acetraderfx

AceTrader.com Representative

- Messages

- 1,109

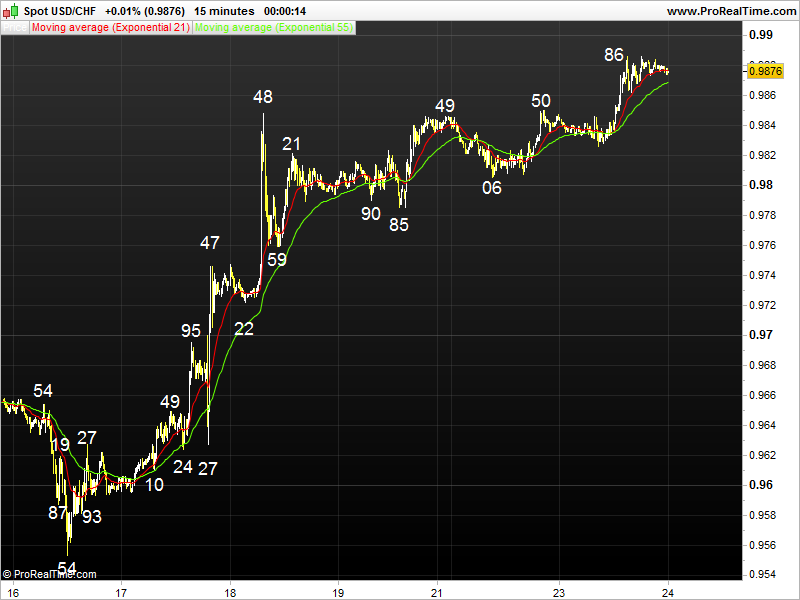

AceTraderFx Dec 24: Daily Technical Outlook & Trading Ideals on USD/CHF

DAILY USD/CHF TECHNICAL OUTLOOK

Last Update At 24 Dec 2014 00:00GMT

Trend Daily Chart

Up

Daily Indicators

Bearish divergences

21 HR EMA

0.9862

55 HR EMA

0.9839

Trend Hourly Chart

Up

Hourly Indicators

Bearish divergences

13 HR RSI

65

14 HR DMI

+ve

Daily Analysis

Resumption of MT uptrend

Resistance

1.0000 - Psychological lvl

0.9972 - 2012 peak

0.9924 - 80.9% proj. 0.9360-0.9818 fm 0.9554

Support

0.9805 - Mon's low

0.9785 - Last Fri's low

0.9722 - Last Thur's low

. USD/CHF - 0.9876 ... Although the greenback remained under pressure initially y'day n weakened to session low at 0.9826 in early European morning, price pared its losses n gained ahead of NY open. Intra-day rise accelerated n the pair rose to fresh 2-year peak at 0.9886 on upbeat U.S. GDP data.

. Looking at the bigger picture, dlr's aforesaid resumption of MT uptrend fm 2014 near 2-1/2 year trough at 0.8698 (Mar) to 0.9886 signals further gain to 0.9924 (being 80.9% projection of rise fm 0.9360 to 0.9818 measured fm 0.9554) wud be seen after initial consolidation. Abv 0.9924 wud extend twds 2012 peak at 0.9972, however, as daily oscillators' readings wud display prominent 'bearish divergences' on such move, sharp gain beyond there is unlikely to be seen this week n reckon psychological res at 1.0000 shud remain intact n yield a much-needed correction later. On the downside, only below 0.9785 (Mon's low) wud indicate a temp. top has been made n risk retracement twds 0.9722.

. Today, as current price is trading abv 21-hr n 55-hr emas, suggesting buying dlr on dips is still the way to go. Only below 0.9805 wud abort intra-day bullishness n risk stronger weakness twds 0.9785.

DAILY USD/CHF TECHNICAL OUTLOOK

Last Update At 24 Dec 2014 00:00GMT

Trend Daily Chart

Up

Daily Indicators

Bearish divergences

21 HR EMA

0.9862

55 HR EMA

0.9839

Trend Hourly Chart

Up

Hourly Indicators

Bearish divergences

13 HR RSI

65

14 HR DMI

+ve

Daily Analysis

Resumption of MT uptrend

Resistance

1.0000 - Psychological lvl

0.9972 - 2012 peak

0.9924 - 80.9% proj. 0.9360-0.9818 fm 0.9554

Support

0.9805 - Mon's low

0.9785 - Last Fri's low

0.9722 - Last Thur's low

. USD/CHF - 0.9876 ... Although the greenback remained under pressure initially y'day n weakened to session low at 0.9826 in early European morning, price pared its losses n gained ahead of NY open. Intra-day rise accelerated n the pair rose to fresh 2-year peak at 0.9886 on upbeat U.S. GDP data.

. Looking at the bigger picture, dlr's aforesaid resumption of MT uptrend fm 2014 near 2-1/2 year trough at 0.8698 (Mar) to 0.9886 signals further gain to 0.9924 (being 80.9% projection of rise fm 0.9360 to 0.9818 measured fm 0.9554) wud be seen after initial consolidation. Abv 0.9924 wud extend twds 2012 peak at 0.9972, however, as daily oscillators' readings wud display prominent 'bearish divergences' on such move, sharp gain beyond there is unlikely to be seen this week n reckon psychological res at 1.0000 shud remain intact n yield a much-needed correction later. On the downside, only below 0.9785 (Mon's low) wud indicate a temp. top has been made n risk retracement twds 0.9722.

. Today, as current price is trading abv 21-hr n 55-hr emas, suggesting buying dlr on dips is still the way to go. Only below 0.9805 wud abort intra-day bullishness n risk stronger weakness twds 0.9785.

Last edited by a moderator: