acetraderfx

AceTrader.com Representative

- Messages

- 1,109

WEEKLY USD/CHF TECHNICAL OUTLOOK

Last Update At 29 Sep 2014 00:12GMT

Trend Daily Chart

Up

Daily Indicators

Rising

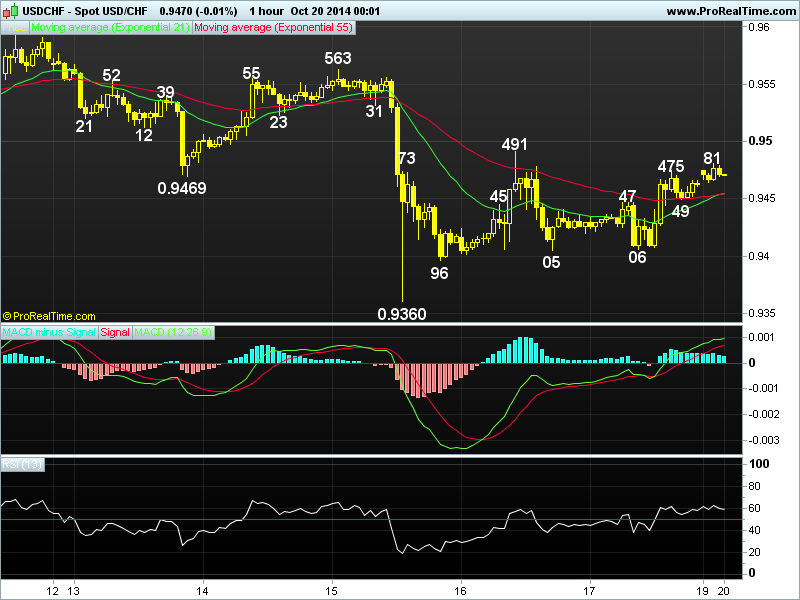

21 HR EMA

0.9503

55 HR EMA

0.9479

Trend Hourly Chart

Up

Hourly Indicators

Bearish divergences

13 HR RSI

70

14 HR DMI

+ve

Daily Analysis

Resumption of MT uptrend

Resistance

0.9620 - 100% proj. fo 0.9353-0.9515 fm 0.457

0.9599 - 70.7% r of 0.9972-0.8698

0.9567 - Mar 2013 top

Support

0.9484 - Last Fri's European high (now sup)

0.9457 - Last Thur's NY low

0.9433 - Sep 167 high (now sup)

. USD/CHF - 0.9517... Dlr continued its recent winning streak last week after meeting renewed buying at 0.8353 on Tue, price climbed to a fresh 1-year peak of 0.9522 in Fri's NY session due to broad-based rally in the dlr.

. Looking at the bigger picture 1st, dlr's aforesaid gain to 0.9522 Fri confirms the 3-legged rise fm Mar's 2-1/2 year trough at 0.8698 to at least retracing MT fall fm 0.9972 (2012 peak) remains in progress n gain to 0.9599 is now envisaged, being 70.7% r of this move, however, as hourly indicators have displayed 'bearish divergences', reckon 0.9620 (equality measurement of 0.9353-0.9515 measured fm 0.9457) wud cap upside ahead of Fri's important U.S. payrolls report n yield a minor correction. Therefore, whilst buying on dips is the way to go, profit shud be taken on next upmove. On the downside, a daily close below 0.9457 wud be the 1st signal temporary top is in place n risk stronger retracement to 0.9389 but sup at 0.9332 shud remain intact.

. Today, as current price is trading abv the 21-hr & 55-hr emas, buying dlr on dips is recommended, however, reckon 0.9599 wud cap upside. Below 0.8457 wud abort present bullish scenario n risk retracement to 0.9433, 0.9407/10.

Last Update At 29 Sep 2014 00:12GMT

Trend Daily Chart

Up

Daily Indicators

Rising

21 HR EMA

0.9503

55 HR EMA

0.9479

Trend Hourly Chart

Up

Hourly Indicators

Bearish divergences

13 HR RSI

70

14 HR DMI

+ve

Daily Analysis

Resumption of MT uptrend

Resistance

0.9620 - 100% proj. fo 0.9353-0.9515 fm 0.457

0.9599 - 70.7% r of 0.9972-0.8698

0.9567 - Mar 2013 top

Support

0.9484 - Last Fri's European high (now sup)

0.9457 - Last Thur's NY low

0.9433 - Sep 167 high (now sup)

. USD/CHF - 0.9517... Dlr continued its recent winning streak last week after meeting renewed buying at 0.8353 on Tue, price climbed to a fresh 1-year peak of 0.9522 in Fri's NY session due to broad-based rally in the dlr.

. Looking at the bigger picture 1st, dlr's aforesaid gain to 0.9522 Fri confirms the 3-legged rise fm Mar's 2-1/2 year trough at 0.8698 to at least retracing MT fall fm 0.9972 (2012 peak) remains in progress n gain to 0.9599 is now envisaged, being 70.7% r of this move, however, as hourly indicators have displayed 'bearish divergences', reckon 0.9620 (equality measurement of 0.9353-0.9515 measured fm 0.9457) wud cap upside ahead of Fri's important U.S. payrolls report n yield a minor correction. Therefore, whilst buying on dips is the way to go, profit shud be taken on next upmove. On the downside, a daily close below 0.9457 wud be the 1st signal temporary top is in place n risk stronger retracement to 0.9389 but sup at 0.9332 shud remain intact.

. Today, as current price is trading abv the 21-hr & 55-hr emas, buying dlr on dips is recommended, however, reckon 0.9599 wud cap upside. Below 0.8457 wud abort present bullish scenario n risk retracement to 0.9433, 0.9407/10.

Last edited by a moderator: