

Avoid trading the news

Those who are looking to trade the lower time frame using the price action signal should never trade the high impact news. During the event of a high impact news release, the forex market becomes extremely volatile and small mistake result in a heavy loss. If you intend to save yourself from such problems, it’s highly imperative you stay in the sideline during such high impact news.

So, do the professional trade the news?

The simple answer is YES. In fact, news trading is one of the easiest ways to catch the large market movements but it takes years of experience. Never execute any trade prior to the news release. Once the new data is released, assess your technical data with the fundamental data. If things go in your favor, execute the trade based on the price action confirmation signal in the lower time frame. But make sure you are not risking more than 2% of your account balance while trading the news.

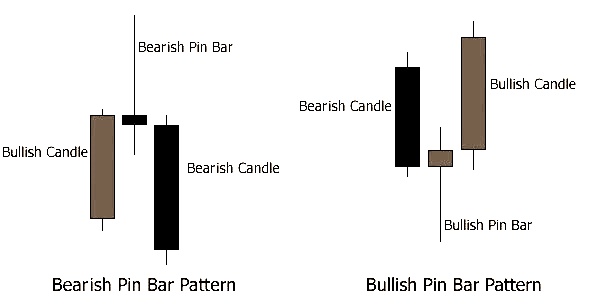

Trading with the pin bar

Those who have prior experience in the retail trading business must have heard about pin bar price action trading system. Pin bar is nothing but a single candlestick pattern which shows strong reversal signals in the market.

Figure: Formation of the bullish and bearish pin bar

A pin bar has a relatively small body and the wick of the candlestick is at least three times bigger than the body. The color of the pin bar doesn’t really add any value. If you spot a bullish pin bar at the critical support level, you can easily execute long orders with a tight stop below the tail of candle. Similarly, when you spot a bearish pin bar right at the critical resistance level, you can easily execute short orders.

Though the pin bar trading strategy is extremely profitable the majority of the novice traders makes mistake. They simply take a huge risk based on the reliability of the pin bar trading system and loses a significant amount of their investment when things go wrong.

Pin bar strategy was just a simple example of how well you can trade the market once you learn price action trading system. For instance, if you use the bullish morning start pattern and bearish evening star, you can easily execute quality trades with high-risk reward ratio. These reversal signals are formed based on the combination of three major candlesticks.

Use of the demo account

The new traders often say price action trading system is the most difficult trading strategy and they prefers to use indicators. Indicators are nothing but the helping tools. You can’t find any quality trade setups based on indicators reading. To be precise indicators acts like trade filter tools. You have to understand the language of the market and practice hard in the Forex demo account to learn more about price action trading

Demo trading accounts are often considered as blessings for the retail traders. Experience does count when it comes to trading business. Being a new trader, you don’t have to risk real money to master the art of currency trading business. Just use the demo accounts offered by professional broker Rakuten and you can easily learn how this market works without risking any real money.

The trend is your friend

Even after learning the details of price action trading strategy, some retail traders fail to make money. They simply trade against the long term market trend and loses a significant portion of their investment. There is saying in Forex market “Trend is your friend”. So if you truly intend to develop yourself as a professional trader, it’s highly imperative your trade with the market trend.

The new traders often think trading the tops and bottoms is the best way to make a huge profit from this market. But in reality, this is nothing but a suicide mission. Being a price action trader you should never try to trade the market against the market trend. Always remember, it’s better to stay in the sideline rather than executing a trade against the market trend.

Higher time frame data

The professional price action traders always prefer to trade higher time frame data. It’s true, in lower time frame trading you will get many signals but the quality will be extremely bad. Most of the time you will end up by trading against the market trend. To avoid such problems, you need to focus on the daily and weekly time frame

Some of you might say higher time frame trading is extremely boring since you will have to wait for a long period of time. But in reality, trading business is more like testing your patience. Those who trade with aggression can never become a profitable trader even after knowing all the details of price action trading strategy.

So, to be a professional price action trader, you must learn the proper way to control your greed. Learn to stay in the sideline so that you can wait for the very best trade setups. Some retail traders often wait for weeks only to execute quality trades. Always remember, the conservative trading technique is the best way to improve your winning edge.

Using the 100 and 200 SMA

SMA stands for simple moving average. The experienced traders often use the 100 and 200 days SMA to find quality trades at the dynamic support and resistance level. You can even scalp the market by using pending orders.

Trading with the 100 and 200 SMA based on price action signal is extremely profitable. But you need to consider one simple fact, the risk-reward ratio. Never execute any trade unless you have a 1:2 risk reward ratio. The outcome of any trade in the forex market is completely random and you can’t say for sure, a certain trade will work.

As a currency trader, you will always have to face losing trades. This will never be a problem for you provided that you trade the market with high-risk reward ratio. Even after losing a few trades in a row, you can easily cover up the loss by following proper trade management skills.

Trading the major chart pattern

Chart pattern trading is one of the easiest ways to catch large market movements. Some of the professionals often say this is the best way to ride the long term market trend. To be honest this statement is true to a certain extent but you need to have some specific skills to become a professional chart pattern trader.

Those who are trading the major currency pairs based on important chart patterns knows the importance of wide stop loss. Some retail traders often ignore chart pattern trading since the stops are too wide and the associated risk factors are not suitable. Unlike them, professional price action traders easily place a trade with tight stops.

The professional price action traders look for potential chart pattern in the higher time frame and they wait for a clear breakout. Unlike the novice traders, they never execute a trade based on the initial breakout. They simply wait for minor retracement of the market and place trade with price action confirmation signal.

Trading the major chart pattern based on price action confirmation signal is one of the easiest ways to earn huge amount of money. Things will be a little bit difficult at the initial stage but if you focus on long term goals, you will be able to change your life based on chart pattern trading using the Japanese candlestick pattern.

Focus on risk management policy

Its true price action trading is one of the easiest ways to make money in the Forex market but this doesn’t mean you will be able to win all trades. Since the outcome of any trade is completely random, you will have to ensure, proper risk management policy in each trade

Risk tolerance level greatly varies from traders to traders. Being a new investor, the first thing that you need to find is your risk tolerance level. Some retail traders can easily lose 3% of their account balance but this might not be the case for you. The professional always suggest never to risk more than 2% of the account balance in any trade since it helps to protect the investment in the long run.

Losing or winning doesn’t really matter as long as you trade with proper money management. In fact, you can even make a consistent profit with a 60% win rate considering you are trading with a 1:2 risk reward ratio. Learn more about the trade management skill and you will be able to make a decent profit out of trading.

Becoming a professional price action trader is a very challenging task. But if you look at the long term goals, it won’t take much time to develop your skills. If necessary seek help from the trained professional and you will be able to get a clear guideline about price action strategy.

Always remember, confidence is the key to become a successful trader. Since you will be trading the market with price action trading strategy, make sure you are not taking any aggressive steps since patience is the key to become a successful price action trader.

Author Profile

Dwayne Buzzell

Info

1535 Views 0 CommentsComments

Table of Contents

Recent

-

Bitcoin Fundamental Briefing, March 2024 Demystifying Cryptocurrency Nodes: Deep Dive into Polygon Node Ecosystem Strategies for Trading Forex on a Budget Bitcoin Fundamental Briefing, February 2024 Bitcoin Fundamental Briefing, January 2024 Strategic Asset Allocation Techniques for Currency Traders Bitcoin Fundamental Briefing, December 2023 Bitcoin Fundamental Briefing, November 2023