Official Ava Response

(This reply was initially posted on Monday but wasn't posted)

1.

Starting from the first off-market trade, how many trades:

a.

Entered at an off-market price?

AvaTrade found 27 trades that the client made across two accounts that were considered arbitrage as the trades were opened at off market prices.

If a trader opens a trade at an off-market price – it gives the trader a ZERO RISK trade opportunity – which is what arbitrage is. This is regardless of how long the trades are kept open for. This is something that the client is arguing. Arbitrage is not based on length of trade; arbitrage is trading on off-market prices that occur through any means which gives the trader the opportunity to make RISK FREE profits.

b.

Exited at an off-market price?

There are no positions exited on off-market prices

c.

Were on-market for both entry and exit?

This question is not relevant to this case. Arbitrage can occur on both entry and exit of trades.

If the AvaTrade trading practices department found that the client opened any trades (In this case 27 trades) that were at off market prices, they cancel the trades. It is in the AvaTrade T&C’s that the client agreed to that allows AvaTrade to cancel the trades in their entirety.

2.

How much money was gained/lost by trades that had an off-market entry or exit?

The client gained $9289.06 through off market trading which was deducted from the client. Details of these trades have been given to the client already. The $9289.06 was made through a total of 27 trades across 2 accounts.

3.

If those trades were adjusted, how much money would be gained/lost?

As stated in our previous response to the client on this thread, AvaTrade,

(i) Does not adjust prices on any of our client’s trades if arbitrage is discovered.

(ii) Cancels all illicit trades of any client found to be opening/closing trades at off market prices.

Hence, all trades that were opened outside of the market rates by this client were cancelled by the Trading Practices department and all profits and/or losses on these trades are deducted.

4.

How much money was gained/lost by on-market trades??

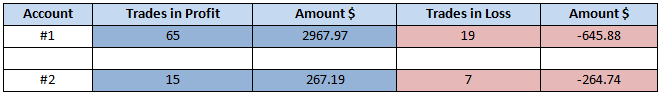

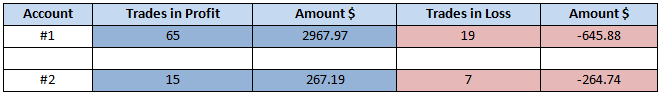

As we stated previously on this thread, the client gained $2,432.61 by trading at on market prices. AvaTrade does not deduct or cancel trades that were made legitimately. The client was allowed to withdraw this money. Please see below the data of the trades that were not deducted from this client.

Non Deducted Trades

5.

If a large, clean deviation happened, the price would almost always rocket in one direction. If any trader opened a trade using perfectly legal spike trading software just as that data was coming out, they would have a good chance of getting either slippage or an off-market fill.

Under those circumstances, the off-market fill would almost always be in the trader's favor. This would require no form of arbitrage at all, but the trades would be virtually identical to those that could be triggered by arbitrage software.

How would AvaTrade differentiate this from using arbitrage software?

Successful news trading is opening and closing positions during news to make quick profits from volatile markets at real market prices. Arbitrage is trading on prices that do not actually exist in the market but caused by unfortunate uncommon delays on platform feeds.

Also, using the scenario put to us above regarding the spike and software. Slippage will only occur on the client’s trades if the client has a Stop or Entry Stop placed on orders or open trades. AvaTrade follows the market convention that stop orders are not guaranteed.

6.

Suspecting possible arbitrage is a valid reason to examine trades. If (and ONLY if) arbitrage can be PROVEN, then that is a valid reason to cancel trades. Otherwise, trades should only be adjusted to match real market prices.

If Ava's terms define Bloomberg as the "real market" then those are the prices that should be used for this adjustment.

No - this is not the case. It is explicitly stated in AvaTrade’s Terms and Conditions that it is the policy of the company to cancel all illicit trading. AvaTrade does not adjust any client’s trades. The client agreed to the company’s T&C’s when he/she opened the accounts.

Using the argument that other companies adjust their prices is not valid.